by Tom Konrad Ph.D., CFA

The most popular way we have to save for our children’s future education is destroying their future.

A 529 savings plan is a tax-advantaged savings plan designed to help pay for education. There are also prepaid tuition plans set up under the section 529 tax rules, but this article is focused on 529 savings plans, and will be what I mean by “529 plans” for the rest of the article.

The money in 529 plans can be used for college as well as K-12 education, apprenticeship programs, and paying off some student debt. Savings plans grow tax-deferred, and withdrawals are tax-free if they’re used for qualified education expenses. Each state (and DC) has its own 529 plan, but you don’t have to live in a state to participate. Many states offer additional tax benefits to local residents.

The problem with most 529 plans is, like 401(k)’s, the plan sponsor chooses the investment provider and the investments available within the plan. This is a good thing in that a limited number of well curated investment choices can help unsophisticated investors make investment choices that are appropriate for college savings goals. For example, New York’s plan offers both age based options and individual portfolios color coded by risk and potential reward. These portfolios are built from Vanguard’s low cost index mutual funds, which are also a good choice for unsophisticated investors interested solely in maximizing their investment returns.

Paved With Good Intentions

In short, New York’s 529 plan, and most of the other plans I have looked at, are well-designed to help parents and grandparents save and grow their money for a child’s future education. They also help destroy the future planet that child has to live on by investing in fossil fuel companies.

Fortunately, the ability to choose between 51 different plans means that no matter where you live in the US, you do have a few environmentally responsible options.

Coverdell Education Savings Accounts

Coverdell Education Savings Accounts (ESA) are similar to 529 plans in that they grow tax-free and the money can be withdrawn tax-free for qualified education expenses, but these can be set up as brokerage accounts, and so can be invested in any fossil free mutual fund or stocks that you choose. Unfortunately, you can only contribute $2,000 a year to these accounts, which may not be nearly enough to pay for four years of college (and possibly high school or K-12 education) at today’s prices, even if you start saving the year the child is born.

For investors well-versed at choosing their own investments, however, it’s probably worth putting that $2,000 a year in an ESA, with any additional money you can save for the child’s education going into a 529 Plan.

529 Plans With Sustainable Investing Options

I just opened two 529 Plan accounts for my grandchildren, and in researching plans with sustainable options, I found this article by Brian Boswell, CFP®, helpful. He lists the following state plans with more sustainable options:

- Pennsylvania, which offers Vanguard’s FTSE Social Index Fund (VFTNX) which the plan calls its “Social Index Portfolio.”

- Virginia, which offers the Parnassus Core Equity Fund (PRBLX), which it calls its “Socially Targeted Investment Portfolio.”

- Illinois, which offers the Calvert Equity Fund (CEYIX), which it calls the “Calvert Equity 529 Portfolio.” This plan is only available through investment advisors.

- California, Connecticut, Oregon & Wisconsin, which offer the TIAA Social Choice Equity Fund (TNWCX).

Note that all of these funds are equity funds, and so may be too risky for some college savers if used alone.

The only 529 plan with a full range of fossil fuel free investing choices used to be Washington DC’s, which used the fossil fuel free investment shop Calvert for its investment manager until recently, when it dropped Calvert in favor of decidedly fossil fuel full JP Morgan Chase in an effort to lower costs. Penny wise, world foolish.

Choosing a Sustainable 529 Plan

If you live in Connecticut, Oregon, Pennsylvania, Virginia, or Wisconsin, then your choice is easy. Your state offers a relatively sustainable choice in its 529 plan, and offers state tax benefits for using the plan. California also has a more sustainable option, but does not offer state tax benefits to residents.

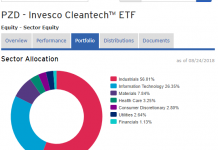

For residents of the other 44 states and California who can get only federal tax benefits it makes sense to choose a fund based on the quality of its offering. The table below compares the available funds based on four measures. Fossil Fuel exposure data is from FossilFreeFunds.org, and Deforestation risk is from DeforestationFreeFunds.org. Both sites are maintained by the nonprofit As You Sow.

| State(s) | Ticker | Fossil Fuel Exposure* | Deforestation Risk* | Annual Fee | 5 year annual historical return |

| PA | VFTNX | B (0.73%) | F | 0.12% | 15.5% |

| VA | PRBLX | A (0%) | B | 0.86% | 14.0% |

| IL | CEYIX | A (0%) | Engages with companies on deforestation | 0.74% | 15.4% |

| CA,CT,

OR,WI |

TNWCX | B (1.45%) | F | 0.32% | 12.0% |

As you can see from the chart, there is no good reason to select the TIAA Social Choice Equity Fund (TNWCX) unless you live in Connecticut, Oregon, and Wisconsin and want to take advantage of the state tax benefits.

Considering all the above factors, the best fund is Illinois’ Calvert Equity Fund (CEYIX). While it has a higher annual fee than Pennsylvania’s Vanguard’s FTSE Social Index Fund, it has still produced a comparable five year annual return after fees, owns no fossil fuel companies, and engages with companies on deforestation issues. Unfortunately, this fund can only be accessed through an advisor who offers the Illinois 529 plan.

This leaves Pennsylvania’s Vanguard’s FTSE Social Index Fund and Virginia’s Parnassus Core Equity Fund. Between these two, we are confronted with a trade-off between our environmental values and cost/historical performance.

While Vanguard’s FTSE Social Index Fund is not completely fossil fuel free, it’s much better than the typical equity portfolio in a 529 plan. For example, the Vanguard Total Stock Market Index Fund (VTSAX) has a 6% exposure to fossil fuel companies, including both fossil fuel producers and utilities. It also scores an F on deforestation. The Social Index Portfolio only has an eighth as much ownership of fossil fuel utilities, and no exposure to fossil fuel producers at all. While the Vanguard Social Index Fund is not perfect, it is low cost and nearly fossil fuel free.

On the other hand, the Parnassus Core Equity Fund (PRBLX) is truly fossil fuel free, and Parnassus is a dedicated socially and environmentally conscious investment shop. Investing responsibly is core to what they do. Further, past performance is no guarantee of future results, so historical performance should always be considered skeptically. You do pay a little more for Parnassus’ environmental expertise, but you are also getting something for that.

My Own Choice

I’m setting up 529 plans for my two grandsons. I had trouble choosing between the Virginia and Pennsylvania plans for the reasons outlined above. Fortunately, money can be transferred between siblings’s 529 plans without any tax consequences, so one grandson got the Virginia Plan, and the other got the Pennsylvania plan. I plan to balance out any future differences in performance by transferring money from one plan to the other.

Calling Tom DiNapoli

Since I’m a New York resident, I’m also planning on working to get a sustainable option added to the New York plan. The State Comptroller, Tom DiNapoil, recently announced that the New York state pension plan would divest from fossil fuels over the coming years. New York’s 529 plan uses Vanguard as its investment provider, so adding the Vanguard FTSE Social Index Fund as an investment option should be as easy for DiNapoli as just asking for it.

Don’t New York’s college savers deserve the option to avoid fossil fuel risks in their portfolios as much as its pensioners? I’d say they deserve it even more, since most students are going to be living with climate change much longer than the average pensioner.

DISCLOSURE: VTSAX and PRBLX through my grandsons’ 529 plans .

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Thanks for this article Tom!

I too am a NY resident and it’s crazy to me we don’t have a fossil free option (or full divestment!) for our 529 plans.

Since Vanguard’s contract with the state is up this year, now is a good time to push the comptroller’s office to make a fossil free option part of its Request for Proposals (RFP).

I started a petition and hope you and your other concerned readers will sign and let the comptroller’s office know this is important to us!

https://chng.it/xWGRm6xD