Ten Clean Energy Stocks of 2022/3 – July Returns

Here are the numbers. I hope to write some market commentary to go with them soon.

Disclosure: Long all the stocks in the 10 Clean Energy Stocks model portfolio.

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Restarting 10 Clean Energy Stocks Series

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

10 Clean Energy Stocks for 2021: Wrap Up

By Tom Konrad, Ph.D., CFA

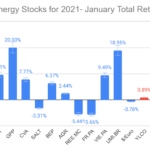

The Ten Clean Energy Stocks for 2021 model portfolio had a decent year. With a 13.2% total return, it handily beat its clean energy income stock benchmark, the Global X Renewable Energy Producers ETF (RNRG, formerly YLCO), which fell 12.1%. It did not, however, compare as well to the wider universe of income stocks, which had an excellent year, with its benchmark SDY up 27.2%.

The poor performance of clean energy stocks in 2021 was largely due to the bursting of a clean energy bubble which formed in the second half of 2020 fueled by speculation...

10 Clean Energy Stocks for 2021: November. Notes on MIXT, GPP, EVA

By Tom Konrad, Ph.D., CFA

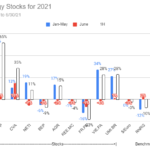

Monthly Performance

Returns for the Ten Clean Energy Stocks for 2021 model portfolio are shown below. It was a good month for clean energy stocks as well as the broader stock market, with the portfolio up 4% for a 20% total return through the end of October. Its clean energy benchmark (RNRG) was up more (8%) but is still down 6% for the year. Its broad market benchmark (SDY) rose 5% and has caught up with the model portfolio at a 20% return year to date.

Earnings

Third quarter earnings season has started. Below are some notes I’ve...

Will McConnell Kill The Bull Market?

By Tom Konrad, Ph.D., CFA

The risks of playing politics

The American news media often tries too hard to be “balanced” when talking about politics.

Depending on which news sources you rely on, you may be hearing that “congress” is having trouble passing bills to fund the government and raise the debt ceiling. More partisan sources will be blaming it on the Democrats or the Republicans, depending on their political bent.

I generally consider myself an independent who cares deeply about the environment and competent government. Since the rise of Donald Trump, the Republicans have shifted from being the party of big business...

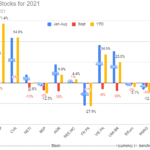

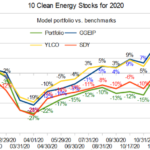

10 Clean Energy Stocks Performance Chart

Here's the performance through August for the 10 Clean Energy Stocks for 2021 model portfolio... The market has turned down a bit since then but the relative performance has not changed significantly. The model portfolio is still well ahead of its benchmarks., both clean energy (RNRG) and broad market (SDY).I don't know if this recent downturn is just a blip, or the start of the possible larger decline I've been worrying about. But I'm prepared if it's the latter.

DISCLOSURE: Long positions all the stocks in the model portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of...

Finding a Bottom and Model Portfolio First Half Returns

By Tom Konrad, Ph.D., CFA

Even as the broad market rose, the start of 2021 was brutal for clean energy stocks. The sector experienced a bubble in late 2020 and January this year as optimism grew that we finally had a President who understands the magnitude of the climate problem and has committed to do something about it. The bubble also grew from the great hope that with the presidency and slim majorities in both houses of congress, he would actually be able to get his agenda through.

That might have happened if the Senate Republicans were interested in governing and...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

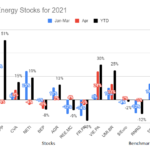

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

Earnings Roundup: Metals Prices Boost Covanta and Umicore

By Tom Konrad, Ph.D., CFA

You don’t have to own mining companies to benefit from rising metals prices.

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. Waste to energy operator Covanta and specialty metals recycler Umicore are both benefiting from skyrocketing metals prices.

Just as renewable energy and energy efficiency stocks have long shown that investors don’t have to own fossil fuel companies to benefit from rising prices of fossil fuels, recyclers like Covanta and Umicore are showing that you don’t have to own environmentally damaging mining companies to benefit from rising...

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

Clean Energy Stock Deflation and Biden’s Infrastructure Plan

By Tom Konrad, Ph.D., CFA

Last month saw buying opportunities in some clean energy stocks as the bubble created from the euphoria over Biden’s election vanished as if it never happened.

Clean energy stocks have simply returned to the general upward trendline from the second and third quarter of 2020. Rather than bursting in a market panic, this seems to have been more of a general deflation.

Some clean energy stocks seem reasonably priced, but there are no great values like we often see during the market panics which typically follow bubbles. Without a panic, I’m not ready to buy aggressively. Stocks...

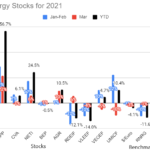

10 Clean Energy Stocks: Returns Through February/ Poll

by Tom Konrad Ph.D., CFA

I'm experimenting with how to display the returns of the 10 Clean Energy Stocks model portfolio. My Patreon supporters seem fairly evenly split between the two options show below, so I'm opening the poll up to my broader readership.

You can see the two most popular options below (with real return data through the end of February) and take the poll here.

Comments are welcome as well.

DISCLOSURE: Long all stocks in the model portfolio.

January Performance: 10 Clean Energy Stocks for 2021

You can find the original list here. I'll be doing commentary on individual stocks as there is news. The first of these is on MiX Telematics (MIXT) earnings, first published for my Patreon subscribers on January 28th and copied below. A note on Scorpio Bulkers (SALT) from February first will be published here tomorrow.

MiX Earnings

MiX Telematics (MIXT) reported earnings this morning . The numbers showed improvement over the previous quarter, but a decline over the previous year due to the covid crisis which was exacerbated by the strengthening dollar.

The results were pretty much what I expected when I added...

Year in Review: 10 Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

Looking Back

At the end of 2019, I was worried about overvaluation.

I wrote that my main goal for the 10 Clean Energy Stocks for 2020 list was “to find stocks which will be resilient in the event of a US bear market.” We certainly had a bear market in 2020, although it was nothing like the kind of bear market I had been anticipating. The bear market was precipitated by the coronavirus pandemic, rather than overvaluation.

While I can claim to have anticipated the 2020 bear market, if not its nature, I was surprised by two other...

10 Clean Energy Stocks for 2021: Diversification

by Tom Konrad, Ph.D., CFA

Rounding out the discussion of the stocks in my 10 Clean Energy Stocks for 2021 list are the two that don’t fit either of the themes I highlighted for 2021: Picks and Shovels or a Possible Yieldco Boom. Both help with diversification, both in terms of their industry and geography.

MiX Telematics (MIXT) was retained from the Ten Clean Energy Stocks for 2020 list because I expect its prospects to improve rapidly as the world comes out of covid lockdowns. The global vehicle telematics provider has a large number of its customers among mass transit, logistics,...