Shares of Sun Power Purchased

As I mentioned yesterday I had a limit order to purchase SunPower Corporation (SPWR). The stock was scheduled to start the day at $18 and I expected that the stock would be up big in the morning, so I set a limit order at $20. Well when the stock started trading it opened up at over $27. Mid-day the stock seemed to rest around the $25 level and that is when I entered the stock with a 1/3 position in my personal portfolio at a price of $25.70. The stock is not available for purchase at Marketocracy, so it...

Two Canadian IPPs For Your Portfolio

Most alternative energy investors are aware of North American wind power's very bright growth prospects. In past articles, we discussed encouraging projections for the US and Canadian (PDF document) wind markets between now and 2015. While onshore European capacity is fast being exhausted, North America is only beginning its foray into wind and some major capex can be expected in this space over the coming years. Besides solid expected growth, another phenomenon is currently impacting the wind industry; consolidation. This is a global movement that is affecting all of the power gen sector, and that has no-doubt been...

Earnings Roundup: Metals Prices Boost Covanta and Umicore

By Tom Konrad, Ph.D., CFA

You don’t have to own mining companies to benefit from rising metals prices.

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. Waste to energy operator Covanta and specialty metals recycler Umicore are both benefiting from skyrocketing metals prices.

Just as renewable energy and energy efficiency stocks have long shown that investors don’t have to own fossil fuel companies to benefit from rising prices of fossil fuels, recyclers like Covanta and Umicore are showing that you don’t have to own environmentally damaging mining companies to benefit from rising...

Ten Clean Energy Stocks for 2013: First Half Review

Tom Konrad CFA I missed my regular monthly update on my Ten Clean Energy Stocks for 2013 model portfolio last month, and a lot has happened to the individual companies since. Because of this, I will split this semiannual update in two parts. This part will look at the performance of the portfolio as a whole, and the reasons it's lagging its benchmarks. The next part will look at the news driving the performance of specific stocks. Since the last update on May 5th, my portfolio has advanced 3.0% for a 10.5% return for the first...

Calpine Gets Hammered

Shares of Calpine Corp. (CPN) suffered a greater than 20% loss yesterday and is now down almost another 13% today. All of this was caused by a court ruling stating that they will be unable to use the $395 million in cash they received from the sale of oil and gas fields earlier this year for the purpose of buying natural gas to run its power plants. The dispute stems from the Bank of New York's decision in September when, acting as trustee for Calpine bondholders, it withheld proceeds from Calpine's sale in July of North...

The Year of the Balance Sheet

Year in Review: Ten Green Energy Gambles for 2009 Tom Konrad, CFA My speculative renewable and alternative energy stock picks for 2009 had mixed results. The gambles came nowhere near the performance of my 10 Clean Energy Stocks for 2009, and only kept pace with their benchmarks. The reasons why can be found on the companies' balance sheets and cash flow statements. In January 2009 in response to popular demand, I gave readers ten picks of speculative green energy stocks. I tend to buck the general trend that renewable energy investors tend to be gamblers, but my annual stock...

How Green are Your Earnings?

What Constitutes an Alternative Energy Company? There's a debate going on in the clean energy investment community about which companies are "green" enough to merit our attention. Before the filming of my WealthTrack appearance, I got into a discussion with Ardour Global Indexes' Joseph LaCorte. The Global Alternative Energy ETF (NYSE: GEX) is based on the index he manages. The format of the show includes a top pick from each of the guests at the end of the show, and Mr. LaCorte was hoping that I'd pick GEX, since I had previously told him that it was...

10 Clean Energy Stocks For 2020 May Update: Red Eléctrica, Ebay, NFI Group

by Tom Konrad, Ph.D., CFA

Market Outlook

The continuing market rebound in the face of a worsening epidemic in the US (outside of the initially hardest hit states) widespread protests against lack of police accountability, and a President who thinks the right response to mostly peaceful protests is to call in the military continues to befuddle me.

The risks in today's stock market outweigh the possibility of future potential gains. Although I was buying aggressively in March, I've shifted back to a more cautious stance, and am mostly starting to sell covered calls on my positions with the greatest gains. I generally...

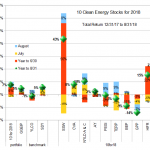

Ten Clean Energy Stocks For 2018: Second Quarter Earnings

Tom Konrad Ph.D., CFA

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the...

The Pros Pick Two (Correction:Four) Offbeat Cleantech Stocks for 2014

Tom Konrad CFA Green 2014 image via BigStock Among the dozen stocks picked by my panel of professional green money managers for 2014, most followed three themes: Solar stocks, IT stocks, and income stocks. Two didn’t, and they are included here. This Cash-Rich Water Company Could Produce a Big Dividend The first is a Japanese water utility, picked by Rafael Coven, the Managing Director at the Cleantech Group, and manager of the Cleantech index (^CTIUS) which underlies the Powershares Cleantech ETF (NYSE:PZD.) Coven likes...

10 Clean Energy Stocks For 2018 Preview

Like last year, I will be offering paying readers a preview of my Ten Clean Energy Stocks for 2018 list. I plan to publish the final article after market close on January 1st. If you would like to see a draft version mailed on December 29th (a full trading day before the final publication) please PayPal $10 to me at with a note that it's for the 10 for 2018 preview. The draft will contain the full list, but may not have a complete stock discussion for each stock. I plan to finish the article over the next couple days.

Note...

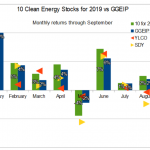

Ten Clean Energy Stocks For 2019: What Caution Looks Like

by Tom Konrad Ph.D., CFA

So far, my worries about stock market valuation and political turmoil have not turned into the stock market downturn I've been warning readers to prepare for. In fact, September has been a particularly sunny month for both clean energy stocks and the stock market in general.My broad income stock benchmark SDY was up 3.9% and the energy income stock benchmark YLCO rose 2.7% for the month, more than reversing August's declines. My 10 Clean Energy Stocks model portfolio accelerated upward by 5.3%, as did my real-money managed strategy, the Green Global Equity Income Portfolio(GGEIP), which...

Ten Clean Energy Stocks for 2013: Summer

Tom Konrad CFA It's been a busy summer for me and my Ten Clean Energy Stocks for 2013 model portfolio. While I delayed my monthly update, the companies in the model portfolio have been very busy reporting (and restating) earnings. Overall, the portfolio was flat for July and August, with 1.2% of dividends offsetting a 1.1% decline in stock prices. This put it further behind my benchmarks, the iShares Russell 2000 Index (IWM) for the broad market, and the Powershares Wilderhill Clean Energy Index (PBW) for clean energy stocks. These each notched up 2%...

In a Buying Mood

Several key indicators I follow have put me back into a buying mood. But sadly I will be spending most of my day in meetings and will not have much time to follow through on any purchases. I wanted to post a quick update about the stocks I'm following. I will be averaging down on some of my current holdings this week and also looking to add some new stocks to the portfolio. Here is my short list of new stocks I'm taking a close look at to add to the portfolio: Capstone Turbine Corp (CPTC)...

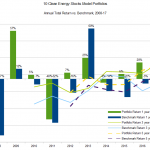

Ten Clean Energy Stocks For 2018

Tom Konrad Ph.D., CFA

Ten Years of "10 Clean Energy Stocks." A 38% total return in 2017 is the one to beat.

I started blogging about investing in clean energy stocks in 2005. At the time, I had just started an independent investment advisory practice, and thought blogging was a good way to impress people with my knowledge of clean energy. I don't know how many people I impressed, but the clients were hardly pounding down the door.

What I did learn, however, was that I loved writing about clean energy from the perspective of a stock investor. Because I was...

Alternative Energy and Climate Change Mutual Funds, Part IV

Tom Konrad CFA Cherry picking the holdings of green energy mutual funds. So far in this series I've concentrated on trying to pick the best of the Alternative Energy and Climate Change Mutual Funds. This is a difficult task, because while I found in Part III that most of the funds' performance has been better than comparable index ETFs, these mutual funds' costs are quite high, even by the standards of most mutual funds, as I discussed in Part I. In part II, I tried looking at the sector breakdown of the funds' holdings, to see if...