Axion Power is Poised to Dominate Energy Storage for Stop-start Idle Elimination

John Petersen After eight years of rarely speaking above a whisper, Axion Power International (AXPW.OB) has found its voice, taken the scientific wraps off its PbC® battery technology and shown potential customers, competitors and investors that it's carrying a big stick and is poised to dominate energy storage for stop-start idle elimination – a cheap and sensible fuel efficiency and emissions reduction technology that's expected to grow at spectacular rates for the rest of the decade as shown in the following forecast of battery demand in vehicles equipped with stop-start systems. In a new white...

Energy Conversion 4Q Sales Disappoint

Energy Conversion Devices Inc (ENER) announced quarterly results on Monday. They beat Wall Street expecations with a less than expected loss, but did not meet sales estimates. They posted a loss of $6.9 million, or 23 cents per share, for the three months ended June 30, compared with a year-ago loss of $11.5 million, or 44 cents per share. The company's loss from continuing operations was 22 cents per share. Wall Street estimates on the loss were 26 cents a share. The stock is currently trading down over 4% in pre-market trading. I have been looking for a...

EV Fast Charging Disincentives

by Daryl Roberts

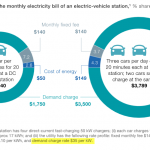

DC Fast Chargers (DCFCs) and Tesla superchargers are a key element in electric vehicle (EV) charging infrastructure that could facilitate wider adoption of EVs by enabling recharging that comes to resemble the time currently taken for gas station stops, and thereby reducing “range anxiety” for drivers.

However, the pricing structure for electrical costs incurred at commercial DC fast chargers is currently prohibitive, because it includes a special fee called a “demand charge”. Rate design in a number of states includes this additional charge, based on the “peak rate” on electric power consumed in kW. In New York,...

Energy Storage: Q3 2012 Winners and Losers

John Petersen I usually write a quarterly recap to summarize what happened in the energy storage and vehicle electrification sectors, but Q2 was a tough enough period that I don't see much sense in dwelling on the bloodletting. So instead of focusing on the past, I'll offer a quick summary table with lots of red ink and turn my attention to Q3, which is shaping up as a time of bright opportunity for some companies and profound risk for others. I expect three companies in my tracking group to perform very well in Q3 –...

The Cruel Realities of EV Range

John Petersen An English proverb teaches us to hope for the best but plan for the worst. With the imminent introduction of a variety of plug-in vehicles that will begin hitting showroom floors in the next few months, the phobia du jour is range anxiety, an entirely rational terror that an EV will get you to your destination in eco-chic style but only get you home with the help of a tow-truck. Sadly, most people who extol the virtues of electric drive are incurable optimists that have little or no regard for the risks inherent in complex systems...

Arotech’s Electric Fuel Joins International Zinc Consortium with Focus on Electric Vehicles for 2008...

Arotech Corporation (ARTX) announced today that its Electric Fuel subsidiary is one of the founders of the recently formed Zinc Energy Storage Technology (ZEST) Consortium. Launched in March 2005, the Consortium's declared aim is to enable the market for zinc-energy storage technology to realize its full potential. The Consortium will initially focus on the electric vehicle market in Asia. In preparation for the Olympic Games in Beijing in 2008, which China in its successful bid to the International Olympic Committee declared would be a "Green Olympics," China has committed to employing 1,000 environmentally clean buses for transportation of...

10 Clean Energy Stocks for 2021: Diversification

by Tom Konrad, Ph.D., CFA

Rounding out the discussion of the stocks in my 10 Clean Energy Stocks for 2021 list are the two that don’t fit either of the themes I highlighted for 2021: Picks and Shovels or a Possible Yieldco Boom. Both help with diversification, both in terms of their industry and geography.

MiX Telematics (MIXT) was retained from the Ten Clean Energy Stocks for 2020 list because I expect its prospects to improve rapidly as the world comes out of covid lockdowns. The global vehicle telematics provider has a large number of its customers among mass transit, logistics,...

New 2006 Civic Hybrid

Green Car Congress has an excellent writeup about the recently announced Honda 2005 Civic Hybrid. Compared to the 2005 Civic Hybrid, the 2006 model with the new IMA is 18% more powerful than its predecessor while delivering a combined EPA estimated fuel economy of 50 mpg US compared to 47–48 mpg US of the 2005 hybrid. The new IMA also adds the ability to cruise only under the power of the electric motor. Honda Motor Co (HMC) has been playing catchup with Toyota in the hybrid marketplace and they are looking strong with this new offering....

Another Look at New Flyer Industries (NFI-UN.TO, NFYIF.PK)

Tom Konrad, Ph.D. CFA Should reduced liquidity at New Flyer Industries concern investors? New Flyer Industries (NFI-UN.TO, NFYIF.PK) is one of my largest single clean energy investments. The company describes itself as the "leader in the heavy-duty bus market for the US and Canada." This is why I first brought it to the attention of readers in April 2008, as a company likely to benefit from peak oil. Increasing the fuel efficiency of our vehicle fleet can reduce our consumption of oil in North America, but not at a pace sufficient to both accommodate declining oil supplies...

Hybrid cars drive a company, and its stock

Energy Conversion Devices Inc (ENER) founded by the now-82-year-old Mr. Ovshinsky in 1960, developed the battery technology that is being used in Toyota Motor Corp.'s Prius the popular "hybrid" car model that has given U.S. automobile titans Ford Motor Co. and General Motors Corp. a run for their money. And the Rochester Hills, Mich., company though it still is unprofitable, making iit a risky bet is drawing backing from serious investors who see a hot market for its products. This story hit the news wires and the Wall Street Journal late last night. ENER...

Honda Natural Gas Civic Sales Sputter

By Jeff Siegel I learned today that sales of Honda's natural gas Civic tanked 65% in 2014. I didn't even know they were still trying to sell those things! I actually remember a few years ago, attending a car show and talking to a Honda rep who was pushing this thing. I didn't have the heart to tell him he was barking up the wrong tree when he tried to sell me on all the benefits. What benefits? Inferior fuel economy, a clunky ride, and no infrastructure? Sure, there was the special fueling unit that could be installed in...

Hyundai gearing up to launch hybrid cars

While Korea is on red-alert to rising oil prices, Hyundai Motor Co., the nation's largest carmaker, is stepping up efforts to develop fuel-efficient cars that run on a combination of gasoline and electricity. Company officials said the introduction of hybrid cars should come around 2007 or possibly earlier.

Energy Storage: Q1 2012 Winners and Losers

John Petersen The first quarter of 2012 was the best of times for shareholders of companies that are developing and manufacturing cheap energy storage products like lead-acid batteries, but the worst of times for shareholders of pure-play lithium-ion battery developers. The following table tracks stock price performance in the energy storage and electric vehicle sectors for the first quarter of 2012 and for the twelve months ended March 31st. Long-term readers will notice that the current list is a good deal shorter than it was in March of last year because of my decisions to...

A Blue-chip Clean Car Stock

One of the criticisms I often hear about cleantech is that, as an asset class, it is too risky and volatile for the average investor. That is a misconception Tom attempted to dispel a few months ago with his Blue-Chip Alternative Energy Portfolio. In fact, some of the most interesting work in cleantech and alternative energy is currently being conducted by large companies. A Clean Car Pick Last year, we told you about a report on investing in clean automotive. We have some interesting follow-up information on one of the companies discussed in that report. ...

Hybrid Locomotives, Vehicle Electrification at Relevant Scale

John Petersen Last month Ricardo PLC (RCDOF.PK) published a report titled "GB Rail Diesel Powertrain Efficiency Improvements" that it prepared for Great Britain's Department for Transport. While most of the fuel efficiency technologies Ricardo evaluated for the report were mechanical systems, its analysis of the fuel efficiency benefits of stop-start and hybrid systems for locomotives offered an intriguing view of a cost-effective vehicle electrification opportunity that can be implemented at relevant scale within a few years. The two types of locomotive systems Ricardo evaluated for the report were simple stop-start idle elimination and full hybridization. The following table...

Plug-in Vehicles, Unconscionable Waste and Pollution Masquerading as Conservation

John Petersen For eighteen months I've been blogging about the energy storage sector and discussing the current and potential markets for batteries and other manufactured energy storage devices. A recurring theme that I've discussed many times is the unrecognized but undeniable truth that while plug-in vehicles masquerade as conservation measures at an individual level, they're incredibly wasteful at a societal level. The conclusion is counter-intuitive and my articles on the subject invariably draw heated criticism from self-anointed defenders of the faith. Their arguments, however, do not change the inescapable truth that plug-in vehicles are one of the most...