Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...

Four Picks and Shovels Stocks

by Tom Konrad, Ph.D., CFA

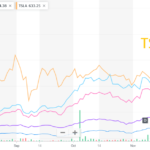

The last three months of 2020 brought an explosion in clean energy stock prices.

Solar stocks (as measured by the Invesco Solar ETF (TAN), nearly tripled. So did the Invesco Wilderhill Clean Energy ETF (PBW), which includes a broader spectrum of companies. Wind stock rose 61%, and even the relatively sedate Yieldcos were up 32%. The stars of the last half of 2020 was undoubtedly Tesla (TSLA, up 246%) and other electric vehicle stocks.

Money Flows Out of Fossil Fuels and Into Clean Energy

I believe that the cause of the current rise in stock prices is largely...

Ten Clean Energy Stocks Under Trump (November 2016)

Tom Konrad, Ph.D., CFA So far, the broad stock market seems to like the idea of a tax and regulation-cutting and infrastructure spending Trump administration and Republican controlled Congress. The bond market is less pleased at the rapidly growing deficits such a "borrow and spend" policy will inevitably entail. While the S&P 500 advanced 3.4% in November, bond funds fell in the face of rising interest rates. The iShares 20+ Year Treasury Bond (TLT) fell 8.4%. Clean energy stocks were also hurt by the incoming President's climate change skepticism and his promises to undo environmental regulations put...

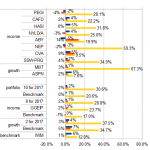

Clean Energy Stocks Gone With the Wind

Tom Konrad CFA Unenchanted April After a great January, the last three months have not been kind to clean energy stocks. While my model portfolios are still in positive territory (+5.4% and +0.9% for the unhedged and hedged portfolios, respectively), and are above my clean energy benchmark (The Powershares Wilderhill Clean Energy ETF, -3.4%), they have again fallen behind my broader market index, the Russell 2000 (+7.3%.) Gone with the Wind trailer, public domain Gone With the Wind April saw the chances of...

Ten Clean Energy Stocks For 2015: A Fine February

Tom Konrad CFA After a rough start to the year, My Ten Clean Energy Stocks for 2015 posted a strong recovery in February. For the month, the model portfolio rose 7.9% in local currency terms and, 8.3% in dollar terms. For comparison the broad universe of US small cap stocks rose 5.9% (as measured by IWM, the Russell 2000 index ETF), and the most widely held clean energy ETF, PBW, shot up 11.6%. This year I split the model portfolio into two sub-portfolios of six income stocks (NYSE:HASI, NYSE:BGC, TSX:...

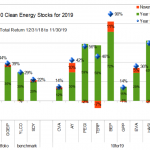

Ten Clean Energy Stocks For 2019: Still Party Time

by Tom Konrad Ph.D., CFA

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I'm frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it's always a good idea to hedge one's bets in the stock market. At least in part...

Ten Clean Energy Stocks For 2014: September Swoon

Tom Konrad CFA Worries including the conflict with ISIL, Ebola, and economic slow-down in Europe, sent the stock market down in the month to October 3rd, with small cap stocks and clean energy stocks falling even farther than the large cap S&P 500. My 10 Clean Energy Stocks for 2014 model portfolio weathered the storm relatively well because of its emphasis on defensive and income stocks. Since the last update, the model portfolio was down 4.8%,...

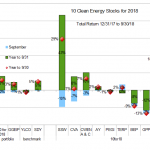

Ten Clean Energy Stocks For 2018: September Quick Update

As you can see from the chart, September was a tough month for my model portfolio of Ten Clean Energy Stocks for 2018. Seaspan (SSW) fell back on trade war fears and Green Plains Partners (GPP) fell on ethanol market weakness caused by retaliatory ethanol tariffs and the Trump EPA's continued undermining of the Renewable Fuel Standard. I'm less sure why Covanta (CVA) is down, but Clearway Energy's (CWEN and CWEN-A formerly NRG Yield) small decline is due to a recent secondary offering.

Two of these (CVA and GPP) were my top picks last month, while the third was Terraform Power (TERP). ...

Q2 Performance Update: 10 Clean Energy Stocks for 2009

The Obama Effect continues to make my annual ten picks shine. Tom Konrad, Ph.D., CFA This is the second performance update on my 10 Clean Energy Stocks for 2009. In the first quarter, the model portfolio was up a tiny 1.6%, but still managed to beat the benchmarks handily (by 8% and 9%), since they were both down significantly. In the last three months, the market has turned around, logging significant gains, but my ten picks have continued to outperform. Company Ticker Change 12/27/08 to 7/2/09 Dividend & Interest The...

10 Clean Energy Stocks For 2016

Tom Konrad CFA The History and Future of the "10 Clean Energy Stocks" Model Portfolios 2016 will be the eighth and possibly final year I publish a list of ten clean energy stocks I expect to do well in the coming year. This series has evolved from a simple, off-the-cuff list in 2008, to a full blown model portfolio, with predetermined benchmarks and monthly updates on performance and significant news for the 10 stocks. While there is much overlap between the model portfolio and my own holdings (both personal and in managed accounts), the model...

Give the Gift of a Future This Christmas: Five Sustainable Companies For Your Kids...

A Carbon Conundrum for Christmas Do we have to choose between happy kids this Christmas, and a happy future for those kids? Practically everything we buy has a negative environmental impact. If green consumption is an oxymoron, so is green giving. Are we left with only greener giving? It often seems that the only way to be truly green is to be like the Grinch (before his heart-enlargement) and not give anyone anything. And skip the tree while you're at it. It's a hard decision, and while there are many Green Shopping Advisories telling us that we can buy...

The Alternative Energy Stocks Paper Portfolio

Here at AltEnergyStocks we try to give the best advice to help our readers sort quality alternative energy investments from the simply overvalued and the dangerous poseurs. How well are we doing? Putting Play Money Where our Mouth Is. As regular readers know, both Charles and I invest in many of the same stocks we recommend. I take a broad portfolio approach, with small stakes in almost everything I think is interesting, and larger stakes in companies I'm more bullish about, while Charles has a highly focused portfolio consisting of a small number of companies he expects to perform...

Ten Green Energy Gambles for 2010: Update I

Tom Konrad, CFA A quick update of last month's list of speculative puts, to reflect the new options symbols. In January, I put together a list of nine puts and one small energy efficiency stock I expect to do well this year. I normally only do updates on these every quarter, but because of the recent change option symbols, I thought I'd revisit my 10 Green Energy Gambles. The links in the original article have stopped working; this new table shows the current list. Here's the list: with updated option symbols. Security Portfolio...

Performance Update: 10 Clean Energy Stocks for 2009

I promised I'd do a performance update on my 10 Clean Energy Stocks for 2009 each quarter. Here is the first (although readers got a mini-update in mid February, because I decided I didn't want to use double-shorts.) Company Ticker Change 12/27/08 to 3/27/09 Dividend & Interest The Algonquin Power Income Trust AGQNF.PK +7.14% 5.36% Cree, Inc. CREE +59.96% First Trust Global Wind Energy ETF FAN -10.73% General Electric GE -32.50% 1.94% Johnson Controls JCI -25.97% 0.77% New Flyer...

Marching Ahead: Ten Clean Energy Stocks For 2016

by Aurelien Windenberger I’ve been a fan of Tom Konrad’s annual renewable model portfolio for years, so I’m happy to be able to assist Tom with some of his monthly updates. After two chilly months to start off 2016, the outlook turned considerably warmer in March, both for the market and for clean energy stocks. The Russell 2000 (IWM) jumped 8% for the month, as market participants took to the “risk-on trade” following Fed Chairwoman Yellin’s dovish commentary. Clean energy stocks did even better, buoyed by a reversal in the broader energy sector. Tom’s ...

Year In Review: 11 Clean Energy Stocks for 2012

Tom Konrad CFA Year In Review For the fourth year in a row, my model portfolio of clean energy stocks has beaten the clean energy sector as a whole, this year by 23.8%. Unfortunately, this was mostly due to another year of poor performance by my industry benchmark, the widely held Powershares Clean Energy (PBW) ETF, which lost 16.4% for the year. My model portfolio, composed of eleven clean energy stocks listed in this article published on January 2nd, gained 7.4%, still short of the performance of the broad market, which gained 16.6%. The general market...