The Solar Industry’s Supply Chain Problems

by Paula Mints

The solar industry has a supply chain problem – no, not just the current polysilicon and glass constraints. Solar wafer, ingot, cell, and module manufacturing are concentrated in China and South East Asia, leaving buyers outside these areas vulnerable to supply chain shocks.

Countries in this region have lower labor costs, lower energy costs, and higher incentives and subsidies for manufacturers. In China, manufacturing is supported (and controlled) by the central government.

Manufacturers in China, who have expanded into South East Asia, can make do with lower

margins than their counterparts in other countries. Manufacturers in South East Asia and China...

First Solar Jettisons Its O&M Business

by Paula Mints

In August, CdTe manufacturer First Solar (FSLR) sold its North America O&M business to NovaSource Power. According to First Solar CEO Mark Widmar, the decision was due to contracting O&M margins and customer demands for more services. The company is also exploring jettisoning its EPC business. First Solar plans to focus on its module manufacturing business.

Comment: Apparently, First Solar finally realized that O&M is low margin and that the EPC business may also not have much margin cushion. Now the company can concentrate on another low margin sector of the solar manufacturing chain, manufacturing.

First Solar has occasionally...

Unprofitable Sunrun Buys Unprofitable Vivint Solar

by Paula Mints

In July, Unprofitable residential solar lease company Sunrun (RUN) announced that it would acquire its unprofitable competitor, Vivint Solar (VSLR). Each share of Vivint stock will be exchanged for .55 shares of Sunrun’s common stock. Sunrun indicated that there were great synergies between the two companies.

Comment: Remember when Tesla (TSLA) adopted Solar City, a company founded by Elon Musk’s cousin? Sorry – remember when Tesla acquired money-losing Solar City and claimed strong growth and profits would follow? Great synergies. A wonderful future. Rainbows, kittens, and a profitable solar future for all.

The residential solar lease and residential PPA offers...

Buyer’s Guide to New York Community Solar

By Ishaan Goel

WHY COMMUNITY SOLAR?

A home solar system is a great investment, with financial returns far in excess of any financial investment that has comparable risk. It’s also a tangible step a homeowner can take to help the environment.

Unfortunately, most New Yorkers (and Americans in general) can’t install home solar. They may be renters, or have roofs that are too old or shaded. Or they may not be able to afford the up-front cost, or not have enough income to take advantage of the tax credits.

That is why New York’s electricity regulator, the Public Service Commission, created community solar:...

Community Solar Providers In NYSEG Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

This list last updated on 9/9/2020.

VENDOR NAME

PRICING STRUCTURE

ADDITIONAL DETAILS

SPECIAL OFFERS

Abundant Solar Power

10% discount subscription model

Contract to be signed

Astral Power

10% discount subscription model (Broker for solar farms)

No cancellation fee. Bill needed in customer’s name

$100 check and $100 donation to Feedmore WNY

BlueWave Solar

10% discount subscription model (Broker for solar farms)

Links to own development as well as any external ones. Available services in your area found through ZIP code search.

Citizens Energy

20% discount subscription model (Nonprofit)

free cancellation; no fees; no credit...

Community Solar Providers In National Grid Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

VENDOR NAME

PRICING STRUCTURE

ADDITIONAL DETAILS

SPECIAL OFFERS

Abundant Solar Power

10% discount subscription model

Contract to be signed

Amp Energy

Mostly 10% subscription model

12-month contract with auto-renew option, termination fees waived with proper notice

Astral Power

10% discount subscription model (Broker for solar farms)

No cancellation fee. Bill needed in customer’s name

$100 check and $100 donation to Regional Food Bank of Northeastern NY

Ampion

10% discount subscription model

Free cancellation at any time, excess credit is banked

BlueWave Solar

10% discount subscription model (Broker for solar farms)

Links to own development as...

Community Solar Providers In PSEG Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

PRICING STRUCTURE

ADDITIONAL COMMENTS

SPECIAL OFFERS

HarvestPower Solar

Subscription model with a discount from utility rate

Estimated 15-30% savings with no out-of-pocket expenses

SUNation

Short-term and long-term contracts to pay a fixed rate below the utility rate

Estimate 15% savings

Community Solar Providers In Central Hudson Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

VENDOR NAME

PRICING STRUCTURE

ADDITIONAL DETAILS

SPECIAL OFFERS

Ampion

10% discount subscription model

Free cancellation with 90-day notice, excess credit is banked. Opt-in options through municipalities available.

$50 donation to local sustainability fund

Astral Power

10% discount subscription model (Broker for solar farms)

No cancellation fee. Bill needed in customer’s name

$100 donation to Food Bank of the Hudson Valley

Community Power Partners

10% discount subscription model

no cancellation fee with 90 days notice, no credit checks and no payment information required

Nexamp Inc.

10% discount subscription model

No cancellation fees and long-term...

Community Solar Providers In ConEd Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

VENDOR NAME

PRICING STRUCTURE

ADDITIONAL DETAILS

SPECIAL OFFERS

Ampion

10% discount subscription model

Free cancellation at any time, excess credit is banked

BlueWave Solar

10% discount subscription model (Broker for solar farms)

Links to own development as well as any external ones. Available services in your area found through ZIP code search.

Sunset Solar Park

20% discount subscription model

YSG Solar

10% discount subscription model

Credits offered can be increased or decreased to suit usage

UGE International

10% discount subscription model

2-year contract, No cancellation restrictions

OnForce Solar

10% discount subscription model

Extra credits carried on;...

Community Solar Providers In Rochester Gas and Electric Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

Updated 9/9/2020.

VENDOR LINK

PRICING STRUCTURE

ADDITIONAL COMMENTS

SPECIAL OFFERS

Ampion

10% discount subscription model

Free cancellation at any time, excess credit is banked

Astral Power

10% discount subscription model

No cancellation fee. Bill needed in customer’s name

$100 check and $100 donation to Foodlink

Community Power Partners

10% discount subscription model

no cancellation fee with 90 days notice, no credit checks and no payment information required

Renovus Solar

Purchase Model with small annual maintenance fee. Discount subscription models also offered.

Panel custom-built to suit need, credits forwarded to electricity bill

Use code "AltEnergyStocks"...

Community Solar Providers In Orange and Rockland Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

Updated 9/8/2020

VENDOR NAME

PRICING STRUCTURE

ADDITIONAL DETAILS

SPECIAL OFFERS

IPP Solar Integration LLC

10% discount subscription model

-

Clearway Community Solar

10% discount subscription model

Cancellation free if replacement found or with 90 day notice, otherwise $200 termination fee

Community Power Partners

10% discount subscription model

no cancellation fee with 90 days notice, no credit checks and no payment information required

Nexamp Inc.

10% discount subscription model

No cancellation fees and long-term contracts

Oya Solar Inc.

10% discount subscription model

Contract for specified period needs to be signed

Astral Power

10% discount subscription model

No cancellation fee....

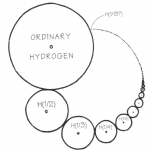

Brilliant Light Power – Commercialization Status

by Daryl Roberts

A potentially paradigm-shifting technology has been under development at an R&D firm in NJ called Brilliant Light Power. For people monitoring the situation, the question currently is about the status of commercialization. It is not a publicly held firm, but is in mid-stages of private equity capitalization in the range of $100-120M.

I recently read a book titled "Randall Mills and the Search for Hydrino Energy", offering a detailed and compelling history of the development of this novel renewable energy technology, authored by an insider, an intern who stayed on to work there for several years (published in...

Walmart vs Tesla

by Paula Mints

Walmart takes on Tesla Solar for Poor Quality Installations and Components

Early in August, after several quarters of slowing sales, Tesla (TSLA) announced a restart of its residential solar lease, referring to it as solar system rentals.

Around the same timeframe, Tesla stated that it had no timeline for the availability of its solar tiles.

On August 20, Walmart (WMT) filed a breach of contract lawsuit against Tesla/SolarCity in the commercial division of the New York State Supreme court claiming “years of gross neglect” leading to several fires at its facilities. According to court documents, one fire took place after...

Clearing Up Some Confusion Over Community Solar In New York

Community Solar in New York has a messaging problem. It is confusing, and even some industry professionals have given up in disgust because of aggressive marketing and a lack of clarity.

Fortunately, aggressive marketing is not universal among community solar developers.

Unfortunately, the lack of clarity is almost universal.

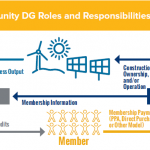

How Community Solar Works in New York

The system the New York utility regulator set up for community distributed generation (CDG, a term which includes community hydropower and community wind as well as community solar) is counter intuitive for most potential customers.

As shown in the diagram above, the electric utility pays for a project's...

EnvisionSolar Now On Nasdaq

The Envision Solar (EVSI) was reviewed in depth in a previous article last September in the context of its avoidance of high demand charges for electric vehicle DC fast chargers.

Envision Solar has completed its Nasdaq listing as reported in the news release on the Nasdaq site & Accesswire. The company issued 2,000,000 shares and expects to receive gross proceeds of $12.0 million before deducting offering expenses.

Prior to the new listing, average pricing for the stock on the OTC market was disclosed to be $.23/share. Applying the 1:50 reverse split, the post-split equivalent stock value would have been $11.50. However,...

Car Insurers Can Help Community Solar Find EV Customers

By Joe McCabe, P.E.

The insurance industry has lots of exposure to climate change. But as Warren Buffet has explained, not so much for companies that do annual policy adjustments, like Berkshire Hathaway. Their exposure is limited because the trends are baked into the premiums. But there is an opportunity for reducing insurance risk due to climate change, and it comes from the insurance industry itself. The business model is to have car insurance salespeople provide leads to virtual electric car charging services. This has perfect demographics because electric vehicle owners are very receptive to solar electricity. Who wouldn't want...