Green Energy Investing For Beginners, Part II: How Much To Invest

Tom Konrad, CFA In Green Energy Investing for Beginners, Part I, gave information to guide the choice of green investment vehicles (mutual funds, ETFs, or stocks.) This article is intended to help investors decide how much of their money to put into those vehicles. An informed decision of how much to invest in green energy is at least as important as how you make the investment. The choice between green Exhange Traded Funds (ETFs) and green Mutual funds rests on a difference of about one percent per year, caused by differences in fees. Yet in the first three quarters...

The Big Win You Missed

by Tom Konrad, Ph.D., CFA

My friend Jan Schalkwijk, CFA of JPS Global Investments just asked me if I had any thoughts on Kontrol Energy (KNR.CN, KNRLF), a Canadian smart building firm I had never heard of. (I just added it to AltEnergyStocks.com's Energy Efficiency and Smart Grid stock lists.)

The stock had just shot up after the client sold and went on a kayaking trip. It had disclosed a sensor for detecting COVID-19 from the air.

While I didn't have anything to say about the company, I did have some thoughts on dealing with the emotions around missing out. Since it's...

Why Do Green Energy Experts Buy Solar Stocks?

Tom Konrad CFA Green energy experts accept that solar panels are one of the least cost effective ways to reduce your carbon footprint. Nevertheless, many buy solar stocks. They should rethink their investment strategies. I recently spoke on "Stock Selection in the Era of Peak Oil and Climate Change" at the ASPO 2009 International Peak Oil Conference. Whenever green energy enthusiasts find out that I analyze green energy stocks professionally, they react in one of two ways. Many want to know my top stock pick in general (New Flyer Industries NFI-UN.TO/NFYIF.PK) or in their favorite sector (see below.) ...

The Short Side of Clean Energy

Green Energy Investing For Experts, Part I Tom Konrad, CFA You don't have to be long Renewable Energy stocks to have a green portfolio. Shorting, selling calls, or buying puts on companies and industries which are heavily dependent on dirty and finite fossil fuels not only makes a portfolio greener, it can protect against the effects of a permanent global decline caused by peak oil. Nate Hagens presented this slide at the 2009 International Peak Oil Conference: It shows his conception of the different schools of thought among those of us who understand peak oil. Those represented in...

Market Call: We’re Near the Peak

Tom Konrad, Ph.D. The current rally from the March 5 bottom has been breathtaking, especially in Clean Energy, with my Clean Energy Tracking Portfolio up 70.5% since it was assembled at the end of February (as of May 1), 11% higher than it was at the three month update last week, and the S&P 500 is up 41% from its March low. Even in a better economic climate, gains of this magnitude would have me running for cover. In the current economic climate, with a gigantic mountain of debt keeping consumers out of the stores, makes me feel this...

Cleantech Investing For EcoGeeks

by Tom Konrad. This story is cross-posted on EcoGeek.org As lovers of green gadgets, EcoGeeks probably know as much about what's new in clean technology (a.k.a Cleantech) as anyone on the web. So if you're an EcoGeek thinking about investing in companies which make the technology you know and love, you will probably take comfort in the old adage that you should invest in what you know. An EcoGeek investing in clean technology companies will have an advantage understanding how a company makes money, and what is a needed innovation with a large market, and what is simply a...

Six Simple Steps to Protecting Your Portfolio With Puts

Tom Konrad CFA Storm Sailor (Photo credit: Abaconda) Sailing into a Storm Despite the unresolved European debt crisis and America’s fiscal cliff, stock markets remain buoyant. With politicians bickering, that is mostly due to aggressive action from central banks. Yet despite the Federal Reserve’s third (and largest) round of quantitative easing (QE3) and the European Central Bank‘s unlimited bond buying program, politicians still have the capacity to throw a monkey wrench in the world economy. Worse, doing nothing is all they have to do to mess things up. Doing nothing is what politicians...

Asking the Right Questions: Why Invest in Clean Energy?

Tom Konrad, Ph.D., CFA Often, knowing more about a company is less useful than knowing just a few of the right things. Knowing the right questions to ask can help investors wade through a sea of mostly irrelevant information. Take a moment to answer the following poll: Suppose you want to know if fictional solar Company MySolar will outperform other solar stocks. Which fact would be most useful in your decision?(poll) The key to this question was the stated goal of "outperforming other solar stocks." An investor who is only hoping to achieve returns equal...

Trading Options and Foreign Stocks: When Low Trading Volume Is Not Illiquid

Tom Konrad, Ph.D., CFA

As usual, I am putting together my Ten Clean Energy Stocks for 2020 model portfolio for publication on January 1st or 2nd next year. As I wrote in November, expensive valuations for the US clean energy income stocks I specialize in mean that the 2020 model portfolio will contain more than the usual number of foreign stocks, and I am also planning on including a little hedging with options.

Why option strategies are now affordable

I have never included options in the model portfolio before because the commission structure did not make it cost effective for small investors...

What Good Is Shareholder Advocacy?

By Marc Gunther. Last week, ExxonMobil added Susan Avery, a physicist, atmospheric scientist and former president of the Woods Hole Oceanographic Institutions, to its board of directors. Shareholder advocates, led by the Interfaith Center on Corporate Responsibility (ICCR), which has been organizing shareholder campaigns at ExxonMobil for nearly two decades yes, two decades welcomed the appointment. Tim Smith, the director of environmental, social and governance (ESG) shareowner engagement at Walden Asset Management, said in a news release: “This action by the board is encouraging for shareowners and we want to commend Exxon for this prudent and...

With the Cleantech Hype Gone, the Real Investment Opportunity Begins

David Gold The bubble has burst. The hype and euphoria of 2008 and 2009 is a distant memory. Fueled in part by the externality of the handouts from the stimulus package, and the (now fleeting) spike of natural gas and oil prices, cleantech has experienced its own mini dotcom era now followed by a dot bomb phase. The politicization of Solyndra, the fracking revolution (that has dramatically increased U.S. fossil fuel reserves) and the realities of what it takes to build successful cleantech companies have all brought the cleantech venture capital space crashing back to earth....

The Black Swan and My Hedging Strategy

Tom Konrad, Ph.D., CFA Nassim Nicholas Taleb's The Black Swan: The Impact of the Highly Improbable changed the way I trade; I can't give a book higher praise. This isn't a book review; since the book is over two years old, and I did not get around to reading it until this Spring, I direct readers to this Foolish Book Review, which agrees with my viewpoint quite well, and to the New York Times for a detailed critique. The latter seemed overly nit-picky to me, but then I'm a fan. Human Biases Recently,...

Neutralizing Your Peak Oil Risk

by Tom Konrad Lifestyle Risks from Peak Oil In the US, we all have a large exposure to the risk of rising energy prices. In addition to the cost of gasoline, the whole US economy runs on oil, so a rise in the oil price is likely to affect our jobs, and the prices of all our assets, including our homes. If other people have less money to spend and invest because of high oil prices, there will be a fall in demand for anything they were buying or investing in. House prices in exurbs and suburbs where the...

Better, or Beta?

Tom Konrad, Ph.D., CFA My Quick Clean Energy Tracking Portfolio has produced unexpected out-performance. Is it because of high beta (β) in a rising market? I recently asked why two portfolios which I had designed to track green energy mutual funds ended up out-performing them by a wide margin. This is the first of a short series of articles looking into possible causes. Could the portfolios be outperforming because the stocks they contain rise more when the market rises (and fall more when the market falls) than do the mutual funds they were designed to track? In...

Do You Need To Invest In Oil To Benefit From Expensive Oil?

Two months ago, Tom told us how he'd dipped a toe into the black stuff (i.e. bought the OIL etf) on grounds that current supply destruction related to the depressed price of crude oil would eventually lead to the same kind of supply-demand crunch that led oil to spike during the 2004 to mid-2008 period. If you need evidence that the current price of crude is wreaking havoc in the world of oil & gas exploration, look no further than Alberta and its oil sands. The oil sands contain the second largest oil reserves in the world after...

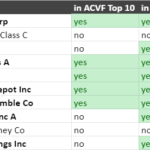

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...