Earnings Roundup: Metals Prices Boost Covanta and Umicore

By Tom Konrad, Ph.D., CFA

You don’t have to own mining companies to benefit from rising metals prices.

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. Waste to energy operator Covanta and specialty metals recycler Umicore are both benefiting from skyrocketing metals prices.

Just as renewable energy and energy efficiency stocks have long shown that investors don’t have to own fossil fuel companies to benefit from rising prices of fossil fuels, recyclers like Covanta and Umicore are showing that you don’t have to own environmentally damaging mining companies to benefit from rising...

Covanta and Hannon Armstrong Earnings

by Tom Konrad, Ph.D. CFA

Two more earnings notes I shared with my Patreon followers on February 18th.

Covanta Holdings (CVA)

Leading waste-to-energy firm Covanta Holdings (CVA) announced 2020 earnings today. There will be a conference call tomorrow morning, but here is my high-level impression:

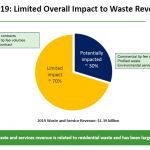

The company managed well through Covid and ended the year within it's original pre-covid guidance. Metals and energy prices, as well as increased maintenance capital expenditures were a drag on results, but prices are improving and capital expenditures will fall in 2021.

The company is conducting a strategic review which will likely result in the sale of some underperforming...

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

Covanta Earnings

(published August 2nd)

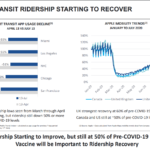

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Covanta Rebounds

by Debra Fiakas, CFA

Waste handler Covanta Holding Company (CVA: NYSE) reported financial results for the first three months of the year at the beginning of May 2020. True enough the net loss might have been wider than published estimates for the quarter, but the consensus target did not reflect a one-time, non-cash charge for asset impairment. Indeed, Covanta’s sales climbed year-over-year to $468 million, of which $61 million was converted to operating cash flow. Waste handling is considered an essential service so Covanta operations remained at full operations even as many of its customers were subject to work stoppages and stay-at-home policies to...

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

Battling Food Waste: Blue Sphere

If ‘food waste’ was a country it would be ranked as the third largest emitter of greenhouse gas emissions in the world behind only China and the United States. To reach this conclusion the World Resources Institute used food waste data in 2011, and considered agriculture inputs, food processing, land use, deforestation, food waste disposal, and landfill impacts.

The carbon footprint of wasted food is a big one with cereals contributing about 35% of the greenhouse gas emissions even though is only about 19% of food waste volume. Meat on the other hand is a small part of the food waste problem as it...

Plastic Bottle-neck

by Debra Fiakas, CFA

In September 2019, the California State Assembly sent out legislation that sets a 10% recycled plastic mandate by 2021 and increases the hurdle rate to 50% by 2030. The law covers plastic bottles that are already covered under the state’s container redemption program. Companies will need to use plastic bottles made from recycled plastic such that at least a minimum percentage of the plastic used meets the mandate.

Environmentalists and even consumers might be celebrating the new law, but the plastic recycling industry could be less than jubilant. The recycling news feed is peppered with headlines that reveal some fraying...

Covanta’s Q1: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Covanta Holding Corp. (NYSE:CVA)

12/31/18 Price: $13.42. Annual Dividend: $1.00. Expected 2019 dividend: $1.00. Low Target: $13. High Target: $25.

3/26/19 Price: $17.86. YTD Dividend: $0.25. YTD Yield: 1.9% YTD Appreciation: 33.1% YTD Total Return: 34.9%

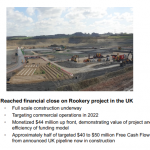

Leading waste-to-energy operator Covanta's stock has been the second best performing holding in my 10 Clean Energy Stocks for 2019 model portfolio. While in many ways the company is similar to the clean energy Yieldcos that dominate the model portfolio, it is different in that it develops its own projects, while most Yieldcos depend on a sponsor to develop projects which...

Covanta Turns Ash Collector

Well into the early 1900s ash collectors plied the streets of America’s cities, picking up ash buckets left at curbs and stoops by households and businesses. The ash collectors sold as much as possible for brick making and soil improvement. The rest went to the handiest dumps.

Since then large utilities have taken over the job of heating and lighting buildings. Coal-fired power plants have become the largest producers of ash. The American Coal Ash Association reports that 53 million metric tons of coal cash were generated in 2013, of which 23 million metric tons were re-used for cement and bricks. The rest was stored...

Darling’s Renewable Diesel Diamond

In July 2013, Darling Ingredients (DAR: NYSE) and its joint venture partner Valero Energy (VLO: NYSE) commissioned the largest facility in North America to convert waste animal fats into renewable diesel. The facility was strategic located adjacent to Valero’s petroleum refining installation in Norco, Louisiana.

At the time the facility was capable of pumping out 12,000 barrels of renewable diesel per day that could be dropped directly into Valero’s distribution network and blended with fossil fuel. Even at that production level the facility showed promise to deliver strong dividends back to its owners. The partners named their venture Diamond Green Diesel and celebrated the unparalleled achievement.

The two partners in Diamond Green...

Plasma Arcs For Pig Waste

This week MagneGas (MNGA: NASDAQ) announced new work completed toward plans to enter the commercial pork sector with a proprietary manure processing and disposal solution. Management held a meeting with the North Carolina Department of Environmental Quality and the U.S. Army Corps of Engineers to discuss MagneGas technology to treat agriculture waste and the state’s required environmental permit protocols. MagneGas aims to sell to pig farmers equipment based on its innovations.

The company wants to help pig farmers address environmental problems cause by manure accumulation with its proprietary waste sterilization process. Handling pig waste using conventional methods can be costly, but failure to...

Covanta Accelerating Zero-Waste-to-Landfill

Last week Covanta (CVA: NYSE) opened a new materials processing facility in Indianapolis, increasing waste handling capacity by 500%. The waste handler has been in operation in the community for three decades, collecting and processing over 2,100 tons of solid waste every day to steam energy in a waste-to-energy incinerator. Citizen Thermal Energy buys the steam to heat the buildings of its commercial customers.

The new materials processing facility increases Covanta’s waste handling capacity. The company is targeting manufacturers in the Indianapolis area that are still sending wastes to landfills. Covanta wants to collect more waste as well as attract waste types unique to manufacturers that need...

List of Waste-to-Energy Stocks

Waste-to-energy stocks are publicly traded companies whose business involves using municipal or other waste as a feedstock to create fuel or electricity. Organic matter and plastics in a waste stream can be converted to fuel and/or electricity chemically, by means of pyrolysis, biologically such as in anaerobic digestion, or by incineration. Alternatively, energy from waste can be captured from natural processes, such as in the collection of methane gas from landfills.

This list was last updated on 6/23/2021

Active Energy Group PLC (AEG.L)

Attis Industries, Inc. (ATIS)

Babcock & Wilcox Enterprises, Inc. (BW)

BioHiTech Global, Inc. (BHTG)

Blue Sphere (BLSP)

Capstone Microturbine (CPST)

China Recycling Energy Corp....

Fiberight: A Deep-Dive Into Trash To Find Cash

by Jim Lane. Biofuels Digest

This week Fiberight secured $70 million for a municipal solid waste center that should be in operation by this May. The high-tech facility will convert 180,000 tons of trash each year from more than 100 Maine towns into biofuel at a 144,000-square-foot steel frame facility that began construction last July.

We visually profile the technology and company in our Multi-Slide Guide here.

The underlying facility is what’s known as a Dirty MRF, or materials recovery facility. That’s where the receiving happens and the sortation begins — and the process of recovering value back from the waste stream begins.

The bottom line...

Carbon Negative Impacts from Biomass Conversion

By Andrew Grant, Biomass Power Projects, LLC, Lee Enterprises Consulting Canada, New England, and California all have Carbon Credit programs to achieve GHG reduction goals. Several forms of biomass diversion from landfills, farms, and other biomass – dependent GHG sources are already in operation to support significant GHG reductions. Examples of GHG reductions are given, and the carbon impact of the different commercially available biomass to GHG reduction processes are described. The three groups of commercially guaranteed biomass conversion processes are: 1. Power Generation, Steam Generation, and CHP: from the combustion of biomass wastes. This industry, with about 100...