Get Your Clean Energy Tax Credits Before They Go Away

The House version of Donald Trump’s “Big Beautiful” budget bill almost completely repeals the provisions of Joe Biden’s signature Inflation Reduction Act (IRA). In particular, the tax credits for homeowners and electric vehicles will be zeroed out in the coming tax year.

If you are a high income earner or a corporation, you will probably see your taxes go down if the Senate passes a similar version of the bill. Lower income earners will likely see their taxes go up… and younger Americans will all likely see their taxes go up in the long term when they have to pay...

Scrappy Companies For Scrappy Investors

By Tom Konrad, Ph.D., CFA

Supply and Demand

One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, cobalt, copper, manganese, graphite, even steel: just name and industrial commodity, and we’re probably going to need a lot more of it.

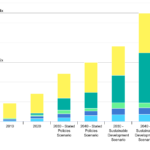

Total mineral demand for clean energy technologies by scenario, 2010-2040

Even worse, it’s not at all clear where all these materials are going to come from. While there are plenty of all the elements we need in the Earth’s crust, actually mining them all in the next 20 years is not...

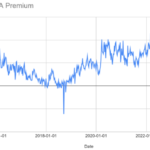

The Brookfield Renewable Energy Corporation Premium

By Tom Konrad, Ph.D., CFA

On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. Quarterly earnings actually beat expectations, but for Yieldcos like Brookfield, cash flow numbers and revenue (which can be more indicative of the company’s ability to pay and raise dividends) can be more important. These fell short.

The company attributes the cash flow shortfall to its own clients delaying payments at the end of December, in order to make their own financial statements look better, and it expects the shortfall to reverse...

The Clear Way to Buy Clearway

By Tom Konrad, Ph.D., CFA

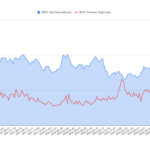

A reader of my recent article on Yieldcos asked which share class of Clearway Energy was the better to buy for tax purposes: Class A shares (CWEN-A) or Class C Shares (CWEN).

For tax purposes, they are identical. They pay the same dividend, and it is treated the same no matter which share class you buy. The reason many large investors often trade CWEN rather than CWEN-A is because it is more liquid. As I write on Jan 23rd, Yahoo! Finance puts the 3 month average share volume for CWEN at 1,372,714, while the corresponding number...

Yieldco Valuations Look Attractive

By Tom Konrad Ph.D., CFA

Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. Perhaps it is worries about hostility towards clean energy under a new Trump administration, or disappointment at the slow implementation of the Inflation Reduction Act. Whatever the cause, prices are low, and many clean energy stocks are likely to produce good returns even if the political climate turns further against them.

This is especially true for companies that are less dependent on favorable policy or subsidies. For instance, Yieldcos, high...

EATV: An ETF for Investing in the Agricultural Transition (Interview)

I met VegTech™ Invest CEO, Elysabeth Alfano at the 2023 ESG for Impact Conference, where she made a strong case for investing in food and agricultural systems innovation as a method for reducing greenhouse gas emissions and other environmental harms. I wanted to learn more about the specific innovative companies she thinks are worth investing in, and so I interviewed her and VegTech™ Invest Chief Investment Officer, Dr. Sasha Goodman about these themes. The interview follows.

Tom Konrad Ph.D., CFA -

Editor

Q: Thanks for taking the time to speak with me. To begin with, can you tell us what VegTech™...

How to Invest in Clean Energy Webinar

Eventbrite sign-up: https://www.eventbrite.com/e/how-to-divest-from-fossil-fuels-and-invest-in-clean-energy-tickets-591429470467?keep_tld=1

Transmission – The Bottleneck We All Saw Coming

by Paula Mints

Transmission and distribution is the process of getting electricity from the point of generation to the point of use. Unfortunately, upgrades, maintenance, and the need to extend the electricity infrastructure from point a to point b are often ignored. Also ignored are infrastructure designs that support a distributed grid with renewable energy sources of electricity.

Transmission bottlenecks are the utterly foreseeable consequence of accelerated solar and

wind deployment. As countries worldwide were announcing RE goals, holding auctions, and providing incentives, system operators everywhere were warning about the need to add new and upgrade existing infrastructure while also warning about...

2023: Looking Up Like the 2009 Disney Movie

There is no shortage of things to worry about as we start 2023. The Federal Reserve is (rightly, in our opinion) worried about inflation becoming entrenched, and so is likely to continue hiking interest rates for much of 2023. Putin looks unlikely to concede defeat in Ukraine, and his desperation may lead to escalation, potentially even of the nuclear variety. California seems to be washing away while remaining in a drought.

China has loosened the zero-Covid policies that helped the country continue functioning during the first stage of the pandemic, while much of the rest of the world shut down. ...

How New Battery Applications Will Disrupt the Home Generator Market

By Tom Konrad Ph.D., CFA

The market for reliable back-up power in homes and businesses is booming.

With more people working from home and increasing news coverage of power outages due to severe weather events and public safety power shutoffs in California (not to mention domestic terrorism), power reliability seems like it’s destined for a long term boom.

New Competition

A decade ago, if you wanted backup power, a generator was the only option. Now, there are an increasing number of battery-based alternatives beginning to compete with generators to provide back-up power. While most battery-based solutions are better than gas or propane generators...

Ten Clean Energy Stocks of 2022/3 – July Returns

Here are the numbers. I hope to write some market commentary to go with them soon.

Disclosure: Long all the stocks in the 10 Clean Energy Stocks model portfolio.

Five Green REITs

by Tom Konrad Ph.D., CFA

Why Green Buildings are Profitable Buildings

Buildings are responsible for approximately a third of greenhouse gas emissions, so making buildings more efficient and switching them to renewable sources of energy is an essential part in addressing climate change.

Fortunately, new technologies such as cold climate heat pumps, heat pump water heaters, induction stoves, as well as the ever falling cost of renewable electricity and improvements to insulation and building envelopes often provide opportunities to improve buildings while achieving extremely attractive investment returns from the energy and maintenance savings alone.

Because of the great financial returns, building owners who...

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Restarting 10 Clean Energy Stocks Series

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Advantage Biodiesel

By Tom Konrad, Ph.D., CFA

Because of rising fertilizer prices, farmers are planting more soybeans than corn. Soybeans are a legume, meaning that they can fix their own nitrogen in the soil, meaning that they need less nitrogen fertilizer, the price of which is spiking due to rising natural gas prices. Corn, in contrast, needs more nitrogen than most other crops.

High gas prices are rising because of Putin’s war on Ukraine, which is also preventing Ukrainian farmers from planting this year’s wheat crop, while sanctions are likely to disrupt wheat supplies from Russia as well.

Corn and (to a lesser extent,...

Twelve Green Investment Themes From Putin’s War on Ukraine

By Tom Konrad, Ph.D., CFA

Horrific, Tragic, Unprovoked, Heartbreaking. There is no lack of adjectives to describe Putin’s war on Ukraine. And while there probably can’t be too much coverage of the tragedies and war crimes, many others can write those far better than I.

As an economic and stock market commentator, the adjective I will focus on is world-changing. There is no doubt that the first land war in Europe since World War II, piled on top of a global pandemic, is already reshaping the economy in dramatic ways.

Some of those changes, like Europe switching away from Russian gas and...