Eneti and Brookfield Renewable Earnings

By Tom Konrad, Ph.D. CFA

Here are a couple earnings notes I shared last week with my Patreon followers.

Eneti, Inc. (NETI) - formerly Scorpio Bulkers (SALT)

Eneti completed its name and ticker change on February 8th. New ticker is NETI (formerly Scorpio Bulkers (SALT), which I recently wrote about here.

Highlights from February 2nd earnings report:

37 of the 47 vessels owned at the 3rd quarter have been sold or have completed sale agreements.

Net asset value is $23.94/share. Since most assets are cash or vessels held for sale, this number is basically accurate.

The stock is still a good buy...

Green Bond Update: Wind Company Bonds

by Corporate Bonder Market Overview Data compiled by the Bank for International Settlements indicate that the total size of the global debt securities market (domestic and international) was $98.7 trillion as at September 2011, of which $89.9 trillion were notes and bonds. Governments accounted for $44.6 trillion of outstanding debt securities, financial organizations $41.9 trillion, corporations $11.2 trillion and international organizations $1.0 trillion. The focus of this report is on corporate borrowers. US corporations are the largest debt issuers, accounting for 46% of corporate debt globally, followed by the Eurozone with 20%, Japan 9%, China 6%, and...

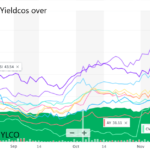

Are YieldCos Overpaying for Their Assets?

Tom Konrad CFA YieldCos buy and own clean energy projects with the intent of using the resulting cash flows to pay a high dividend to their investors. Several such companies, often captive subsidiaries of listed project developers, have listed on U.S. markets since 2013. So far, YieldCos have been a win-win: The developers that list YieldCos have gained access to inexpensive capital, and income investors have gotten access to a new asset class paying stable and growing dividends. So far, they have also gained from significant stock price appreciation. The seven U.S.-listed YieldCos are up...

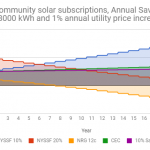

Buyer’s Guide To Community Solar in New York

by Tom Konrad Ph.D., CFA

An updated version of this article is available here.

After a painfully long wait, community solar (also called shared solar) is finally coming to New York state. After years of regulatory uncertainty, the state Public Services Commission (PSC) has put enough of the enabling regulations in place for a number of developers to move forward.

What is Community Solar?

A community solar installation is a large scale (typically 1 to 3 MW, or the size of about 150 to 800 residential solar installations) in which subscribers can sign up to lease or purchase a share of the production...

Five Pioneers Mining the Sun for Income

by Jared Wiedmeyer For the past few years, solar industry stakeholders have imagined a future where the general public has the ability to invest in pure-play renewable energy real estate investment trusts (REITs) that finance and construct both utility-scale and distributed photovoltaic (PV) projects in the United States. While these stakeholders wait for this reality to come to fruition, existing REITs already have several options to own or develop solar projects that still allow them to comply with the IRS's asset and income tests. This past May, Chadbourne & Park's Kelly Kogan and Scott Bank moderated a roundtable with...

Trash Stocks Trashed: An Income Opportunity?

Tom Konrad CFA Dumpster diving for high yielding gems. An earlier version of this article was written at the end of July and published on my Forbes blog, before the August market implosion. I've updated it here to reflect the new stock prices and some recent company news. Renewable energy has many advantages over fossil energy. One of the most important is that it's renewable. As supplies of Oil and other fossil fuels are used up, they become harder and more expensive to extract, while renewable energy is generally getting cheaper over time,...

Green Bond Market Heats Up After Slow Start To 2015

$7.2 billion of green bonds issued. Market shows signs of maturity, including more currencies, and non-investment grade bonds. Emerging market green bonds are ramping up, while green munis are booming. by Tess Olsen-Rong, Climate Bonds Market Analyst The first three months of 2015 (Q1) have seen 44 green bond deals totalling $7.2bn of issuance. After relatively low issuance in January the amount of green bonds issued has been climbing each month, with March three times bigger than January. This year will be the biggest year ever for green bonds: there’s a healthy pipeline of bonds in the...

Solar Income, Really?

Tom Konrad CFA Disclosure: Long BEP, HASI. NRG Yield (NYSE:NYLD) was spun out of its parent, NRG Energy, Inc. (NYSE:NRG) in July, and has since been greeted with enthusiasm by investors. The stock priced at $22, 10% over the mid-point of its expected range, and the underwriters exercised their full over-allotment option. NRG Yield presents itself as an owner and operator of contracted renewable and conventional electricity generation, as well as thermal infrastructure assets. (Thermal infrastructure provides heat or cooling to businesses for use in their operations.) The company has a green tinge because of its wind and...

Fifteen Clean Energy Yield Cos, Created Unequal

Tom Konrad CFA Renewable Energy Investing Grows Up. In January I predicted 2014 would be the year "renewable energy finance comes of age." Here's how Jennifer Runyon quoted me on Renewable Energy World: Konrad believes that 2014 will be a great year for renewable energy finance, he said. He said that we saw the beginning of it in 2013 with the securitization of a bond by Solar City (SCTY) and pointed to Hannon Armstrong’s (HASI) securitization of an energy efficiency bond in late December 2013 as another indicator that renewable energy...

Income From Hydroelectric Power

by Debra Fiakas CFA Are you an investor hungry for current income? Is there a green line of global warming fear running through your investment selections? I have stock that fulfills both requirements. Brookfield Renewable Energy Partners (BEP: NYSE) is a renewable power producer with assets in Canada, the U.S. and Brazil. Brookfield generates over 5,900 megawatts of power each year from plants running on river water, wind or natural gas. Another 2,000 megawatts is apparently under development in Canada and Brazil. What Brookfield does best is hydroelectric production. The company claims over 170...

Green Bonds From Terraform Global, SolarCity, and Hannon Armstrong

by the Climate Bonds Team Yieldco TerraForm Global (GLBL) issues a whopping $810m green bond (7 years, 9.75%, B2/B+) TerraForm Global Operating has issued an $810m green bond, with 7-year tenor, 9.75% coupon and ratings of B2 and B+ from Moodys and S&P respectively. TerraForm Global is a recent yieldco spin off (IPO last month) of SunEdison (SUNE) group (have a look here if the yieldco concept is new to you). Terraform Global owns and operates renewable energy assets - solar, wind and hydro - in emerging markets, in the following locations: Solar: China, India, South Africa,...

CAFD: Don’t Let The Joke Be On You

Tom Konrad CFA Sunpower and First Solar are indulging in nerd jokes. Their YieldCo, called 8point3 Energy Partners had its initial public offering on June 19th. The name is an astronomy nerd joke and a reference to the time it takes the sun's rays to reach the Earth, 8.3 minutes. Last week, we found out that its ticker symbol is CAFD, a "financial nerd joke" because it stands for "cash available for distribution." CAFD is an important YieldCo metric, but it's not a perfect one. If you're not a financial nerd but are interested in...

The Yieldco Virtuous Cycle

by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

A Yieldco’s stock price rises

It issues new shares, and invests the money in renewable energy projects.

Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if...

One Week, Three YieldCo Deals. Are More Buyouts on the Horizon?

by Tom Konrad, Ph.D., CFA

It's been a busy several days in the YieldCo space.

On February 5, 8point3 Energy Partners (NASD:CAFD) announced an agreement to be acquired by an infrastructure investment fund managed by Capital Dynamics. While I was still writing an article on why the sale price was at a virtually unheard of discount relative to the stock market price, two more YieldCo deals were announced: NRG Energy (NYSE:NRG) agreed to sell its sponsorship stake in NRG Yield (NYSE:NYLD and NYSE:NYLD/A) to Global Infrastructure Partners, and YieldCo TerraForm Power (NASD:TERP) made an offer to buy out Spanish YieldCo Saeta Yield (Madrid:SAY) at a 20 percent...

Massachusetts: Green Bond Auction Hot, Other Bonds Tepid

by Sean Kidney The Massachusetts AA+ green bond I mentioned last week got a lot of coverage on release this week – even the WSJ ran the story. But there was a twist: it seems the State had to scale back the total $1.1bn GO offering to $670m on tepid demand, but the green bond bit was 30% oversubscribed. For all you prospective issuers out there: the green bonds also lured as many as 9 new institutional investors for Massachusetts bonds. One buyer went so far as to say “We think more municipalities should do the same." So perhaps...

Power REIT’s Preferred Stock Offering: A Hedge That Pays 7.75%

Power REIT's preferred stock offerning (NYSE:PW-PRA) is an excellent hedge for the legal risks borne by the holders of its common stock (NYSE:PW.)