Five Green REITs

by Tom Konrad Ph.D., CFA

Why Green Buildings are Profitable Buildings

Buildings are responsible for approximately a third of greenhouse gas emissions, so making buildings more efficient and switching them to renewable sources of energy is an essential part in addressing climate change.

Fortunately, new technologies such as cold climate heat pumps, heat pump water heaters, induction stoves, as well as the ever falling cost of renewable electricity and improvements to insulation and building envelopes often provide opportunities to improve buildings while achieving extremely attractive investment returns from the energy and maintenance savings alone.

Because of the great financial returns, building owners who...

Analyzing Greystone Logistics

by Roel Aerts

Greystone Logistics (GLGI) designs and manufactures plastic pallets for the logistics industry. They use recycled plastic which would otherwise be destined for landfill. They grind and pelletize the plastic in house. Injection molding and proprietary resin blend is used to manufacture the pallets.

Greystone is headquartered in Oklahoma and has its manufacturing plant in Iowa.

Recent results and Financials

· The company had invested heavily in manufacturing equipment several years ago, that loaded them with quite some debt. Over the last years they worked on a massive reduction in debt. In 2 years they reduced it from 21.6M$ to 9.4M$...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

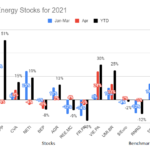

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

The Big Win You Missed

by Tom Konrad, Ph.D., CFA

My friend Jan Schalkwijk, CFA of JPS Global Investments just asked me if I had any thoughts on Kontrol Energy (KNR.CN, KNRLF), a Canadian smart building firm I had never heard of. (I just added it to AltEnergyStocks.com's Energy Efficiency and Smart Grid stock lists.)

The stock had just shot up after the client sold and went on a kayaking trip. It had disclosed a sensor for detecting COVID-19 from the air.

While I didn't have anything to say about the company, I did have some thoughts on dealing with the emotions around missing out. Since it's...

The Basics of Residential Clean Energy For Realtors and Homeowners

Note: The following is a handout written by AltEnergyStocks Editor Tom Konrad at the request of a leading local Realtor where he lives in Ulster County, NY. It is intended as a handout that local Realtors can give to new homeowners who express an interest in reducing their home energy use and using renewable energy. Some of the information and may not be applicable if you live in other areas because of varying climate, energy costs, and regulation. While most of the locally specific has been removed from this version, and the remainer is broadly applicable, homeowners in other...

The Challenge of Scaling Up Building Energy Retrofits

It’s almost always easier and cheaper to build an energy-efficient building in the first place than retrofitting existing structures. But humanity doesn’t always have that luxury.

by Tom Konrad, PhD., CFA

The sheer number of older, inefficient buildings means retrofits must be a critical part of decarbonizing the world’s building stock.

There’s a pressing need, then, to develop new techniques for performing large numbers of energy-efficiency retrofits quickly and cost-effectively. The average age of a U.S. home is nearly 40 years, while nearly 40 percent of homes in the U.K. were built before World War II.

Most building energy retrofits are one-off affairs...

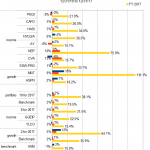

Bargain Priced Alternative Energy Stocks

A review of Crystal Equity Research’s novel alternative energy indices found a number of companies that have delivered exceptional price appreciation over the last year. Several were reviewed in the recent post “Alternative Returns” on May 8th. Expectations for growth appeared to be driving the price movement, so the last post “Quest for Growth” featured four companies from the indices for which analysts have posted high growth predictions. Not unexpectedly some investors have already bid higher the stocks of those promising companies.

In this post we go back to the lists to find the companies with both high growth predictions and low price-earnings...

List of Energy Efficiency Stocks

Energy efficiency stocks are publicly traded companies using a wide range of technologies to deliver the same energy services using less energy in the built environment. This includes efficient lighting such as LED lighting stocks, insulation, efficient motors, efficient appliances and appliance replacement services, sensor and control technologies, the internet of things, efficient power conversion and generation, and energy efficient design, construction, and retrofits.

See the list of efficient vehicle stocks and alternative transportation stocks for companies reducing energy used in transportation.

This list was last updated on 7/20/2022.

Acuity Brands(NYSE:AYI)

AIXTRON SE (AIXA.DE)

Ameresco, Inc. (AMRC)

Appliance Recycling Centers of American (ARCI)

Aspen Aerogels, Inc....

List of LED Lighting Stocks

LED lighting stocks are publicly traded companies involved in the manufacture or deployment of efficient LED lighting technology.

AIXTRON SE (AIXA.DE)

Acuity Brands (AYI)

Amtech Systems Inc (ASYS)

Applied Materials (AMAT)

Carmanah Technologies Corporation (CMH.TO, CMHXF)

Cree, Inc. (CREE)

Energy Focus (EFOI)

EPISTAR corporation (2448.TW)

Koninklijke Philips N.V. (PHG)

Lighting Science Group Corporation (LSCG)

Lime Energy (LIME: Nasdaq)

LSI Industries Inc. (LYTS)

Orion Energy Systems, Inc (OESX)

Osram Licht AG (OSAGF, OSR.DE)

Neo-Neon Holdings Limited (1868.HK)

Revolution Lighting Technologies, Inc. (RVLT)

Rubicon Technology, Inc. (RBCN)

SemiLEDs Corporation (LEDS)

Trans-Lux Corporation (TNLX)

Universal Display(OLED)

Veeco Instruments Inc. (VECO)

Zumtobel Group (ZMTBF: OTC or ZAG.VI)

If you know of any LED lighting stock that is not listed here and should be, please let us know...

OLED Miscues

Last week shares of Universal Display (OLED: Nasdaq) closed down 15.8% on the week. The price move was a surprise, especially for Universal’s ebullient management team. The company had reported sales and earnings well above expectations for the fourth quarter ending December 2017, as the market embraces the company's proprietary energy-saving display technology. The consensus had been for $0.85 in earnings per share on $100 million in total sales for the quarter. Management delivered.

Sales in the quarter totaled $115.9 million as sales of proprietary PHOLED phosphorescent materials soared. Net income was $32.8 million or $0.69 per share. Excluding a one-time write-off of deferred tax assets of $11.5 million...

Hannon Armstrong Declines to Raise Dividend, Sets 3 Year Guidance

Investors did not like Hannon Armstrong's (NYSE:HASI) fourth quarter earnings announcement last night. While core earnings were a little weaker than expected, that is not what has the stock trading down 11% today. What shocked investors is the fact that the company did not raise the dividend this year for the first time since the REIT went public, and it gave 3 year guidance which likely disappointed many investors.

Last month, I wrote,

I expect that Hannon Armstrong will continue to be a well run and conservative business in 2018, and that management will raise the dividend at the lower end...

See You Later, Hannon Armstrong

by Tom Konrad Ph.D., CFA

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its...

Can Investors Recover Faith In Energy Recovery?

by Debra Fiakas CFA

Despite reporting the highest gross profit margin in Energy Recovery's (ERII: Nasdaq) history, investors were sorely disappointed with financial results in the Company’s second quarter ending June 2017. On the first day of trading following the earnings release the share price gapped downward and closed even lower under above average trading volume. This is likely because there was some expectation that Energy Recovery could finally report a net profit in the quarter as sales of the Company’s flagship PX Pressure Exchanger to the desalination market had appeared to pick up in recent months. Unfortunately the Company reported...

Recycler Priced for Recovery

by Debra Fiakas CFA

Shares of Appliance Recycling Centers of America (ARCI: Nasdaq) has trended downward over the last year, despite some strong fundamental progress in the company’s position the recycling sector. The corporate name tells at least part of the company’s story. Besides recycling appliances such as washers, dryers and refridgerators, ARC also sells new and like-new appliances right out of the box. The company has eighteen stores branded ApplianceSmart across the country. Services to electric utilities and other energy companies related to energy efficiency programs provide yet another revenue source.

In the twelve months ending March 2017, ARC reported...

Lights of Energy Focus

by Debra Fiakas CFA It is the season of lights. Lights for Hanukkah. Lights for Christmas. Energy Focus (EFOI: Nasdaq) has been having a season of lights all year. The company reported $62.3 million in total sales of its LED lighting products in the most recently reported twelve months. Customers included large business and industry, property owners and the military. The oil and gas industry is an important market vertical. Energy Focus really shines for the U.S. Navy with its explosion proof LED globes in all the colors the Navy needs to provide military personnel safety...

Looking for Cash in Old Refrigerators

by Debra Fiakas CFA

Appliance Recycling Centers of America (ARCI: NYSE) is a typical small company, toiling away in seeming obscurity and struggling to get proper valuation of their success. There is little glamour in old refrigerators and washing machines, but ARCA has figured out how to wring cash from recycling our household appliances. In the last three fiscal years the company converted 1.6% of sales to operating cash flow.

Unfortunately, things have turned a bit sour in the world of old Frigidaires and tired Maytags. Last week ARCA reported financial results for the quarter ending September 2015. The company suffered...