Amyris’ Sugarcane-derived Vaccine Adjuvant

by Jim Lane

COVID-19 has changed the way we do things…like drink more alcohol, wash our hands more, wear a mask, limit our gatherings and trips, but positive things have come about too. More time to connect with friends and family via online tools, a new respect for healthcare, agriculture and other essential workers, breathing cleaner air, and finding new ways to connect, entertain and innovate. Even in the bioeconomy, companies are doing the “pandemic pivot” and creating innovations to improve our future.

We’ve covered how the ethanol industry jumped in to save the day with hand sanitizer production, but today...

Amyris Launches Leading Hand Sanitizer and Receives Initial Positive Result for Vaccine Adjuvant

by Jim Lane

In California comes the news that synthetic biology leader Amyris (AMRS) is stepping out to help fight COVID-19. Amyris may be more well known for its sustainable ingredients for the Health & Wellness, Clean Beauty and Flavors & Fragrances markets, but as you all know, things have changed a lot over the last few months and Amyris is now launching a hand sanitizer to help address the high demand triggered by COVID-19. Additionally, the company has completed initial testing of a leading vaccine adjuvant.

Amyris is leveraging its existing capabilities to fast track the availability of a safe...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

Impossible Foods Launches Impossible Pork

by Helena Tavares Kennedy

It began with beef without the cow, even leather without the cow, and now we wave goodbye to pork from the pig with the news that Impossible Foods has launched pork made from plants.

Not only that, but Impossible Foods is going beyond the Impossible Whopper and expanding their work with Burger King in a new Impossible Croissan’which using Impossible Sausage made from plants as well. That will be available in only some Burger King locations starting in late January.

What’s in it?

Impossible Foods says their new pork protein is mostly made with soy protein, coconut oil, sunflower oil....

Living Endangeredly- Q2 Biobased Earnings Roundup

by Jim Lane

In hand we now have the latest earnings reports from what you might call the 8 Pathfinders – eight publicly traded stocks whose second quarter results offer insights into the health and performance of the advanced bioeconomy as 2019 heads towards its closing crescendos.

Our 8 Pathfinders – In the world of global renewable diesel at scale, Neste (Neste.HE); pure-play enzymes, Novozymes (NVMB); In pharma and synbio, Codexis (CDXS); as a hybrid play in advanced fuels, Aemetis (AMTX); in advanced marine and jet fuels, Gevo (GEVO); for biodiesel and hydrocarbons, Renewable Energy Group (REGI); in advanced began foods,...

Can Amyris Find The Ingredients Of Success?

In late August 2018, sustainable ingredients developer Amyris (AMRS: Nasdaq) staged a successful secondary offering by a selling stockholders, Foris Ventures and Vivo Capital Fund. In conjunction with the offering the company raised $46.0 million in new capital through the exercise of warrants held by existing shareholders. Last week the shares closed over 40% higher than the $6.25 deal price. The chief executive officer lauded shareholders for their support and apparent endorsement of the company’s game plan to commercialize sustainable alternatives to petroleum-sourced materials used in fragrance, health and beauty products.

Amyris leadership should celebrate its loyal shareholders given how far the company drifted...

Biofuels & Biobased Earnings Roundup: Amyris

by Jim Lane

The Top Line. In California, Amyris (AMRS) reported Q2 GAAP revenue for the second quarter of 2018 of $24.8 million, compared with $25.7 million for the second quarter of 2017. Grants and collaborations revenue was $11.4 million for the second quarter of 2018 compared with $10.3 million for the year-ago period. The company noted that Q2 revenue was $24.8 million compared with the same period in 2017 of $21.7 million when adjusted for the low margin product sales on contracts assigned to DSM (DSM.AS). This reflects 15% growth on an absolute basis. GAAP net loss for the first half was $89.1...

Biofuels & Biobased Earnings Roundup: Novozymes

by Jim Lane

The Top Line. In Denmark, Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) reported 4% organic sales growth for the first half and a 5 percent jump in Q2 with bioenergy reporting a 14% jump. Overall, net profit grew 5% and the company affirmed its 2018 guidance. Sales dipped to DKK 7,018m from DKK 7,278m, and EBITDA was flat at DKK 2,464m, although we primarily attribute that to currency shifts.

The Big Highlights. Growth in Food & Beverages and Agriculture & Feed; Bioenergy particularly strong. Good ramp-up of recent product launches. +7% organic sales growth in emerging markets; Freshness & hygiene platform in Household Care developing according to...

Biofuels & Biobased Earnings Roundup: Corbion

by Jim Lane

The Top Line. In the Netherlands, Corbion (CRBN.AS; CSNVY) reported H1 2018 sales of € 439.2 million, a decrease of 4.9% compared to H1 2017, entirely due to negative currency effects. Organic sales growth was 3.1%. EBITDA excluding one-off items in H1 2018 decreased by 19.0% to € 71.5 million due to negative currency effects and the inclusion of the Algae Ingredients business. Organic EBITDA excluding one-off items increased by 1.2% in H1 2018.

The Big Highlights. The acquisition of the Algae Ingredients business (TerraVia assets + SB Renewable Oils joint venture) has added an algae fermentation platform to Corbion. In H1 2018,...

Biofuels & Biobased Earnings Roundup: DSM

by Jim Lane

The Top Line. In the Netherlands, Royal DSM (Amsterdam: DSM.AS; US OTC:KDSKF; US ADR:RDSMY) reported a good H1 with organic sales growth in underlying business estimated at 10% and adjusted EBITDA growth of underlying business estimated at 7%, with sales of €4,794 million and adjusted EBITDA of €771 million.

The Big Highlights. Nutrition: an estimated 8% underlying organic sales growth and Adjusted EBITDA growth of underlying business estimated at 6%. Materials: 7% organic sales growth and Adjusted EBITDA growth of 5%. DSM also confirmed its full year outlook 2018, as provided at Q1 2018, and expects an Adjusted EBITDA growth towards...

The Return of Advanced Biofuels

by Jim Lane

For several years now we have seen a significant number of players pivoting from biofuels towards smaller but higher-value markets in chemicals, nutrition, nutraceuticals, pharma, materials, flavorings, fragrances, cosmetics and more. We’ve reported on the proliferation of applications both in the Digest and in What’s Nuu? and indeed there’s been so much that’s Nuu, it’s been dizzying at times with all the spinning and twirling.

Capital costs and policy uncertainty have played their part, but the foot on the pedal for many has been oil prices. The scale of operations to compete with oil prices in the 2014-2017 period...

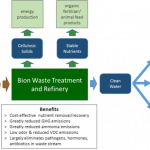

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Amyris In The Age Of Rapid Change

by Jim Lane

Last month, Amyris (AMRS) and Chevron (CVX) announced that Novvi and Chevron have entered into an agreement to jointly develop and bring to market novel renewable base oil technologies. Novvi is Amyris’ JV with Cosan (CZZ) to produce targeted hydrocarbon molecules from plant sugar for automotive, industrial, marine, and construction applications at unbeatable economics. Think lubricants for engines and machines.

Since launching its first commercial production in 2014, Novvi has been steadily increasing its base oil production to keep up with robust and growing demand for a variety of automotive, marine and industrial applications. Meanwhile, Chevron has one of...

Gevo’s Glow

Specialty chemicals developer Gevo, Inc. (GEVO: Nasdaq) is celebrating a string of market wins for its renewable chemicals and fuels. Since its beginning thirteen years ago this month, Gevo has been doggedly perfecting its synthetic biology and chemical technologies and turning it into products that are in demand by consumers and industry. Last week shareholders were treated to an announcement by the U.S. Environmental Protection Agency (EPA) raising the amount of isobutanol for on-road use to 16% blend level from 12.5%. As a producer of renewable isobutanol Gevo will be a direct beneficiary of the EPA action. Following directly on the heels of that news,...

List of Biochemicals Stocks

Biochemicals stocks are publicly traded companies whose business involves using plant or animal based feedstocks (biomass) to create new chemicals or substitutes of existing petrochemicals, plastics, or other fossil fuel derived substances other than fuels.

This post was last updated on 7/9/2021.

Amyris (AMRS)

BioAmber (BIOA)

Bion Environmental Technologies (BNET)

Circa Group AS (CIRCA.OL)

Codexis (CDXS)

Corbion (CRBN.AS; CSNVY)

Danimer Scientific, Inc. (DNMR)

Eastman Chemical Company (EMN)

Global Bioenergies (ALGBE: EURONEXT)

Novozymes (Copenhagen:NZYM-B; OTC:NVZMY)

Royal DSM (DSM.AS; KDSKF; RDSMY)

SECOS Group (SES.AX)

If you know of any biochemicals stock that is not listed here and should be, please let us know by leaving a comment. Also for stocks in the list that you think should...

Investing in Biopolymers

Last month Eastman Chemical Company (EMN: NYSE) announced an expansion of its urethane extrusion line at one of its specialty chemical plants. This one located near Martinsville, Virginia makes paint protection films and window films. Urethane is perfect to protect surfaces in a home or business. It is not brittle like plastic, but has excellent tolerance for grease and oils. When exposed to the elements it does not rot or degrade over time like rubber.

Shareholders likely cheered the development in Virginia for potential addition to market share. Eastman grabbed $9.6 billion in sales from the specialty chemicals market in 2017, earning $1.4 billion in net income or...