Report Alleges EPA Tests Skewed Against Ethanol By Oil Industry Influence

by Jim Lane

In Washington, researchers for a report published by the Urban Air Initiative contend that “technical data that shows the nation has been exposed to decades of flawed test fuels and flawed driving tests, which in turn means flawed emissions results and mileage claims”. The complete Beyond a Reasonable Doubt series from UAI is available here.

Further, EPA emails obtained under the Freedom of Information Act reveal that, according to a report from Boyden Grey & Associates, the Agency appears to have directly solicited financial contributions and technical input, “especially on the fuel matrix,” from an oil industry controlled research organization.

Of the...

China Trys to Cork EU Solar Tariffs With Wine Probe

Doug Young China is quickly learning how to play the game of tit-for-tat trade wars, with news that Beijing has launched a new anti-dumping probe against wines imported from the European Union. Anyone who has followed recent China-EU trade relations will know, of course, that announcement of this new probe by the Commerce Ministry comes the same day that the EU formally announced anti-dumping tariffs against imported Chinese solar panels. While I certainly don’t condone this kind of trade war rhetoric, I have to say that China’s decision to target Europe’s wine industry looks like a very...

Cap and Trade: Right Debate, Wrong Solution

David Gold As we have seen in just the past few years, fossil fuel prices can vary dramatically over very short periods of time. Creating greater certainty regarding steady increases in fossil fuel prices over the coming decade would have an enormous impact on private sector investments in both alternative energy and energy efficiency. Cap and trade is the right debate to be having because it focuses the discussion on how to change the fundamental economics of fossil-based energy. But ultimately cap and trade is the wrong solution; superior means exist to achieve the results...

Renewable Fuels’ Dunkirk

by Jim Lane

It’s been a very busy week in Washington DC, the high point being a letter to seven senators sent late Thursday by EPA Administrator Scott Pruitt, who took significant (and as of a few days ago, unexpected) steps toward strengthening the foundation for ethanol and renewable fuels.

The truth? It’s a Trump Administration back-down. EPA overreached on de-clawing the Renewable Fuel Standard on behalf on some grumpy oilpatch donors (known as GODs), and the Trump Administration managed to revive a Grand Alliance around renewable fuels — one that now includes almost 40 members of the United States Senate,...

Occupy Wall Street and the Next Economy: Clamoring for Solutions

Garvin Jabusch The Occupy Wall Street movement (OWS), now in its fourth week, is getting a lot of media attention. Opinions are divided. By and large, conservatives represent the protesters as 'a mob' (a notable exception is former governor of Louisiana and current GOP presidential candidate Buddy Roemer, who said on MSNBC that "politicians need to listen to these young people, it could change America"). Meanwhile, progressives view them as a justifiable, if not inevitable, reaction to the social inequity that results from a system rigged in favor of the ultra-wealthy. In their foundation document, the ...

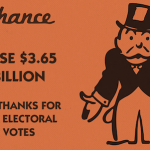

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...

What The US Election Will Mean For The Global Solar Industry

by Paula Mints The endless and endlessly not amusing US presidential election is thankfully wrapping up in November and there is a lot at stake for solar – globally. This is because the market for solar components and systems is global. Even the smallest installer buys imports. Even the smallest component manufacturer has the potential to ship product into any global market. A hiccup in one market (China, for example) reverberates throughout the entire global market for solar components and systems. A hiccup in the US market for solar deployment would affect business plans and forecasts...

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...

Aggressive New CAFE Standards; The IC Empire Strikes Back

John Petersen Last Friday President Obama and executives from thirteen leading automakers gathered in Washington DC to announce an historic agreement to increase fleet-wide fuel economy standards for new cars and light trucks from 27.5 mpg for the 2011 model year to 54.5 mpg for the 2025 model year. While politicians frequently spin superlatives to describe mediocre results, I believe the President's claim that the accord "represents the single most important step we've ever taken as a nation to reduce our dependence on foreign oil" is a refreshing example of political understatement. After three decades of demagoguery, debate,...

A Small New York Town Plans a Profitable, 100% Renewable Energy Future

A community choice program and a lack of natural gas are enabling Marbletown to achieve 100 percent renewable energy and tackle 100 percent renewable energy —while saving money.

by Tom Konrad, Ph.D., CFA

With advances in technology, the pathways to 100 percent renewable energy are becoming clear. As a result, the central challenge has become less about how to get there, and more about how to pay for it.

The town of Marbletown, in New York's Hudson River Valley, is finding that problem is solving itself.

Marbletown is a town of 5,500 people covering 55 square miles on the edges of the Catskills...

The Farm Bill: 5-Minute Guide to the Energy Title

Jim Lane Only 5 min BigStock Photo What’s in that Durn-tootin’ US Farm Bill, anyhow? For the harried taxpayer, some relief. For energy security and rural economic development, targeted investments that now head to the legislative floor. Here are the need-to-knows. In Washington, the House and Senate Agricultural committees have now passed their respective versions of the proposed 2013 farm bill, which would take effect for fiscal 2014 through fiscal 2018. Both bills have energy titles meaning that, should they find passage, as expected this summer,...

The Utility Death Spiral: Beyond The Rhetoric

by Lynne Kiesling Unless you follow the electricity industry you may not be aware of the past year’s discussion of the impending “utility death spiral”, ably summarized in this Clean Energy Group post: There have been several reports out recently predicting that solar + storage systems will soon reach cost parity with grid-purchased electricity, thus presenting the first serious challenge to the centralized utility model. Customers, the theory goes, will soon be able to cut the cord that has bound them to traditional utilities, opting instead to self-generate using cheap PV, with batteries to regulate the intermittent...

Low Carbon Fuel Rules: From CAFE to LCFS and Everything In Between

The Whole Darn Low Carbon Landscape. How they Work, How they Work Together, and How they Might Work Better

by Joanne Ivancic, executive director, Advanced Biofuels USA

The Trump Administration is taking a new look at Obama Administration era Co2 regulations. On the transportation side, these include reviewing Corporate Average Fuel Economy (CAFE) standards; threatening to take away California’s authority to set their own mileage and pollution controls, including CO2 (carbon dioxide) emission reduction standards; and quarreling with the petroleum and biofuels industries over implementation and enforcement of the Renewable Fuel Standard (RFS).

Thus, the Clean Air Act (CAA), California’s unique authority...

US Crawls Closer to Energy Policy

by Debra Fiakas CFA Last week President Obama signed into law the Energy Efficiency Improvement Act of 2015. The law is intended to reduce energy requirements in commercial buildings, manufacturing facilities and residential structures. The law improves building codes, provides assistance to manufactures to achieve energy efficiency and paves the way for conservation activities by federal agencies. It is the closest thing the United States has to an energy policy…..so far. It took years to get this small piece of energy policy through Congress. Indeed, at one point in its convoluted travels through the House of...

Here comes the sun….not

Marc Gunther Germany, once the world’s leading market for solar power, is pulling back its subsidies. Q Cells (QCLSF.PK), once the world’s largest solar company, just went bankrupt. This isn’t happy news. If the country that birthed the Green Party cannot sustain its support for solar, what does that tell the rest of us? It should tell us that it’s time (actually way past time) to get serious about energy and climate policy. This week, as I followed the news from Germany, I talked with a couple of energy-policy experts who I respect–Jesse Jenkins of the...

Foundations don’t practice what they preach

by Stephen Viederman Philanthropic foundations are like old-fashioned slot machines. They have one arm and are known for their occasional payout. Although the term “mission-related investing” found its way into the lexicon of philanthropy decades ago, the finance committees of most foundations continue to manage their endowments like investment bankers. Their portfolios give no hint that they are institutions whose purpose is the public benefit. There is a chasm between mission – grantmaking – and investment. The logic of a synergy between the two has yet to take hold. For example, number of reports circulated in the US...