Hydrogen Fuel Cells: Comparing Efficiencies

The previous articles in this series focused on the power costs and operational lifetimes of hydrogen fuel cells. These factors are important, as cheaper and long-lasting fuel cells are vital for the adoption of hydrogen as a fuel. (For details of how these cells work, refer to the first article).

Cost and durability are far from being the only characteristics of fuel cells worth consideration. Here we focus on fuel cell efficiency - this is the proportion of the chemical energy stored within the hydrogen supplied to the fuel cell, that is eventually converted into usable electricity.

The graph shows the...

PEM Fuel Cells – Hoping to Challenge Internal Combustion

The first article in this series introduced the two prominent types of hydrogen fuel cells - alkaline fuel cells (ALKFCs) and proton-exchange membrane fuel cells (PEMFCs). Fuel cells are devices that convert stored hydrogen into usable energy, and constitute an essential part of the hydrogen economy. Subsequent articles shall focus on various characteristics of these two cells.

The graph above shows the power costs ($/kW) of PEMFCs and ALKFCs as the technology has advanced over time. In other words, they show the initial capital cost for every 1 kW of fuel cell capacity (note that this axis is in the...

Alkaline Fuel Cells – In Need of Revival

The previous article in this series on hydrogen fuel-cells focused on proton-exchange membranes fuel cells (PEMFCs). These cells have been the interest of the industry in recent years, and make up the majority of the market. However, it is also worth discussing alkaline fuel cells (ALKFCs), an older variety of cells that remain prominent today. (For details on how these cells work, refer to the first article in this series).

The graph shows the power costs ($/kW) of PEMFCs and ALKFCs as the technology has advanced over time. In other words, it plots the initial capital cost for every 1...

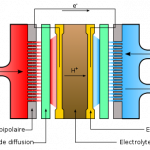

Introduction to Fuel Cell Technologies

Fuel cell technology is vital to building the hydrogen economy. Fuel cells combine hydrogen and oxygen into water, while generating a current and some heat energy. Thus, they are used to retrieve stored energy from hydrogen as electricity in large-scale stationary applications, and convert hydrogen fuel to power in automobiles.

This article introduces a series on fuel cell technologies which will explore the various technologies, the efforts and challenges to improving them, and their prospects for wide-spread adoption.

There are a range of fuel cell technologies. The two most prominent are alkaline fuel cells (ALKFC) and proton exchange membrane fuel cells...

McPhy: Growing With Hydrogen

by Debra Fiakas, CFA

Hydrogen system developer McPhy Energy SA (MCPHY: PA) recently reported impressive sales growth in the first half of 2019 - 23% higher than last year. Sales were boosted by delivery of a refueling station in Houdain, France for a bus operation that is 100% powered by hydrogen. New orders for projects in Germany, Bangladesh and Switzerland will keeps the company busy in the month ahead installing additional hydrogen fueling stations and electrolysis equipment for hydrogen production.

Despite the success, McPhy has not achieved profitability. Thus the company remains dependent upon financing to support operations. In 2017, the company secured an equity sales agreement with Kepler...

Shareholders Cry Foul as UQM Agrees to Buyout

UQM Technologies (UQM: NYSE) has agreed to be acquired by Danfoss Power Solutions for $1.71 per share in cash, providing a deal value near $100 million. UQM leadership expects timely review by government authorities and has recommended approval of the deal by shareholders. A date has not been set for the required shareholder vote. Assuming all goes according to schedule, a deal closing is possible sometime in the second quarter 2019.

Electric propulsion and generation technologies are at the core of UQM’s solutions for manufacturing, transportation and power industries. The substitution of electric motors for combustion engines has been driving demand for the UQM’s products. Market opportunities have abounded...

List of Fuel Cell Stocks

Fuel cell stocks are publicly traded companies whose business involves fuel cells, devices for efficiently converting the energy in a fuel (often hydrogen) directly into electricity by chemical means, without combustion. Applications include road transport, large-scale energy storage and short-haul transport such as forklifts.

This list was last updated on 5/6/2021

AFC Energy (AFC.L)

Ballard Power Corporation (BLDP)

Bloom Energy Corporation (BE)

Cell Impact AB (CI-B.ST)

Ceres Power Holdings PLC (CPWHF)

Enova Systems (ENVS) - out of business since 2015.

FuelCell Energy (FCEL)

Impact Coatings AB (IMPC.ST)

ITM Power (ITM.L, ITMPF)

McPhy Energy SA (MCPHY: PA)

myFC Holding AB (MYFC.ST)

Neah Power Systems (NPWZ)

Nikola Corporation (NKLA)

Plug Power (PLUG)

PowerCell Sweden AB (PCELL.ST, PCELF)

Proton...

SFC Energy: Growing Remote Power

by Debra Fiakas CFA Fuel cell developer SFC Energy, A.G. (F3C.DE) recently came calling on money managers in New York City. The company’s chief financial officer Steffen Schneider wants U.S. investors to know SFC has more going for it than simple fuel cells. True enough the company sells fuel cell components, but it is also capable of delivering complete off-grid energy solutions and integrating full systems. Schneider talks up SFC’s sterling customer list, including Volkswagen, Siemens, Schlumberger, Shell Oil, Arch Coal, Conoco-Phillips, and other industrial users. Then there are government agencies such as NATO, the FBI in...

FuelCell Energy Rising

by Debra Fiakas CFA Last week I was surprised to find FuelCell Energy (FCEL: Nasdaq) on a list of companies registering a particularly bullish technical formation called an ‘Aroon’ indicator. This measure that is designed to reveal stocks entering a new, decisive trend. Shares of this fuel cell technology developer and producer had been in a steady decline through most of the year 2014, reaching a 52-week low price of $1.05 in January 2015. However, since then FCEL has regained 27% from that low point. Source: Stockcharts.com The turn in fortunes seemed to...

Hyster-Yale’s Fuel Cell Deal

by Debra Fiakas CFA Near the close of 2014, Nuvera Fuel Cells was acquired by NACCO, an operating company of Hyster-Yale Materials Handling, Inc. (HY: NYSE). Nuvera sells a proprietary fuel cell stack under the brand name Orion for industrial mobility, automotive and aerospace applications. The company also sells its PowerTap Hydrogen Station for on-site hydrogen generation (see image below). The purchase price was not disclosed and Hyster-Yale has not provided guidance on how the deal will impact its sales and earnings in 2015. Apparently, Nuvera’s sales and earnings are not material to Hyster-Yale in the...

Toyota Opens The Fuel Cell Kimono

by Debra Fiakas CFA Last week Toyota Motor Corporation (TM: NYSE) announced its intention to share its patented fuel cell technology with other automotive manufacturers. Engineers from competing auto manufacturers can get a look at Toyota’s fuel cell designs up through 2020. Toyota has taken a page from Tesla Motors (TSLA: Nasdaq), which made its electric vehicle battery designs available to the public last year. Since the car business is intensely competitive, automotive manufacturers are typically quite circumspect about their innovations. However, producers of cars powered by alternative energy sources are faced with a unique problem ...

Fuel Cells: Know Your Market

by Debra Fiakas CFA The New Year got off to a rocky start for Ballard Power Systems (BLDP: Nasdaq), a developer of fuel cell technologies and systems. The company ran into some trouble with its strategy to penetrate the China market through a partner. No one should be surprised by Ballard’s difficulties. Fuel cell technology has been under development for more than two decades. Frankly, technology is not the problem - at least any more. Early on developers were beset by numerous challenges, not the least of which was the problem of getting fuel cells to work properly...

Ballard Terminates Azure Hydrogen Licenses; Can It Find A Better China Partner?

by Debra Fiakas CFA Before the open of the first trading day of 2015, fuel cell developer Ballard Power Systems (BLDP: Nasdaq) announced the termination of technology licenses to Azure Hydrogen, which was to have been Ballard’s introduction to the China market. The license agreements covered the sale of Ballard’s bus power module and telecom backup power system. Ballard has charged Azure with breaching the agreements and the two companies have apparently not been able to come to alternative terms. Azure had made sales in the China and not all of the equipment had been paid. ...

Hydrogenics: Powering Up

by Debra Fiakas CFA In the last post on Hydrogenics, Inc. (HYGS: Nasdaq) in April 2014, the stock seemed to be languishing on news of a potentially dilutive common stock offering. At the time profits still seem illusive. However, over the last few months circumstances have improved. Shares of Hydrogenics have moved higher on the company’s recent introduction of a fuel cell power system for medium and heavy duty vehicles. Additionally, in July this year Hydrogenics was chosen by Ontario as one of five grid storage projects. This has turned HYGS into an interesting stock to watch. ...

Fuel Cell Follies: Off-Roading

by Debra Fiakas CFA Consumer adoption of hydrogen-fueled vehicles could have quite a catalytic impact on the entire fuel cell industry. Two of the public fuel cell technology companies come to mind first: Plug Power, Inc. (PLUG: Nasdaq), FuelCell Energy, Inc. (FCEL: Nasdaq) and Ballard Power Systems, Inc. (BLDP: Nasdaq). These companies have been toiling away for years on fuel cell technologies, finding success on the periphery with industrial, campus and power generation solutions. All three companies trade at modest prices and could look like great bargains for investors with an extended investment horizon. Forklift Fuel Cells...

Mantra’s Promise of Innovation

by Debra Fiakas CFA How often do we see the crowd rooting for the underdog? You could hear the cheers for Mantra Energy (MVTG: OTC) last week at the Marcum Microcap Conference in New York City. Mantra is a developmental stage company pursuing technologies to harness carbon dioxide for energy. Of course, the company has no revenue and therefore no earnings. Indeed, its technologies are so unique and as yet at such an early stage some might find them almost fanciful. Yet for some investors, a fanciful underdog is even better than another. Mantra sees itself...