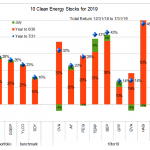

Ten Clean Energy Stocks For 2019: Marginally Hotter

by Tom Konrad Ph.D., CFA

July 2019 was “marginally” the warmest month on record. Meanwhile, the stock market was also inching to new highs, and the real, sweltering evidence of climate change continues to let clean energy income stocks turn in a blistering performance.

While my broad income stock benchmark SDY was up 16.0% through the end of July (0.9% for the month), my clean energy income stock benchmark YLCO is up 23.4% through July (0.4% for the month,) My 10 Clean Energy Stocks model portfolio is up 28.3% (1.3%) and my real-money managed strategy, GGEIP, is up 26.4% (1.2%) for...

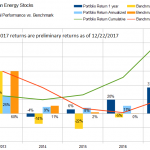

Ten Clean Energy Stocks For 2017: Taking Profits

By Tom Konrad Ph.D., CFA

2017 is turning into a second banner year in a row for my “Ten Clean Energy Stocks” model portfolio. I expected at best to make high single digit returns after the impressive 20% (while my benchmark fell 4%). Instead, the portfolio produced a 36.8% total return while its benchmark is up 19.5% with only four trading days left in the year.

Such returns are obviously cause for celebration, and also for profit taking. I plan to replace at least five of this year's list with new stocks in the 2018 (tenth annual) “Clean Energy Stocks” model...

10 Clean Energy Stocks Performance Chart

Here's the performance through August for the 10 Clean Energy Stocks for 2021 model portfolio... The market has turned down a bit since then but the relative performance has not changed significantly. The model portfolio is still well ahead of its benchmarks., both clean energy (RNRG) and broad market (SDY).I don't know if this recent downturn is just a blip, or the start of the possible larger decline I've been worrying about. But I'm prepared if it's the latter.

DISCLOSURE: Long positions all the stocks in the model portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of...

Five Alternative Energy Stocks For 2014

By Jeff Siegel There's no doubt about it: 2013 was a fantastic year for alternative energy investors. The big story this year was Tesla (NASDAQ: TSLA). A company that we began touting years before the company even went public, Tesla soared this year, taking the stock from $34.71 in January to a high of $194.50 a share in September. Folks, a 460% gain from an electric car company in just nine months would've been laughable in 2013. Today, it's the one of the most hyped stories in the world of finance... And if you listened to me...

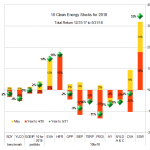

October Undoes September: Ten Clean Energy Stocks For 2015

Tom Konrad Ph.D., CFA In the two months since my last "monthly" update, clean energy stocks fell precipitously in September and then recovered most of those losses in October, although not for the year. Income focused Yieldcos have been particularly badly hit, but my income heavy Ten Clean Energy Stocks for 2015 model portfolio has done quite well in spite of this. I attribute this resilience to my emphasis on current dividend income, rather than the dividend plus double-digit growth that many Yieldcos were promising before the collapse in their stock prices rendered...

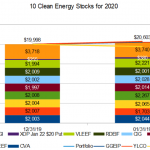

Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update

by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran's top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran's Foreign...

Ten Clean Energy Stocks Back In Positive Territory Year To Date

Stay tuned for a full update next month, but it's nice to be back in the black... especially with the benchmarks still struggling. Thanks to Enviva (EVA), Covanta (CVA), and Seaspan (SSW). Until then, here's the May update, where I said EVA and CVA were two of my 3 top short term picks , and I commented that "I still think Seaspan has significant room to the upside."

AY (at $18.91) and TERP (at $10.83) are my top short term picks right now.

Disclosure: Long EVA, HIFR, GPP, BEP, TERP, PEGI, AY, NYLD, NYLD/A, CVA, SSW.

Shares of Hydrogenics Purchased

Hydrogenics Corp (HYGS) is a developer of fuel cell technology and hydrogen generation. They are also working with wind farm technology in the generation of hydrogen. Back in January of this year they successfully completed the purchase of Stuart Energy which compliments their product portfolio. Shares of the stock have been under pressure for the last couple of months due to missed expectations on Q1 revenue results. There is also some major concern about an increase in product backlog. In August, HYGS issued their most recent quarterly earnings and are attempting to reassure the...

Trading Alert: AAER Inc. (TSE:AAE)

I took 2 long positions yesterday (1 in my normal trading account and the other in my retirement account) in an emerging Canadian integrator of megawatt-sized wind energy conversion systems (i.e turbines) called AAER Inc . Besides turbine assembly, the company also provides a range of services to clients in the wind industry, ranging from assistance in project planning and financing to post-installation maintenance. Now it must be said from the outset that is a very speculative play on North American wind and not suitable for all investors. I entered one of my positions at C$0.38 and the...

Two Canadian IPPs For Your Portfolio

Most alternative energy investors are aware of North American wind power's very bright growth prospects. In past articles, we discussed encouraging projections for the US and Canadian (PDF document) wind markets between now and 2015. While onshore European capacity is fast being exhausted, North America is only beginning its foray into wind and some major capex can be expected in this space over the coming years. Besides solid expected growth, another phenomenon is currently impacting the wind industry; consolidation. This is a global movement that is affecting all of the power gen sector, and that has no-doubt been...

Cold Winter, Spring Coming? Ten Clean Energy Stocks For 2016

Tom Konrad CFA The first two months of 2016 have been chilly ones for the market, and for clean energy stocks. In addition to the worries about the world economy and plunging oil prices which have been hitting stocks in general, the clean energy sector had to deal with the Supreme Court's stay on Obama's Clean Power Plan. This effect was mitigated the following week by the lost of conservative Justice Scalia, but many states' subsequent delays of their compliance plans have put an additional chill on clean energy stocks, even ones which are unlikely to be affected....

10 Clean Energy Stocks for 2011: Q2 Update

Tom Konrad CFA Some investors buy clean energy stocks because it's the right thing to do, others because we know that the diminishing availability and increasing environmental impacts of traditional fuels will eventually force society to adopt more sustainable solutions. Cartoonist Scott Adams says we're all wrong, and we should invest in companies we hate. Although Adams' column is meant to amuse, rather than as investment advice, it's funny because he touches on two very important truths about investing. Although a few investors can outperform the market over the long run, the vast majority can't,...

Ten Clean Energy Stocks For 2015: A Fine February

Tom Konrad CFA After a rough start to the year, My Ten Clean Energy Stocks for 2015 posted a strong recovery in February. For the month, the model portfolio rose 7.9% in local currency terms and, 8.3% in dollar terms. For comparison the broad universe of US small cap stocks rose 5.9% (as measured by IWM, the Russell 2000 index ETF), and the most widely held clean energy ETF, PBW, shot up 11.6%. This year I split the model portfolio into two sub-portfolios of six income stocks (NYSE:HASI, NYSE:BGC, TSX:...

Shares in Active Power Purchased

I currently don't have time to do a complete writeup on this stock, but wanted to let everyone know that I purchased shares in Active Power Inc (ACPW) this afternoon for both my personal portfolio and the mutual fund. The average price was at $3.77. I will updated this post later this afternoon with more details. Updated at 10:00 PM As I mentioned above I purchased shares in Active Power Inc (ACPW) this afternoon for both the mutual fund and my personal portfolio. Active Power designs and sells battery-free uninterruptible power supply (UPS) systems....

Ten Clean Energy Stocks for 2012: 10% more than other top-10 lists

Tom Konrad. CFA A "bonus" stock pick this year. Also, notes on New Flyer Industries and Finavera Wind Energy. Maybe it was because Seeking Alpha did not carry my annual list of 10 Clean Energy Stocks for 2012 this year, but no one seems to have noticed that there were actually 11 stocks in the list. Call it the Spinal Tap of top-ten lists. If anyone did notice the extra pick, they didn't leave a comment. What happened was that I have two number 8 stocks, but there is enough text...

Ten Clean Energy Stocks For 2014: September Update and Thoughts on the Finavera Deal

Tom Konrad CFA Clean energy stocks and the market in general rebounded strongly in August. My broad market benchmark of small cap stocks, IWM, rose 4.5%, returning to positive territory up 1.7% for the year. My clean energy benchmark PBW also jumped back into the black with an 11.1% gain for the month and 10.8% for the year to date. The less volatile defensive stocks in my 10 Clean Energy Stocks for 2014 model portfolio rose 1.9%. For the year to...