Community Solar Providers In ConEd Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

VENDOR NAME

PRICING STRUCTURE

ADDITIONAL DETAILS

SPECIAL OFFERS

Ampion

10% discount subscription model

Free cancellation at any time, excess credit is banked

BlueWave Solar

10% discount subscription model (Broker for solar farms)

Links to own development as well as any external ones. Available services in your area found through ZIP code search.

Sunset Solar Park

20% discount subscription model

YSG Solar

10% discount subscription model

Credits offered can be increased or decreased to suit usage

UGE International

10% discount subscription model

2-year contract, No cancellation restrictions

OnForce Solar

10% discount subscription model

Extra credits carried on;...

Community Solar Providers In Rochester Gas and Electric Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

Updated 9/9/2020.

VENDOR LINK

PRICING STRUCTURE

ADDITIONAL COMMENTS

SPECIAL OFFERS

Ampion

10% discount subscription model

Free cancellation at any time, excess credit is banked

Astral Power

10% discount subscription model

No cancellation fee. Bill needed in customer’s name

$100 check and $100 donation to Foodlink

Community Power Partners

10% discount subscription model

no cancellation fee with 90 days notice, no credit checks and no payment information required

Renovus Solar

Purchase Model with small annual maintenance fee. Discount subscription models also offered.

Panel custom-built to suit need, credits forwarded to electricity bill

Use code "AltEnergyStocks"...

Community Solar Providers In Orange and Rockland Territory

See the Buyer's Guide to New York Community Solar for details on how New York community solar works and lists for other utility territories.

Updated 9/8/2020

VENDOR NAME

PRICING STRUCTURE

ADDITIONAL DETAILS

SPECIAL OFFERS

IPP Solar Integration LLC

10% discount subscription model

-

Clearway Community Solar

10% discount subscription model

Cancellation free if replacement found or with 90 day notice, otherwise $200 termination fee

Community Power Partners

10% discount subscription model

no cancellation fee with 90 days notice, no credit checks and no payment information required

Nexamp Inc.

10% discount subscription model

No cancellation fees and long-term contracts

Oya Solar Inc.

10% discount subscription model

Contract for specified period needs to be signed

Astral Power

10% discount subscription model

No cancellation fee....

Earnings Roundup: Covanta, NFI Group, Green Plains Partners

by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I've been sharing with my Patreon supporters. If you'd like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I'm reprinting those thoughts below.

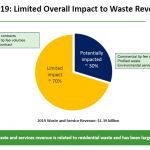

Covanta Earnings

(published August 2nd)

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but...

Amyris’ Sugarcane-derived Vaccine Adjuvant

by Jim Lane

COVID-19 has changed the way we do things…like drink more alcohol, wash our hands more, wear a mask, limit our gatherings and trips, but positive things have come about too. More time to connect with friends and family via online tools, a new respect for healthcare, agriculture and other essential workers, breathing cleaner air, and finding new ways to connect, entertain and innovate. Even in the bioeconomy, companies are doing the “pandemic pivot” and creating innovations to improve our future.

We’ve covered how the ethanol industry jumped in to save the day with hand sanitizer production, but today...

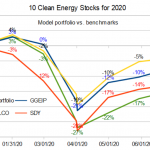

10 Clean Energy Stocks for 2020: July Update on Valeo MiX, and NFI

A secular shift in the transportation paradigm?

by Tom Konrad, Ph.D., CFA

I'm continually surprised at the strength and length of the stock market recovery in the face of a worsening pandemic in the US.

The stock market may not be the economy, but it's not totally divorced from the economy either. Perhaps the Senate's unwillingness to even talk about another aid package and the subsequent failure to pass one until after the benefits in the initial CARES act expire will trigger the market reversal I've been expecting at least since late April. Or it won't. I have a long track record...

Climate-Risk Adjusted Returns and the Weasel Coefficient

By Tom Konrad, Ph.D., CFA

An 80% Weasel Coefficient

Some activists, including a friend of mine, recently had a conversation with representatives of TIAA to try to persuade them to divest from fossil fuels. The conversation was mostly cordial, but predictably did not get anywhere.

One of the activists summed up the response from TIAA as “a non-response with a weasel coefficient of at least 80%.” Regarding the weasel coefficient, he also asked,

Can anyone explain to me what "our overarching strategy which targets climate-risk adjusted returns over the long-term” means in plain English?

Well, yes. Yes I can.

Climate Risk Adjusted Returns

When an investment...

After Consolidation, Solar Will Shatter Expectations

by Shawn Kravetz, Esplanade Capital

Somewhat catalyzed by COVID-19 disruptions but more so by sector maturation, solar is entering a consolidation phase driven by:

Solar incumbents seeking to fortify market positions and reduce costs through

scale

Legacy/traditional energy and utility players seeking renewables exposure to

diversify away from fossil fuels, accommodate investor concerns, and generate

sustainable, predictable profit streams

Corporates capitalizing on cost of capital advantages particularly in cross-border

acquisitions

Parents, specifically China state-owned independent power producers, privatizing

their separately listed renewable subsidiaries (typically in Hong Kong) to bolster

their renewable bona fides and exploit wide valuation discrepancies (typically

between mainland China and Hong Kong).

Like the entire...

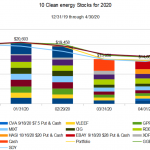

10 Clean Energy Stocks for 2020: June Update

by Tom Konrad, Ph.D., CFA

The coronavirus pandemic no longer has the United States by its financial center throat, the New York City area, but is instead is now gnawing ravenously at its arms and legs. In June, the stock market seems to be just starting to get a clue that this is also a bad thing, leading to a month of volatility and general consolidation.

Europe, in a display of relative competence, has been much more effective than the US at getting the pandemic beast under control, and so investors looking for safe havens might do well to look there. ...

Interview on the Bigger Than Us Podcast

Here's an interview https://bit.ly/3dv5ywg I did for the Bigger Than Us podcast. I'm very impressed with Raj Daniels, the interviewer... he saw patterns in my approach to investing (and life in general) that, before he drew them out of me and put them into words, I had not even recognized myself.

https://anchor.fm/nexuspmg/episodes/74-Tom-Konrad-Ph-D---CFA--is-an-investment-analyst-and-writer-focused-on-clean-energy-stocks-eftq3v/a-a2i8ffh

OriginClear Gambles on Marketing Program

by Debra Fiakas, CFA

Last week waste water treatment developer OriginClear (OCLN: OTC/QB) announced pilot projects for rental of its commercial water systems for pool cleaning. The company has several patents to its credit, protecting its innovations. OriginClear has developed a proprietary catalytic process to clean up solids from waste water as well as an oxidation technology to eliminate microtoxins in water. Unfortunately, the company has struggled to extract value from its efforts. OriginClear has yet to report profits. Indeed in the most recently reported fiscal year ending December 2019, revenue of $3.588 million only barely covered cost of goods of $3.217 million, let alone operating expenses that...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

10 Clean Energy Stocks For 2020 May Update: Red Eléctrica, Ebay, NFI Group

by Tom Konrad, Ph.D., CFA

Market Outlook

The continuing market rebound in the face of a worsening epidemic in the US (outside of the initially hardest hit states) widespread protests against lack of police accountability, and a President who thinks the right response to mostly peaceful protests is to call in the military continues to befuddle me.

The risks in today's stock market outweigh the possibility of future potential gains. Although I was buying aggressively in March, I've shifted back to a more cautious stance, and am mostly starting to sell covered calls on my positions with the greatest gains. I generally...

Covanta Rebounds

by Debra Fiakas, CFA

Waste handler Covanta Holding Company (CVA: NYSE) reported financial results for the first three months of the year at the beginning of May 2020. True enough the net loss might have been wider than published estimates for the quarter, but the consensus target did not reflect a one-time, non-cash charge for asset impairment. Indeed, Covanta’s sales climbed year-over-year to $468 million, of which $61 million was converted to operating cash flow. Waste handling is considered an essential service so Covanta operations remained at full operations even as many of its customers were subject to work stoppages and stay-at-home policies to...

10 Clean Energy Stocks for 2020: May Update Part 1

by Tom Konrad, Ph.D., CFA

For the last few monthly updates, I've been focusing on the big picture, and have neglected to say anything about many of the 10 Clean Energy Stocks for 2020 since I looked at how the pandemic would likely affect each stock in March.

This month, I'm trying to rectify the oversight, and have been posting updates on individual stocks for my Patreon supporters since Friday. Below is a collection of the updates I've published so far. I am to keep posting one a day until I've gotten to all of them, after which I plan to...

Woulda, Coulda, Shoulda

With the market's rapid rebound from March lows and the Nasdaq Composite stock index closing higher than it was at the end of last year, many of us are probably asking ourselves:

Did I miss my chance to buy at the lows?

or:

Will I ever make up for my losses?

These questions point to dangerous emotions for stock market investors. Fear of missing out often leads to investment mistakes. This is why investment advisors always tell their clients that they are better off not looking at their portfolios in a downturn.

A big loss makes some people want to sell everything, for fear...