The Yieldco Virtuous Cycle

by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

A Yieldco’s stock price rises

It issues new shares, and invests the money in renewable energy projects.

Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if...

Four Picks and Shovels Stocks

by Tom Konrad, Ph.D., CFA

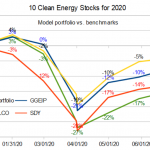

The last three months of 2020 brought an explosion in clean energy stock prices.

Solar stocks (as measured by the Invesco Solar ETF (TAN), nearly tripled. So did the Invesco Wilderhill Clean Energy ETF (PBW), which includes a broader spectrum of companies. Wind stock rose 61%, and even the relatively sedate Yieldcos were up 32%. The stars of the last half of 2020 was undoubtedly Tesla (TSLA, up 246%) and other electric vehicle stocks.

Money Flows Out of Fossil Fuels and Into Clean Energy

I believe that the cause of the current rise in stock prices is largely...

Ten Clean Energy Stocks for 2021: The List

by Tom Konrad, Ph.D., CFA

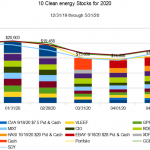

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

Mix Telematics (MIXT)

Green Plains Partners (GPP)

Covanta Holding (CVA)

Red Electrica (REE.MC, RDEIF, RDEIY)

Valeo, SA (FR.PA, VLEEF, VLEEY)

Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

Scorpio Bulkers, Inc. (SALT) - Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

Brookfield Renewable Energy Partners (BEP) - A leading clean energy Yieldco...

Early Thoughts On 10 Clean Energy Stocks for 2021

by Tom Konrad, Ph.D., CFA

In the past, I've allowed readers to pay for early access to the list of the 10 stocks I will pick for the model portfolio the next year. This year, early access to the top 10 list will be a perk for all my patrons on Patreon, who get a first peak at drafts of all my articles. I posted a draft of this article on December 18th.

It's going to be hard to pick 10 stocks that I think are good values this year, but it's past time to start thinking about it. I thought...

10 Clean Energy Stocks for 2020: Rose Colored Covid

by Tom Konrad, Ph.D., CFA

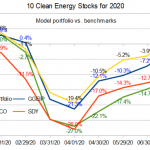

The stock market took off in November, fueled by very positive covid-19 vaccine news, and possibly also the prospect of a little competence and sanity in the White House. While both of these are unambiguously positive for the economy, I think investors are seeing the future through rose colored glasses.

Rose colored covid-19.

What a Biden Victory Means for the Economy

A Biden victory is good news in that we will finally have someone in the White House who will work to reduce the infection rate in the pandemic, rather than vacillating between wishful thinking and actively spurring...

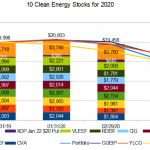

10 Clean Energy Stocks for 2020: Updated Model Portfolio

by Tom Konrad, Ph.D., CFA

After a couple down market days, all the limit orders I listed on Monday have executed.

Here is the current portfolio:

Position

Shares

Position

Shares

CVA

135

CIG

587

CVA Mar21 $7.50 Put

-2

RDEIF

100

VLEEF

57

VEOEF

75

GPP

276

EBAY Jan ‘21 $8 Put

-1

NFYEF

98

Cash

$4415

MIXT

274

Coming Up:

Third quarter earnings season is starting… I plan to write short notes on earnings as they come out for my Patreon supporters, which will be compiled into longer articles on AltEnergyStocks.com a few days later.

Also, I’m doing a talk on how to divest from fossil fuels with the founder of divestor.org this coming Monday at 8:30 pm ET for the Climate and Health subgroup of Citizens Climate Lobby ...

10 Clean Energy Stocks for 2020: Spooked in October, but Trading Anyway

by Tom Konrad, Ph.D., CFA

Two of the cash covered puts in the 10 Clean Energy Stocks for 2020 model portfolio have now expired, and I am left with a difficult decision as to what to replace them with.

As I discussed last month, I feel the market is overvalued given the economic impact of the pandemic and little prospect of fiscal stimulus before January. Yes, the market is not the whole economy, and large tech firms and high income workers and the wealthy are doing great while people on the bottom half of the income ladder are being crushed. With...

10 Clean Energy Stocks for 2020: The Waiting

by Tom Konrad, Ph.D., CFA

Despite high valuations, a rampaging pandemic, and the end of the $600 weekly supplemental unemployment payments from the CARES Act, the stock market continued upward in August.

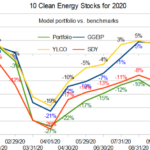

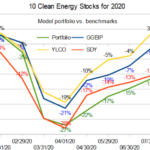

Like most ordinary people in this economy, my Ten Clean Energy Stocks model portfolio is still not feeling the recovery the way the big tech companies and the ultra wealthy are, although my real-money Green Global Equity Income Portfolio (GGEIP) is now hitting new highs for the year.

The difference between the model portfolio’s performance and GGEIP is mostly a result of trading: It had a large cash position at...

10 Clean Energy Stocks for 2020: July Update on Valeo MiX, and NFI

A secular shift in the transportation paradigm?

by Tom Konrad, Ph.D., CFA

I'm continually surprised at the strength and length of the stock market recovery in the face of a worsening pandemic in the US.

The stock market may not be the economy, but it's not totally divorced from the economy either. Perhaps the Senate's unwillingness to even talk about another aid package and the subsequent failure to pass one until after the benefits in the initial CARES act expire will trigger the market reversal I've been expecting at least since late April. Or it won't. I have a long track record...

10 Clean Energy Stocks for 2020: June Update

by Tom Konrad, Ph.D., CFA

The coronavirus pandemic no longer has the United States by its financial center throat, the New York City area, but is instead is now gnawing ravenously at its arms and legs. In June, the stock market seems to be just starting to get a clue that this is also a bad thing, leading to a month of volatility and general consolidation.

Europe, in a display of relative competence, has been much more effective than the US at getting the pandemic beast under control, and so investors looking for safe havens might do well to look there. ...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

10 Clean Energy Stocks For 2020 May Update: Red Eléctrica, Ebay, NFI Group

by Tom Konrad, Ph.D., CFA

Market Outlook

The continuing market rebound in the face of a worsening epidemic in the US (outside of the initially hardest hit states) widespread protests against lack of police accountability, and a President who thinks the right response to mostly peaceful protests is to call in the military continues to befuddle me.

The risks in today's stock market outweigh the possibility of future potential gains. Although I was buying aggressively in March, I've shifted back to a more cautious stance, and am mostly starting to sell covered calls on my positions with the greatest gains. I generally...

10 Clean Energy Stocks for 2020: May Update Part 1

by Tom Konrad, Ph.D., CFA

For the last few monthly updates, I've been focusing on the big picture, and have neglected to say anything about many of the 10 Clean Energy Stocks for 2020 since I looked at how the pandemic would likely affect each stock in March.

This month, I'm trying to rectify the oversight, and have been posting updates on individual stocks for my Patreon supporters since Friday. Below is a collection of the updates I've published so far. I am to keep posting one a day until I've gotten to all of them, after which I plan to...

Woulda, Coulda, Shoulda

With the market's rapid rebound from March lows and the Nasdaq Composite stock index closing higher than it was at the end of last year, many of us are probably asking ourselves:

Did I miss my chance to buy at the lows?

or:

Will I ever make up for my losses?

These questions point to dangerous emotions for stock market investors. Fear of missing out often leads to investment mistakes. This is why investment advisors always tell their clients that they are better off not looking at their portfolios in a downturn.

A big loss makes some people want to sell everything, for fear...

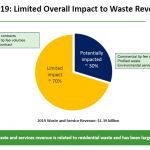

Covanta and Green Plains Partners Don’t Let A Crisis Go To Waste

by Tom Konrad, Ph.D., CFA

Last week, two of the stocks in my Ten Clean Energy Stocks model portfolio cut their dividends. Covanta Holding Corp (CVA) dropped its quarterly payout from $0.25 to $0.08 (a 68% cut) while Green Plains Partners (GPP) slashed its quarterly distribution from $0.475 to $0.12, a drop of 74.75%.

Before reducing their dividends, both companies had payout ratios near 100%, meaning that substantially all of their free cash flow was going to pay dividends. In general, companies are very reluctant to cut their dividends because it is a signal that their management thinks they cannot grow...

Ten Clean Energy Stocks for 2020: Trades

by Tom Konrad Ph.D., CFA

Four weeks ago, I predicted that the 12% market correction we had seen would turn into a true bear market. Bear markets are often defined as a decline of more than 20% for the major market indexes, but I find it more useful to focus on long term changes in investor sentiment.

What I did not predict was just how severe the effect of the coronovirus shutdown would be on the economy. I thought we would need the combined of the effect of the shutdown and investors re-assessing their risk tolerance to bring us into full...