Dyadic International (DYAI.PK), A Stock To Avoid

Tom Konrad, Ph.D., CFA Dyadic International hopes to use proprietary gene discovery to revolutionize cellulosic biofuel and pharmaceuticals. Investors should stay away. Dyadic International (DYAI.PK) says they are applying their "proprietary enabling biotechnologies for multi-billion dollar markets in industrial enzymes, biofuels and biotherapeutics." A very exciting prospect, and just the sort of thing I've long warned investors to avoid. In short, they are a company with gigantic claims and not a lot of track record to back them up. Why I Care (I don't, really) In our survey of readers, one respondent asked that I write more about stocks...

Corn Fractionation Improving Ethanol Production

Ethanol and isobutanol producer Gevo, Inc. (GEVO: Nasdaq) is installing equipment in its Luverne, Minnesota plant to improve efficiency in corn processing. The company is leasing a proprietary corn fractionation or slicing process developed Shockwave, LLC based in DesMoines, Iowa. The new equipment is intended to increase by-product output, including feed protein products and food-grade corn oil. With sales of more valuable by-products Gevo expects to improve overall profit margins. Shareholders can expect to see results after the first quarter 2019, when the equipment installation is expected to be complete.

Shockwave keeps a low profile with no corporate website and no one to answer phone calls. However,...

Dyadic: a 5-Minute Guide

Jim Lane Dyadic International, Inc. is a global biotechnology company that uses its patented and proprietary technologies to conduct research, development and commercial activities for the discovery, development, manufacture and sale of products and solutions for the bioenergy, industrial enzyme and biopharmaceutical industries. Address: 140 Intracoastal Pointe Drive Suite 404 Jupiter, Florida 33477 Year founded: 1979 Stock Ticker: Pink Sheets: DYAI Type of Technology(ies) Patented and proprietary C1 platform technology based on a unique fungal microorganism which is programmable and scalable in producing enzymes and proteins in large quantities ...

California’s Other Ethanol Producers

by Debra Fiakas CFA In the last two posts Pacific Ethanol (PEIX: Nasdaq) and Aemetis, Inc. (AMTX: OTC/BB) got all the attention. Both companies have crafted their facilities to accept lower-cost sorghum as an alternative feedstock, opening up the door to lower carbon intensity measures for their ethanol output. There are other ethanol producers in the state, which we believe are still relying on corn as feedstock. Which companies will remain in operation in California is not yet clear. Standards sets by California Air Resources Board (CARB) for the carbon intensity of alternative fuels favors local producers and...

The Battle for California’s Ethanol Market

by Debra Fiakas CFA For all the fuss, investors might think California’s ethanol market is another Gold Rush. The Midwest-based ethanol producers are up in arms over California’s attempt to set standards for renewable fuels sold in the state. My recent post, describes legal maneuverings by South Dakota-based ethanol producer Poet, LLC and others to block a ‘carbon intensity’ standard imposed by the California Air Resources Board (CARB). Under the CARB standard the carbon intensity of alternative fuels includes elements for power and other inputs as well as transportation and distribution. The formula CARB is...

EPA Slashes Corn Ethanol Targets Under Proposed Renewable Fuel Standard

Renewable Diesel Takes Smaller Cut Jim Lane “EPA continues to assert authority under the general waiver provision to reduce biofuel volumes based on available infrastructure,” says BIO. “This is a point that will have to be litigated. It goes against Congressional intent.” In Washington, the EPA released its proposed standards for 2014, 2015, and 2016 and volumes for renewable fuels. The volumes, as widely expected, include substantial reductions from the statutory standards in the original 2007 Energy Independence & Security Act. The EPA also released a 2017 proposed standard for biomass-based diesel. Yet, while attracting significant...

A Decade Of Unexpected Curves In The Bioeconomy

By Jim Lane

Over the years we’ve all seen a lot of curveballs in the advanced bioeconomy. You see companies like Valero, which lobby the United States Congress with unbridled intensity to get rid of the Renewable Fuel Standard, on the verge of becoming the single-biggest producer of RINs in the United States (with news that they might take capacity at Diamond Green Diesel up to 540 million gallons).

You see companies like Solazyme which love the Renewable Fuel Standard and drive up to nearly a billion-dollar post-IPO valuation based on delivering fuels at volume, then announcing that there are even...

Ten Solid Clean Energy Companies to Buy on the Cheap: #7 Deere & Co....

The first and last word in any discussion of biofuels should always be "Feedstock." Feedstock is the "Bio" out of which biofuels will eventually be made, whether it be corn, sugar, jatropha, algae, palm oil, switchgrass, forestry waste, or municipal solid waste. Before the era of peak oil, we lived in a world of plenty, which meant that we could squander energy, not only by driving Hummers, but by feeding energy intensive products such as corn crops to livestock, and by dumping "free" sources of energy such as garden waste and used cooking oil into landfills. The era of...

ADM and Siouxland Ethanol Announce Marketing Agreement

Archer-Daniels-Midland Co. (ADM) and Siouxland Ethanol LLC are pleased to announce the formation of an ethanol marketing agreement. As part of this marketing agreement, ADM will market all ethanol produced by Siouxland Ethanol at its forthcoming 50 million gallon Jackson, Nebraska facility. Construction has begun and the plant is expected to be operational in early 2007. In addition to producing ethanol, the plant will produce an estimated 165,000 tons of distiller grains on an annual basis.

The Future of Alternative Fuels: Ethanol

Besides a slew of clean car announcements connected to the North American International Auto Show, the alt energy topic that has made media and blog headlines most often over the past week has been alternative fuels. We are thus going to run a 2-part series on alternative fuels this week as follows: ethanol today and coal-to-liquids tomorrow. ETHANOL: INVESTOR FRIEND OR FOE? I’m going to start this post with a statement of opinion: I don’t really like corn-based ethanol (as an investment), I never have, and, as a result, I haven’t followed this space as closely as...

Throwing Corn off the Green Bus

Dana Blankenhorn I am a big booster of alternative energy. Harvesting the wind, the Sun, the heat of the Earth, the tides – I'm there and NIMBYs be damned. But I am increasingly having second thoughts about one type of green energy. Corn-based ethanol. (I would toss in sugar cane, too, but America doesn't grow enough to matter here.) Corn ethanol was one of the first biofuels to find a market. Pushed by companies like Archer Daniels Midland (ADM) and Cargill, corn ethanol is now an integral ingredient in many blends of gasoline. It is...

List of Ethanol Stoccks

This Post was updated on 8/16/21.

Ethanol stocks are publicly traded companies whose business involves producing ethanol alcohol (C2H5OH) made from biomass for use as a fuel in gasoline blends. Common feedstocks include corn and sugar cane. Ethanol is the most widely produced and used biofuel, and all ethanol stocks are also biofuel stocks.

Aemetis, Inc. (AMTX)

Andersons Inc (ANDE)

Archer Daniels Midland (ADM)

Bluefire Renewables (BFRE)

Cosan Ltd (CZZ)

Green Plains Partners LP (GPP)

Green Plains Renewable Energy (GPRE)

MGP Ingredients (MGPI)

Pacific Ethanol (PEIX)

Raízen S.A. (RAIZ4.SA)

REX American Resources Corp. (REX)

SunOpta (STKL)

If you know of any ethanol stock that is not listed here and should be, please let us know...

Novozymes Ignites Yeast Wars

Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) moved into yeast this week with a new organism, Innova Drive.

It’s saccharomyces cerevisae — the workhouse yeast that has been powering wine fermentation since the days of Noah and the Ark. But here’s a new strain engineered to cut fermentation times up to two hours, and yield boosts of up to two percent.

A 2% yield increase and a 5% faster rate of production — let’s illustrate it — would mean something like 7.1 million gallons per year of more ethanol from the same standard 100 million gallon nameplate plant. Retailing at up to $10 million dollars, per year (yes,...

Cosan: No Haven for Ethanol Investors

by Debra Fiakas CFA The stark reality of basing their business model on a food commodity has been brought into sharp focus for ethanol producers. The drought settling across the U.S. corn crop is helping drive up corn prices for hog producers, chicken farms and ethanol plants alike. Investors who simply must have a position in ethanol might think the sugarcane-based ethanol producers could offer a safe haven against the supply and margin squeeze that is certain to hobble GreenPlains Renewable Energy (GPRE: Nasdaq), Pacific Ethanol (PEIX: Nasdaq) and Poet (private), among others relying on corn feedstock....

Aemetis’ Cellulosic Ethanol From Orchard Waste Project

by Jim Lane

There were more than 100 presentations at ABLC last week and not a clunker amongst them, but if I were to point the reader’s attention at one or two that stood out from the rest because of the short-term or long-term implications, I’d start with the news from Aemetis (AMTX) that they are embarking now on a $158 million cellulosic ethanol plant — to be built in Riverbank, California, in partnership with LanzaTech.

Cellulosic ethanol is selling for such a high price in California right now — the value jumps north of $4.00 per gallon at times —...

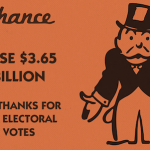

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...