Scrappy Companies For Scrappy Investors

By Tom Konrad, Ph.D., CFA

Supply and Demand

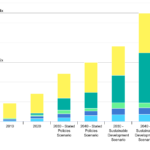

One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, cobalt, copper, manganese, graphite, even steel: just name and industrial commodity, and we’re probably going to need a lot more of it.

Total mineral demand for clean energy technologies by scenario, 2010-2040

Even worse, it’s not at all clear where all these materials are going to come from. While there are plenty of all the elements we need in the Earth’s crust, actually mining them all in the next 20 years is not...

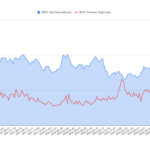

The Brookfield Renewable Energy Corporation Premium

By Tom Konrad, Ph.D., CFA

On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. Quarterly earnings actually beat expectations, but for Yieldcos like Brookfield, cash flow numbers and revenue (which can be more indicative of the company’s ability to pay and raise dividends) can be more important. These fell short.

The company attributes the cash flow shortfall to its own clients delaying payments at the end of December, in order to make their own financial statements look better, and it expects the shortfall to reverse...

How to Invest in Clean Energy Webinar

Eventbrite sign-up: https://www.eventbrite.com/e/how-to-divest-from-fossil-fuels-and-invest-in-clean-energy-tickets-591429470467?keep_tld=1

Transmission – The Bottleneck We All Saw Coming

by Paula Mints

Transmission and distribution is the process of getting electricity from the point of generation to the point of use. Unfortunately, upgrades, maintenance, and the need to extend the electricity infrastructure from point a to point b are often ignored. Also ignored are infrastructure designs that support a distributed grid with renewable energy sources of electricity.

Transmission bottlenecks are the utterly foreseeable consequence of accelerated solar and

wind deployment. As countries worldwide were announcing RE goals, holding auctions, and providing incentives, system operators everywhere were warning about the need to add new and upgrade existing infrastructure while also warning about...

10 Clean Energy Stocks Updates: Green Plains Partners Refi; Covanta Buyout

By Tom Konrad, Ph.D., CFA

Second quarter earnings season is in full swing. Below are a couple updates and the monthly performance chart that I recently shared with my Patreon supporters.

Green Plains Partners Earnings and Future Dividend

(published August 2nd)

Ethanol Master Limited Partnership Green Plains Partners (GPP) declared second quarter earnings today. The main news remains the long anticipated debt refinancing and new dividend guidance going forward.

At the end of the first quarter, I predicted that, after debt refinancing, GPP would increase its quarterly dividend to something in the $0.25 to $0.30 range.

The new guidance is for the partnership to target...

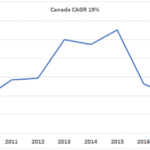

Pop Goes the Clean Energy Stock Bubble

by Tom Konrad, Ph.D., CFA

2020 ended with a massive spike in clean energy stock prices. From the end of October, election euphoria drove Invesco WilderHill Clean Energy ETF (PBW) from $63.32 to $136 at the close on February 9th, a 114% gain in 100 days.

Joe Biden is as strong a supporter of clean energy as Donald Trump was a supporter of big fossil fuel companies, but even with control of the presidency and both chambers of congress, there is a limit to what a president can do in a short time. This is especially true when their top priority...

List of Green Investment Advisors

If you want your money to help with the transition to the clean energy economy, most investment advisors will probably try to accommodate by finding a few green mutual funds for you.

There are now hundreds of mutual funds and ETFs that brand themselves as green, but many will not meet your definition of what is "green." This could mean not being completely divested from fossil fuels, investing in nuclear power, or owning too much of non-fossil fuel stocks like Apple (AAPL) and Facebook (FB) and not enough green-focused companies like Tesla (TSLA).

An investment advisor who does not consider values...

Stock Picking For Green Investors (Presentation)

Here is a short presentation on stock picking for green investors by AltEnergyStocks Editor Tom Konrad CFA, Ph.D., with a couple stock picks. I gave this presentation as part of a workshop on divestment from fossil fuels and investment in green stocks at the third annual Climate Solutions Summit. The Divestment part is here.

The Case of Divestment From Fossil Fuels (Powerpoint presentation)

This is a presentation from the Third Annual Climate Solution Summit by Katelyn Kriesel, Board President of the Sustainable Economies Alliance on the case for divesting from Fossil Fuels.

_Divestment Presentation - New Paltz

Katelyn Kriesel is an expert in the field of sustainable finance. She is a Financial Advisor with Hansen’s Advisory Services, located in Fayetteville, NY, a firm that has specialized in Socially Responsible Investing for over 30 years. She is also Board President and founder of the Sustainable Economies Alliance (SEA), a not-for-profit organization that is raising community awareness regarding economic sustainability and empowerment. She uses this expertise...

ESG5 Summit brief

A conference hosted in NYC in early April, 2019 ESG5 SUMMIT showcased the issues of current concern to institutional asset managers. ESG as a term is a rebranding of SRI (socially responsible investing) and CSR (corporate social responsibility) now under broad headings of Environment Social & Governance, to reflect that it is more than just an investing style, but is concerned with risk management and value creation. ESG strategies are being pursued by a range of participants, including public and private pension funds, mutual funds and ETFs, family offices and sovereign wealth funds, and advisors and advocacy groups.

The goals are...

Solar Energy Industry Association (SEIA) Tax Equity Conference Brief

I recently attended the Solar Energy Industry Association's (SEIA) Finance and Tax Seminar in New York. The subject matter in this event delved into issues related to tax equity finance. Each panel session was moderated by a tax attorney or an accountant, and most of the content of the sessions consisted of technical tax law.

To place the discipline into context, one speaker noted that the tax equity renewables investing deal volume in 2018 was $2-3B for solar and $9B for wind, and the number of tax equity participants is roughly only 25-35 large corporations. So unless there are changes...

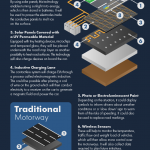

Roadway Revolution: Meet the Smart Highways of the Future

by Giles Kirkland

Even though many states seem to enter the “construction season” every spring, there’s still a significant backlog of vital repairs and improvements needed for state roads, interstates and bridges – around $420 billion worth as of 2017.

Not only are our roads falling apart, there are greater numbers of people in more vehicles on them. But what if, instead of simply following same repaving or rebuilding formula that never seems to catch up, municipalities get “smarter” with their fixes?

Smart cars use the newest technologies to save energy, improve safety, and assist in navigation. Missing from many of the...

The MacArthur Foundation Invests In Climate Solutions- And In Fossil Fuels

By Marc Gunther.

Eighteen months ago, the people who manage the endowment at the John D. and Catherine T. MacArthur Foundation got some bad news: Investments they had made in funds managed by EnerVest, a Houston-based private equity firm that operates more than 33,000 oil and gas wells across the US, had plummeted in value to almost nothing.

The losses were small, relatively speaking — roughly $15 million, a fraction of the foundation’s $7 billion endowment — but they were unwelcome, if only because they called attention to the fact that MacArthur, whose mission is, famously, to build a “more just, verdant and peaceful world,” had...

Conference Brief – Solar & Storage Finance

Renewable energy finance has many different kinds of participants, as revealed recently at the Solar & Storage Finance conference hosted in NYC. . Listening to the live actors from the financial side of the renewable power industry moved the issues off the page, to a more concrete experience of their specific concerns, including the extent to which their distinct missions were siloed, how they are competitive, and how they synergize.

The presentations were organized to highlight these differences. Several panel discussions were set back-to-back the contrast between lenders vs tax equity investors, both in terms of their goals, but also...

Solar & Storage Finance Conference Notes

I attended the Solar & Storage Finance conference hosted in NYC in late October 2018. Presenters included a mix of capital providers & asset managers, private non-profit entities & public agencies, legal, accounting & consulting firms, intermediaries, firms providing risk analysis, ratings & mitigation, & various vendors of energy storage and IT-related services. The tone of the discussions was noteworthy for its near total absence of ideological comments about environmental urgency. Rather, it was a meeting of finance technicians and technocrats focused on the nuts & bolts of accomplishing those ends, with the merits and relevance of mission assumed.

The...

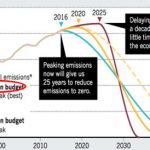

Green New Deal Roadmap – Accelerating Renewable Energy Infrastructure Development

Investment in renewable energy is rising, but clearly needs to grow faster to meet the goals for an expedited transition away from carbon infrastructure if we are to avoid dangerous climate change, given that now even the Trump administration forecasts a 7°C increase by 2100, which would be catastrophic.

The Paris Agreement determined that in order to keep warming below 2°C, the global economy would need to be restricted to a 600 gigaton carbon “budget”, and completely decarbonize by 2040.

Emissions must be cut by 70% in the Paris-congruent Remap case, and 90% of those cuts in energy-related CO2 emissions can...