Advantage Biodiesel

By Tom Konrad, Ph.D., CFA

Because of rising fertilizer prices, farmers are planting more soybeans than corn. Soybeans are a legume, meaning that they can fix their own nitrogen in the soil, meaning that they need less nitrogen fertilizer, the price of which is spiking due to rising natural gas prices. Corn, in contrast, needs more nitrogen than most other crops.

High gas prices are rising because of Putin’s war on Ukraine, which is also preventing Ukrainian farmers from planting this year’s wheat crop, while sanctions are likely to disrupt wheat supplies from Russia as well.

Corn and (to a lesser extent,...

A Disappointing Supreme Court Biofuel Decision. Why It’s Not Over Yet

By Jim Lane

The case

Last week’s decision stems from a May 2018 challenge brought against EPA in the U.S. Court of Appeals for the Tenth Circuit by the Renewable Fuels Association, the National Corn Growers Association, National Farmers Union, and the American Coalition for Ethanol, working together as the Biofuels Coalition. The petitioners argued that the small refinery exemptions were granted in direct contradiction to the statutory text and purpose of the RFS and challenged three waivers the EPA issued to refineries owned by HollyFrontier Corp. and CVR Energy Inc.’s Wynnewood Refining Co.

The case is HollyFrontier Cheyenne Refining, LLC v....

Gevo Soars: The Story Behind the Rise

by Jim Lane

What in the world has gone right with Gevo?

For years now, Gevo (Nasdaq:GEVO) has remained true to a vision of low-carbon, advanced renewable fuels, when so many others pivoted away to the world of ABF — Anything But Fuels. Some tried chemicals, cannabis, algae, natural gas, nutraceuticals, vegan foods — lately, protein has been all the rage. Gevo was one of the few true believers and paid the price of stock price punishment and near-extinction, for years.

While they weathered a debilitating patent battle with DuPont, until it settled and DuPont imploded. And the collapse of oil prices...

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

Covanta Earnings

(published August 2nd)

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

Budget Cut at Methanex

by Debra Fiakas, CFA

Initially investors were worried about a few delayed orders as a consequence of the coronavirus outbreak in China. The global supply chain, of which China is a critical link, would be temporarily interrupted by work stoppages in that country. As the virus jumped to other countries it became clear that businesses all over the world could experience business interruption and that could mean significant earnings erosion.

Investor alarm spiked as denial and dysfunctional appeared to be the main themes in the U.S. policy response to the situation. Panic ensued destroying billions in the U.S. capital base. Bank of America estimates the...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

Trump Administration Flip-Flops On Oil Refinery Waivers Again, Farm Groups Protest Again

by Jim Lane

In Washington, what must have become a weary if vigilant posse of the nation’s biofuel and farm advocates are out on the hustings again this week, over a fresh attack on the US Renewable Fuel Standard, this one led by officials in the Trump Administration, if a story reported by Bloomberg stands up against scrutiny.

What has been described as a “misinformation campaign spearheaded by Senator Ted Cruz” is seeking to overturn a unanimous court decision that would halt the Environmental Protection Agency’s abuse of Small Refinery Exemptions (SREs) under the Renewable Fuel Standard.

The backstory

In a unanimous panel, the...

Biofuel Industry Reacts To EPA New Renewable Fuel Standard

Yay or Nay for EPA? RFS Volumes out for 2020, Biodiesel for 2021 – What’s the reaction from industry?

by Jim Lane

What’s the reaction from industry? Coal for Christmas?

Should Santa bring coal for EPA’s stocking this year? Do the biofuels and agriculture industries think the EPA just put coal in their stocking? Is it thumbs up or thumbs down from biofuel industry advocates on last week’s U.S. Environmental Protection Agency renewable fuel volumes? What about the exempted volumes?

The Ruling – Rotten or Respectable?

First, a bit on the EPA ruling that establishes the required renewable volumes under the Renewable Fuel Standard (RFS) program for...

Aviation Biofuel Overview

by Debra Fiakas, CFA

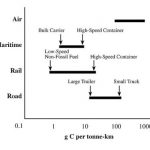

The aviation industry contributes about $2.7 trillion to the world’s gross domestic product. It may seem like a big number, but that is only 3.6% of the world’s wealth. Aviation may be a minor player in terms of creating wealth, it is a big culprit in climate change. Flying around the world accounts for as much as 9% of humankind’s climate change impact. Indeed, compared to other modes of transportation, flight has the greatest climate impact.

The negative impact of carbon emitted by aircraft is made even worse by the fact that the emissions point is mostly at cruising altitudes high...

North American Outlook on Biofuels Challenges and Opportunities

Challenges and Opportunities in Biofuels

By Steve Hartig, Former VP of Technology Development at ICM

The North American biofuels market can be split into three main segments all of which have major dynamics. What I would like to do is give a high-level overview of what I see as some of both the challenges and opportunities across these.

Ethanol which is a produced from corn and sorghum in about 200 plants mainly across the Midwest and blended at about 10% with gas. Majors such as POET, Green Plains, Flint Hills, Valero, ADM and Cargill do a bit more than half of the 16...

EPA Reneges on Trump’s Biofuels Deal

by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after...

Green Plains’ Cattle Drive

As quickly as the ethanol producer jumped into the cattle business, Green Plains (GPRE: Nasdaq) has sold off half of its Green Plains Cattle Company to a group of investment funds for $77 million. Operating at six locations in Colorado, Kansas, Texas and Missouri, the company has the capacity to feed 355,000 head of cattle each year. The cattle business contributed $271 million to total revenue in the most recently reported quarter ending June 2019, delivering a modest operating profit near $7.3 million.

There has been considerable stress in the feed cattle industry. The number of cattle in feedlots is down compared to last year, an unusual development...

Betting On Renewable Diesel: Valero or Darling?

Valero Energy (VLO: NYSE) recently disclosed ongoing discussions to expand its renewable diesel production to a second plant that would be built and managed by its Diamond Green Diesel joint venture with Darling Ingredients (DAR: NYSE).

The proposed plant that would be located in Port Arthur, Texas and turn out 400 million gallons of renewable diesel and 40 million gallons of naptha per year. As a food by-products processor Darling has easy access to low-cost used cooking oils and animals fats that serves as the feed stock for Diamond Green’s renewable diesel production.

Valero management has cited increasing global demand for low- to no-carbon...

Living Endangeredly- Q2 Biobased Earnings Roundup

by Jim Lane

In hand we now have the latest earnings reports from what you might call the 8 Pathfinders – eight publicly traded stocks whose second quarter results offer insights into the health and performance of the advanced bioeconomy as 2019 heads towards its closing crescendos.

Our 8 Pathfinders – In the world of global renewable diesel at scale, Neste (Neste.HE); pure-play enzymes, Novozymes (NVMB); In pharma and synbio, Codexis (CDXS); as a hybrid play in advanced fuels, Aemetis (AMTX); in advanced marine and jet fuels, Gevo (GEVO); for biodiesel and hydrocarbons, Renewable Energy Group (REGI); in advanced began foods,...