BioNitrogen: Valuable Technology, Management Questions

by Debra Fiakas CFA My last post outlined how Bion Environmental Technologies, Inc. (BNET: OTC/QB) is transforming livestock waste into organic fertilizer. Bion is not the only aspiring fertilizer producer. BioNitrogen Holdings Corp. (BION: OTC/PK) was recently patent protection for a process to produce urea from stranded natural gas. Instead of burning off the unwanted gases, oil and gas operators can turn it into an economically viable by-product. There is more than just cash flow at stake for oil and gas producers. Burning off stranded gas increases harmful emission that can lead to penalties in the...

The Low Cow-bon e-Cow-nomy

Jim Lane This month in Finland, a team of intrepid researchers herded one thousand European cows one-by-one into a glass “metabolic chamber” to measure their methane emissions, digestion, production characteristics, energy-efficiency, metabolism, and the microbial make-up of their rumens. The Project is known as RuminOmics, but if it had been titled The Truman Show II: When the Cows Come Home, we wouldn’t have been a bit surprised. The Cow Emission Crisis. No Kidding Around. The ultimate aim of the study was to find an optimal, low-emission, high-yield cow, and the team noted in its premise that of all greenhouse...

Bion: Waste To Dollars

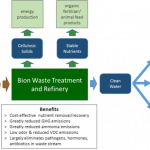

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

A Concrete Proposal

The Economist recently had a story on how the cement industry is beginning to confront the fact that the industry produces 5% of the world's emissions of greenhouse gasses. Carbon dioxide is emitted not only by the fossil fuels used to create the heat used in the creation of cement, and by the chemical reaction in that process. Unfortunately for us, cement is a remarkably useful building material, not least as a structural material which can also serve as thermal mass in passive solar buildings. All the large cement firms: Lafarge, Holcim, and Cemex (NYSE:CX) have joined a voluntary...

Ten Insights into Carbon Policy and Its Implications

On November 27, I attended the National Renewable Energy Laboratory's (NREL) Fifth Energy Analysis Forum, hosted by NREL's Strategic Energy Analysis & Applications Center. The forum focused on carbon policy design, the implications for Renewable Energy and Energy Efficiency. As a stock analyst focused on that sector, I am extremely lucky to have NREL as a local resource: the quality and the level of the experts at NREL and the ones they bring in is probably not matched anywhere in the country, and conferences like these provide priceless insights into what these Energy Analysts are thinking. Why should investors...

Tetra Tech: Energy Engineer

by Debra Fiakas CFA In the coming years power generators will be under pressure to meet new standards for lower carbon emissions embedded in the EPA’s Clean Power Plan. Each state has to meet a set of standards set by the EPA based that state’s particular circumstances in electrical generation. The carbon pollution limits begin in 2022 and ramp to full effect by 2030. Power generators could meet standards by reducing harmful emissions from existing fossil fuel-fire plants. Unfortunately, that may prove too costly at some of the older plants. It is logical that power generators...

While Others Seek to Inject CO2, Airgas Sells It

by Debra Fiakas CFA Just one of the many suppliers of industrial and commercial carbon dioxide, Airgas, Inc. (ARG: NYSE) recently announced plans to build a new carbon dioxide plant in Houston. The press release hit news wires right along with announcements of carbon capture projects and other investments to reduce greenhouse effect from too much CO2 in the atmosphere. In one those strange twists that makes our world so interesting and vexing at the same time, is the fact that we use carbon dioxide all the while we invest wildly to reduce CO2...

A Coal Stock…Almost

This morning, I read an article in this week's Economist that summarized well what I've been hearing over the past few weeks: coal is back in fashion with power utilities. As pointed out in the article, on a BTU basis, coal remains the cheapest fuel for thermal generation, an the prospect of high carbon prices is not deterring even European power generators from investing in coal-fired assets. A few months ago, Tom discussed his peak coal portfolio. The long-term perspective is of course critical to keep in mind, and that piece helps putting recent news around...

Plastics from Carbon Dioxide

by Debra Fiakas CFA In the last post, I promised to close out this series on carbon dioxide capture with a note on a third example of Department of Energy funding for innovations in turning carbon dioxide (CO2) into a valuable raw material. Besides changing the chemistry of inorganic compounds and feedstock for biofuel production, CO2 has some potential for plastics. In 2010, the DOE placed a bet of $18.4 million on Novomer, Inc., which is a self-described sustainable chemicals developer. The bet appears to be paying off as Novomer and its partners go into production...

FuelTech: Pushing on a String of New Orders

by Debra Fiakas CFA Earlier this month Fuel Tech, Inc. (FTEK: Nasdaq) announced the receipt of order for air pollution control systems totaling $2.0 million. The customers are strung out across the U.S., Europe and China, but they all have dirty combustion systems and need to reduce toxic nitrogen oxide (NOx) and carbon dioxide (CO2) emissions or risk running afoul of government clean air standards. These shipments are just the most recent in a string of orders Fuel Tech has won in recent months. In late August 2015, the company received similar air pollution contracts from...

OriginOil Renames Product – Will It Help The Business?

by Debra Fiakas CFA Mid-March 2014, OriginOil, Inc. (OOIL: OTC/QB) relaunched its waste water treatment process for shale gas producers. The company’s CLEAN-FRAC and CLEAN-FRAC PRIME products are now called OriginClear Petro. OriginOil is expanding into the industrial and agricultural waste water treatment markets using the product name OriginClear Waste. The company has been toiling away since 2007 perfecting its “Electro Water Separation” process that uses electrical impulses in a series of steps to disinfect and separate organic contaminants in waste water. In June 2014, OriginOil management declared its development stage completed and start of full...

Tetra Tech’s Two-Penny Disappointment

by Debra Fiakas, CFA

Tetra Tech’s (TTEK: NASDAQ) quarter earnings report last week was met with high drama as traders reacted with surprisingly vehement disappointment over the recent financial performance of the engineering and technology business. The company’s stock price gapped down in the first day of trading following the announcement, falling through a significant line of price support. The shares continued to fall and finished the week at a price not seen since mid-April 2017 before the stock began its recent drive higher.

The drama unfolded after Tetra Tech reported net earnings of $0.52 per share on $498 million in total...

Axion Power is Poised to Dominate Energy Storage for Stop-start Idle Elimination

John Petersen After eight years of rarely speaking above a whisper, Axion Power International (AXPW.OB) has found its voice, taken the scientific wraps off its PbC® battery technology and shown potential customers, competitors and investors that it's carrying a big stick and is poised to dominate energy storage for stop-start idle elimination – a cheap and sensible fuel efficiency and emissions reduction technology that's expected to grow at spectacular rates for the rest of the decade as shown in the following forecast of battery demand in vehicles equipped with stop-start systems. In a new white...

Three Water Recycling Stocks

by Debra Fiakas CFA The water series continues as we attempt to get arms around the very large market to package, deliver, purify, treat, and recycle water. As the need for water increases with population and economic activity, the use of waste waters has become an imperative. In this post we look at three companies helping to clean up, reclaim and otherwise recycle waste water. Ecosphere Technologies, Inc. (ESPH: PK) has introduced several water solutions that can be used in agriculture, mining, industry, or municipal applications. The company’s flagship Ozonix Technology is a chemical-free system to recycle...

Capturing CO2 for Environmental Remediation

by Debra Fiakas CFA In 2009, the Department of Energy (DOE) awarded $17.4 million in funding to a gaggle of companies pursuing practical uses for carbon dioxide. The recipients were asked to kick in a total of $7.7 million. A year later in 2010, the DOE picked six projects to a second round of support totaling $82.6 million. Industrial giant Alcoa, Inc. (AA: NYSE) leads one of the winning groups, including partners U.S. Nels, CO2 Solutions (CST: V or COSLF: OTC/BB) and Strategic Solutions. The DOE gave the Alcoa team $13.5 million to complete a pilot...

List of Pollution Control Stocks

Pollution control stocks are publicly traded companies whose business involves technologies for removing or reducing the emissions of harmful pollutants, contaminants, and/or waste from human activity, or removing these pollutants from the environment or water.

This article was last updated on 6/25/2020.

Advanced Emissions Solutions, Inc. (ADES)

Advanced Disposal Services (ADSW)

Babcock & Wilcox Enterprises, Inc. (BW)

Bion Environmental Technologies (BNET)

Biorem Inc. (BRM.V, BIRMF)

Casella Waste Systems (CWST)

CECO Environmental Corp. (CECE)

CDTi Advanced Materials, Inc. (CDTI)

Clearsign Combustion Corp. (CLIR)

CO2 Solutions, Inc. (CST.V, COSLF)

Donaldson Company, Inc. (DCI)

Ecolab, Inc. (ECL)

EcoSphere Technologies, Inc. (ESPH)

Euro Tech Holdings (CLWT)

Fuel Tech (FTEK)

iPath Global Carbon ETN (GRN)

OriginClear (OCLN)

Pacific Green Technologies Inc. (PGTK)

Republic Services,...