List of High Yield Alternative Energy Stocks

This is a list of renewable and alternative energy stocks with dividend or distribution yields above 4%. The list includes most Yieldcos (high distribution companies that own renewable energy operations), but is not limited to Yieldcos. Some Yieldcos may be excluded if their yield is below 4%.

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Brookfield Renewable Partners L.P. (BEP)

Clearway Energy, Inc. (CWEN,CWEN-A)

Companhia Energética de Minas Gerais (CIG)

Covanta Holding Corporation (CVA)

Crius Energy Trust (KWH-UN.TO, CRIUF)

Enviva Partners, LP (EVA)

Foresight Solar Fund plc (FSFL.L)

GATX Corporation Series A (GMTA)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Green...

The Status of The Yieldco

by Tom Konrad, Ph.D., CFA Last week I delivered the keynote at Yieldcon USA, a conference put on by Solar Plaza entirely focused on Yieldcos. (Yieldcos are companies that own clean energy assets such as solar and wind farms and use the cash flows to pay a high rate of current income to investors.) Given all that's gone on in the space in the last few weeks, the conference could not have been more timely. You can find the presentation here and embedded below:

Green Dividend Yield Portfolio

By Harris Roen There is a new and growing interest in the world of alternative energy investing, the search for high-quality dividend yield among green investments. To this end, the Roen Financial Report has created a Green Dividend Yield Portfolio, a select group of high-yield alternative energy stocks. Together, this selection of companies can produce a steady stream of income for the alternative energy investor. A New Source for Dividend Yield The Green Dividend Yield Portfolio is a collection of high-yield stocks that are in the alternative energy business. Companies that fall...

Eneti and Brookfield Renewable Earnings

By Tom Konrad, Ph.D. CFA

Here are a couple earnings notes I shared last week with my Patreon followers.

Eneti, Inc. (NETI) - formerly Scorpio Bulkers (SALT)

Eneti completed its name and ticker change on February 8th. New ticker is NETI (formerly Scorpio Bulkers (SALT), which I recently wrote about here.

Highlights from February 2nd earnings report:

37 of the 47 vessels owned at the 3rd quarter have been sold or have completed sale agreements.

Net asset value is $23.94/share. Since most assets are cash or vessels held for sale, this number is basically accurate.

The stock is still a good buy...

Christmas Climate Bond From Hannon Armstrong

Sean Kidney Out Monday: a very interesting bond from US listed sustainable infrastructure investor, Hannon Armstrong Sustainable Infrastructure (NYSE:HASI): a $100 million asset-backed securitization of cash flows from over 100 individual wind, solar and energy efficiency installations, all with investment grade obligors. They’re calling them “Sustainable Yield Bonds”; Climate Bonds for us. Coupon is 2.79%. This first bond was privately placed - but they’re planning lots more. Hannon Armstrong have taken the high ground on emissions and built in quantitative annual reporting of greenhouse gas emission reductions, measured in metric tons per $1,000 of par value. The assets...

Comparative Valuation of 15 Yieldcos

Tom Konrad CFA Compared to the peak of the Yieldco bubble in May, many Yieldcos have dropped by more than half, and most by more than a third. Some of this decline is because rapid dividend growth depends on an endless supply of cheap investor capital which is another way of saying that we can have rapid dividend growth or high dividend yields, but not both. Part of the decline was due to the realization that many Yeildcos (most notably Terraform Power (TERP), Terraform Global (GLBL), and Abengoa Yield (ABY)) were not immune to...

Fifteen Clean Energy Yield Cos: Company Structure

Tom Konrad CFA In the first article of this survey of yield cos, I looked at the possible reasons for the seemingly endless enthusiasm for US-listed clean energy yield cos. Here, I'll take a look at how these yield cos are constructed, and why investors should prefer one structure over another. Who's Your Daddy? Most yield cos have been created by clean energy project developers in order to create a ready, low-cost buyer for those projects. With the recent string of very successful IPOs, the capital available for such projects may prove...

Power REIT’s Preferred Stock Offering: A Hedge That Pays 7.75%

Power REIT's preferred stock offerning (NYSE:PW-PRA) is an excellent hedge for the legal risks borne by the holders of its common stock (NYSE:PW.)

Covanta and Hannon Armstrong Earnings

by Tom Konrad, Ph.D. CFA

Two more earnings notes I shared with my Patreon followers on February 18th.

Covanta Holdings (CVA)

Leading waste-to-energy firm Covanta Holdings (CVA) announced 2020 earnings today. There will be a conference call tomorrow morning, but here is my high-level impression:

The company managed well through Covid and ended the year within it's original pre-covid guidance. Metals and energy prices, as well as increased maintenance capital expenditures were a drag on results, but prices are improving and capital expenditures will fall in 2021.

The company is conducting a strategic review which will likely result in the sale of some underperforming...

Sunny Climate For Solar Income Up North

Tom Konrad CFA Disclosure: I am long PW and HASI. In a rational world, the sunniest places would have the warmest reception for solar technology and investment. While solar is having its day in the sun in Hawaii, state incentives make the economics of photovolatics equally attractive in Vermont, a state not known for its sunny skies. And while California is famous for its rapid deployment of solar, the economics are at least as good in Washington state, New York, New Hampshire, and chilly Maine. It’s not only the economics of solar which can counter-intuitively get better...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

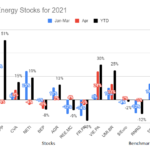

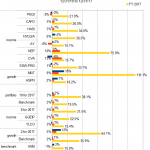

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

See You Later, Hannon Armstrong

by Tom Konrad Ph.D., CFA

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its...

Convertible Solar Bonds: Trina, SunPower Stoke Fire; Ascent Descends

by Sean Kidney Trina’s $150m 3.5% 5yr convertible solar bond In June Chinese solar manufacturer Trina announced the private placement of $150m of 5 year, 3.5% convertible bonds to “institutional investors” (no details provided). Trina weren’t clear how they would use the proceeds, but they are planning to build 400-500MW of solar plants over the rest of this year. Book-runners were Deutsche Bank, Barclays, J.P. Morgan and Goldman Sachs (Asia), with co-manager HSBC. SunPower issues $400m 7yr 0.875% (!) convertible solar bond That same month SunPower announced a private placement of $400 million, 7 year, 0.875% senior convertible bonds. What...

Green Bond Market Heats Up After Slow Start To 2015

$7.2 billion of green bonds issued. Market shows signs of maturity, including more currencies, and non-investment grade bonds. Emerging market green bonds are ramping up, while green munis are booming. by Tess Olsen-Rong, Climate Bonds Market Analyst The first three months of 2015 (Q1) have seen 44 green bond deals totalling $7.2bn of issuance. After relatively low issuance in January the amount of green bonds issued has been climbing each month, with March three times bigger than January. This year will be the biggest year ever for green bonds: there’s a healthy pipeline of bonds in the...

Northland Power’s Solar-Backed Bond

New Canadian Climate bond: Northland Power releases a pretty big ABS - CA$232m (US$206m) - backed by solar projects with proceeds for renewables. 18-year tenor, 4.397% coupon, BBB. Securitisation key future area for green bonds.

Comparing Community Solar Subscriptions And Yieldcos

By Tom Konrad, Ph.D. CFA Community solar is gaining traction in many states. The concept, also known as shared solar or solar gardens, originated in the mid-2000s as a way to allow broader participation in the ownership of solar photovoltaic (PV) systems, while also encouraging local development. Community solar broadens access to solar beyond homeowners with suitable roofs. A National Renewable Energy Laboratory report from 2015 estimated that 49 percent of households cannot own solar because they do not own their own home, or they live in high-rise buildings with insufficient roof space. Rooftop solar is impractical for many...