by Debra Fiakas CFA

The U.S. Environmental Protection Agency is preparing to execute on the Clean Power Plan aimed at reducing carbon emissions from U.S. power generation facilities. Each state has to meet a set of standards set by the EPA based that state’s particular circumstances in electrical generation. The carbon pollution limits begin in 2022 and ramp to full effect by 2030.

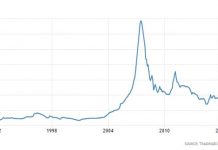

In the meantime, the power generation industry must begin preparation in order to be ready for the initial standards. The lower-carbon emitting power sources will clearly be in favor as a consequence of the new standards. That means a new lease on life for the nuclear industry, which has been out of favor due to safety concerns. Most investors might first think of the uranium mining industry as a beneficiary of a nuclear renaissance. However, there is another contestant in the game that could be a big winner in the drive to clean up the electrical grid.

Lightbridge Corporation (LTBR: Nasdaq) is a developer of nuclear fuel technologies. The company has long been known for its efforts to perfect thorium-based fuels as an alternative to uranium. However, it is an all-metal fuel that could help Lightbridge makes its bones in the evolving nuclear power industry. The company has developed and patented a novel zirconium metal design that replaces the ceramic-type fuel rods now in use by pressurized water reactors. Lightbridge’s fuel rods are also produced differently. A co-extrusion technology is used to extrude a single piece of solid fuel rid from a metallic matrix composed of a uranium and zirconium alloy.

The Lightbridge fuel rod affords a number of advantages. Most important for nuclear power plant operates is the potential for a 10% to 17% increase in power generating capacity from existing reactors. For new reactors the “power uprate” as Lightbridge calls it, could be as high as 30%. The Lightbridge all-metal fuel rods could also extend the operating cycle length from 18 months to 24 months. These benefits mean a dramatic change for the better in the economics of nuclear power plants, making both existing and new plants more attractive alternatives to fossil fuel plants that spew out offending carbon pollution.

Increased efficiency and improved economics are only part of the story. Lightbridge’s metal-allow fuel rods also improve reactor safety. For example, in the event of a large loss-of-coolant, fuel rod temperatures rise and a ‘melt-down’ of the fuel rods can occur. Tests of the Lightbridge zirconium-based fuel rods show that they remain 200 degrees Celsius below the 850 to 900 degrees at which the steam rising from the water around the fuel rods would begin to break down the zirconium and begin leaking radioactivity.

Some reactor system adjustments would be required to use Lightbridge’s all-metal fuel rods. That hurdle does not seem to have intimated four of the leading power generation companies in the U.S. In April 2015, Duke Energy (DUK: NYSE), Southern Company (SO: NYSE), Dominion Generation (D: NYSE) and Exelon Generation (EXC: NYSE) notified the Nuclear Regulatory Commission (NRC) of their interest in Lightbridge’s novel fuel rods. The notification indicated the group of four would be submitting an application sometime in 2017 to use the Lightbridge fuel beginning in 2020.

Of course, the power generators will not be Lightbridge’s customers. The company will license its technologies to fuel suppliers such as Westinghouse. The licensing strategy presents an attractive, high-margin model. Until sales from its fuel rod technology hit the top-line, management has been providing consulting services to the nuclear power industry. Revenue in the twelve months ending June 2015, were $1.1 million. While the company still reported a net loss of $4.3 million in that twelve-month period, operations only used $3.5 million in cash. The company has $2.4 million in cash on its balance sheet, suggesting a runway of about nine months before the bank account is overdrawn. The company recently announced a new financing facility through which management can ‘put’ shares of common stock for up to $10 million in value over the next two years. The equity financing facility provides some assurance that the company can move forward with the next phase of testing and proofing required to get approval by the NRC.

Lightbridge shares trade near $1.00 per share, well below where investors might expect valuation for a company that is on the cusp of a major product introduction. The depressed stock price might arise from the company’s long association with thorium fuel development, which seemed to languish as the years went by. Lightbridge has also been heavily dependent upon relationships in Russia to test and proof the all-metal fuel rods. With the imposition of sanctions against Russia related to incidents in the Ukraine, Lightbridge has had to find alternatives. Two new laboratory deals have been set up, but the significance of those relationships does not seem to have filtered into investor sentiment. Likewise we do not believe investors have been impressed by the group of four power generators who have gone on record with the NRC with their interest in the all-metal fuel rod. Perhaps the breakthrough of a fuel supplier license would get investor attention. This is the step that would pave the way for orders and revenue.

In my view, LTBR is a stock well worth putting on a watch list even if the stock appears to present more risk that it’s worth today. For those who have a long-term time horizon, the stock price can be considered an option on the last laboratory tests and the application to the NRC in 2017. Granted neither of lab tests or applications is on par with actual orders. Yet both hurdles must be cleared before fuel suppliers could find it worthwhile to give Lightbridge a call.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. BLSP is featured in research reports published by Crystal Equity Research. Please note the important disclosures at the end of all Crystal Equity Research reports. Please read the important disclosures related to sponsorship and subscriptions in the final pages of all reports.