Investing In Wood Pellets, Part I

Last week, I mentioned that I had attended a conference focused on opportunities in the biomass and bioenergy sectors. One of the article ideas I got from this conference was on the emerging market for wood pellets (tightly packed sawdust and other wood shavings) for heat and electricity. How interesting that, over the weekend, the magazine Science published an article suggesting that the US should ramp up its use of wood for small-scale heat and electricity production (the article is not available free of charge but you can find a summary here). The Wood (Pellet) Advantage It...

Western Wind: A Clean Energy Rodney Dangerfield?

Tom Konrad CFA Renewable energy power producer Western Wind Energy Corp (WNDEF.PK, WND.V) feels it gets no respect. In particular, they have long felt that the investing public does not recognize the value of the company's existing and nearly completed wind farms. Western Wind's Kingman I Wind & Solar park. Photo courtesy of the company. Independent Valuation Almost every company will tell you that their shares are undervalued, but what's a bit more unusual in this case is that their assets (Wind farms with a little solar thrown in) are...

Focus On Clean Power Income Trusts

Last week, Tom brought you a piece on the Algonquin Power Income Fund (AGQNF.PK), in which he opined that shift in investor attention away from capital gains toward yield might eventually provide a catalyst for the prices of yield-focused securities such as income trusts to rise. So-called utility trusts, or income trusts where the underlying corporation is engaged in utility activities such as power generation, are a common feature of the Canadian income trust sector (the mother of all income trust sectors). A sub-set of utility trusts is the clean power utility trust, where the power generation...

Power REIT: Light At The End Of The Tunnel?

Tom Konrad CFA

It Could Have Been The First Yieldco

Light at the End of the Tunnel photo via BigStock

I first became interested in Power REIT (NYSE MKT:PW) in 2012 because of the company's plans to become what would have been the first US-listed "yieldco," i.e. a clean energy power producer paying a high level of reliable dividends to investors. The company was an infrastructure Real Estate Investment Trust (REIT) with a single asset: its subsidiary, Pittsburgh & West Virginia Railway (P&WV) which owned 122 miles of track leased to Norfolk Southern Corp. (NYSE:NSC), which had in turn subleased the track...

SunEdison Spinning Yieldcos

by Debra Fiakas CFA Two weeks ago TerraForm Global, Inc. filed yet another amendment to its S-1 registration statement as the SunEdison, Inc. (SUNE: NYSE) spinout grinds forward with its initial public offering. TerraForm is a collection of SunEdison’s renewable energy properties, primarily its solar, wind and hydro-electric power generation facilities around the world. The current portfolio sums up to over 1,400 megawatts in total generating capacity, of which over 900 are spoken for through power purchase commitments that cover the next 19 years. On a pro forma basis, the assets produced $298.9 million in total revenue, providing...

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...

Western Wind Expects Full Cash Grant for Windstar

Tom Konrad CFA The Windstar Wind Farm. Photo credit: Western Wind Energy On July 10, shares of Western Wind Energy (TSX:WND, OTC:WNDEF)plummeted because of a $12.2 million shortfall in the 1603 cash grant from the US Treasury for the company’s Windstar wind farm compared to the application. In order to reassure skittish investors, the company held a conference call on Monday, July 16. On the tenth, I thought that investors should write off the 1603 cash grant shortfall, despite the fact that the company intended to send a delegation...

The Safest Alternative Energy Yieldco

By Jeff Siegel If you're a regular reader of these pages, you know I'm bullish on alternative energy yieldcos. In fact, I've covered Pattern Energy Group (NASDAQ:PEGI) and NRG Yield (NYSE:NYLD) at length. The way I see it, yieldcos are the next big alternative energy investments for retail investors. They enable regular investors to buy into multiple alternative energy assets that produce steady cash flow. For those not particularly keen on risk, but still want exposure to the burgeoning alternative energy space, this is a great way to do it. The bottom line is that...

Western Wind & Brookfield: Time To Declare Victory and Go Home

Tom Konrad CFA Yesterday, I tendered my shares of Western Wind Energy (TSX-V:WND, OTC:WNDEF) to Brookfield Renewable Energy Partners' (TSX:BEP.UN, OTC: BRPFF) extended offer for Western Wind at C$2.60 a share. This is despite the fact that I think (and was even quoted in a Western Wind press release) saying Western Wind is worth more than C$2.60. Two things have changed. After conversations with other investors, Western Wind CEO Jeff Ciachurski, and a representative of Brookfield, as well as reading some evidence of extremely bad governance in Western Wind's Q3 2012 filing, I no...

Alterra Power: Cash to Invest

Tom Konrad CFA I sometimes think Alterra Power (TSX:AXY, OTC:MGMXF) is unfairly lumped with other small, renewable energy developers. A typical problem for small developers over the last few years has been raising the funds to invest, even when they have compelling prospects. For instance, Western Wind Energy stock (TSX:WND,OTC:WNDEF) has been beat up recently because a large Federal cash grant is delayed. Finavera Wind Energy (TSXV:FVR, OTC:FNVRF) has been declining for most of the year as they look for a strategic partner to help fund their permitted wind developments, despite significant progress permitting those projects and...

Calpine to sell about a fifth of power plants

Calpine Corp. (CPNLQ.PK) said it plans to sell about one-fifth of its power plants in a bid to emerge as a leaner company focused on its profitable geothermal and gas-fired operations. The company also said it plans to close three offices and cut about 775 jobs. Without identifying the plants, Calpine said the sale of about 20 facilities would allow it to focus on core assets and key markets. The company's largest power markets are California and Texas. The plans drafted by CEO Robert May should allow the company to save over $150 million a year and...

Dividends and Value Among Renewable Energy Power Producers

Tom Konrad CFA Almost every stock market sector fell significantly in late July and August this year, and such market declines send me searching for value stocks paying good dividends which I can hold for the long term. In mid-July, I found some decent values by sifting through the trash, but I was less enthused by the value proposition of conglomerates involved in the clean energy space. Today I'll take a look at a group of...

Brilliant Light Power – Commercialization Status

by Daryl Roberts

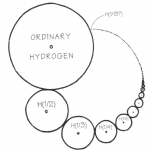

A potentially paradigm-shifting technology has been under development at an R&D firm in NJ called Brilliant Light Power. For people monitoring the situation, the question currently is about the status of commercialization. It is not a publicly held firm, but is in mid-stages of private equity capitalization in the range of $100-120M.

I recently read a book titled "Randall Mills and the Search for Hydrino Energy", offering a detailed and compelling history of the development of this novel renewable energy technology, authored by an insider, an intern who stayed on to work there for several years (published in...

The Muscle Car Of Energy Efficiency

Tom Konrad CFA Disclosure: I am long TSX:PRI / PENGF. The poster child of energy efficiency has long been changing a light bulb. First, it was swapping out an incandescent for a compact fluorescent, now the swap is to an LED. Changing a light bulb is a small step that anyone can take, and it’s so cost effective that it can pay for itself in months if the bulb is used frequently. This is a good example of household energy efficiency measures: a small action requiring a limited investment that anyone can take that pays back quickly....

CBD Energy and SFC Smart Fuel Cell Look Promising

From Small Fries to Big Shots? (Pt. 2 of 2) Bill Paul Here now are two more small alternative energy companies, both of which look to be just starting to hit their stride. How far they'll go only time will tell, but each seems to warrant a closer look. Take note: like the vast number of other pure-play alternative energy firms with intriguing growth prospects, neither of these is U.S.-based. Rule of thumb: whether you're a big institutional or small individual investor, to succeed in alternative energy, you must scour every corner of the earth. First up: CBD Energy,...

Power REIT: Why David Should Defeat Goliath

by Al Speisman, Esq. Al Speisman, Esq. Power REIT1 (NYSE MKT:PW) is a micro-cap Real Estate Investment Trust with assets generating consistent, secure cash flow. Power REIT’s assets consist of long-term railroad infrastructure as well as 600 acres of land leased to solar farms. Power REIT’S current underlying value of $11.07 per share is delineated in a shareholder presentation on Power REIT’S Web-Site. This valuation does not factor in potential success in Power REIT’s pending Federal Appeal. A recent article appearing in Value Investors...