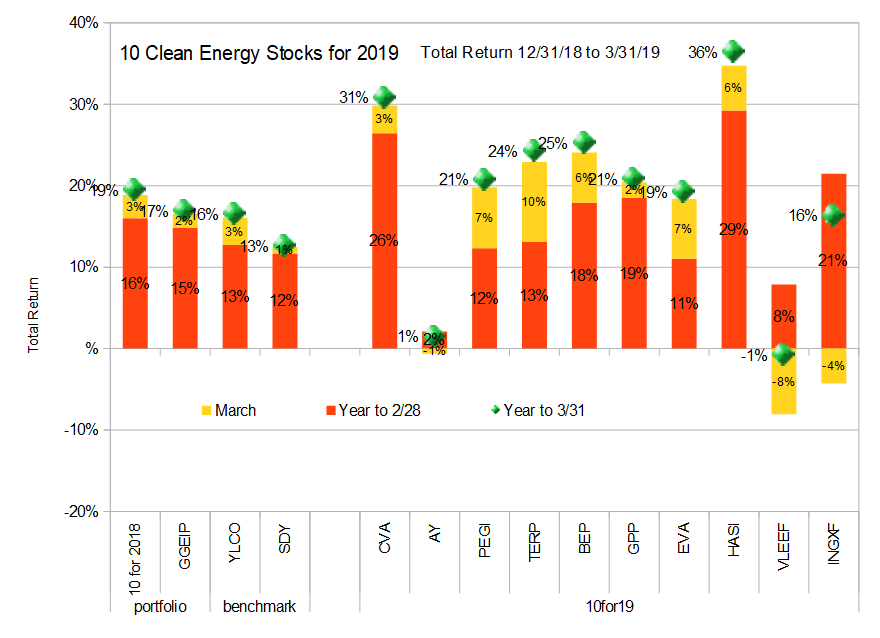

The first quarter of 2019 saw the market’s largest quarterly gain in a decade, and my 10 clean energy stocks model portfolio outperformed both the broad market and the clean energy income ETF I use as a benchmark (see chart above.)

Performance that strong makes me nervous, especially since the last time we saw gains like these it was the stock market rebound from the financial crisis. In this case, while the market was down in the last quarter of 2018, it had only been enough of a decline to blow a little of the foam off the top of a market that was looking very bubbly. The first quarter’s gains have shaken up the market’s champagne bottle all over again.

While this particular investor is happy to pop the cork in celebration, you can bet I’m taking pains to make sure the spray is not going to drench me or my portfolio. I’ve been selling some positions for cash, selling covered calls on others, and letting cash covered short puts expire without selling new ones. In short, I’ve been taking steps to lower my portfolio’s sensitivity to market movements in preparation for a possibly severe market decline. I’ve returned to my more customary bearish stance after my relatively aggressive (for me) buying towards the end of 2018.

Yes, I was also bearish at the end of February, and, in fact, I’m bearish most of the time, so me being nervous about the market is not much of an indicator that stocks are going to fall. That said, the few times I’ve been bullish (the start of 2019, early 2009, and late 2015 (for Yieldcos after the 2015 Yieldco bust), for example, have all seen strong gains. So maybe we’re not going to see the crash I’m worrying about this year, but I’m pretty confident the risks going forward outweigh the upside of a few more percentage points gain that might come from staying fully invested.

Of the ten stocks in the model portfolio, the one large position I’m holding all of is Atlantica Yield, PLC (NASD:AY). It has failed to join its Yieldco brethren in the recent rally, and so its relatively attractive valuation provides some downside protection. While Valeo SA (FR.PA, VLEEF) has also been flat for the year to date, that auto parts supplier is much more sensitive to economic conditions than the other stocks in the portfolio, most of which are quite defensive in nature. I’m holding Valeo, too, but that is not a particularly large position.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, VLEEF.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

What does a heads up defensive position look like?

These 10 stocks look so well selected I am reluctant to sell any positions to take something off the table (just today VLEEF jumped over 12%). But maybe take profits on a portion and hold as cash? Or should one hedge the overall market?

For me it usually means selling covered calls, and selling a portion of the positions which have appreciated most. At the start of January I had no cash to speak of, and held some uncovered short puts. Now, from selling, I’m at about 10% cash and short term CDs, have been letting the short puts expire, and have been selling covered calls. I also have an uncovered short call position in NEP, which is another Yieldco which I think is somewhat overvalued. I very seldom sell a whole position unless I don’t like the company any more, which is not true for any of these.

For someone with a smaller account who does not use options (most people) you could just sell a bit of the positions that have appreciated most and keep it in cash or short term CDs.

Hi Tom,

My question concerns Pattern Energy. Recently, I’ve been reading more about paired solar and battery storage. Here is a headline from CleanTechnica “Global Storage Market Set To Grow 13-Fold By 2024, Add 146 Gigawatt-hours”. Of course, you can pair storage with wind as well. But from what I understand, solar is inherently cheaper than wind. That’s one thing which makes investing is solar so tough. A lot of companies make solar panels, while wind turbines (and the skill to construct a wind farm on the development side) have a higher cost of entry. A quote from that article “There was also a notable trend for solar-plus-storage projects providing semi-dispatchable renewable capacity.”

Do you have an opinion as to whether paired solar + storage will pose a threat to the wind industry at some point over the next few to several years? I realize that a company with a 2 billion dollar market cap has more acute existential concerns, but at the same time, this could be a black swan type of event that ends up hurting part of the renewable sector.

I really like Pattern, especially their work in Japan and the pairing with the Canadian Pension Plan, but I don’t want to fall too much for any one stock, which I why I’m trying to stay wary.

Thank you and congrats on a great quarter.

-Bryan

Paired solar and storage are absolutely *not* a threat to wind. They are allies. While solar is cheaper than wind, solar + storage is far more expensive on a per kWh basis at times when the sun is not shining. Wind typically blows strongest in the evening, winter, during stormy weather, and at night (depending on your location) and so does not usually compete with solar. This is especially true at higher latitudes. Where I live in NY State, wind is strongest in the winter, but solar produces 2-3x as much power in the summer. Batteries cannot even begin to address the seasonal mismatch, which will become even more pronounced as we electrify heating. See this article: http://www.altenergystocks.com/archives/2019/02/a-small-new-york-town-plans-a-profitable-100-renewable-energy-future/. In short, the combination of solar and wind with storage is far more cost effective at meeting our 24/365 energy needs than solar+storage alone. The principle of diversification holds in our electricity generation portfolio just as in our stock portfolios. The technologies in the cross-hairs of cheaper storage are first nuclear and coal, then natural gas peakers, then natural gas combined cycle.

Im thinking about whether the yieldco’s can take advantage of storage.

All of them. They buy assets after others develop them. I think the only one that owns storage so far is CWEN, though.