Lithium Technology Dominates Large Energy Storage Projects

by Debra Fiakas, CFA

Market share for lithium technology has been extended by another 22 megawatts with the selection of lithium-based batteries by Duke Energy (DUK: NYSE) for three separate of power facilities operated by Duke Energy Florida. Duke did not specify the source of the lithium-based batteries, but the company seems to have an affinity for Tesla’s (TSLA: Nasdaq) battery products. Last year Duke Energy with its partner University of South Florida chose Tesla’s lithium-based batteries for a 100-kilowatt solar project in St. Petersburg, Florida.

Application of lithium-based technology in a relatively small, microgrid application like that in St. Petersburg is no surprise. Lithium-based batteries offer high energy...

Canadian and Tanzanian Graphite Connections

A list of graphite companies covered in this series can be found here.

Like performance test results, customer relationships are critical stepping stones for graphite developers. In June 2018, Northern Graphite (NGC: TSX-V) announced a memorandum of understanding with a European trading company to sell 100% of the output from Northern’s Bisset Creek resources in Ontario, Canada. China-based manufacturers are the intended end-users. Northern management is using the arrangement as leverage with prospective investors to finance mine infrastructure and processing equipment. Capital costs are expected to exceed CA$145 million.

Northern claims a proprietary purification technology the company intends to use to upgrade its graphite output. Its Bissett Creek deposit...

Yankee Graphite

Several graphite developers have made plans to integrate forward into the hottest segment of the market - battery-grade graphite. According to Industrial Minerals, spherical graphite suitable for lithium ion battery anodes is priced in a range of $2,700 to $2,800 per metric ton in China where many battery manufacturers are located. This compares quite well to the range of about $655 to $790 per metric ton for flake graphite concentrate.

The integration strategy has sent the sector into a frenzy of activity to prove their graphite meets expectations of battery manufacturers. The only graphite deposit in the U.S. mainland is under development by Westwater Resources...

Graphite Developers Eye Large Growing Market

The post “Integrated Graphene Producers” featured several graphene producers with novel business models that marry captive graphite sources to the technology and knowhow to produce graphene. These are not the only graphite producers. Although not as elegant as graphene with its svelte single-atom profile, the market for graphite has its appeal as well. Graphite has been a staple in steel industry crucibles, foundry molds and automobile brake linings. These days graphite has moved into another even more important place in cars - lithium ion batteries that make electric vehicles viable as replacements for gas guzzling cars and trucks.

Spherical graphite is especially desirable because the graphite anodes hold...

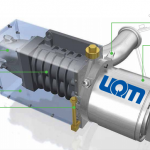

Shareholders Cry Foul as UQM Agrees to Buyout

UQM Technologies (UQM: NYSE) has agreed to be acquired by Danfoss Power Solutions for $1.71 per share in cash, providing a deal value near $100 million. UQM leadership expects timely review by government authorities and has recommended approval of the deal by shareholders. A date has not been set for the required shareholder vote. Assuming all goes according to schedule, a deal closing is possible sometime in the second quarter 2019.

Electric propulsion and generation technologies are at the core of UQM’s solutions for manufacturing, transportation and power industries. The substitution of electric motors for combustion engines has been driving demand for the UQM’s products. Market opportunities have abounded...

Conference Brief – Solar & Storage Finance

Renewable energy finance has many different kinds of participants, as revealed recently at the Solar & Storage Finance conference hosted in NYC. . Listening to the live actors from the financial side of the renewable power industry moved the issues off the page, to a more concrete experience of their specific concerns, including the extent to which their distinct missions were siloed, how they are competitive, and how they synergize.

The presentations were organized to highlight these differences. Several panel discussions were set back-to-back the contrast between lenders vs tax equity investors, both in terms of their goals, but also...

Solar & Storage Finance Conference Notes

I attended the Solar & Storage Finance conference hosted in NYC in late October 2018. Presenters included a mix of capital providers & asset managers, private non-profit entities & public agencies, legal, accounting & consulting firms, intermediaries, firms providing risk analysis, ratings & mitigation, & various vendors of energy storage and IT-related services. The tone of the discussions was noteworthy for its near total absence of ideological comments about environmental urgency. Rather, it was a meeting of finance technicians and technocrats focused on the nuts & bolts of accomplishing those ends, with the merits and relevance of mission assumed.

The...

Nemaska: A Lithium Bargain

Nemaska Lithium (NMKEF: OTC/PK, NMX: TO) is a newcomer to the lithium industry. The company recently came to the market with battery-grade lithium from spodumene rock carved out of its Whabouchi mine in northern Quebec, Canada and converted in a proprietary electrochemical process to battery-grade lithium material at an in-house facility in Shawinigan to the south. The company filled its first orders in Summer 2018.

The company expected to produce over 200,000 metric tons of lithium-bearing spodumene concentrate from its Whabouchi mine with an average 6.25% lithium oxide content. The mine is expected to remain productive for over three decades at that extraction rate. The processing plant in...

Nemaska Sprints to Early Lead In Lithium Mining Race

Thank Elon Musk with his Tesla (TSLA) gigafactory for sparking a global obsession with lithium-ion batteries and the materials need to turn them out. Claimed by Musk to be the largest building in the world, the factory was planned to reach capacity in stages. By the time the factory is fully completed in 2020, production capacity is expected to be 150 gigawatt hours of battery packs.

Ever since construction of Musk’s gigafactory began in 2014, investors around the world have been fretting over the adequacy of lithium supplies in particular. The gigafactory concept appeared to trigger a whole slew of ‘me too’ factories...

Hydrogenics: Will Hydrogen Skeptics Be Blown Away?

The hydrogen technology developer Hydrogenics Corporation (HYGS: Nasdaq) is taking on wind energy. The company’s fuel cell power systems for stand-by and site power sources, hydrogen generators for industrial situations, and energy storage and fuel solutions for fleet owners. Hydrogen has gained in popularity because it is a zero-emission fuel source when burned with oxygen. The energy efficiency of hydrogen as a transportation fuel is also enticing. An electric motor powered by hydrogen fuel cell is two to three times more efficient than an internal combustion engine running on gasoline.

Hydrogen is not without its critics. One of the criticisms is that hydrogen is not entirely a carbon-neutral...

The Race For Silicon Anodes

Graphite is the most widely used material for battery anodes. The anode is the positively charged electron collector in a battery. It collects and accelerates the electronics emitted by the battery’s cathode. Graphite gets the anode job because it is has excellent electric conductivity and resists heat and corrosion. Plus it is light weight, soft and malleable.

As satisfied as manufacturers might be with graphite anodes, none would balk at an alternative material that boosts battery performance or reduces cost. Scientists believe battery capacity can be increased as much as ten times by using silicon for anodes. It requires six atoms of carbon to bind one...

There’s Hydrogen In That There Biogas

I don’t suppose that anyone actually dreams of hydrogen, but in the bio-economy there just isn’t quite enough of it and we read about it and sometimes think about it so much that we might as well be dreaming about it.

For those newer to the field, one of the problems of using biomass to make a fuel is that a carbohydrate contains around 53% oxygen by weight and needs about 16% more hydrogen that it contains to make a hydrocarbon fuel. That’s one of the reasons that biofuels are often esters (such as biodiesel) or alcohols (such as ethanol),...

List of Electricity Storage Stocks

Electricity storage stocks are publicly traded companies whose business involves the storage of electricity. They include battery stocks and hydrogen stocks (see links), while companies involved in other storage technologies such as pumped hydro energy storage, Compressed Air Energy Storage, capacitors, flywheels, and thermal storage are listed here.

This list was last updated on 3/22/2022.

Dais Analytic Corp. (DLYT)

Dresser-Rand Group (DRC)

Fluence Energy, Inc. (FLNC)

Graftech International (GTI)

Highpower International (HPJ)

Kemet Corp. (KEM)

Maxwell Technologies Inc (MXWL)

If you know of any energy storage stock that is not listed here and should be, please let us know by leaving a comment. Also for stocks in the...

List of Hydrogen Stocks

Hydrogen stocks are publicly traded companies whose business involves the use of hydrogen as energy storage or a transportation medium. See also fuel cell stocks.

This list was last updated on 8/27/2021.

AFC Energy (AFC.L)

Ballard Power Corporation (BLDP)

Bloom Energy Corporation (BE)

Cell Impact AB (CI-B.ST)

Defiance Next Gen H2 ETF (HDRO)

FuelCell Energy (FCEL)

Fusion Fuel Green PLC (HTOO)

Green Hydrogen Systems A/S (GREENH.CO)

Hazer Group Limited (HZR.AX)

HydrogenPro AS (HYPRO.OL)

HydroPhi Technologies Group, Inc. (HPTG)

HyperSolar, Inc (HYSR)

Hynion AS (HYN.OL)

ITM Power PLC (ITM.L, ITMPF)

MagneGas Corporation (MNGA)

McPhy Energy SA (MCPHY.PA)

myFC Holding AB (MYFC.ST)

Nel ASA (NEL.OL)

Nikola Corporation (NKLA)

PowerCell Sweden AB (PCELL.ST, PCELF)

Plug Power (PLUG)

PowerHouse Energy Group plc (PHE.L)

Proton Power Systems (PPS.L)

Quantum...

List of Fuel Cell Stocks

Fuel cell stocks are publicly traded companies whose business involves fuel cells, devices for efficiently converting the energy in a fuel (often hydrogen) directly into electricity by chemical means, without combustion. Applications include road transport, large-scale energy storage and short-haul transport such as forklifts.

This list was last updated on 5/6/2021

AFC Energy (AFC.L)

Ballard Power Corporation (BLDP)

Bloom Energy Corporation (BE)

Cell Impact AB (CI-B.ST)

Ceres Power Holdings PLC (CPWHF)

Enova Systems (ENVS) - out of business since 2015.

FuelCell Energy (FCEL)

Impact Coatings AB (IMPC.ST)

ITM Power (ITM.L, ITMPF)

McPhy Energy SA (MCPHY: PA)

myFC Holding AB (MYFC.ST)

Neah Power Systems (NPWZ)

Nikola Corporation (NKLA)

Plug Power (PLUG)

PowerCell Sweden AB (PCELL.ST, PCELF)

Proton...

List of Battery Stocks

Battery stocks are publicly traded companies whose business involves the manufacture of batteries, battery components, or battery management systems used to store electricity through electrochemical means.

This list was last updated on 3/21/2022.

Advanced Battery Technologies Inc (ABAT)

Albermarle Corp (ALB)

Aspen Aerogels, Inc. (ASPN)

Axion Power International (AXPW)

BioSolar, Inc. (BSRC)

BYD Company, Ltd. (BYDDY)

China BAK Battery (CBAK)

Contemporary Amperex Technology Co., Limited (300750.SZ)

Eguana Technologies Inc. (EGT.V)

Electrovaya, Inc. (EFL.TO)

EnerSys (ENS)

Eos Energy Enterprises, Inc. (EOSE)

ESS Inc. (GWH)

Fluence Energy, Inc. (FLNC)

Flux Power Holdings, Inc (FLUX)

Global X Lithium ETF (LIT)

Highpower International (HPJ)

Invinity Energy Systems (IES.L, IVVGF)

Johnson Controls (JCI)

Li-Cycle Holdings Corp. (LICY)

Lithium Technology Corporation (LTHUQ)

Livent Corporation (LTHM)

mPhase Technologies (XDSL)

Microvast Holdings,...