A Quick Clean Energy Tracking Portfolio

Yesterday, I outlined a strategy to approximately replicate the performance of a Clean Energy mutual fund at much lower cost, with only a couple hours of effort. I gave a cost example based on $5000 invested in 5 stocks, with another $1000 worth of a single stock added in each subsequent year. This is the procedure I would use to select the initial five stocks. Collect all the top five or ten holdings of the available Clean Energy mutual funds. This data is available from Morningstar, and on fund sponsor's home pages. A few of these holdings may...

Q2 Performance Update: Ten Green Energy Gambles for 2009

Tom Konrad, Ph.D., CFA I never thought 2009 would be a good year for risky stocks, but my readers asked for them anyway. So far, my risk taking readers have not been burnt too badly, and the portfolio as a whole continues to track its benchmarks. In my first quarter update for my green energy gambles for 2009, I noted that the portfolio had lost about 10%, between the benchmark returns (-12% and -5%), but not very impressive. Since then, the portfolio as a whole has gained a little ground, and is almost exactly midway between the benchmarks. The...

Marching Ahead: Ten Clean Energy Stocks For 2016

by Aurelien Windenberger I’ve been a fan of Tom Konrad’s annual renewable model portfolio for years, so I’m happy to be able to assist Tom with some of his monthly updates. After two chilly months to start off 2016, the outlook turned considerably warmer in March, both for the market and for clean energy stocks. The Russell 2000 (IWM) jumped 8% for the month, as market participants took to the “risk-on trade” following Fed Chairwoman Yellin’s dovish commentary. Clean energy stocks did even better, buoyed by a reversal in the broader energy sector. Tom’s ...

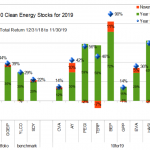

Year In Review: 11 Clean Energy Stocks for 2012

Tom Konrad CFA Year In Review For the fourth year in a row, my model portfolio of clean energy stocks has beaten the clean energy sector as a whole, this year by 23.8%. Unfortunately, this was mostly due to another year of poor performance by my industry benchmark, the widely held Powershares Clean Energy (PBW) ETF, which lost 16.4% for the year. My model portfolio, composed of eleven clean energy stocks listed in this article published on January 2nd, gained 7.4%, still short of the performance of the broad market, which gained 16.6%. The general market...

10 Clean Energy Stocks for 2020: Updates on GPP, HASI, CVA

by Tom Konrad, Ph.D., CFA

Market Decline

Last week I warned "The risks in today's stock market outweigh the possibility of future potential gains." Looks like we're seeing those risks manifest in short order. The last couple days' decline have me looking at a few stocks to start adding to my positions again, especially MiX Telematics (MIXT) discussed on June 2nd and Green Plain Partners (GPP), discussed below.

Note that this pullback could easily be very early days of a much larger market decline. We might even see the market fall far enough to test the March lows... any of my buying...

Early Thoughts On 10 Clean Energy Stocks for 2021

by Tom Konrad, Ph.D., CFA

In the past, I've allowed readers to pay for early access to the list of the 10 stocks I will pick for the model portfolio the next year. This year, early access to the top 10 list will be a perk for all my patrons on Patreon, who get a first peak at drafts of all my articles. I posted a draft of this article on December 18th.

It's going to be hard to pick 10 stocks that I think are good values this year, but it's past time to start thinking about it. I thought...

Ten Clean Energy Stocks For 2014

A list of ten high yield and value clean and alternative energy stocks expected to do well in 2014.

Ten Clean Energy Stocks I’d Buy Now

Tom Konrad CFA Buying opportunities return to clean energy. Two years ago I had a problem. In the universe of clean energy stocks I watch, I could not find any that I thought were good values. So I wrote an article saying "We're near the peak." If you had been comparing that call to the performance of the broad stock market since then, you would have to conclude that I was ludicrously wrong. The S&P 500 is up 40% since then. If on the other hand, you'd been watching clean energy stocks, you would...

Earnings Season For Ten Clean Energy Stocks

Tom Konrad CFA The third quarter earnings season has been quite eventful for my Ten Clean Energy Stocks for 2013 and six alternative picks model portfolios, so much so that writing about them has taken a back seat to keeping up with the announcements. There were a number of earnings disappointments and earnings announcements which were in line with my expectations but the market treated like disappointments. These resulted in an overall decline of 2.5% for the portfolio since the last update, even as my industry benchmarks, the Powershares Wilderhill Clean Energy (PBW) and my...

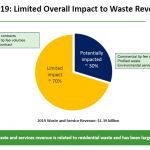

Covanta’s Q1: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Covanta Holding Corp. (NYSE:CVA)

12/31/18 Price: $13.42. Annual Dividend: $1.00. Expected 2019 dividend: $1.00. Low Target: $13. High Target: $25.

3/26/19 Price: $17.86. YTD Dividend: $0.25. YTD Yield: 1.9% YTD Appreciation: 33.1% YTD Total Return: 34.9%

Leading waste-to-energy operator Covanta's stock has been the second best performing holding in my 10 Clean Energy Stocks for 2019 model portfolio. While in many ways the company is similar to the clean energy Yieldcos that dominate the model portfolio, it is different in that it develops its own projects, while most Yieldcos depend on a sponsor to develop projects which...

10 for 2020 Preview

by Tom Konrad, Ph.D., CFA

Over the last couple years, I've given paying subscribers a chance to see my annual list one trading day early. I did not get it organized this year, but I just got an email from a past participant who was interested. I initially said no, I'd rather be fair to all readers but then I thought maybe there are others who can benefit.

I currently have a list of 11 stocks, which I will be narrowing down to 10 after the close on Dec 31st. Anyone who forwards me (tom@thiswebsite.com) an email confirming a donation in...

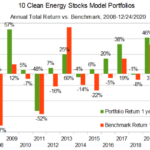

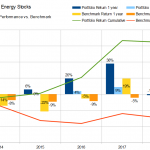

Ten Clean Energy Stocks For 2018: Wrap Up

by Tom Konrad Ph.D., CFA

Almost every major index fell in 2018. My Ten Clean Energy Stocks model portfolio and the Green Global Equity Income Portfolio (GGEIP), the real-money portfolio that I manage were not exceptions. Still, I'm satisfied with their performance: the model portfolio lost only 1.3 percent for the year, while GGEIP was down 2.6 percent. That's well ahead of most indexes, including my benchmarks YLCO (down 7.8 percent) and SDY (down 4.1%.) These benchmarks are intended to reflect the performance of clean energy dividend stocks and general of dividend stocks, respectively. Non-income oriented indexes such as the...

Ten Clean Energy Stocks Under Trump (November 2016)

Tom Konrad, Ph.D., CFA So far, the broad stock market seems to like the idea of a tax and regulation-cutting and infrastructure spending Trump administration and Republican controlled Congress. The bond market is less pleased at the rapidly growing deficits such a "borrow and spend" policy will inevitably entail. While the S&P 500 advanced 3.4% in November, bond funds fell in the face of rising interest rates. The iShares 20+ Year Treasury Bond (TLT) fell 8.4%. Clean energy stocks were also hurt by the incoming President's climate change skepticism and his promises to undo environmental regulations put...

Shares of Daystar Technologies Purchased

DayStar Technologies Inc (DSTI) has been on my radar for some time and the recent operational update created some renewed interest in the company. The stock traded up nicely over the past couple of days and it is now trading back down to the near term support due to some profit taking on the news. I have been looking for a good entry point on this stock and I feel like today is the day to make the move. Technically, the downside of this stock is that it may not be able to hold its currently levels and could...

The Alternative Energy Stocks Paper Portfolio

Here at AltEnergyStocks we try to give the best advice to help our readers sort quality alternative energy investments from the simply overvalued and the dangerous poseurs. How well are we doing? Putting Play Money Where our Mouth Is. As regular readers know, both Charles and I invest in many of the same stocks we recommend. I take a broad portfolio approach, with small stakes in almost everything I think is interesting, and larger stakes in companies I'm more bullish about, while Charles has a highly focused portfolio consisting of a small number of companies he expects to perform...

Where To Next For Solar PV Stocks?

Charles Morand There was an interesting post in Barron's tech trader daily on Monday discussing how solar PV stocks are coming under pressure, in part because product prices are falling further than expected. About a month ago, I discussed the potential return effect for households in given states of removing the $2,000 ITC cap. Such measures, it seems, are failing to kickstart demand, and solar recovery might end up being significantly slower than many had been expecting. Case in point, since hitting a high of $11.49 on June 11, the TAN ETF is down about 12%. KWT, for...