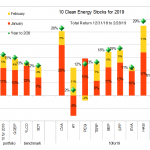

10 Clean Energy Stocks for 2021: Diversification

by Tom Konrad, Ph.D., CFA

Rounding out the discussion of the stocks in my 10 Clean Energy Stocks for 2021 list are the two that don’t fit either of the themes I highlighted for 2021: Picks and Shovels or a Possible Yieldco Boom. Both help with diversification, both in terms of their industry and geography.

MiX Telematics (MIXT) was retained from the Ten Clean Energy Stocks for 2020 list because I expect its prospects to improve rapidly as the world comes out of covid lockdowns. The global vehicle telematics provider has a large number of its customers among mass transit, logistics,...

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

Covanta Earnings

(published August 2nd)

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

Car Insurers Can Help Community Solar Find EV Customers

By Joe McCabe, P.E.

The insurance industry has lots of exposure to climate change. But as Warren Buffet has explained, not so much for companies that do annual policy adjustments, like Berkshire Hathaway. Their exposure is limited because the trends are baked into the premiums. But there is an opportunity for reducing insurance risk due to climate change, and it comes from the insurance industry itself. The business model is to have car insurance salespeople provide leads to virtual electric car charging services. This has perfect demographics because electric vehicle owners are very receptive to solar electricity. Who wouldn't want...

Valeo February Update (Ten Clean Energy Stocks)

I'm trying something different and doing quick updates on individual stocks in my 10 Clean Energy Stocks model portfolio as I have time to write. The portfolio as a whole has been accelerating with the instant torque of an electric vehicle this year (details here.) I thought I'd start with the company that's newest to my readers,

Valeo SA (FR.PA, VLEEF)

12/31/18 Price: €25.21/$28.20. Annual Dividend: €1.25. Expected 2019 dividend: €1.25. 03/4/19 price: €29.13/$33.00. YTD gain: 15.5% Euro/ 12.8% USD.

I added this stock to the portfolio because it has great technology and and improving market share, but weak industry growth and overoptimistic management projections in 2018...

Roadway Revolution: Meet the Smart Highways of the Future

by Giles Kirkland

Even though many states seem to enter the “construction season” every spring, there’s still a significant backlog of vital repairs and improvements needed for state roads, interstates and bridges – around $420 billion worth as of 2017.

Not only are our roads falling apart, there are greater numbers of people in more vehicles on them. But what if, instead of simply following same repaving or rebuilding formula that never seems to catch up, municipalities get “smarter” with their fixes?

Smart cars use the newest technologies to save energy, improve safety, and assist in navigation. Missing from many of the...

Shareholders Cry Foul as UQM Agrees to Buyout

UQM Technologies (UQM: NYSE) has agreed to be acquired by Danfoss Power Solutions for $1.71 per share in cash, providing a deal value near $100 million. UQM leadership expects timely review by government authorities and has recommended approval of the deal by shareholders. A date has not been set for the required shareholder vote. Assuming all goes according to schedule, a deal closing is possible sometime in the second quarter 2019.

Electric propulsion and generation technologies are at the core of UQM’s solutions for manufacturing, transportation and power industries. The substitution of electric motors for combustion engines has been driving demand for the UQM’s products. Market opportunities have abounded...

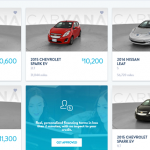

Surprisingly Affordable Electric Vehicles

When will electric vehicles cost the same or less than gas cars? If you are buying a used vehicle, the answer is “Today.”

If you are considering buying a used car, cost is clearly important to you. That’s why you should seriously consider a used electric vehicle (EVs). Lists of cars that lose their value fastest (a good thing if you are a used car buyer) are full of electric vehicles and luxury vehicles. The first generation of electric vehicles including GM's (GM) Chevy Volt and the Nissan (NSANY) Leaf regularly appear on lists of cars that depreciate quickly. Less...

Less Well Known Autonomous Car Stocks

Car manufacturers have fully embraced self-driving or autonomous cars. It is not because they have heard a loud clamor for such technology from consumers. No, automakers are keen on the idea because manufacture of self-driving cars could help them overcome the short comings of highly cyclical sales pattern associated with its car dependent upon a single driver. In other words, they are in it for themselves whether consumers benefit or not.

If consumers are not so important, at least investors should benefit. Besides the car manufacturers there are a few smaller companies that can give investors a taste of the self-driving car phenomenon.

LiDar and...

Manufacturers Going All Out for Self-driving Car Tech

There is a clutch of self-driving cars and cars with autonomous driving features on the market today. Drivers just cannot seem to get enough of them. Apparently, the idea of zooming down the highway with little to no responsibility holds considerable appeal. Then again, maybe it is the novelty of the idea that will eventually give way to the next fad.

In August 2018, Cox Automotive revealed the results of a survey that found fewer Americans are embracing self-driving technology than previously thought. A surprising 49% of respondents said they would NEVER own a fully-autonomous car. This is up from 30% naysayers two years ago. Views...

Westport Fuels Natural Gas Conversion

Earlier this week Westport Fuel (WPRT: Nasdaq) reported financial results for the quarter ending September 2018. Based on British Columbia, Westport is a developer and manufacturer of clean fuel systems for both fossil and renewable fuel sources. It has taken some years, but Westport management has worked hard and overcome a number of obstacles to bring a mix of engines and systems capable of handling various fuels such as natural gas, hydrogen and liquid petroleum gas.

Revenue jumped to $65.5 million in the September 2018, quarter delivering $4.3 million in cash earnings. The company’s relationship with truck engine manufacturer Cummins (CMI: NYSE) is proving to be...

Envision’s Off Grid Electric Vehicle Charging Stations

In a recent discussion about the extent to which Demand Charges are an impediment to development of DC fast chargers EV Fast Charging Disincentives, the solutions explored included primarily a) regulatory reform of the rate design & b) technology solutions involving battery based peak shaving.

A 3rd solution could be added, for strategies involving charging with behind-the-meter renewable generation. Solar carports can offer such a solution, with various configurations involving batteries sized to support L2 chargers. Most of the PV carports are grid-connected but can be islanded. I recently discovered a system that is completely off-grid. So far most of the carports...

The Race For Silicon Anodes

Graphite is the most widely used material for battery anodes. The anode is the positively charged electron collector in a battery. It collects and accelerates the electronics emitted by the battery’s cathode. Graphite gets the anode job because it is has excellent electric conductivity and resists heat and corrosion. Plus it is light weight, soft and malleable.

As satisfied as manufacturers might be with graphite anodes, none would balk at an alternative material that boosts battery performance or reduces cost. Scientists believe battery capacity can be increased as much as ten times by using silicon for anodes. It requires six atoms of carbon to bind one...

List of Electric Vehicle and Plug-In Hybrid Electric Vehicle Stocks

Electric Vehicle (EV) and Plug-in Electric Vehicle (PHEV) stocks are publicly traded companies which produce EVs or PHEVs, their components, or charging infrastructure.

This list was last updated on 6/3/22.

AeroVironment, Inc. (AVAV)

Blink Charging Co. (BLNK)

BYD Company, Ltd. (BYDDY)

Enova Systems, Inc. (ENVS)

EEStor Corporation (ZNNMF)

Electrameccanica Vehicles Corp. (SOLO)

Envision Solar International (EVSI)

EVgo, Inc. (EVGO)

Fisker (FSR)

GreenPower Motor Co. (GPV.V)

iShares Self-Driving EV and Tech ETF (IDRV)

Kandi Technologies Corp. (KNDI)

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS)

Leo Motors (LEOM)

Lordstown Motors Corp. (RIDE)

Navitas Semiconductor Corporation (NVTS)

Nio Inc. (NIO)

Nikola Corporation (NKLA)

Proterra Inc. (PTRA)

Tesla Motors, Inc. (TSLA)

UQM Technologies (UQM)

Valeo SA (FR.PA, VLEEF, VLEEY)

Vision Marine Technologies Inc. (VMAR)

VMoto Limited...

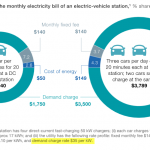

EV Fast Charging Disincentives

by Daryl Roberts

DC Fast Chargers (DCFCs) and Tesla superchargers are a key element in electric vehicle (EV) charging infrastructure that could facilitate wider adoption of EVs by enabling recharging that comes to resemble the time currently taken for gas station stops, and thereby reducing “range anxiety” for drivers.

However, the pricing structure for electrical costs incurred at commercial DC fast chargers is currently prohibitive, because it includes a special fee called a “demand charge”. Rate design in a number of states includes this additional charge, based on the “peak rate” on electric power consumed in kW. In New York,...

Low Carbon Fuel Rules: From CAFE to LCFS and Everything In Between

The Whole Darn Low Carbon Landscape. How they Work, How they Work Together, and How they Might Work Better

by Joanne Ivancic, executive director, Advanced Biofuels USA

The Trump Administration is taking a new look at Obama Administration era Co2 regulations. On the transportation side, these include reviewing Corporate Average Fuel Economy (CAFE) standards; threatening to take away California’s authority to set their own mileage and pollution controls, including CO2 (carbon dioxide) emission reduction standards; and quarreling with the petroleum and biofuels industries over implementation and enforcement of the Renewable Fuel Standard (RFS).

Thus, the Clean Air Act (CAA), California’s unique authority...

Rapidly Growing Alternative Energy Companies

The last post highlighted several companies in the alternative energy, conservation and environment technology fields that have delivered exceptional price performance over the last year. Prospects for growth in sales or earnings appeared to be key drivers of the price movement. It makes sense to seek indicators of growth as cues for those companies that may become tomorrow’s price movers.

Crystal Equity Research’s novel alternative energy indices were a good place to go on a ‘quest for growth.’

Beach Boys Index - Biodiesel

The two analysts who publish estimates for Renewable Energy Group (REGI: Nasdaq)apparently expect a surge in growth in the current year followed by a leveling...