Ten Clean Energy Stocks Back In Positive Territory Year To Date

Stay tuned for a full update next month, but it's nice to be back in the black... especially with the benchmarks still struggling. Thanks to Enviva (EVA), Covanta (CVA), and Seaspan (SSW). Until then, here's the May update, where I said EVA and CVA were two of my 3 top short term picks , and I commented that "I still think Seaspan has significant room to the upside."

AY (at $18.91) and TERP (at $10.83) are my top short term picks right now.

Disclosure: Long EVA, HIFR, GPP, BEP, TERP, PEGI, AY, NYLD, NYLD/A, CVA, SSW.

Ten Solid Clean Energy Companies to Buy on the Cheap: Intro, and Honorable Mentions

With the recent market declines, the start of the year may not have been the best time to publish ten speculative stock recommendations. Considering the S&P fell 6% in the month of January, I find it quite surprising that an equal-weighted portfolio of those picks is up over 6% for the same period (using the prices I quoted in the original articles.) If the market as a whole continues down, I expect it to drag those speculative picks with it. Small, profitless companies tend to be hurt more than others in market declines, and to benefit more from booms. ...

Why I Sold My Utility Stocks

In times like these of financial uncertainty, regulated utilities have traditionally been considered a safe haven. But that is changing. The Dow Jones Utilities Average was down 30% in 2008, vs. a 34% drop in the Dow Industrials. Not much of a safe haven. In a recent interview, utilities analyst Daniel Scotto noted, that the utility industry offers "a lot less security" than it used to. His reasoning is based mainly on the fact that the regulated portion of utility company's business is smaller than it has been in previous recessions, making them vulnerable to lower growth (or even...

Valeo February Update (Ten Clean Energy Stocks)

I'm trying something different and doing quick updates on individual stocks in my 10 Clean Energy Stocks model portfolio as I have time to write. The portfolio as a whole has been accelerating with the instant torque of an electric vehicle this year (details here.) I thought I'd start with the company that's newest to my readers,

Valeo SA (FR.PA, VLEEF)

12/31/18 Price: €25.21/$28.20. Annual Dividend: €1.25. Expected 2019 dividend: €1.25. 03/4/19 price: €29.13/$33.00. YTD gain: 15.5% Euro/ 12.8% USD.

I added this stock to the portfolio because it has great technology and and improving market share, but weak industry growth and overoptimistic management projections in 2018...

Ten Clean Energy Stocks For 2018: Terraform, Clearway, and Enviva

by Tom Konrad Ph.D., CFA

Last week, I neglected to discuss Terraform Power (NASD: TERP) in the third quarter update on the other ten clean energy stocks for 2018. I did not notice the omission until after the post had been published, so I decided to write a quick follow-up this week after I had a chance to digest the earnings announcements (including TERP's) which were scheduled for later in the week.

Stock discussion

Clearway Energy, Inc (NYSE: CWEN and CWEN/A)

12/31/17 Price: $18.90 / $18.85. Annual Dividend: $1.133(6.0%). Expected 2018 dividend: $1.26(6.7%) Low Target: $14. High Target: $25.

10/31/18 Price: $19.61/$19.42 ...

10 Clean Energy Stocks For 2019 – First Two Months Results

It's hard to find anything to complain about in the first two month's performance of my 10 Clean Energy Stocks for 2019 model portfolio. Unfortunately, I'm about to go on vacation and don't have time to do an update on all the earnings reports that have come out over the last two weeks. I will try to get to them individually as I have time.

Strategically, I'd like to say I'm getting very nervous about this market rally, and think that readers should be taking profits opportunistically and increasing your cash positions.

10 Clean Energy Stocks For 2018 Preview

Like last year, I will be offering paying readers a preview of my Ten Clean Energy Stocks for 2018 list. I plan to publish the final article after market close on January 1st. If you would like to see a draft version mailed on December 29th (a full trading day before the final publication) please PayPal $10 to me at with a note that it's for the 10 for 2018 preview. The draft will contain the full list, but may not have a complete stock discussion for each stock. I plan to finish the article over the next couple days.

Note...

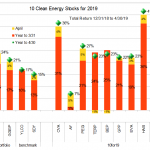

Ten Clean Energy Stocks For 2018: September Quick Update

As you can see from the chart, September was a tough month for my model portfolio of Ten Clean Energy Stocks for 2018. Seaspan (SSW) fell back on trade war fears and Green Plains Partners (GPP) fell on ethanol market weakness caused by retaliatory ethanol tariffs and the Trump EPA's continued undermining of the Renewable Fuel Standard. I'm less sure why Covanta (CVA) is down, but Clearway Energy's (CWEN and CWEN-A formerly NRG Yield) small decline is due to a recent secondary offering.

Two of these (CVA and GPP) were my top picks last month, while the third was Terraform Power (TERP). ...

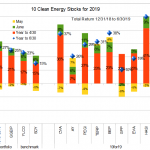

Ten Clean Energy Stocks For 2019: April Ascent

In April, my 10 clean energy stocks model portfolio continued to power ahead, despite the concerns about market valuation I expressed last month. As I said at the time "me being nervous about the market is not much of an indicator that stocks are going to fall" at least in the short term. So I continue to trim winning positions and increase my allocation to cash as stocks advance.

Both the model portfolio and the Green Global Equity Income Portfolio (GGEIP) were up 4.5% and 3.6% respectively in April. This was solidly ahead of their clean energy income benchmark YLCO...

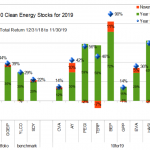

Ten Clean Energy Stocks For 2019: Sell The Peaks

I missed my regular monthly update in early June because of vacation.

In hindsight, early June looks like it was a good buying opportunity. The broad market of dividend stocks (represented by my benchmark SDY) falling six percent in May, only to rebound a similar amount in June. At the time, I would have continued to advise caution: “Sell the peaks” rather than “Buy the dips.”

Particularly volatile stocks like European autoparts supplier Valeo (FR.PA) from this list would have generated even greater short term gains. But it would take more than a six percent market decline to transform this bear...

Covanta’s Q1: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Covanta Holding Corp. (NYSE:CVA)

12/31/18 Price: $13.42. Annual Dividend: $1.00. Expected 2019 dividend: $1.00. Low Target: $13. High Target: $25.

3/26/19 Price: $17.86. YTD Dividend: $0.25. YTD Yield: 1.9% YTD Appreciation: 33.1% YTD Total Return: 34.9%

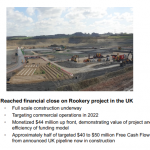

Leading waste-to-energy operator Covanta's stock has been the second best performing holding in my 10 Clean Energy Stocks for 2019 model portfolio. While in many ways the company is similar to the clean energy Yieldcos that dominate the model portfolio, it is different in that it develops its own projects, while most Yieldcos depend on a sponsor to develop projects which...

10 for 2020 Preview

by Tom Konrad, Ph.D., CFA

Over the last couple years, I've given paying subscribers a chance to see my annual list one trading day early. I did not get it organized this year, but I just got an email from a past participant who was interested. I initially said no, I'd rather be fair to all readers but then I thought maybe there are others who can benefit.

I currently have a list of 11 stocks, which I will be narrowing down to 10 after the close on Dec 31st. Anyone who forwards me (tom@thiswebsite.com) an email confirming a donation in...

Early Thoughts On 10 Clean Energy Stocks for 2021

by Tom Konrad, Ph.D., CFA

In the past, I've allowed readers to pay for early access to the list of the 10 stocks I will pick for the model portfolio the next year. This year, early access to the top 10 list will be a perk for all my patrons on Patreon, who get a first peak at drafts of all my articles. I posted a draft of this article on December 18th.

It's going to be hard to pick 10 stocks that I think are good values this year, but it's past time to start thinking about it. I thought...

Ten Clean Energy Stocks Under Trump (November 2016)

Tom Konrad, Ph.D., CFA So far, the broad stock market seems to like the idea of a tax and regulation-cutting and infrastructure spending Trump administration and Republican controlled Congress. The bond market is less pleased at the rapidly growing deficits such a "borrow and spend" policy will inevitably entail. While the S&P 500 advanced 3.4% in November, bond funds fell in the face of rising interest rates. The iShares 20+ Year Treasury Bond (TLT) fell 8.4%. Clean energy stocks were also hurt by the incoming President's climate change skepticism and his promises to undo environmental regulations put...

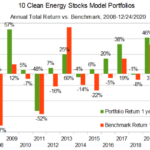

Ten Clean Energy Stocks For 2017: January Jump

Tom Konrad Ph.D., CFA The year got off to a spectacular start for my tenth annual Ten Clean Energy Stocks model portfolio. (You can read about the performance in 2016 and prior years here.) The portfolio and its income and growth subportfolios were up 9%, 8%, and 14%, respectively. Clean energy stocks in general also did well, with my three respective benchmarks up 2 to 3% each. (I use the YieldCo ETF YLCO as a benchmark for the income stocks, the Clean Energy ETF PBW as a benchmark for the...

Ten Clean Energy Stocks For 2016: Year In Review

Tom Konrad, Ph.D., CFA 2016 was generally a good year for the stock market, but the average clean energy investor did not share in the gains. Clean energy investors naturally gravitate toward exciting stocks developing solar and, more recently, electric vehicles. These technologies are bringing great benefits to the planet and customers (including me- I installed a solar array on my home in in 2014, and my wife and I just bought a Toyota Prius Prime plug-in.) Investors' lousy returns are due to a common problem in sectors with rapidly improving technology: Competition within the industry...