Valeo SA – Paris Stock Exchange. See also VLEEF (US OTC) and VLEEY (US ADR)

Tag: Valeo – FR.PA

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Finding a Bottom and Model Portfolio First Half Returns

By Tom Konrad, Ph.D., CFA

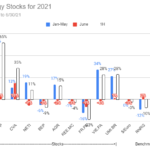

Even as the broad market rose, the start of 2021 was brutal for clean energy stocks. The sector experienced a bubble in late 2020 and January this year as optimism grew that we finally had a President who understands the magnitude of the climate problem and has committed to do something about it. The bubble also grew from the great hope that with the presidency and slim majorities in both houses of congress, he would actually be able to get his agenda through.

That might have happened if the Senate Republicans were interested in governing and...

Four Picks and Shovels Stocks

by Tom Konrad, Ph.D., CFA

The last three months of 2020 brought an explosion in clean energy stock prices.

Solar stocks (as measured by the Invesco Solar ETF (TAN), nearly tripled. So did the Invesco Wilderhill Clean Energy ETF (PBW), which includes a broader spectrum of companies. Wind stock rose 61%, and even the relatively sedate Yieldcos were up 32%. The stars of the last half of 2020 was undoubtedly Tesla (TSLA, up 246%) and other electric vehicle stocks.

Money Flows Out of Fossil Fuels and Into Clean Energy

I believe that the cause of the current rise in stock prices is largely...

Ten Clean Energy Stocks for 2021: The List

by Tom Konrad, Ph.D., CFA

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

Mix Telematics (MIXT)

Green Plains Partners (GPP)

Covanta Holding (CVA)

Red Electrica (REE.MC, RDEIF, RDEIY)

Valeo, SA (FR.PA, VLEEF, VLEEY)

Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

Scorpio Bulkers, Inc. (SALT) - Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

Brookfield Renewable Energy Partners (BEP) - A leading clean energy Yieldco...

10 Clean Energy Stocks for 2020: July Update on Valeo MiX, and NFI

A secular shift in the transportation paradigm?

by Tom Konrad, Ph.D., CFA

I'm continually surprised at the strength and length of the stock market recovery in the face of a worsening pandemic in the US.

The stock market may not be the economy, but it's not totally divorced from the economy either. Perhaps the Senate's unwillingness to even talk about another aid package and the subsequent failure to pass one until after the benefits in the initial CARES act expire will trigger the market reversal I've been expecting at least since late April. Or it won't. I have a long track record...

10 Clean Energy Stocks for 2020: May Update Part 1

by Tom Konrad, Ph.D., CFA

For the last few monthly updates, I've been focusing on the big picture, and have neglected to say anything about many of the 10 Clean Energy Stocks for 2020 since I looked at how the pandemic would likely affect each stock in March.

This month, I'm trying to rectify the oversight, and have been posting updates on individual stocks for my Patreon supporters since Friday. Below is a collection of the updates I've published so far. I am to keep posting one a day until I've gotten to all of them, after which I plan to...

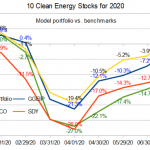

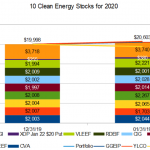

Ten Clean Energy Stocks for 2020: Navigating the Storm

by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I'm not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

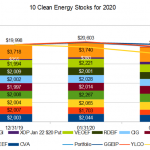

You can see overall performance for January and February in the following chart. Not that...

Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update

by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran's top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran's Foreign...

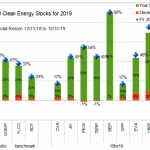

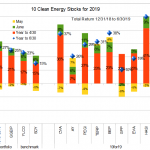

2020 Hindsight: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Sometimes it's good to be wrong.

When I published the Ten Clean Energy Stocks For 2019 model portfolio on New Year's Day 2019, I thought we were likely in the beginning of a bear market. With 20/20 hindsight, that was obviously wrong.

I made the following predictions and observations:

"he clean energy income stocks which are my focus should outperform riskier growth stocks."

"eep value investors will put a floor under the stock prices of these ten stocks."

"I could also be wrong about the future course of this market."

"I have a history...

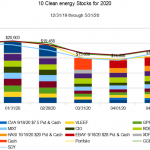

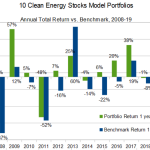

Ten Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

If it's tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

I've been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year's returns were also achieved in the context of full- to over-valuation of most of the clean energy...

Trading Options and Foreign Stocks: When Low Trading Volume Is Not Illiquid

Tom Konrad, Ph.D., CFA

As usual, I am putting together my Ten Clean Energy Stocks for 2020 model portfolio for publication on January 1st or 2nd next year. As I wrote in November, expensive valuations for the US clean energy income stocks I specialize in mean that the 2020 model portfolio will contain more than the usual number of foreign stocks, and I am also planning on including a little hedging with options.

Why option strategies are now affordable

I have never included options in the model portfolio before because the commission structure did not make it cost effective for small investors...

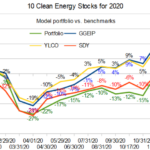

Ten Clean Energy Stocks For 2019: Still Party Time

by Tom Konrad Ph.D., CFA

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I'm frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it's always a good idea to hedge one's bets in the stock market. At least in part...

Ten Clean Energy Stocks For 2019: Pattern Buyout, Analyst Downgrades

by Tom Konrad Ph.D., CFA

Although valuations and political uncertainty have me spooked, October was another strong month for the stock market in general and clean energy income stocks in particular.

While my broad income stock benchmark SDY added 1.6% for a year to date total gain of 19.6%. My clean energy income stock benchmark YLCO did even better, 2.7% for October and 29.7% year to date. The 10 Clean Energy Stocks model portfolio fell somewhere in between for the month (up 1.8%) but remains unchallenged for the year to date (40.7%). My real-money managed strategy, GGEIP, lagged as I reduce...

Ten Clean Energy Stocks For 2019: What Caution Looks Like

by Tom Konrad Ph.D., CFA

So far, my worries about stock market valuation and political turmoil have not turned into the stock market downturn I've been warning readers to prepare for. In fact, September has been a particularly sunny month for both clean energy stocks and the stock market in general.My broad income stock benchmark SDY was up 3.9% and the energy income stock benchmark YLCO rose 2.7% for the month, more than reversing August's declines. My 10 Clean Energy Stocks model portfolio accelerated upward by 5.3%, as did my real-money managed strategy, the Green Global Equity Income Portfolio(GGEIP), which...

Ten Clean Energy Stocks For 2019: Marginally Hotter

by Tom Konrad Ph.D., CFA

July 2019 was “marginally” the warmest month on record. Meanwhile, the stock market was also inching to new highs, and the real, sweltering evidence of climate change continues to let clean energy income stocks turn in a blistering performance.

While my broad income stock benchmark SDY was up 16.0% through the end of July (0.9% for the month), my clean energy income stock benchmark YLCO is up 23.4% through July (0.4% for the month,) My 10 Clean Energy Stocks model portfolio is up 28.3% (1.3%) and my real-money managed strategy, GGEIP, is up 26.4% (1.2%) for...

Ten Clean Energy Stocks For 2019: Sell The Peaks

I missed my regular monthly update in early June because of vacation.

In hindsight, early June looks like it was a good buying opportunity. The broad market of dividend stocks (represented by my benchmark SDY) falling six percent in May, only to rebound a similar amount in June. At the time, I would have continued to advise caution: “Sell the peaks” rather than “Buy the dips.”

Particularly volatile stocks like European autoparts supplier Valeo (FR.PA) from this list would have generated even greater short term gains. But it would take more than a six percent market decline to transform this bear...