Finding the Key to CIGS PV Reliability

by Joseph McCabe, PE This past week there was a photovoltaic (PV) workshop that probably wasn't on your radar. It was held at the National Renewable Energy Laboratory (NREL) and is called the PV Module Reliability Workshop (PVMRW). This is where the nerds of the PV industry get together to discuss the factors that influence how long a PV module will last and other factors which might influence the long-term performance of a PV system. It wasn't on your radar because it is not something that influences big business. Or is it? If you track the PV industry...

SolarCity Announces Expansion in New York, Files for $200 Million IPO

Vince Font Just days after announcing the launch of major expansions in New York state, the San Mateo-based solar company SolarCity has filed for an IPO in excess of $200 million. Having already received more than $1.5 billion in funding from a variety of high profile companies including Google, PG&E, and U.S. Bancorp, SolarCity is betting on the success of its business model to appeal to stock investors eager to snatch up a slice of the potentially lucrative solar pie. The company’s business model is simple and effective, and has led SolarCity to rapidly become...

Yingli Queues Up For Next Chinese Solar Bailout

Doug Young Yingli (NYSE: YGE) has become the latest player in China’s struggling solar sector to get a lifeline from Beijing, as an interesting picture starts to emerge of the relative health of the sector’s major players and who is likely to lead a coming consolidation. The list of who gets these lifelines could also reflect the relative importance Beijing places on China’s wide and varied field of solar panel and panel component makers, meaning some of these lifeline recipients could emerge as potential leaders to help consolidate the sector in the months ahead.I should make a big...

Channel Problems Keep BIPV Out of the Money

Dana Blankenhorn Building Integrated Photovoltaic (BIPV) is often in the news. There's a romance to it. Instead of having ugly solar panels on your house, your whole house could be an integrated solar system. It could use all the heat and light hitting it, from any angle, look like any other house, and pay for itself. Pythagoras Solar, an Israeli start-up, says its solar windows, cells sandwiched in glass, can both lower heating and cooling costs while they generate electricity, paying for themselves in 3-4 years. Pythagoras is private, but most publicly-traded BIPV plays are penny stocks, like...

Solar Module Prices: The Trend Is Down

by Paula Mints Buckle up, another module price war is afoot – or maybe it’s dumping or maybe it’s panicked selling or maybe it is the result of overcapacity and softening demand or maybe it is China’s government saying NO MORE to it’s out of control market and effectively stranding a whole lot of overcapacity or maybe it is all of the aforementioned. Pricing is always a complex subject. The average price for modules from China is currently $0.60/Wp (and dropping) and the average price for smaller buyers is $0.66/Wp (and dropping). These are averages and...

Energy Conversion Devices (NASDAQ:ENER): Jefferies Vs. Cramer

Two different opinions on Energy Conversion Devices came out last Thursday (Jan. 11). Analyst Jeffrey W. Bencik at Jefferies & Co said that ENER was one his top 2 picks in the solar industry for '07, opining that despite continued volatility this should be a rewarding year for ENER investors. He believes that attention will "shift from company specific performance to a top down focus on the evolution of solar incentive schemes." Jim Cramer, on Thursday's Mad Money, said he could not, "in good conscience, recommend that stock with oil at $51, going to $49. So,...

Community Solar Providers In ConEd Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

VENDOR NAME

PRICING STRUCTURE

ADDITIONAL DETAILS

SPECIAL OFFERS

Ampion

10% discount subscription model

Free cancellation at any time, excess credit is banked

BlueWave Solar

10% discount subscription model (Broker for solar farms)

Links to own development as well as any external ones. Available services in your area found through ZIP code search.

Sunset Solar Park

20% discount subscription model

YSG Solar

10% discount subscription model

Credits offered can be increased or decreased to suit usage

UGE International

10% discount subscription model

2-year contract, No cancellation restrictions

OnForce Solar

10% discount subscription model

Extra credits carried on;...

Cree, a Solar Play?

For investors excited about Cree's (NASD:CREE) Light-Emitting Diode (LED) business, here's one more piece of good news: The EE Times Reports that the Fraunhofer Institute for Solar Energy Systems (Freiburg, Germany) claims it has achieved a record efficiency for its inverter designed for PV generators, using Cree's SiC transistors. I've previously noted that inverters are a good way to participate in the Solar and Wind power markets without needing to invest in the high priced (or foreign) companies which dominate those markets, and even without this news, Cree is a longtime favorite of this blog. The stock shot up...

Ascent Solar: Grounded

By Brandon Qureshi Recently, Ascent Solar Technologies (ASTI: Nasdaq) , a publicly traded solar power company, received an additional $5.0 million from institutional investor Ironridge Technology, thereby completing a $10 million Series B Preferred Stock investment. AST, based in Thornton, Colorado, has emerged as a leader in the development of flexible, thin, high-performance solar panels. In order to examine AST within an industrial context, a profile of the solar power industry is necessary: According to sources such as Time and E&E Publishing, the industry has experienced record levels of popularity in the United States in the last...

Trina Joins Solar Fund Raising Queue

by Doug Young Just a day after the solar panel sector was hit by a new negative trade ruling from the US, Trina Solar (NYSE: TSL) gave its investors another unwanted surprise with word that it is preparing to raise more than $200 million through a combination of new stock and bond offerings. Trina joins a growing list of solar panel makers that are looking to western capital markets as confidence returns to the sector following a prolonged downturn dating back to early 2011. The fact that Trina and others are turning to western capital markets to...

Five Solar Stocks For 2015

By Jeff Siegel Times sure have changed! In 2006, I attended my first Solar Power International (SPI) conference in D.C. It was a no-frills event but loaded with valuable information I used to help Energy and Capital readers get a jump on the solar bull market that ran from 2006 to 2008. Truth be told, we cleaned up. But nothing lasts forever. And when the market nosedived in 2008, solar stocks were not exempt from the ravenous bears that mauled everything in their path. Of course, as the broader market began to inch back up in 2010, solar...

Suntech Plunges as Reckoning Day Approaches

Doug Young I rarely write about the same company 3 times in a single week, but in this case the developments are coming so quickly at plunging solar panel pioneer Suntech Power (NYSE: STP) that an update to this fast developing story is necessary. Company watchers will know that Friday was the official deadline for Suntech to repay some $540 million in bonds that have just come due. The company has no cash to make that repayment, and earlier this week received a 2 month extension on that deadline from a majority of bondholders. (previous post) Meantime, Chinese...

Will Crystalline Solar Kill Thin Film?

A Conversation with Applied Material’s Solar Head Charlie Gay by Neal Dikeman I had a chance to chat today with Dr. Charlie Gay, the President of Applied Materials' (AMAT) solar division. You may recall, we broke the story in the blogosphere 5 years ago about Applied’s entry into solar, which was anchored with a highly touted and very aggressive strategy for turnkey large format amorphous silicon and tandem cell plants called SunFab. Charlie reminded me that when they began 5 years ago, they did so along two major thrusts: The acquisition of Applied Films in...

How Weather Risk Transfer Can Help Wind & Solar Development

by Daryl Roberts

The Need To Accelerate Renewables Adoption

Renewables are growing rapidly as a percentage of new electric generation, but are still being assimilated too slowly and still constitute too small of a fraction of total generation, to be able to transition quickly enough to scale into a low carbon economy in time to mitigate climate change.

The issue of providing public support, with subsidies and other reallocation methods, is a politically charged subject. High carbon advocates, for example American Petroleum Institute, argues that support for renewables distorts the market. On the other hand, it has been argued, for example by...

SolarCity: Fanning the Flames

by Debra Fiakas CFA Solar power installer Solar City (SCTY: Nasdaq) has attracted a swarm of shareholder lawsuits in recent weeks. The stock is trading at a price level 44% below its 52-week high of $88.35 set in February 2014. That has to be disheartening for those who were on the wrong side of the trades at those lofty levels. In February when traders were bidding $88 and change for SCTY, the stock was trading at about 50 times revenue and 47 times cash flow from operations. Of course, since the company had yet to produce...

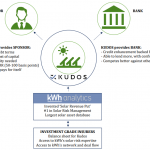

New Financing Models for Solar Energy

By Harris Roen As more homeowners and business become interested in installing solar, a myriad of financing options have evolved. From third-party financiers to Solar REITs, the options available to benefit the renewable energy industry and end users keep expanding. This article highlights what alternative energy investors should know about trends in creative financing for renewables, and which investments should profit. Solar REIT What it is: A Real Estate Investment Trust (REIT) is a security that invests directly in real estate. Investors can buy and sell shares of the REIT like a stock. The REIT can...