List of Synthetic Fuel and Drop-in Biofuel Stocks

Synthetic fuel stocks are publicly traded companies creating transportation fuel from non-liquid feedstocks such as natural gas, coal, and municipal waste. Drop-in biofuel stocks are publicly traded companies creating transportation fuel from organic feedstock that can be used, transported, and stored by conventional petrofuel infrastructure. A synthetic fuel is a biofuel if it is made from organic feedstock. It is a drop-in fuel if it is compatible with the existing infrastructure for petroleum based fuels.

This post was last updated on 7/20/2022.

Amyris (AMRS)

Archaea Energy, Inc. (LFG)

BioAmber (BIOA)

Codexis (CDXS)

Darling Ingredients (DAR)

Gevo (GEVO)

Global Bioenergies (ALGBE.NX)

Neste, Inc. (NEF.F, NESTE.HE, NTOIF, NTOIY)

N-Viro International Corp. (NVIC)

Sasol Ltd. (SSL)

Velocys, PLC (VLS.L)

If...

Aviation Biofuel Overview

by Debra Fiakas, CFA

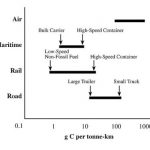

The aviation industry contributes about $2.7 trillion to the world’s gross domestic product. It may seem like a big number, but that is only 3.6% of the world’s wealth. Aviation may be a minor player in terms of creating wealth, it is a big culprit in climate change. Flying around the world accounts for as much as 9% of humankind’s climate change impact. Indeed, compared to other modes of transportation, flight has the greatest climate impact.

The negative impact of carbon emitted by aircraft is made even worse by the fact that the emissions point is mostly at cruising altitudes high...

The Low Sulfur Diesel Crisis of 2020 And How To Prevent It

“The global economy likely faces an economic crash of horrible proportions in 2020, not for want of a nail but want of low-sulfur diesel fuel,” writes renowned energy analyst Phil Verleger in a note this month titled “$200 Crude, the Economic Crisis of 2020, and Policies to Prevent Catastrophe”. Not good timing for a White House re-election effort if, as expected, the blame falls on lack of preparedness in the 2017-2020 run-up to the projected crisis..

It’s a dire scenario but there’s hard data behind it, and though few go as far as Verleger, almost every expert is warning of a...

Aviation Biofuels: The Year of the Tree

by Jim Lane

When the world’s leaders for sustainable aviation fuels have a general meeting the week before the COP24 global climate sessions (this year in Poland), you can bet that the focus will be breaking the “You Can Have Two out of Three Conundrum” of aviation fuels. Which is to say: affordable, available at scale, and sustainable, pick any two of the three.

Fossil fuels are (usually) affordable and always available at scale. Sustainable jet fuels that are available at scale have generally not been affordable to date, and affordable sustainable fuels have been mostly explored at bench scale, so...

Betting On Renewable Diesel: Valero or Darling?

Valero Energy (VLO: NYSE) recently disclosed ongoing discussions to expand its renewable diesel production to a second plant that would be built and managed by its Diamond Green Diesel joint venture with Darling Ingredients (DAR: NYSE).

The proposed plant that would be located in Port Arthur, Texas and turn out 400 million gallons of renewable diesel and 40 million gallons of naptha per year. As a food by-products processor Darling has easy access to low-cost used cooking oils and animals fats that serves as the feed stock for Diamond Green’s renewable diesel production.

Valero management has cited increasing global demand for low- to no-carbon...

Corn Fractionation Improving Ethanol Production

Ethanol and isobutanol producer Gevo, Inc. (GEVO: Nasdaq) is installing equipment in its Luverne, Minnesota plant to improve efficiency in corn processing. The company is leasing a proprietary corn fractionation or slicing process developed Shockwave, LLC based in DesMoines, Iowa. The new equipment is intended to increase by-product output, including feed protein products and food-grade corn oil. With sales of more valuable by-products Gevo expects to improve overall profit margins. Shareholders can expect to see results after the first quarter 2019, when the equipment installation is expected to be complete.

Shockwave keeps a low profile with no corporate website and no one to answer phone calls. However,...

North American Outlook on Biofuels Challenges and Opportunities

Challenges and Opportunities in Biofuels

By Steve Hartig, Former VP of Technology Development at ICM

The North American biofuels market can be split into three main segments all of which have major dynamics. What I would like to do is give a high-level overview of what I see as some of both the challenges and opportunities across these.

Ethanol which is a produced from corn and sorghum in about 200 plants mainly across the Midwest and blended at about 10% with gas. Majors such as POET, Green Plains, Flint Hills, Valero, ADM and Cargill do a bit more than half of the 16...

Conversions To Renewable Diesel

by Helena Tavares Kennedy

The seasons are changing in many parts of the world right now, but what really is changing this autumn is how the world is looking at renewable diesel. Phillips 66 and REG’s announcement about a new renewable diesel plant on the U.S. West Coast planned for 2021 comes after a notable increase in refineries that are being converted and changed over to renewable diesel. Change is good, especially in this case.

As Bob Dylan sang, “For the loser now, Will be later to win, For the times they are a-changin’.” And who knew he was singing about the RFS...

Gevo Soars: The Story Behind the Rise

by Jim Lane

What in the world has gone right with Gevo?

For years now, Gevo (Nasdaq:GEVO) has remained true to a vision of low-carbon, advanced renewable fuels, when so many others pivoted away to the world of ABF — Anything But Fuels. Some tried chemicals, cannabis, algae, natural gas, nutraceuticals, vegan foods — lately, protein has been all the rage. Gevo was one of the few true believers and paid the price of stock price punishment and near-extinction, for years.

While they weathered a debilitating patent battle with DuPont, until it settled and DuPont imploded. And the collapse of oil prices...

Biofuel Industry Reacts To EPA New Renewable Fuel Standard

Yay or Nay for EPA? RFS Volumes out for 2020, Biodiesel for 2021 – What’s the reaction from industry?

by Jim Lane

What’s the reaction from industry? Coal for Christmas?

Should Santa bring coal for EPA’s stocking this year? Do the biofuels and agriculture industries think the EPA just put coal in their stocking? Is it thumbs up or thumbs down from biofuel industry advocates on last week’s U.S. Environmental Protection Agency renewable fuel volumes? What about the exempted volumes?

The Ruling – Rotten or Respectable?

First, a bit on the EPA ruling that establishes the required renewable volumes under the Renewable Fuel Standard (RFS) program for...

EPA Reneges on Trump’s Biofuels Deal

by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after...

REG Enters Renewable Diesel With Syntroleum Purchase

Jim Lane In Oklahoma, and Iowa, Renewable Energy Group (REG; NASD:REGI) announced that it would acquire substantially all of the assets of Syntroleum Corporation (NASD:SYNM), and assume substantially all of the material liabilities of Syntroleum, for 3,796,000 shares of REG common stock worth $40.08 million at today’s market close. The purchase price subject to reduction in the event that the aggregate market value of the REG common stock to be issued would exceed $49 million or if the cash transferred to REG is less than $3.2 million). “This will help us grow our advanced biofuel business, enhance our intellectual...

Biofuels Rocking The Boats (and Ships)

Companies that rock the boat often end up leading the way for others. While some companies have paved the way for road transportation and others reached high in the sky for aviation, there are some big boats out there that are also looking for alternative renewable fuels. Here are some companies that are answering the call for the maritime and shipping sectors with viable biofuel alternatives, the technologies and innovations, the rough waves that still lie ahead, and how they can reach that destination on the horizon.

Gevo and Butanol

We start with Gevo (GEVO) and their butanol. Why butanol? It...

Making Cash From Rice Trash

by Jim Lane

In our three-part series this month on utilizing waste resources, we’ll turn to rice straw, which is a major headache for Chinese and Indian emissions. Praj and Gevo are working hard on perfecting a technology to address this.

Specifically, in the past month, Gevo (GEVO) also executed an agreement with Praj to develop jet fuel and isooctane from rice straw and other feedstocks. Gruber noted that “we believe this second-generation technology combination has great potential to address India’s rice straw burning problem and related air pollution, while generating low-carbon hydrocarbons for jet fuel and gasoline. Praj is a leader...

Renewable Energy Group’s New CEO: C.J. Warner

by Jim Lane

In Iowa, white smoke has emerged from the Renewable Energy Group (REGI) conclave: Tesoro EVP and former Sapphire Energy CEO C.J. Warner has been named chief exec of Renewable Energy Group, at a pivotal moment for biodiesel in Washington and around the world and amidst a boom for renewable diesel like the world has never seen.

REG has been making good progress with Wall Street under interim CEO Randy Howard and its share price has been on the rise, and the plants have been humming along nicely churning out hundreds of millions of gallons of biodiesel and the liquid gold...

Rentech’s Wood Saw Hits a Knot

by Debra Fiakas CFA Last week Rentech, Inc. (RTK: NYSE) revealed plans to idle its wood pellet production facility in Wawa, Ontario Canada. To operate efficiently the plant requires additional repairs and upgrades beyond the replacement of conveyors that was completed in Fall 2016. Beside the fact that the additional repairs were not included in the regular capital budget, Rentech management has apparently determined the expenditure is not economic given profits from Wawa. When Rentech reports financial results for the fourth quarter ending December 2016, shareholders will be treated to an asset impairment charge for the Wawa facility....