From Solar 2009: Investment Opportunities in Solar Stocks, Part 1

Tom Konrad, Ph.D. The last panel I attended at Solar 2009 focused on investment opportunities in Solar. This is the first of several entries with ideas from the speakers. They were: Allen Goodman, of ECG Consulting Group James Groelinger, of Bellegrove Associates J. Peter Lynch, of Salem Financial, Inc. Pradeep Haldar, Ph.D., MBA of the University at Albany Each had perspectives on the solar (mostly photovoltaic (PV) industry, and struck me as very knowledgeable in the field. The caliber of the industry and investment knowledge on display impressed me, so I'll share with readers some of the...

Beijing Taking Hands-Off Approach To Solar Recovery

by Doug Young China sent an important message to the struggling solar panel sector last week when one of the country’s major manufacturers was forced to turn to global capital markets to raise new funds, hinting that it couldn’t receive the money from state-backed domestic sources. The move sparked a sell-off for New York-listed shares of Yingli Green Energy (NYSE: YGE), as its request for funds met with a frosty response on Wall Street. The fact that Yingli had to seek funding from commercial-oriented western investors indicates Beijing is taking a hands-off approach to financing...

New Loans For LDK and Canadian Solar Just Band-Aids

Doug Young Stock Band-Aid Image via BigStock A couple of items from the struggling solar panel sector are showing how the industry is limping forward, receiving minor rescue loans to continue funding operations while manufacturers await a bigger rescue package from Beijing. I can only guess that the bigger package, which has been talked about for much of the last half year, will finally be rolled out by the middle of this year. That will finally allow the industry to try and put itself on more sustainable long-term...

Photovoltaics: 10 Trends to Watch in 2013

2012 Report Card plus my 2013 trends and predictions. Ed Gunther Though I’ll blame my lingering flu, the Photovoltaics: 11 Trends to Watch in 2012 review and 2013 photovoltaic (PV) trends and predictions post has again extended well into February. As usual, I won’t be grading on a curve. Photovoltaic Market Demand Growth Last year, I said: In 2012, I predict at least 25% global PV installation demand growth. I am tempted by the under since the early year Feed-in Tariff (FiT) headwinds seem stronger than ever with serious talk of a 1 GW...

Hopping On The Short Enphase Bandwagon

On July 25th, Prescience Point Capital Management recently released a report accusing Enphase energy Inc. (ENPH) of earnings manipulation. Prescience is an investment manager with a reputation for strong short-side analysis. I was intrigued, and decided to investigate Prescience's claims for two reasons:

I am generally concerned about overall market conditions, so adding a short position to my portfolio is attractive in the current market environment.

As an analyst who specializes in clean energy stocks, I have suspected that Enphase would not survive much longer because I believe that its core technology is no longer the best solution for...

List of Solar Farm Owner and Developer Stocks

Solar farm owner and developer stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

This list was last updated on 3/21/2022.

See also the list of Solar Manufacturing Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

7C Solarparken AG (HRPK.DE)

Abengoa SA (ABG.MC, ABGOY, ABGOF)

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Azure Power Global Ltd. (AZRE)

Bluefield Solar Income Fund (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy...

Sol-Wind: New Yieldco With A Tax Twist

By Tim Conneally The pool of public solar yieldcos keeps growing. Just before the Christmas holiday, Sol-Wind Renewable Power LP filed for a $100 million initial public offering with the Securities and Exchange Commission. This will be the eighth Yieldco to debut since 2013, and the stock will trade on the NYSE under the symbol SLWD. But there's something different about this one. Sol-Wind is a yieldco that utilizes a Master Limited Partnership (MLP) structure, so it will be taxed differently from the other Yieldcos. Generally speaking, a Yieldco is similar to MLPs by nature, but the taxation...

Suntech Reorganizes While Sector Stabilizes

Doug Young Several solar panel companies are in the headlines once again, led by an news that bankrupt former superstar Suntech (NYSE: STP) is nearing a reorganization that will cost its stockholders most of their money. While that may sound bad, I personally don’t have much sympathy for anyone who continued to hold Suntech stock after the company started experiencing major problems about a year ago. Meantime, the news is a bit more positive for rivals Yingli (NYSE: YGE) and Renesola (NYSE: SOL), which both reported narrowing losses as outlook for the sector continues to improve with stabilizing...

Solar City IPO: A Bit Pricey

by Debra Fiakas CFA Renewable energy retailer SolarCity has filed for an initial public offering of 10 million shares of its common stock and a few shares owned by existing shareholders. The offering is valued at between $130.0 million and $150.0 million based on an anticipated share price between $13 and $15 per share. SolarCity expects its shares to trade on Nasdaq under the symbol SCTY. Proceeds raised by SolarCity will be used support acquisitions of complementary operations. Proceeds could also be used to support SolarCity’s capital spending program as it seeks to extend its distributed network...

The Performance Of Solar PV Systems

Aug 11-09 Solar PV Charles Morand A couple of weeks ago, I noted the importance of examining parameters other than module costs when gauging the economic competitiveness of solar PV energy. I noted how multiple factors influence the levelized cost of energy produced by solar PV systems, and thus its relative cost position on the grid. Nothing new here. However, besides standard test conditions (STC) conversion efficiency, or nameplate conversion efficiency, public data on parameters other than cost per watt-peak is not always easy to come by. That's...

Will Crystalline Solar Kill Thin Film?

A Conversation with Applied Material’s Solar Head Charlie Gay by Neal Dikeman I had a chance to chat today with Dr. Charlie Gay, the President of Applied Materials' (AMAT) solar division. You may recall, we broke the story in the blogosphere 5 years ago about Applied’s entry into solar, which was anchored with a highly touted and very aggressive strategy for turnkey large format amorphous silicon and tandem cell plants called SunFab. Charlie reminded me that when they began 5 years ago, they did so along two major thrusts: The acquisition of Applied Films in...

Evergreen Solar and Solyndra Fail: Is Wall Street’s Hatred of the Solar Industry Still...

Garvin Jabusch Much has been made this week about the nearly contemporaneous bankruptcy filings of two American solar companies, Silicon Valley’s Solyndra and Evergreen Solar (formerly ESLR) out of Massachusetts. These two had something in common: Both made different types of photovoltaic (PV) panels and both were more expensive than average PV. These two firms did not fail because they manufactured in America, or because solar itself is untenable (on the contrary), but primarily because they were deploying advanced technology that ultimately could not find enough of a market to achieve the scale required to become profitable. It's...

Don’t Bet Against SolarCity

By Jeff Siegel DISCLOSURE: Long SCTY. It wasn't an April Fool's Day gag when I said it was time to buy SolarCity Corp. (NASDAQ: SCTY) at the beginning of the month. After a brief standstill, the company's battery-backed solar projects have begun to move forward again. The State of California Public Utilities Commission has added an important item to its May 15 agenda that will make a huge difference for SolarCity. Utility companies may finally be blocked from imposing big fees on battery-backed solar systems. For more than a year, California's largest utilities companies demanded...

Staying Alive: Could Thin-film Manufacturers Come Out Ahead in the PV Wars? Part 1

Jennifer Runyon As the solar PV market goes through its trials and tribulations, thin-film manufacturers could be poised to take on more market share. In the solar electricity market, capitulation, consolidation and contraction are the buzzwords of the day. Today, all solar PV manufacturers face an over-supplied and underfunded PV market. The oversupply and drop in subsidy markets across Europe and the U.S. has forced crystalline silicon manufacturers to sell their PV panels below manufacturing costs or risk losing all market-share. As the weeks tick by, major manufacturers, one after another, are going under or announcing...

The Solar Industry’s Supply Chain Problems

by Paula Mints

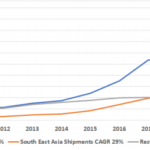

The solar industry has a supply chain problem – no, not just the current polysilicon and glass constraints. Solar wafer, ingot, cell, and module manufacturing are concentrated in China and South East Asia, leaving buyers outside these areas vulnerable to supply chain shocks.

Countries in this region have lower labor costs, lower energy costs, and higher incentives and subsidies for manufacturers. In China, manufacturing is supported (and controlled) by the central government.

Manufacturers in China, who have expanded into South East Asia, can make do with lower

margins than their counterparts in other countries. Manufacturers in South East Asia and China...

Solar Stocks Will Continue to Outperform But Remain Volatile

By Harris Roen The market is starting to notice that solar investing has been extremely profitable in 2013. As of the middle of September, the average solar stock is up over 50% in the past year, and over 15% in three months (that’s over 60% annualized!). These returns are taken from a broad list of about 60 publically traded companies in the solar industry (see chart above). Though all are involved in solar, solar may not be the primary business of many of these companies. For example, Panasonic (PCRFY) produces photovoltaics, but it is only a small...