Correction, or Bear Market?

by Tom Konrad, Ph.D., CFA

On February 21st, I was helping an investment advisor I consult with pick stocks for a new client's portfolio. He lamented that there were not enough stocks at good valuations. This is one of the hardest parts of being an investment advisor: a client expects the advisor to build a portfolio of stocks which should do well, but sometimes, especially in late stage bull markets, most stocks are overvalued. I reminded him, "The Constitution does not guarantee anyone the right to good stock picks." He agreed, but he still had to tell his client that...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

Our Blue Chip Alternative Energy Stock List

The market has fallen sharply, and Solar stocks have fallen even more following rumors that Congress will pass the Energy Bill without the Production Tax Credit or Investment Tax Credit. Given this volatility and Renewable Energy's reputation for profitless startups, now might seem like an excellent time for a risk adverse investor to abandon the sector altogether. Not so. Even if all tax credits and other incentives for Renewable Energy were to be removed, the underlying drivers of Alternative Energy remain firmly in place: Rising energy prices and decreasing reserves, the need to reduce our Greenhouse gas emissions to avoid...

Woulda, Coulda, Shoulda

With the market's rapid rebound from March lows and the Nasdaq Composite stock index closing higher than it was at the end of last year, many of us are probably asking ourselves:

Did I miss my chance to buy at the lows?

or:

Will I ever make up for my losses?

These questions point to dangerous emotions for stock market investors. Fear of missing out often leads to investment mistakes. This is why investment advisors always tell their clients that they are better off not looking at their portfolios in a downturn.

A big loss makes some people want to sell everything, for fear...

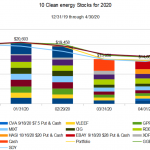

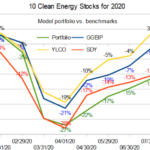

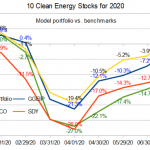

10 Clean Energy Stocks for 2020: The Waiting

by Tom Konrad, Ph.D., CFA

Despite high valuations, a rampaging pandemic, and the end of the $600 weekly supplemental unemployment payments from the CARES Act, the stock market continued upward in August.

Like most ordinary people in this economy, my Ten Clean Energy Stocks model portfolio is still not feeling the recovery the way the big tech companies and the ultra wealthy are, although my real-money Green Global Equity Income Portfolio (GGEIP) is now hitting new highs for the year.

The difference between the model portfolio’s performance and GGEIP is mostly a result of trading: It had a large cash position at...

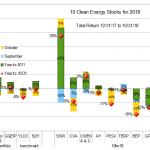

Ten Clean Energy Stocks For 2018: Third Quarter Earnings

Tom Konrad Ph.D., CFA

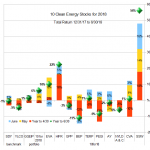

After a fairly brutal September and October my Ten Clean Energy Stocks model portfolio is barely hanging on to positive territory for the year (up 2.4%) as is the private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP, up 0.8%). Yet I can take comfort in superior relative performance, since my broad dividend income benchmark SDY is now down 0.1% for the year, and the clean energy income benchmark YLCO has fallen 5.8%. All returns are total return after fees and dividends.

The strong relative performance in a weak market is most likely due to...

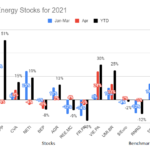

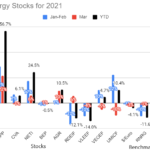

Clean Energy Stock Deflation and Biden’s Infrastructure Plan

By Tom Konrad, Ph.D., CFA

Last month saw buying opportunities in some clean energy stocks as the bubble created from the euphoria over Biden’s election vanished as if it never happened.

Clean energy stocks have simply returned to the general upward trendline from the second and third quarter of 2020. Rather than bursting in a market panic, this seems to have been more of a general deflation.

Some clean energy stocks seem reasonably priced, but there are no great values like we often see during the market panics which typically follow bubbles. Without a panic, I’m not ready to buy aggressively. Stocks...

See You Later, Hannon Armstrong

by Tom Konrad Ph.D., CFA

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its...

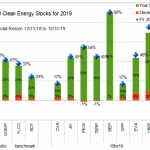

2020 Hindsight: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Sometimes it's good to be wrong.

When I published the Ten Clean Energy Stocks For 2019 model portfolio on New Year's Day 2019, I thought we were likely in the beginning of a bear market. With 20/20 hindsight, that was obviously wrong.

I made the following predictions and observations:

"he clean energy income stocks which are my focus should outperform riskier growth stocks."

"eep value investors will put a floor under the stock prices of these ten stocks."

"I could also be wrong about the future course of this market."

"I have a history...

10 Green Energy Gambles for 2009

The credit crunch made me reassess my investing strategy last September. First, my expectation of the lack of availability of credit for companies without reliable cash flow led me to sell several early stage and troubled companies. Second, my experience of attempting to re-orient my portfolio in a hurry convinced me that I simply own too many companies. For the purposes of diversifying company-specific risk, nearly all the benefits can be achieved with as few as 10 companies, if those companies have sufficiently different performance characteristics. In less ideal circumstances, 20-40 companies will usually be sufficient. I currently own...

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

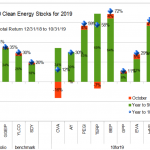

Ten Clean Energy Stocks For 2019: Pattern Buyout, Analyst Downgrades

by Tom Konrad Ph.D., CFA

Although valuations and political uncertainty have me spooked, October was another strong month for the stock market in general and clean energy income stocks in particular.

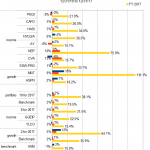

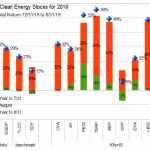

While my broad income stock benchmark SDY added 1.6% for a year to date total gain of 19.6%. My clean energy income stock benchmark YLCO did even better, 2.7% for October and 29.7% year to date. The 10 Clean Energy Stocks model portfolio fell somewhere in between for the month (up 1.8%) but remains unchallenged for the year to date (40.7%). My real-money managed strategy, GGEIP, lagged as I reduce...

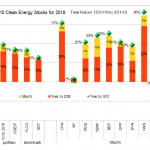

Ten Clean Energy Stocks For 2018: First Half Update

The first half of 2018 has been difficult for most investors, including clean energy investors and dividend income investors. Through June, my broad dividend income benchmark SDY lost 0.6%, while my clean energy income benchmark YLCO lost 4.7%, including dividend income.

My picks were also down for most of the year, finally struggling back into positive territory at the end of May. They finished the first half up a solid 5.9%. The real money strategy I manage, the Green Global Equity Income Portfolio (GGEIP), also squeaked in to positive territory by 1.2% at the end of June.

Details of then stocks'...

Ten Clean Energy Stocks For 2019: Will Pattern Merge With Terraform?

by Tom Konrad Ph.D., CFA

August 2019 saw economic warning signs flashing and a worsening trade war with China. Unsurprisingly, this led to weakness in most stock market indexes.

My broad income stock benchmark SDY was down 2.4% and the energy income stock benchmark YLCO fell 0.3% for the month. Most of the stocks in my 10 Clean Energy Stocks model portfolio continued to buck the trend, with the portfolio as a whole gaining 2.2% for the month. My real-money managed strategy, GGEIP, also turned in a solid 1.9% gain.

The strong performance of my portfolios probably rises from the falling interest...

Too Good To Last? Ten Clean Energy Stocks For 2019

The first quarter of 2019 saw the market's largest quarterly gain in a decade, and my 10 clean energy stocks model portfolio outperformed both the broad market and the clean energy income ETF I use as a benchmark (see chart above.)

Performance that strong makes me nervous, especially since the last time we saw gains like these it was the stock market rebound from the financial crisis. In this case, while the market was down in the last quarter of 2018, it had only been enough of a decline to blow a little of the foam off the top of...

10 Clean Energy Stocks for 2020: July Update on Valeo MiX, and NFI

A secular shift in the transportation paradigm?

by Tom Konrad, Ph.D., CFA

I'm continually surprised at the strength and length of the stock market recovery in the face of a worsening pandemic in the US.

The stock market may not be the economy, but it's not totally divorced from the economy either. Perhaps the Senate's unwillingness to even talk about another aid package and the subsequent failure to pass one until after the benefits in the initial CARES act expire will trigger the market reversal I've been expecting at least since late April. Or it won't. I have a long track record...