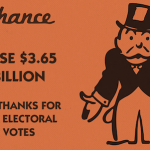

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...

The Other Cellulosic Fuel

by Debra Fiakas CFA In an article posted in November I incorrectly named the product of Kior, Inc. (KIOR: Nasdaq) as cellulosic ‘ethanol’. Kior does indeed use cellulosic biomass - wood chips to be exact - but the company’s catalytic pyrolysis technology turns out crude oil that can be further refined into gasoline or diesel. Ethanol, on the other hand, is the product of a fermentation process. There is nothing new about catalytic pyrolysis - superheating in a container with no oxygen. Oil refiners have been fracturing large, complex hydrocarbons using heat and catalysts for...

EPA’s 2018 Renewable Fuel Targets Disappoint Producers

In Washington, the Environmental Protection Agency released its final Renewable Fuel Standard renewable volume obligations for 2018. The agency finalized a total renewable fuel volume of 19.29 billion gallons , of which 4.29 BG is advanced biofuel, including 288 million gallons of cellulosic biofuel.

As the Renewable Fuels Association explained: “That leaves a 15 BG requirement for conventional renewable fuels like corn ethanol, consistent with the levels envisioned by Congress in the 2007 Energy Independence and Security Act. The 2018 total RFS volume finalized today represents a minor increase (10 million gallons) over the 2017 standards, and a modest increase...

Green Plains’ Cattle Drive

As quickly as the ethanol producer jumped into the cattle business, Green Plains (GPRE: Nasdaq) has sold off half of its Green Plains Cattle Company to a group of investment funds for $77 million. Operating at six locations in Colorado, Kansas, Texas and Missouri, the company has the capacity to feed 355,000 head of cattle each year. The cattle business contributed $271 million to total revenue in the most recently reported quarter ending June 2019, delivering a modest operating profit near $7.3 million.

There has been considerable stress in the feed cattle industry. The number of cattle in feedlots is down compared to last year, an unusual development...

Report Alleges EPA Tests Skewed Against Ethanol By Oil Industry Influence

by Jim Lane

In Washington, researchers for a report published by the Urban Air Initiative contend that “technical data that shows the nation has been exposed to decades of flawed test fuels and flawed driving tests, which in turn means flawed emissions results and mileage claims”. The complete Beyond a Reasonable Doubt series from UAI is available here.

Further, EPA emails obtained under the Freedom of Information Act reveal that, according to a report from Boyden Grey & Associates, the Agency appears to have directly solicited financial contributions and technical input, “especially on the fuel matrix,” from an oil industry controlled research organization.

Of the...

DowDuPont To Exit Cellulosic Biofuels

by Jim Lane

In Delaware, DowDuPont (DWDP) announced that it intends to sell its cellulosic biofuels business and its first commercial project, a 30 million gallon per year cellulosic ethanol plant in Nevada, Iowa. The Nevada project is still going through start-up.

In an official statement, the company said:

As part of DowDuPont’s intent to create a leading Specialty Products Company, we are making a strategic shift in how we participate in the cellulosic biofuels market. While we still believe in the future of cellulosic biofuels we have concluded it is in our long-term interest to find a strategic buyer for our...

Dyadic: a 5-Minute Guide

Jim Lane Dyadic International, Inc. is a global biotechnology company that uses its patented and proprietary technologies to conduct research, development and commercial activities for the discovery, development, manufacture and sale of products and solutions for the bioenergy, industrial enzyme and biopharmaceutical industries. Address: 140 Intracoastal Pointe Drive Suite 404 Jupiter, Florida 33477 Year founded: 1979 Stock Ticker: Pink Sheets: DYAI Type of Technology(ies) Patented and proprietary C1 platform technology based on a unique fungal microorganism which is programmable and scalable in producing enzymes and proteins in large quantities ...

Earth to Cellulosic Ethanol: Glad You’re Here, What Took So Long?

Jim Lane Part I of II Cellulosic ethanol arrives at scale “The five years away forever” put to rest but are there troubling waters still ahead? For whom, and why? There’s a gigantic disconnect between two sections in the country as to whether the United States should be celebrating the success or the failure of cellulosic biofuels biofuels made from crop residues, energy crops, and other feedstocks including municipal solid waste, and which feature a 60 percent or greater full-lifecycle reduction of greenhouse gas emissions compared to conventional gasoline. The supporters On the one...

Green Plains Bets on Ethanol Recovery

by Debra Fiakas CFA Last week the Chief Executive Officer of Green Plains Renewable Energy, Inc. (GPRE: Nasdaq), Todd Becker, revealed during conference calls following its quarter earnings report that the company has been in discussions to sell ethanol to industrial users in Mexico. It is news that could be music to shareholders ears. U.S. storage tanks are brim full of ethanol as producers like Green Plains stock pile inventories waiting for better selling prices. Green Plains has made claims to Mexico sales before, but has never revealed customer names or volumes. None were named...

EPA Reneges on Trump’s Biofuels Deal

by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after...

Hand Sanitizer: Salvation for Ethanol Producers?

by Jim Lane

If you’ve not heard, NuGenTec is looking for Distillers to help supply Ethanol for Hand Sanitizers in California! We have two automated bottling lines waiting for ethanol to produce 8oz and 16oz gel type hand sanitizers, they write. You can learn more here.

And as we reported this morning, Aemetis (AMTX) is one of those companies jumping into the market, even as transport fuel demand falls off, driving fuel ethanol prices into an all-time low range of around $0.70 per gallon.

The shortage is real

If you’ve been trying to buy hand-sanitizer, it’s been hard to find. Here in Digestville, we’ve...

North American Outlook on Biofuels Challenges and Opportunities

Challenges and Opportunities in Biofuels

By Steve Hartig, Former VP of Technology Development at ICM

The North American biofuels market can be split into three main segments all of which have major dynamics. What I would like to do is give a high-level overview of what I see as some of both the challenges and opportunities across these.

Ethanol which is a produced from corn and sorghum in about 200 plants mainly across the Midwest and blended at about 10% with gas. Majors such as POET, Green Plains, Flint Hills, Valero, ADM and Cargill do a bit more than half of the 16...

A Simple Fix To Farmer’s Tariff Woes?

by Jim Lane

As most know by now, the US and China have fired opening salvos in a trade war, with the US targeting a range of commodities including steel and aluminum, and China retaliating with, to date, stiff tariffs on a range of agricultural products, but primarily hitting soybeans and corn because of the volume of trade in those agricultural goods. Overall, China imports $24 billion of agricultural goods from the US and is a leading export market for the US.

The trade wars prompted North Dakota farmer Kevin Skunes, president of the National Corn Growers Association, to state:

“Farmers are...

Green Plains Primes The Pump

by Debra Fiakas CFA Ethanol producer Green Plains Renewable Energy, Inc. (GPRE: Nasdaq) announced today plans to build a fuel terminal point in Beaumont, Texas. The terminal will be located at a facility owned by Green Plains’ partner in the venture, Jefferson Gulf Coast Energy Partners. It will be helpful to have a friend in the project that is expected to cost $55 million to complete just ethanol storage and throughput capacity. Planned storage capacity is equivalent to 500,000 barrels, with the potential to expand to 1.0 million barrels. Capacity to handle biofuels or other...

Coskata’s $100 million IPO: The 10-Minute Version

Jim Lane The first gas fermentation technology to come to the public markets: Coskata files its $100 million IPO. Here’s our 10-minute version of the filing, with a translation of the risks into English. In Illinois, Coskata has filed an S-1 registration statement for a proposed $100 million initial public offering. The number of shares to be offered in the proposed offering and the price range for the offering have not yet been determined. The lead book-running managers for the offering are Citigroup, Barclays and Piper Jaffray. The company is currently ranked #17 in the world...

Cellulosic Electricity: Stock Analysts v. Venture Capitalists

Romm v. Kholsa In a persuasive series of articles, entitled "Pragmatists vs. Environmentalists" (Parts I, II, and III) on Gristmill, Vinod Khosla provides the reasoning behind his "dissing" of plug-in hybrids, which drew the ire of Joeseph Romm. Neither seems to think the argument is settled, and Joeseph Romm returns fire here. As someone who knows as much about investing as Joe Romm and has written as much about Climate Change and Energy Policy as Vinod Khosla, I feel the need to jump into the debate and settle the matter. (Will either of them will notice?)...