Joe McCabe

Energy amazes me; the ramifications from elementary school physics of converting potential energy into kinetic energy. It’s happening everywhere around us, and can have far reaching ramifications. An example is the potential energy in the form of pressure built up under Japan in plate tectonics before the recent earthquake, turned into land shaking, country moving, tsunami creating kinetic energy that reaches across the world. There are other forces, lets call it society energy, that can create financial shock waves in the energy industry including political, religious, and inaccurate supply curve assumptions.

Energy Industry Domino Effect

The energy industry is prone to frequent unexpected events that change its entire structure. Domino effects magnify and spread the effects of events. A chain reaction occurs when a small change causes a similar change nearby, a pattern that repeats leading to large scale changes, much like one falling domino triggering the fall of an entire room full of edge balanced dominoes. Middle East political changes could not have been predicted to the extent of change seen in the last few weeks. There will be more change in the Middle East, no longer will dictatorships and rule by force be sustainable possibly due to small amounts of energy used by tweets and Facebook users. The financial ramifications in the Middle East have been seen in recent increases in the price of oil. The domino failures of the Deepwater Horizon oil well disaster will make oil more expensive and harder to reach. The nuclear fear, whether justified or not, will change energy policy in Japan and elsewhere.

We have experienced events recently which will compound to help change our energy future towards converting solar energy into electricity and, more specifically, photovoltaics (PV).

For example, the California Energy Crisis of 2001 helped spark investments in system level solar electric solutions at the California Energy Commission under the Public Interest Energy Research Department. These vertically integrated system solutions projects were recognized by the US Department of Energy (DOE) as a good use of public funds when they replicated the concept across the country in the Solar America Initiative. The DOE continues this system level approach with the SunShot Initiative, the most recent program to further reduce the cost of electricity from solar. As these system costs continue to fall, conventional costs will continue to rise.

Oil will be needed to support Japan after the recent earthquake disaster. Russia has promise energy industry support to Japan, the easiest of which to implement is fuel. Clean up is going to take lots of horsepower from fuel. The Japanese electrical grid will be without electricity from nuclear generators for quite sometime. Bloomberg reported that Tokyo Electric is still seeking government approvals for a full restart of the Kashiwazaki Kariwa nuclear power plant (five reactors at 1,067 MW and two at 1,315 MW for a total 7,965 MW), which was shutdown after being damaged by an earthquake in 2007. The company posted its first loss in 28 years after it was forced to buy fossil fuels at record prices to make up for the lost nuclear output.

Licensing

California will need to revisit its approach to re-licensing nuclear plants after the Fukushima nuclear accident. Imagine evacuating the area around the San Onofre California nuclear energy plant (two reactors, at 1,172 MW and 1,178 MW, completed in 1983 and 1984 respectively), with the prevailing but constantly changing winds blowing inland towards Orange County and Los Angeles just 70 miles away.

Nuclear licensing will be revisited for Diablo Canyon Nuclear Power Plant, which is owned by Pacific Gas & Electric (PCG), aka PG&E. It is not in as populated an area as the San Onofre nuclear plant, but San Luis Obispo California is very close to Diablo Canyon. The maximum output of this power plant is 2,240 MW. The Diablo Canyon plant was recently re-commissioned with new steam generators after 25 years of operating. Somewhat alarmingly after considering the recent Japanese earthquake, a January 2011 PG&E report outlines a previously unknown potential volcanic fault located 1 km off shore of the Diablo Canyon Power Plant. Recent licensing procedures are investigating extending the life expectance of the Diablo Canyon nuclear plant. An Unusual Event was declared at 1:23 AM PT on Friday March 11 at Diablo Canyon, apparently in response to tsunami warnings. Again, representing energy industry domino effects from events thousands of miles away.

We now know that our assumption that a 9.0 Richter scale earthquake could not happen is false. And the dominoes falling because of that earthquake (Tsunami, power outages, backup systems failures), demonstrate the fragility of our energy systems.

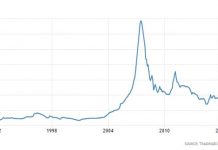

Oil and Solar

Previous high oil prices created the first bubble of solar stocks in the summer of 2008. Sunpower (SPWRA) reached its highs in December of 2007 and First Solar (FSLR) briefly topped above $300 around the same time that oil was peaking. Over the past month, that trend has been inverted, with oil rising as solar stocks have fallen. I’m not predicting another solar bubble, but I expect solar stocks will see a steady rise for well executing companies.

M&A activity will continue with Evergreen Solar (ESLR) a prime candidate. They have a good brand, unique approach to utilization of silicon without cutting with saws and the associated losses. The market cap of Evergreen with their associated MW/year capacities makes it a nice acquisition when including their intellectual property at current low share prices.

A sad but interesting visual during the tsunami news coverage in Japan was seeing a house float by that had PV modules across what was once the south facing roof. While this specific building had obviously experienced a disaster, the energy supply from the PV being distributed did not cause a societal disaster.

Rising oil prices and increased attention towards the risks of nuclear energy in the ring of fire will increase alternatives to conventional energy production.

As our mistaken assumptions about the security and sustainability of traditional energy sources fall like dominoes, alternative energy businesses become more and more attractive.

DISCLAIMER: Long OIL and FSLR.

Joseph McCabe is a solar industry expert with over 20 years in the business. He is an American Solar Energy Society Fellow, a Professional Engineer, and is internationally recognized as an expert in thin film PV, BIPV and Photovoltaic/Thermal solar industry activities. McCabe has a Masters Degree in Nuclear and Energy Engineering.

Joe is a Contributing Editor to Alt Energy Stocks and can be reached at energy [no space] ideas at gmail dotcom.