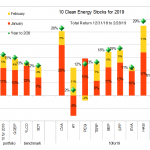

10 Clean Energy Stocks For 2019 – First Two Months Results

It's hard to find anything to complain about in the first two month's performance of my 10 Clean Energy Stocks for 2019 model portfolio. Unfortunately, I'm about to go on vacation and don't have time to do an update on all the earnings reports that have come out over the last two weeks. I will try to get to them individually as I have time.

Strategically, I'd like to say I'm getting very nervous about this market rally, and think that readers should be taking profits opportunistically and increasing your cash positions.

Ten Clean Energy Stocks for 2012

Tom Konrad, CFA There is a silver lining to the horrible year clean energy stocks had in 2011: the opportunity to buy clean energy stocks (often considered a growth sector) at prices one would expect from value stocks. Each year since 2008 I have published an annual list of ten clean energy stocks I thought were good buys at the beginning of the year. While the 2008 list was not really intended as an investment portfolio, my annual lists quickly evolved into a mini-portfolio of stock intended for hands-off investors who did not want to pay the high...

Ten Clean Energy Stocks for 2012: 10% more than other top-10 lists

Tom Konrad. CFA A "bonus" stock pick this year. Also, notes on New Flyer Industries and Finavera Wind Energy. Maybe it was because Seeking Alpha did not carry my annual list of 10 Clean Energy Stocks for 2012 this year, but no one seems to have noticed that there were actually 11 stocks in the list. Call it the Spinal Tap of top-ten lists. If anyone did notice the extra pick, they didn't leave a comment. What happened was that I have two number 8 stocks, but there is enough text...

Correction, or Bear Market?

by Tom Konrad, Ph.D., CFA

On February 21st, I was helping an investment advisor I consult with pick stocks for a new client's portfolio. He lamented that there were not enough stocks at good valuations. This is one of the hardest parts of being an investment advisor: a client expects the advisor to build a portfolio of stocks which should do well, but sometimes, especially in late stage bull markets, most stocks are overvalued. I reminded him, "The Constitution does not guarantee anyone the right to good stock picks." He agreed, but he still had to tell his client that...

Ten Clean Energy Stocks For 2015: Marching Ahead

Tom Konrad CFA My Ten Clean Energy Stocks for 2015 model portfolio added a second month to its winning streak, with a 6.1% gain for the month and a 5.7% gain for the year, despite a continued drag by the strong dollar. If measured in terms of the companies' local currencies, the portfolio would have been up 7.5% for the month and 10.5% for the quarter or year to date. For comparison, the broad universe of US small cap stocks rose 1.5% for the month and 4.0% for quarter, as measured...

Shares of IDA Corp. Purchased

The fears of Rita have fallen away and the market is finally moving to the upside again this morning. I have been watching IdaTech (IDA) for purchase for a couple of weeks and I had previously mentioned I have been looking for a good entry point on this stock. IDAcorp is an Idaho power utility with electrical generation using Hydro, Natural Gas, and Coal. They also own IDATech which manufactures fuel cell solutions. I'm waiting on this one until the technical picture of the chart improves. I would be a buyer if we can either get...

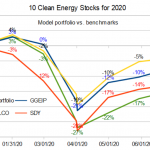

10 Clean Energy Stocks for 2020: June Update

by Tom Konrad, Ph.D., CFA

The coronavirus pandemic no longer has the United States by its financial center throat, the New York City area, but is instead is now gnawing ravenously at its arms and legs. In June, the stock market seems to be just starting to get a clue that this is also a bad thing, leading to a month of volatility and general consolidation.

Europe, in a display of relative competence, has been much more effective than the US at getting the pandemic beast under control, and so investors looking for safe havens might do well to look there. ...

Shares of Capstone Rising

Shares of Capstone Turbine Corp (CPTC) are rising sharply this morning with high volume and gapped up with a gain of over 35% this morning. There is currently no news to cause this increase today and I will be digging deeper to find out what is going on. This is good news for the stock and also the portfolio. My holdings are now up over 50% in about 10 days. If you were thinking of buying the stock now, you should wait till some news confirms this move. Update at 12:15 EST: The only news I can...

Buying Green Stocks Pays, but Finding Green in Brown Pays More

Tom Konrad CFA Although green stocks did better than un-green (or brown) stocks since Newsweek's 2009 Green Rankings were published, the big winners were the greenest stocks in the brownest sectors. Newsweek has released its 2010 Green Rankings for America's 500 largest corporations, and the companies at the top of the list are happily gloating about being greener than their rivals. More important to investors is the question: Do the greenest companies beat the market? Marc Gunther notes that the top 100 companies in the 2009 Green Rankings outperformed the S&P 500 by 6.8%. ...

What 11 Clean Energy Stocks Did on My Summer Vacation

Tom Konrad CFA August Overview I was traveling for much of the month of August, and so did not keep up with most of my stocks. But not much happened while I was gone, with the broad market and renewable energy stocks both producing small gains for the month of a little over three percent, as measured by my benchmarks, the Russell 2000 index (^RUT, 3.4%), and the most widely held clean energy ETF, the Powershares Wilderhill Clean Energy ETF (PBW, 3.2%). My Clean Energy model portfolio also had a relatively uneventful month,...

10 Clean Energy Stocks For 2016

Tom Konrad CFA The History and Future of the "10 Clean Energy Stocks" Model Portfolios 2016 will be the eighth and possibly final year I publish a list of ten clean energy stocks I expect to do well in the coming year. This series has evolved from a simple, off-the-cuff list in 2008, to a full blown model portfolio, with predetermined benchmarks and monthly updates on performance and significant news for the 10 stocks. While there is much overlap between the model portfolio and my own holdings (both personal and in managed accounts), the model...

Questions about DayStar Technologies

I received an e-mail from a reader that had questions about holding DSTI. I had some concerns about DSTI. I was wondering if you still believe investment in this company or alternative energy stocks is worth it. If crude oil drops further (let say mid 50s) do you think it will have negative impact on alternative energy stocks particularly ENER and DSTI. I was very happy with the holding a couple days ago, but the performance of DSTI in last 2 days without any news has got me concerned. Let me answer your question with first a...

Ten Clean Energy Stocks For 2017: First Quarter Earnings

Tom Konrad Ph.D., CFA In the two months since the last update, most of the stocks in my Ten Clean Energy Stocks model portfolio have reported first quarter earnings. There were few surprises, and those were mostly pleasant ones, allowing the model portfolio to add to its gains, and pull a little farther ahead of its benchmark. For the year to the end of May, the model portfolio is up 13.8%, 2% ahead of its benchmark. The benchmark is an 80/20 blend of the clean energy income...

Ten Clean Energy Stocks For 2016: Earnings Season

Tom Konrad CFA May was a tough month for most clean energy stocks, even though the broad market was up slightly, but my Ten Clean Energy Stocks for 2016 model portfolio continued to out-perform, mostly because of strong earnings for several stocks. The model portfolio was up 3.1% for the month and 3.8% for the year to date, even though its clean energy benchmark fell 2.0%, for a decline of 2.8% for the year through May 31st. The broad market of small cap stocks also rose, and was up 2.2% for a total gain of 2.4% for the...

The Pros Pick 14 Cleantech Stocks for 2014

Tom Konrad CFA Over the last few weeks, I’ve brought you articles about the top Cleantech stock picks for 2014 from my panel of Cleantech money manager. This article puts them all in one place. Disclosure: I am long MIXT, ACCEL, SBS, and HASI. Originally, there were twelve picks. Then, a mis-communication with Rafael Coven, Managing Director at the Cleantech Group, and manager of the index which underlies the Powershares Cleantech ETF (NYSE:PZD) had me listing two more stocks he likes. Through a happy coincidence, that brings the total picks...

Will McConnell Kill The Bull Market?

By Tom Konrad, Ph.D., CFA

The risks of playing politics

The American news media often tries too hard to be “balanced” when talking about politics.

Depending on which news sources you rely on, you may be hearing that “congress” is having trouble passing bills to fund the government and raise the debt ceiling. More partisan sources will be blaming it on the Democrats or the Republicans, depending on their political bent.

I generally consider myself an independent who cares deeply about the environment and competent government. Since the rise of Donald Trump, the Republicans have shifted from being the party of big business...