Fossil Fuel Industry: Killing the Customer

by Debra Fiakas, CFA

Published by the Climate Accountability Institute, the Carbon Majors Reportlays bare the truth about which companies are responsible for industrial greenhouse gas emissions. One hundred fossil fuel producers are linked to 71% of global industrial greenhouse gases emitted since 1988. Something like a line in the sand for climate scientists, 1988 is the year human-induced climate change was official recognized by the Intergovernmental Panel on Climate Change.

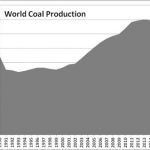

Fossil fuels in the form of coal, crude oil and gas are by far and large the culprits. Rolling forward three decades later, we can observe in the charts below that fossil fuel production...

Hedging Your Climate Risks

Whether you agree it's because of human activity or not (and, for the record, I do), there's no doubt that the weather has been a little wacky over the past few years, driving a range of events that have had very real repercussions on businesses and the economy. Hurricane Katrina is one obvious example, but there have also been other, more subtle cases. Many ski resort operators in North America, for instance, were beginning to believe that winter would never arrive on the eastern side of the continent. In the west, we're now being told that cold weather...

Competition In Environmental Markets Heats Up

Close followers of the environmental finance space have known it for a while; Climate Exchange (CXCHF.PK or CLE.L) is sitting on a potential gold mine. The market for environmental commodities, but especially carbon emissions, is slated to grow significantly over the next 5 to 7 years. It was therefore only a matter of time before competition sprung up, both from small players trying to leverage their technological platforms and from the big guys. The big guys came out swinging this week, with NYMEX announcing a partnership with JP Morgan and Morgan Stanley, among others, to set up a...

Linking Emissions Trading Systems

For those interested in the topic of emissions trading, a new piece was just published by the International Emissions Trading Association on the topic of 'linking' different emissions trading regimes (PDF document). Linking entails allowing emission credits from one scheme to be rendered tradable in another. For example, European credits would be valid and tradable in California, and vice-versa. Beyond allowing the carbon market to become more efficient and liquid, linking could also present a range of arbitrage opportunities. For all of you environmental markets fiends out there, I would definitely recommend this paper. It's short (13...

The Republican-Proposed Carbon Tax

by Noah Kaufman A group of prominent conservative Republicansincluding former Secretary of State James Baker III, former Treasury Secretary Hank Paulson, former Secretary of State George Shultz and former Walmart Chairman Rob Waltonmet with key members of the Trump administration on Wednesday about their proposal to tax carbon dioxide emissions and return the proceeds to the American people. Such an economy-wide tax on carbon dioxide could enable the United States to achieve its international emissions targets with better economic outcomes than under a purely regulatory approach. Attributes of the Republican Carbon Tax Proposal While the details on the...

Carbon ETFs/ETNs: Playing Copenhagen

Charles Morand At $126 billion transacted in 2008, up from $11 billion in 2005, the global carbon market is the fastest growing commodities market in the world and, provided that an agreement is reached at the COP15 conference in Copenhagen and that the US adopts a cap-and-trade program, this growth could go on for several more years. Yet this is a market that remains comparatively unknown for a number of reasons, not the least of which is the fact that the rules surrounding it are very complex. Unlike other commodities, to successfully invest directly in...

ADR For Climate Exchange plc

One of our readers made a useful comment on our last post about Goldman Sachs and Climate Exchange plc. I thought some of you who are unlikely to go back to that post might be interested: "Hey this article on the Climate Exchange was great information. But you should tell your readers that there is an ADR trading OTC here in the states - CXCHF. Get it while the gettin is good. How long 'til GS takes this to the big board?" Thanks for this heads up, cascadehigh. UPDATE: Following this post, I got the...

World Energy Solutions (XWES) and Ram Power (RPG.TO) Appear Promising

From Small Fries to Big Shots? Part 1 of 2 by Bill Paul Feel like rolling the dice on some small alternative energy stocks that appear to have big-time potential? Just remember: sometimes you roll snake eyes. First up: World Energy Solutions Inc. (Symbol: XWES), which currently trades on NASDAQ for $3 and change per share. Worcester, MA-based World Energy Solutions operates online exchanges for energy and green commodities, including the one administered by Regional Greenhouse Gas Initiative Inc. (RGGI), the regulatory scheme under which 10 Northeastern and Middle Atlantic states "cap" their power plants' emissions by requiring...

Is Energy Sourcing the Gateway Drug to Energy Efficiency?

Tom Konrad CFA I recently interviewed Richard Domaleski, CEO of World Energy Solutions (NASD:XWES). World Energy is a comprehensive energy management services firm whose core offering is extremely price competitive energy sourcing (that is, finding an energy provider to supply all of a client's energy needs at the lowest possible cost.) They achieve competitive sourcing using an electronic energy exchange designed to achieve much better price discovery in what is traditionally a very opaque market. According to Domaleski, a recent KEMA study showed that only 7% of large commercial, industrial, and government customers are sourcing their...

Climate Change Will Hurt The Poor Most But the Solutions Don’t Have To

The International Center for Appropriate and Sustainable Technology (iCAST) helps communities use local resources to solve their own problems. I've been a fan of iCAST's approach of teaching people how to fish (or, in this case, how to apply sustainable technologies) rather than giving away fish since I first encountered them at a conference in 2006. Last week, they took advantage of some of their own local resources (namely the fact that the DNC was in Denver) to organize a luncheon with a panel of nationally recognized speakers, any one of whom would have been enough to draw a...

UBS Launches CO2 Emissions Index

UBS (NYSE:UBS) announced on Friday the launch of the UBS World Emissions Index (UBS-WEMI) – the world’s first index based on global carbon markets. At the moment, only the two exchanges linked to the EU Emissions Trading Scheme (ETS) , the Nordic Power Exchange (Nordpool) and the European Climate Exchange (ECX), qualify for WEMI. The index is composed of future contracts on CO2 weighted between the two trading platforms as follows: ECX, 72.11% and Nordpool, 27.89%. The weights are allocated based upon the liquidity of the underlying exchanges as well as their respective share in the European carbon market....

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...

Carbon Emissions ETF

Today, while reading an article on cleantech ETFs by The Motley Fool, I found out that XShares Advisors LLC and the Chicago Climate Exchange were working on a carbon emissions-based ETF (PDF document). There is not a lot of info available on what exactly this ETF will track. We reported back in November that UBS had launched an index based on European carbon prices. As noted by Richard Kang at around the same time, this index is well-suited for something like an ETF. If any of our readers have any further insight on this, don't hesitate...

Trading Places: Will America’s Carbon Market Outsize Europe’s?

Charles MorandIn early January, I said the following on the likelihood that the Obama Administration would move on carbon regulations in the near-term: "The next 12 to 18 months are unlikely to produce much in the way of vigorous environmental action on the part of government (barring subsidies for alternative energy related to the stimulus package), especially if it means additional costs on industry." Clearly, I had underestimated the power of another fundamental rule of politics - besides "don't anger the rust belt states that gave you your presidency by burdening their industries with avoidable costs in the midst...

Some Emissions Trading News

A lot has happened in the world of carbon finance and emissions trading since we last wrote about this topic, so I felt this might be good time to provide a quick update. (A) The World Bank Carbon Finance Unit recently released its State and Trends of the Carbon Market 2007 (PDF document), a periodic assessment of the scale and characteristics of the global market for carbon dioxide emissions. The Bank found a large increase in the volumes traded (131%) and dollar value (177%) of the global carbon market in 2006 over 2005. Unsurprisingly, the EU ETS...

Beware The Vagaries Of Government

I just came across this article on potential problems with the emerging trade in carbon credits. The piece is not technical and I wouldn't say that it is particularly well-researched, but it does raise a key point - as the market for carbon emissions grows, the need for standardization and collaboration between governments and regulators will become ever more pressing. This could create problems. The carbon market is unique in that the commodity traded derives its value primarily from its ability to meet the requirements set by an environmental regulator. There is also a market for voluntary...