Pop Goes the Clean Energy Stock Bubble

by Tom Konrad, Ph.D., CFA

2020 ended with a massive spike in clean energy stock prices. From the end of October, election euphoria drove Invesco WilderHill Clean Energy ETF (PBW) from $63.32 to $136 at the close on February 9th, a 114% gain in 100 days.

Joe Biden is as strong a supporter of clean energy as Donald Trump was a supporter of big fossil fuel companies, but even with control of the presidency and both chambers of congress, there is a limit to what a president can do in a short time. This is especially true when their top priority...

This Isn’t What Green Money Management Looks Like

Tom Konrad, Ph.D., CFA

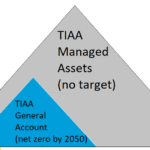

I don’t spend much time reading investment company ESG reports, but a friend asked me to take a look at a copy of the TIAA’s 2021 Climate Report. I was deeply unimpressed. Here are a few things in the report that triggered my greenwashing radar:

TIAA wants to work with companies to improve their behavior. They call this company engagement. “e do not expect to account for the majority of our emissions reduction — we are primarily focused on company engagements” page 9.

Much of TIAA’s emphasis is on reducing emissions from their own operations,...

Better, or Beta?

Tom Konrad, Ph.D., CFA My Quick Clean Energy Tracking Portfolio has produced unexpected out-performance. Is it because of high beta (β) in a rising market? I recently asked why two portfolios which I had designed to track green energy mutual funds ended up out-performing them by a wide margin. This is the first of a short series of articles looking into possible causes. Could the portfolios be outperforming because the stocks they contain rise more when the market rises (and fall more when the market falls) than do the mutual funds they were designed to track? In...

With the Cleantech Hype Gone, the Real Investment Opportunity Begins

David Gold The bubble has burst. The hype and euphoria of 2008 and 2009 is a distant memory. Fueled in part by the externality of the handouts from the stimulus package, and the (now fleeting) spike of natural gas and oil prices, cleantech has experienced its own mini dotcom era now followed by a dot bomb phase. The politicization of Solyndra, the fracking revolution (that has dramatically increased U.S. fossil fuel reserves) and the realities of what it takes to build successful cleantech companies have all brought the cleantech venture capital space crashing back to earth....

An Elephant Hunter Explains Inflection Point Investing

John Petersen In "An Elephant Hunter Explains Market Dynamics" I discussed the two basic types of public companies; earnings-driven companies that are “bought” in top-tier weighing machine markets and event-driven companies that are “sold” in lower-tier voting machine markets. Today I'll get a bit more granular and show how "sold" companies usually fall into one of two discrete sub-classes that have a major impact on their stock market valuations. As a starting point, I'll ignore the China-based companies that are listed in the US because their quirky metrics would only confuse the analysis. Then I'll break...

Should I Sell My Mutual Fund To Go Solar?

by Tom Konrad Ph.D., CFA An enthusiastic solar volunteer recently asked me: “What can I invest in to prepare for the next financial crisis?” The situation made the question deeply ironic. The woman asking me was trying to help people invest in solar systems through Solarize, a nonprofit, community-sponsored group buying and discount program. Our town of Marbletown, New York and the neighboring towns of Rochester and Olive have just launched Solarize Rondout Valley, a campaign open to residential and commercial building owners in Ulster County. Solarize campaigns are designed to make it easier and cheaper...

The Trump Trade

by Garvin Jabusch The first two weeks under the Trump administration have been a shock to the system. With the change in administration, how will you approach your stock portfolio(s)? For starters, your fundamentals should remain unchanged. For me, that means looking for great companies in expanding markets that are enabling long-term economic growth, and reducing systemic risks. Of course, this also means buying these stocks at low valuations. Benjamin Graham and Warren Buffett were right about ‘wonderful companies at fair prices.’ That is never going to change. With that said, let’s look at what has changed and...

Down and Out in 2011: Headlines from Possible Futures

Tom Konrad, CFA If you don't know what could go wrong in 2010, it could still hurt your portfolio. In Nassim Taleb's Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets, he describes an exercise at one of his early jobs. In order to become aware of risks they otherwise might have overlooked, they were to assume that they would lose all the money under their management in the coming year, and they work backwards to figure out how that might have happened. This struck me as an excellent idea, which investors...

When to Sell: Five Rules of Thumb

A common complaint about investment writers is that we are always willing to tell you the next stock to buy, but we don't always get around to telling you when to sell. I'm as guilty of this as most: generally, I write about the stocks I'm interested in... which are the ones I'm buying, not selling. And, although I write the occasional negative article (Petrosun Drilling most recently, but also US Sustainable Energy and Global Resource Corporation), these were more stocks to avoid, rather than stocks which had seen their run. This is unlikely to change. For a start,...

Climate-Risk Adjusted Returns and the Weasel Coefficient

By Tom Konrad, Ph.D., CFA

An 80% Weasel Coefficient

Some activists, including a friend of mine, recently had a conversation with representatives of TIAA to try to persuade them to divest from fossil fuels. The conversation was mostly cordial, but predictably did not get anywhere.

One of the activists summed up the response from TIAA as “a non-response with a weasel coefficient of at least 80%.” Regarding the weasel coefficient, he also asked,

Can anyone explain to me what "our overarching strategy which targets climate-risk adjusted returns over the long-term” means in plain English?

Well, yes. Yes I can.

Climate Risk Adjusted Returns

When an investment...

Six Simple Steps to Protecting Your Portfolio With Puts

Tom Konrad CFA Storm Sailor (Photo credit: Abaconda) Sailing into a Storm Despite the unresolved European debt crisis and America’s fiscal cliff, stock markets remain buoyant. With politicians bickering, that is mostly due to aggressive action from central banks. Yet despite the Federal Reserve’s third (and largest) round of quantitative easing (QE3) and the European Central Bank‘s unlimited bond buying program, politicians still have the capacity to throw a monkey wrench in the world economy. Worse, doing nothing is all they have to do to mess things up. Doing nothing is what politicians...

Permaculture Design and Stock Market Investing

by Tom Konrad Ph.D., CFA

Passive Investing And Modern Agriculture: Parallels

Today's stock market is a dynamic and scary place.

Once choosing stocks to invest in based on the fundamental value of the companies they represent (called fundamental or value investing) was the dominant paradigm for investors. No longer. In 2017, JP Morgan estimated that only 10 percent of trading came from fundamental investors. The vast majority of trading now comes from computer based algorithmic trading, and passive investors following pre-defined rules, such as index investors. According to Morningstar, nearly 45 percent of all stocks are owned by passive investors. These should...

An Investor’s Reaction to a Trump Victory

See my response here: https://www.greentechmedia.com/articles/read/how-one-clean-energy-investor-is-reacting-to-a-trump-victory Tom Konrad

Asking the Right Questions: Why Invest in Clean Energy?

Tom Konrad, Ph.D., CFA Often, knowing more about a company is less useful than knowing just a few of the right things. Knowing the right questions to ask can help investors wade through a sea of mostly irrelevant information. Take a moment to answer the following poll: Suppose you want to know if fictional solar Company MySolar will outperform other solar stocks. Which fact would be most useful in your decision?(poll) The key to this question was the stated goal of "outperforming other solar stocks." An investor who is only hoping to achieve returns equal...

Green Energy Investing for Experts, Index and Wrap-Up

Tom Konrad, CFA My Green Energy Investing for Experts series looked at ways shorting could both protect your portfolio against market decline, and make it greener by shorting decidedly non-green companies. This is an index of the entries, plus one more industry for you to consider. Green Energy Investing for Experts, Part I made the case that shorting stocks that are particularly vulnerable to peak oil or climate change is a good way to hedge a portfolio of green stocks against a market decline while making the whole portfolio greener. Green Energy Investing for Experts, Part II looked at...

The Difference between Reality and Pandering

Garvin Jabusch Innovation and increasing economic efficiency have always been the keys to profits and wealth. Getting more value out of systems without commensurate increases in inputs is the definition of growing efficiency, and it has been the engine of human economies since someone figured out how to use energy from a water wheel to grind grain instead of doing it by hand with a stone bowl and pestle. With that development (to simplify), a couple family members could run the wheel, freeing up everyone else for other pursuits. This kind of gain is the hallmark, to greater and...