How New Battery Applications Will Disrupt the Home Generator Market

By Tom Konrad Ph.D., CFA

The market for reliable back-up power in homes and businesses is booming.

With more people working from home and increasing news coverage of power outages due to severe weather events and public safety power shutoffs in California (not to mention domestic terrorism), power reliability seems like it’s destined for a long term boom.

New Competition

A decade ago, if you wanted backup power, a generator was the only option. Now, there are an increasing number of battery-based alternatives beginning to compete with generators to provide back-up power. While most battery-based solutions are better than gas or propane generators...

Alkaline Electrolyzers – The Future needs a Metamorphosis

by Ishaan Goel

The second article in this series on water electrolyzers focused on polymer electrolyte membrane electrolyzers (PEMEs). PEMEs have increasingly captured the interest of industry over recent years, due to favorable technical characteristics. Despite this, the global electrolyzer market today is dominated by a much older model - alkaline electrolyzers (ALKEs). (For details of how both electrolyzers work, refer to the first article in the series).

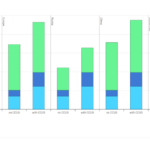

The graph above shows the investment costs ($/kW) of ALKEs and PEMEs as the technology has advanced over time. In other words, they show the initial capital cost for every 1 kW of...

Earnings Roundup: Metals Prices Boost Covanta and Umicore

By Tom Konrad, Ph.D., CFA

You don’t have to own mining companies to benefit from rising metals prices.

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. Waste to energy operator Covanta and specialty metals recycler Umicore are both benefiting from skyrocketing metals prices.

Just as renewable energy and energy efficiency stocks have long shown that investors don’t have to own fossil fuel companies to benefit from rising prices of fossil fuels, recyclers like Covanta and Umicore are showing that you don’t have to own environmentally damaging mining companies to benefit from rising...

PEM Electrolyzers – Cracking the Chicken and Egg Problem

by Ishaan Goel

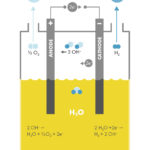

The first article in this series introduced two prominent types of water electrolyzers – alkaline electrolyzers (ALKEs) and polymer electrolyte membrane electrolyzers (PEMEs). Electrolyzers are devices that convert water into hydrogen and oxygen using electricity. They enable energy storage through hydrogen when combined with fuel cells, and can decarbonize hydrogen production for industry if supplied with renewable power. Subsequent articles shall focus on various characteristics of these two electrolyzer variants.

The graph above shows the investment costs ($/kW) of PEMEs and ALKEs as the technology has advanced over time. In other words, they show the initial capital cost...

Introduction to Electrolyzer Technologies

by Ishaan Goel

Hydrogen has become increasingly prominent as a potential carbon-free fuel, for both automobiles and providing electricity to buildings. It has direct applications in decarbonizing important industries like steel, and can serve as a storage medium for extra renewable energy over seasonal durations too.

Since hydrogen gas does not occur naturally in our atmosphere, its method of production is an essential component of the hydrogen economy. There are several such methods (discussed in detail here), but the one with least emissions involves using renewable power to run electrolyzers - devices that use electricity to convert water into hydrogen and...

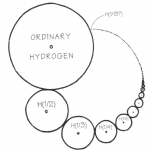

The Many Shades of Hydrogen

by Ishaan Goel

INTRODUCTION

In 2020, hydrogen shot to the forefront of the renewable energy conversation, with stakeholders making major investments in its growth. The European Union has allocated nearly EUR 400 billion to hydrogen within its Covid-19 recovery package, to ramp up production capacity ~150 times by 2030. Globally, hydrogen production projects under development have nearly tripled (by capacity) with several firms announcing ambitious gigawatt-scaled ventures.

The appeal of hydrogen stems from its excellent capabilities as both an energy carrier and storage medium. Beyond its extensive usage in high-temperature industrial processes and manufacturing, it shows potential in areas that have proven...

PEM Fuel Cells – Hoping to Challenge Internal Combustion

The first article in this series introduced the two prominent types of hydrogen fuel cells - alkaline fuel cells (ALKFCs) and proton-exchange membrane fuel cells (PEMFCs). Fuel cells are devices that convert stored hydrogen into usable energy, and constitute an essential part of the hydrogen economy. Subsequent articles shall focus on various characteristics of these two cells.

The graph above shows the power costs ($/kW) of PEMFCs and ALKFCs as the technology has advanced over time. In other words, they show the initial capital cost for every 1 kW of fuel cell capacity (note that this axis is in the...

Brilliant Light Power – Commercialization Status

by Daryl Roberts

A potentially paradigm-shifting technology has been under development at an R&D firm in NJ called Brilliant Light Power. For people monitoring the situation, the question currently is about the status of commercialization. It is not a publicly held firm, but is in mid-stages of private equity capitalization in the range of $100-120M.

I recently read a book titled "Randall Mills and the Search for Hydrino Energy", offering a detailed and compelling history of the development of this novel renewable energy technology, authored by an insider, an intern who stayed on to work there for several years (published in...

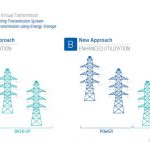

Energy Storage as Transmission Explained

by Blackridge Research

The latest trend is that power transmission companies around the world are increasingly looking at energy storage technology to defer or replace transmission system upgrades. How this works is energy storage is placed along a transmission line and operated to inject or absorb power, mimicking transmission line flows. Going with names like “virtual transmission” in Australia and “GridBooster” in Germany, projects totaling over 3 GW of capacity are poised to increase system efficiency and reliability across the world.

Storage as transmission offers an array of benefits over traditional transmission infrastructure. They are faster to deploy, have smaller footprint,...

What Do Investors Get With BioSolar?

by Debra Fiakas, CFA

Last week management of energy storage developer BioSolar, Inc. (BSRC: OTC/PK) provided an update on the company lithium-ion battery design. The company’s engineers along with a manufacturing partner are still making changes to the design called the 21700 cell. Additionally, the company recently decided to take greater control over raw materials supply, potentially sourcing and processing materials in the U.S.

Engineers at BioSolar have been trying to increase the storage capacity of lithium-ion batteries by improving the anode component. The plan is to sell 'super anodes' to battery manufacturers to make existing lithium-ion batteries work like super batteries. Prototypes were tested in July...

McPhy: Growing With Hydrogen

by Debra Fiakas, CFA

Hydrogen system developer McPhy Energy SA (MCPHY: PA) recently reported impressive sales growth in the first half of 2019 - 23% higher than last year. Sales were boosted by delivery of a refueling station in Houdain, France for a bus operation that is 100% powered by hydrogen. New orders for projects in Germany, Bangladesh and Switzerland will keeps the company busy in the month ahead installing additional hydrogen fueling stations and electrolysis equipment for hydrogen production.

Despite the success, McPhy has not achieved profitability. Thus the company remains dependent upon financing to support operations. In 2017, the company secured an equity sales agreement with Kepler...

Beyond ZEVs: The Negative Emission Vehicle

by Jim Lane

Wandering the halls at the BIO World Congress and later to be seen again at ABLC NEXT this November, we ran across one of the most interesting technologies relating to ethanol production and markets we have seen in a month of Sundays, perhaps two months’ worth.

The problem

First, let’s revisit the problem. There’s simply too much ethanol being produced for the markets to absorb, given the Trump Administration’s massive cutbacks in US ethanol targets —In the resulting massively oversupplied market, the inevitable has happened, ethanol producers, growers and the Midwestern economies are being crushed. And they thought they...

Hydrogen in Oil’s Back Yard

by Debra Fiakas, CFA

As well derricks cast oily shadows across the landscape, Air Products and Chemicals, Inc. (APD: NYSE) has installed Saudi Arabia’s first hydrogen fueling station.The set up is tucked safely into APD’s new technology center in a science park, but the significance of this incursion into oil and gas country can be felt across the region.The fueling station, which incorporates APD’s SmartFuelhydrogen fueling technology, will service six Toyota Mirai fuel cell electric vehicles. Undertaken in cooperation with Saudi Aramco, the project is intended to demonstrate the potential for hydrogen as transportation fuel.

Hydrogen has potential advantages over conventional fuels, including Saudi Arabia’s oil and...

In Search Of Solid State Battery Stocks

by Debra Fiakas, CFA

Greater energy density or the amount of energy stored is the mission of every battery developer. The higher the energy density, the longer a battery can serve its owner. Scientists have been adjusting circulating chemistry, cloaking electrodes in exotic metals, and otherwise tinkering with conventional battery designs. Debate even spills over into the raw material supply chain as it has recently over the use of expensive and sometimes difficult to source cobalt as an additive to lithium ion battery designs. Others are trying to tame silicon for use in battery anodes.

Perhaps the most daring developers have abandoned conventional battery design...

Lesser Known Battery Chemistries

by Debra Fiakas, CFA

The last post Vanadium Flow Battery Companies, featured several companies bringing vanadium redox flow batteries to the market for large-scale energy storage projects. These highly efficient and long-lived batteries take advantage of the unique properties of vanadium. There are other interesting chemical mixes on the battery market that could yield returns for investors.

Sodium-sulfur

There are at least eight different installations of sodium-sulfur or NaS batteries around the world. One of the largest is the Yerba Buena Energy Storage System owned by Pacific Gas & Electric Company (PCG: NYSE) in California. Rated at 4 megawatts or 24 megawatt hours, the system can provide backup electricity...

Vanadium Flow Battery Companies

The recent post “Lithium Technology Dominates Large Energy Storage Projects” featured companies offering utility-scale lithium battery systems. Industry research firm Navigant estimates that lithium-ion technology accounts for almost 30% of non-pumped storage capacity developed since 2011. This might be due in part to the dramatic decreases in cost for lithium ion batteries. A study completed by Bloomberg New Energy Finance found that the ‘levelized’ cost of energy for lithium ion batteries has fallen by 76% to $187 per megawatt hour in the first quarter 2019 from $800/MWh in 2012.

Is the story over for utility-scale storage? Should investors look for lithium ion battery manufacturers and forget...