The Peak Coal Portfolio

Last week, we alerted you to a report from Germany's Energy Watch Group called “Coal: Resources and Future Production,��? which predicts peak coal by 2025. Readers of AltEnergyStocks are doubtless familiar with peak oil, the inevitable fact that as we consume a finite resource (oil reserves) at some point the rate of that consumption must peak, and taper off. Serious arguments about peak oil center around "when" oil production (and consumption) will peak, not "if." The same it true for other finite natural resources, such as natural gas, uranium, and even coal. The difference with coal is the received...

Betting Against Shale Natural Gas Plays

Green Energy Investing For Experts, Part III Tom Konrad, CFA Controversy continues to grow about the economic viability of shale gas. Investors who doubt the companies' claims should consider buying puts. The Case for Gas From the perspective of a green energy investor, natural gas is the most benign fossil fuel. Natural gas emits less carbon than other fossil fuels (slightly more than half as much as coal, when used for electricity generation.) Natural gas turbines also can quickly compensate for fluctuating supply and demand from other sources of electricity. This quick response makes them a natural complement...

Oil Prices & Alternative Energy Stocks

The recent slump in the price of energy commodities that has accompanied slumps in the rest of the market has reignited an old debate: to what extent is the performance of alt energy companies (and their stock prices) linked to fossil energy prices? People who argue that the two are closely connected implicitly believe that policy-makers and other important economic actors view alt energy mainly as a hedge against high energy prices, and therefore believe that a drop in fossil energy costs will result in a fall from grace for alt energy (there is evidence that at least...

Natural Gas Liquids are Following Natural Gas Off a Fracking Cliff

Tom Konrad CFA The unprecedented boom in natural gas supplies over the last few years as been one of the few tail-winds for the US economy over the last few years, as plummeting natural gas prices have lowered costs for both industry and consumers. Few outside the natural gas industry even understood the shear scale of the shale gas resource, although industry insiders did. The Shale Gas Glut In 2008, I recall a natural gas executive complaining about how he could not get policymakers to understand the sheer scale of the shale gas resource. To be honest, I...

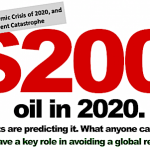

The Low Sulfur Diesel Crisis of 2020 And How To Prevent It

“The global economy likely faces an economic crash of horrible proportions in 2020, not for want of a nail but want of low-sulfur diesel fuel,” writes renowned energy analyst Phil Verleger in a note this month titled “$200 Crude, the Economic Crisis of 2020, and Policies to Prevent Catastrophe”. Not good timing for a White House re-election effort if, as expected, the blame falls on lack of preparedness in the 2017-2020 run-up to the projected crisis..

It’s a dire scenario but there’s hard data behind it, and though few go as far as Verleger, almost every expert is warning of a...

Shorting Mexico’s Peak Oil Economy

Green Energy Investing for Experts, Part II Tom Konrad, CFA The next Tequila Crisis will be a peak oil crisis. Mexico's government is dependant on revenues from declining oil fields. The prospects for replacing these revenues look slim. Shorting Mexico Country ETFs looks like a good way to hedge market exposure. In Green Energy Investing For Experts, Part I, I discussed why it makes sense to use companies and sectors that may be hurt by peak oil or climate change as a hedge against the market exposure in a green portfolio. In Mexico, peak oil is already a reality. ...

What Is Peak Oil?

Charles Morand Peak Oil is a term that has become common currency in energy debates in last three years, due in large part to the spectacular rise in the price of crude between 2005 and the end of 2008. But what does Peak Oil actually mean and, more importantly, what do I mean when I use it in my articles? In the purest and original sense of the term, Peak Oil refers to the point in time at which the rate of oil production (as measured, for instance, in barrels per day) peaks. This peak,...

Crude Oil & Alt Energy: The Non-Relationship That Just Won’t Go Away

Charles Morand The relationship - or lack thereof - between oil prices and the performance of alt energy stocks has been a long-time interest of mine. I discussed it last in late March when I looked at correlations between the daily returns of alt energy and fossil energy ETFs. At the time, I found that only a weak relationship existed between the two and that if someone wanted to make a thematic investment play on Peak Oil, alt energy ETFs were not an ideal way to do so. Seeing as the popular press and countless "experts"...

The Best Peak Oil Investments: Index

Tom Konrad CFA Part Subject / Description Stocks mentioned I Biofuels Overview WM II Hydrogen Vehicles and Vehicle Electrification III Natural Gas Vehicles WPRT, CLNE, and one I missed: FSYS IV Synthetic fuels: Gas-to-Liquids, Coal-to-Liquids, and Biomass-to-Liquids SSL, SYNM, RTK V Biofuel from Algae GSPI.PK, OOIL.OB, PALG.OB, PSUD.PK VI Barriers to Alternative Fuels ...

Peak Oil & Energy Efficiency In The News

A couple of interesting items in the news yesterday on topics dear to alt energy investors' hearts. Firstly, a new report (PDF document) by CIBC World Markets arguing that globalization could be reversed by high oil prices. The folks at CIBC WM contend that growing shipping costs driven by higher prices for transportation fuels could erase the Asian labor cost advantage, driving a renaissance in North America's manufacturing sector. What's the main culprit? Peak Oil, albeit not called directly Peak Oil. I watched an interview with Jeff Rubin, CIBC WM's Chief Economist, on Bloomberg's In Focus yesterday, and...

De-Carbonizing Electricity – Will King Coal Finally Be Dethroned?

Charles Morand Last Friday, the WSJ's Environmental Capital blog noted how, according to HSBC, growing government efforts to de-carbonize the electricity supply across the developed world would hurt makers of power generation technology with high exposure to coal. Yesterday, the EIA released its Electric Power Monthly report for April 2009. In it, the agency notes the following: The drop in coal-fired generation was the largest absolute fuel-specific decline from April 2008 to April 2009 as it fell by 20,551 thousand megawatthours, or 13.9 percent The April decline was the third consecutive month of historically large drops...

The End of Elastic Oil

Tom Konrad CFA The last ten years have brought a structural change to the world oil market, with changes in demand increasingly playing a role in maintaining the supply/demand balance. These changes will come at an increasingly onerous cost to our economy unless we take steps to make our demand for oil more flexible. We're not running out of oil. There's still plenty of oil still in the ground. Oil which was previously too expensive to exploit becomes economic with a rising oil price. To the uncritical observer, it might seem as if there is nothing to...

Shale Gas: Promises, Promises, Promises

Tom Konrad CFA Dr. Arthur Berman, of Labyrinth Consulting Services has taken a hard look at actual production data from Barnett Shale in 2007. What he found should worry anyone expecting this abundant, relatively clean, domestic energy resource to be cheap. It should especially worry investors in shale gas companies, such as CHK, DVN, and XTO. In a panel entitled "Natural Gas Game Changers?" at the 2009 International Peak Oil Conference, Dr. Breman presented some results from his research into the actual production from the nearly 2000 horizontal gas wells drilled in the Barnett Shale in 2007. The Oil...

What the L.A. Methane Leak Tells Us About Investing

by Garvin Jabusch Sempra Energy’s leaking gas field in Porter Ranch, CA, near Los Angeles, has been making national headlines recently, as it now enters its third month of being the largest methane leak in U.S. history. How big is that? The LA Times says that, “by early January, state air quality regulators estimate, the leak had released more than 77 million kilograms of methane, the environmental equivalent of putting 1.9 million metric tons of carbon dioxide in the air.” 1.9 million metric tons of carbon dioxide and counting. In addition, methane isn’t only a powerful greenhouse gas, it can...

Plug-in Vehicles; Waist Deep In The Big Muddy

John Petersen Generation specific cultural references can be treacherous ground for bloggers because the flashback effect is usually limited to readers with long and vivid memories. In this case, however, the lessons of history are so relevant that I'll accept the risk and offer some context for younger readers. In my youth a war wrapped in the liberal ideology of the Kennedy and Johnson administrations and fueled by an underlying concern over who would control oil and gas resources in the Gulf of Tonkin was fought in the jungles of Vietnam, Laos and Cambodia. By current standards,...

Cleantech Economics 101: Higher Fossil Fuel Prices; More Cleantech

David Gold With all the complexities of cleantech policy and technologies, there is only one simple thing needed for an explosion of competitive clean technologies – increased price of fossil fuels. The amount of R&D expenditures that will need to be invested in clean technology in order for it to hurdle the bar into competitiveness is much greater with low fossil fuel prices. And, the lower those prices, the less appetite the private sector has for making such investments. This leaves a much-increased burden on the back of government through grants and subsidies– a back that is...