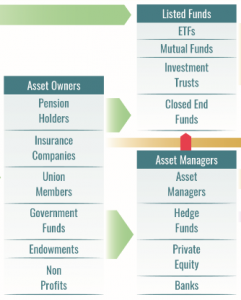

A conference hosted in NYC in early April, 2019 ESG5 SUMMIT showcased the issues of current concern to institutional asset managers. ESG as a term is a rebranding of SRI  (socially responsible investing) and CSR (corporate social responsibility) now under broad headings of Environment Social & Governance, to reflect that it is more than just an investing style, but is concerned with risk management and value creation. ESG strategies are being pursued by a range of participants, including public and private pension funds, mutual funds and ETFs, family offices and sovereign wealth funds, and advisors and advocacy groups.

(socially responsible investing) and CSR (corporate social responsibility) now under broad headings of Environment Social & Governance, to reflect that it is more than just an investing style, but is concerned with risk management and value creation. ESG strategies are being pursued by a range of participants, including public and private pension funds, mutual funds and ETFs, family offices and sovereign wealth funds, and advisors and advocacy groups.

The goals are to allocate funds that encourage corporate practices that positively promote environmental stewardship, diversity, human rights, and consumer protection, and steer funds away from corporations with socially harmful business models. In connection with the Paris climate summit, a group of investment funds with $26 trillion AUM, pledged to pressure the worst 100 companies responsible for 65% of all emissions. That effort has expanded to become the G20’s Taskforce on Climate-related Financial Disclosure (TCFD) which now includes over 500 firms with market caps of $7.9Tr, including 150 financial institutions managing assets over $100 trillion, including 20 of 30 systemically important banks and 8 of 10 of the largest asset managers.

To support these efforts, metrics, ratings & other resources have been developed for determining materiality, ie., whether the investment can make a material impact, and whether it can generate alpha and can compete with conventional investments. The most prominent data analytics are provided by the Sustainability Accounting Standards Board (SASB), UN Principles for Responsible Investing (PRI), Sustainalytics & MSCI. Other entities that have developed their own systems for assessment and reporting, include: CSRHub, Ceres, Edison Electric Institute (EEI), Global Reporting Initiative (GRI), Carbon Disclosure Project (CDP), Climate Disclosure Standards Board, UN Sustainable Development Goals, Oxfam, World Resources Institute, SSI, & Sustainable Investment Forum (USSIF).

SASB developed an extensive sustainability framework of environmental & social capital necessary to create long-term value, and a Materiality Map to provide guidance on use of SASB standards in making disclosures, and for conducting materiality assessments of issues that are likely to affect financial condition or operating performance. For purposes of scoring and ranking, each industry has its own unique sustainability profile, and assessment of the ESG factors as shown below must be adapted for relevance.

A big data approach is necessary to manage the large disclosure datasets from many categories to build key indexes, improve ratings, assess material outcomes and compare alpha outcomes by strategy. A data-centric quantitative approach starts with 1) self-reported data from 600-10,000 companies using over 900 indicators, from primary providers including Bloomberg, Thomson, & Factset. 2) This information is filtered into professional ESG opinions using fewer indicators, 16-250, as provided by services such as MSCI, Sustainalytics, ISS, & Vigeo in a smaller company universe of 1500-8000. 3) The last step is aggregating these into consensus opinions and narrowing the indicator sets to 12 sub-categories to simplify ESG decisions, as provided by CSRHub.

Concrete outcomes from ESG practices are measured primarily in terms of “materiality” in the sense of effecting changes, solving problems in the real world, but also secondarily in terms of generating alpha, producing financial gains by the corporations or investors.

Addressing the 2nd issue first, one study, presented by the panelist from CSRHub, analyzed six generic ideas for using ESG approaches to generate alpha:

- Long / short strategies, buying positively rated and selling negatively rated firms.

- Buying category leaders

- Rely on recommendations from high value consensus opinion sources, ie., Sustainalytics & MSCI

- Select highly rated firms that also report frequently

- Stick with a large cap blue chip with good ESG ratings

- Focus on firms with good materiality metrics.

In each approach, empirical factors were found that mitigated the effectiveness of the strategy:

- The ESG ratings of the best & worst rated companies were found to be mean-reverting, the ratings value of the top 20% drop the most, the bottom 20% improve the most. “ESG trend momentum” persisting for more than 6 months occurs for fewer than 5% of companies.

- The “leaders” do not persist, those highest ranked drop substantially by their 5th year

- Sustainalytics & MSCI scorings don’t match up

- High ESG disclosure scores on the Bloomberg platform correlate only weakly, 25%, with highly rated consensus scoring compiled by CSRHub.

- There seems to be no correlation between a CSRHub rating and market cap or revenue.

- Material metrics are just not well enough covered by analysts, rarely fill in even 50% of ESG indicators in their analyses.

This study suggested that obtaining alpha with ESG-related strategies is difficult to achieve. This would tend to corroborate a widely accepted assumption that ESG investing plans reduce returns on capital & shareholder value. However, a Harvard report contends that empirical results show that “companies committed to ESG are finding competitive advantages in product, labor, and capital markets, and portfolios that have integrated “material” ESG metrics have provided average returns to their investors that are superior to those of conventional portfolios, while exhibiting lower risk.”

An example of the 1st strategy, which appears to be succeeding, is an Energy Transition Long-Short strategy offered by advisory service Fossil Free Index, which holds long positions in clean energy, advanced transportation, and smart grid companies, and short positions on reserve-owning fossil fuel companies, and is currently outperforming the S&P.

Gender diversity was also cited as benefiting profitability. The Thirty Percent Coalition promotes gender diversity on corporate boards and institutional investor boards, and contends there are clear, identifiable results that diversity lead to better performance and governance. Several participants with affiliations to institutional funds expressed confidence that performance improvements corresponded with improvements in gender diversity on their boards.

ESG ratings are being made available to retail investors as well. Yahoo Finance includes a tab for Sustainability, that includes scoring for a Total, and separate Environment, Social & Governance for performance, ranked in a percentile against other peer companies, with graphics, and a scoring for controversy level. It also includes a list indicating involvement in 14 adverse areas: alcoholic beverages, adult entertainment, gambling, tobacco, animal testing, fur, controversial weapons, small arms, catholic values, GMO, military contracting, pesticides, thermal coal, palm oil. Fidelity is offering similar tools on its platform as well.

Index & ETF products have proliferated: MSCI (iShares/Blackrock) has 4 categories with 17 ESG & climate indices, Thomson Reuters has 4, CleanEdge has 4, FTSE4Good has 7, S&P/DowJones offers a large family of sustainability indices, ETF.com lists 78 socially responsible ETFs with $7.4B AUM. ETFdb.com offers a deep resource, with 35 ESG themes, 77 metrics and a screener which identifies 23 assets with ESG scoring in 90th percentile. The volume of assets invested in ESG funds are up nearly 60% from the prior year, as reported in the WSG. ESG funds are being marketed by Wall Street as a “bankable trend,” as private equity & hedge funds report participating in these offerings. However, it is still early in the overall trend, less than 2.5% of 401(k) plans offer ESG funds as an investment option.

The effectiveness of actively managed ESG portfolios as compared to passive index funds is debated. However, one strategy in which active management seems to be effective involves ESG “activist” investment. ESG advisor firms search for underperforming publicly traded firms with low ESG ratings, then begin with a consulting engagement, which then transitions into negotiating an equity position as a long-term value investor, in order to effect a turnaround by implementing ESG policies & practices, to achieve improved productivity & financial outcomes. Two such firms pursuing this approach were present, Barington Capital Group, & Impactive Capital and reported on their process and positive outcomes.

Returning to the primary issue of materiality, does ESG investing, and implementation of ESG practices, make a material difference in the real world? How effective is voluntary ESG participation as compared to material effects resulting from compliance with statutory requirements? One panelist, William Jannace, adjunct professor at Fordham Law school, observed that sustainability policies for corporations are driven by a) an internal reputational desire to contribute, & b) external demand from customers or RFP conditions, but c) contended that more significant outcomes are driven by compliance with regulatory imposition.

At worst ESG participation as a cultural artifact that may be criticized as “greenwash”, bandwagon promotion with no substantial behaviors, and at best can drive only incremental improvements, unable on its own to drive solutions to the largest systemic problems. Two such examples were considered:

Illicit financial flows (IFF): from kleptocratic capital flight & laundering, human trafficking of migrants & sex slaves, & from black market drugs & arms, facilitated by use of complex entity structuring & tax venue shopping, has been estimated between $21Tr – $32Tr, according to a Tax Justice Network study of data from the BIS, IMF, and several private sector analysts including Gabriel Zucman. Would the financial services industry on a voluntary basis from a commitment to ethical principles and motivated by the desire to appear supportive of initiatives against human trafficking refuse to handle financial flows found to be associated with such criminal activity? Clearly a naïve expectation. Without the compulsion to comply with Anti-money Laundering (AML) statutes, under threat of federal prosecution, the progress achieved to date likely would not have occurred. But the recalcitrance of the US to legislate & enforce aggressively has led some experts to now rank the United States as the world’s biggest financial secrecy haven. Corporate social & governance commitments are not trivial, but should be recognized as a social catalyst for coalescing sentiment for triggering cultural shifts. ESG would be synergistic with legislative reform, where the heavy lifting really occurs.

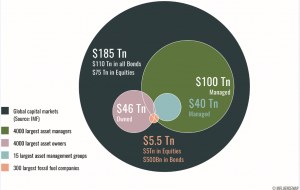

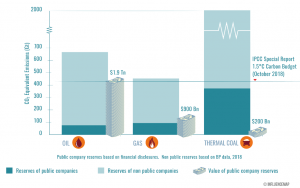

Climate Change: expedited reductions in GHG emissions is clearly on everyone’s ESG list but voluntary adoption is not capable of scaling to the same extent as a mandated industrial policy, such as outlined in the Green New Deal, and would likely be unrealized without regulatory enforcement by the EPA and other agencies. Further, concern for a “carbon bubble” of potentially stranded assets of fossil fuel reserves that cannot be burned, has been recognized in various high-level risk assessments, including the IMF, World Bank & HSBC. The most alarming analysis came from Mark Carney, governor of the Bank of England, who calculated that one-third of global wealth is invested in oil, gas, coal, and other “carbon-heavy” companies. Citigroup’s ’17 GPS report concurs with an estimate that the “total value of stranded assets could be over $100 trillion”, which is 5x the size of losses associated with the ‘08 housing bubble.* A devaluation of those assets could crater the entire global economy, at minimum would adversely affect countless institutional funds.

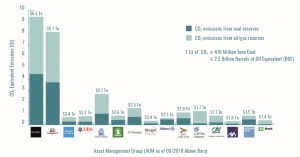

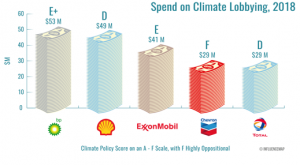

Large sustainable asset managers such as Ceres and Trillium calling for $1Tr per year in climate change investments, are potent advocates for collective commitment, but even they recognize that transition depends on policy choices to remove the obstacles to clean energy scaling imposed on our political system by entrenched “incumbent” industries. ESG investing is exerting significant pressure towards reduction of GHGs, but does ESG investing have enough leverage to influence more dramatic policy change? It could lend weight to “outside the box” policy proposals, such as a proposed fossil fuel nationalization plan, which would be beyond the scope of anything that could be achieved by ESG asset management. The infographics below illustrate the scope of the entrenchment of incumbent carbon assets, are from Influence Map which is a site that monitors fossil fuel investment, subsidies, influence activity & embedded portfolio climate risk. Who Owns the Fossil Fuels shows the sheer scale of the fossil fuel ownership & investment chain.

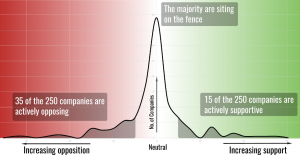

Aside from rampant ambivalence, with 75% of the largest companies neutral about climate change, the fossil fuel influence apparatus is so deep that the prospect of counter-influence from ESG practices succeeding at scale seems remote, except insofar as ESG investing is coupled with ESG lobbying to also pursue major enforceable policy shifts.

Other resources at InfluenceMap provides detailed rankings of companies on the A-list of climate policy engagement, that participate both in ESG activities and participating against fossil fuel lobbying.

Although one impression is that ESG adds value almost entirely by limiting risks & excluding exposures to negative factors, in reality companies with high ESG scores have experienced increases in operating efficiencies, & lower risks with lower costs of capital. In early 2018, the US Dept of Labor, had issued ERISA guidance that “managers cannot sacrifice shareholder return for ESG considerations”, which imposed a conflict of interest for for institutional investors’ fiduciary duty, and for portfolio companies investors were seeking to influence toward greater implementation of ESG policies. But because ESG factors have been increasingly shown to have positive correlations with corporate financial performance and value, ERISA reversed its earlier instructions.

In the broader corporate culture, this implied conflict of interest has been used opportunistically by CEOs, under an economic theory of “shareholder primacy” as advocated by Milton Friedman, to justify policies that benefit C-suite interests at the expense of workers and environment, aggravating wealth & income inequality. “Shareholder supremacism” is being targeted for reform under the Accountable Capitalism Act, S. 3348, which would impose obligations on the largest 1000 corporations, under newly issued charters, to consider broader stakeholder interests, include labor on the board of directors, and require 75% board approval for political expenditures, enforced by risk of revocation of charter.

ESG activism as a response to the groundswell of changing public sentiment is catalyzing some very significant outcomes, against the monumental resistance of the fossil fuel industry, on the battlefield of shareholder resolutions. Exxon & Chevron, both of which have stated in analyst meetings that they plan to increase extraction, have recently prevailed against resolutions that would have required the companies to disclose targets for reducing GHG emissions. However, the SEC has sided with shareholders on two other requests, a) to create new board committees to address climate change and b) to fully disclose political contributions to tax-exempt “dark money” 501(c)(4) organizations. Exxon & Chevron have made huge dark money contributions to Main Street Investors Coalition launched by NAM, which has executives on the board from Exxon, Shell, Devon Energy, Southern Co & a Koch subsidiary, to combat the threat of these resolutions, according to governance consultant Nell Minow at ValueEdge Advisors.

However, BP & Shell have been more responsive to shareholder resolutions that call for disclosures and for alignment of business plans with Paris goals. Shell has joined with Climate Action 100+, an institutional investor initiative, and announced plans to reduce the carbon footprint from its energy products, which release 10x more emissions than from direct operations, and further, agreed to link the targets to executive pay.

Both ESG activism and lobbying for policy changes for ESG goals are necessary components of a strategy for change.

*[These large numbers have been disputed – even comparing to the “ownership“ diagram above showing total assets of $185Tr, if the assets at risk for being stranded are estimated at $100Tr, which correlates to the estimated one-third of wealth or economic activity, then implied total assets would be $300Tr. Other mitigating factors would be a) that the at-risk reserves would be less if some were considered chemical feedstocks rather than fuels to be burned; & b) some critic contend equity share value is derived less from assets and is based more on free cashflow, hence would discounting reserves would not depress equity value to such an extent.]