Emissions Standards Driving Algae Aviation Fuel Sourcing…or not

by Debra Fiakas CFA Algae in the River Wate photo via BigStock My post “Algae Takes Flight” featured Algae-Tec (ALGXY: OTC/PK), Lufthansa’s new biofuel partner. Algae-Tec has agreed to operate an algae-based biofuel plant in Europe to supply Lufthansa with jet fuel. Lufthansa is footing the capital costs of the plant, which is to be located in Europe near a carbon source. Algae thrive on carbon so industrial plants and power plants using fossil fuels make the best neighbors. Lufthansa has agreed to purchase a...

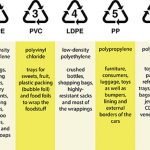

Plastic Recyclers Chasing Arrows

According to Plastics Europe Research Group, over 35 million tons of plastic material was produced globally in 2016, the last year for which full-year data is available. That brought total plastic production to 9 billion tons since 1950. All of those plastic materials remain in existence somewhere - still in use, landfills, junk yards, blowing around the countryside, waterways, oceans, fish stomachs. The post “Plastic Contagion’ on April 13th outline the dangers presented by plastic waste, ranging from respiratory failure from toxic emissions to reproductive interference in aquatic animals.

The building burgeoning volume of plastic waste has sent environmentalists scrambling for solutions to the plastic waste...

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...

Climate Legislation: Who wins? Who loses?

Most Americans now agree that something needs to be done to reduce our greenhouse gas emissions. Hopefully most Americans now appreciate that this is not a small, but even more so, not a simple problem. I am a big believer that the playing field for our low carbon future should start level, and the market should be structured to allow our major power and energy companies a chance to lead the way, instead of simply dishing out punishment for our combined historical choices. Carrots and sticks work well together, but sticks alone are not going to solve our...

Climate Change Will Hurt The Poor Most But the Solutions Don’t Have To

The International Center for Appropriate and Sustainable Technology (iCAST) helps communities use local resources to solve their own problems. I've been a fan of iCAST's approach of teaching people how to fish (or, in this case, how to apply sustainable technologies) rather than giving away fish since I first encountered them at a conference in 2006. Last week, they took advantage of some of their own local resources (namely the fact that the DNC was in Denver) to organize a luncheon with a panel of nationally recognized speakers, any one of whom would have been enough to draw a...

The Republican-Proposed Carbon Tax

by Noah Kaufman A group of prominent conservative Republicansincluding former Secretary of State James Baker III, former Treasury Secretary Hank Paulson, former Secretary of State George Shultz and former Walmart Chairman Rob Waltonmet with key members of the Trump administration on Wednesday about their proposal to tax carbon dioxide emissions and return the proceeds to the American people. Such an economy-wide tax on carbon dioxide could enable the United States to achieve its international emissions targets with better economic outcomes than under a purely regulatory approach. Attributes of the Republican Carbon Tax Proposal While the details on the...

GlyEco Expands Antifreeze Recycling Footprint

by Debra Fiakas CFA Glyeco recycles waste glycol into reusable antifreeze, windshield wiper fluid and air conditioning coolants for the automotive and industrial markets. The used coolant and antifreeze liquids are frequently contaminated with water, dirt, metals and oils. The company uses a proprietary technology at the foundation of its recycling system to eliminate contaminants. The company focuses mainly on ethylene glycol in its six processing plants. Last month chemical recycler GlyEco, Inc. (GLYE: OTC/QB) acquired Brian’s On-Site Recycling, a provider of antifreeze and air conditioning coolant disposal services in the Tampa, Florida area. The deal extends...

Carbon Emissions ETF

Today, while reading an article on cleantech ETFs by The Motley Fool, I found out that XShares Advisors LLC and the Chicago Climate Exchange were working on a carbon emissions-based ETF (PDF document). There is not a lot of info available on what exactly this ETF will track. We reported back in November that UBS had launched an index based on European carbon prices. As noted by Richard Kang at around the same time, this index is well-suited for something like an ETF. If any of our readers have any further insight on this, don't hesitate...

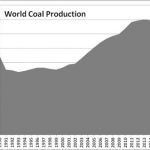

Fossil Fuel Industry: Killing the Customer

by Debra Fiakas, CFA

Published by the Climate Accountability Institute, the Carbon Majors Reportlays bare the truth about which companies are responsible for industrial greenhouse gas emissions. One hundred fossil fuel producers are linked to 71% of global industrial greenhouse gases emitted since 1988. Something like a line in the sand for climate scientists, 1988 is the year human-induced climate change was official recognized by the Intergovernmental Panel on Climate Change.

Fossil fuels in the form of coal, crude oil and gas are by far and large the culprits. Rolling forward three decades later, we can observe in the charts below that fossil fuel production...

World Energy Solutions (XWES) and Ram Power (RPG.TO) Appear Promising

From Small Fries to Big Shots? Part 1 of 2 by Bill Paul Feel like rolling the dice on some small alternative energy stocks that appear to have big-time potential? Just remember: sometimes you roll snake eyes. First up: World Energy Solutions Inc. (Symbol: XWES), which currently trades on NASDAQ for $3 and change per share. Worcester, MA-based World Energy Solutions operates online exchanges for energy and green commodities, including the one administered by Regional Greenhouse Gas Initiative Inc. (RGGI), the regulatory scheme under which 10 Northeastern and Middle Atlantic states "cap" their power plants' emissions by requiring...

Has Shale Gas Reduced Carbon Emissions?

Jim Hansen Last week, I wrote that the U.S. is on course to set a new export record of coal. A few days later the EIA made similar projections and estimate that exports will reach 125 million tons for 2012. One side effect of the success of U.S. coal exports is the degree to which may they have cancelled out the carbon emissions reduction experienced in the U.S. as shale gas displaced coal in the power generation sector. This question of displacement was addressed in a study just released by researchers at the University of...

List of Environmental Markets Stocks

This post was last updated on 4/27/2022.

Environmental market stocks are publicly traded companies whose business involves the trading of commodities designed to represent an environmental attribute, such as renewable electricity, the environmental benefits of renewable energy (Renewable Energy Credits ), Carbon Offsets and other types of environmental offsets.

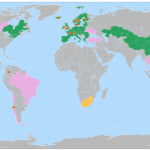

Carbon emission trading implemented

Carbon emission trading scheduled

Carbon tax implemented

Carbon tax scheduled

Carbon emission trading or carbon tax under consideration

By Tbap , via Wikimedia Commons

Crius Energy Trust (KWH-UN.TO, CRIUF)

GlyEco, Inc. (GLYE)

Hannon Armstrong Sustainable Infrastructure (HASI)

Just Energy Group Inc. (JE)

KraneShares Global Carbon ETF (KRBN)

Trading Emissions PLC (TRE.L)

If you know of...

A New Player In The North American Emissions Trading Sector

Over the past two weeks, a couple of announcements were made that went mostly unnoticed despite their importance to the North American carbon marketplace. Firstly, on May 30, the Montreal Exchange, a derivatives exchange, announced that it was launching an emissions trading market for CO2. The Montreal Exchange is now a unit of the TSX Group (TSXPF.PK or X.TO), the firm that runs all of Canada's exchanges. The second announcement came last week, when the premiers of Quebec and Ontario, Canada's two largest provinces and the heart of its industrial base, announced that they were moving ahead...

Hedging Your Climate Risks

Whether you agree it's because of human activity or not (and, for the record, I do), there's no doubt that the weather has been a little wacky over the past few years, driving a range of events that have had very real repercussions on businesses and the economy. Hurricane Katrina is one obvious example, but there have also been other, more subtle cases. Many ski resort operators in North America, for instance, were beginning to believe that winter would never arrive on the eastern side of the continent. In the west, we're now being told that cold weather...

How Energy Deregulation Affects States and Stocks

by Elaine Thompson

Bloomberg New Energy Finance, in an executive summary of its New Energy Outlook 2017 report, predicts renewable energy sources will represent almost three-quarters of the $10.2 trillion the world will invest in new power-generating technology.

Analysts outline several reasons for this increase in spending, such as the decreasing costs of wind and solar and consumers’ increasing interest in solar panels. Competition between power sources also continues to grow, with products like utility-scale batteries upsetting coal and natural gas’s roles in the marketplace.

But more importantly, state-driven renewable portfolio standards pave the way for additional ventures in renewable energy technologies, particularly...

ADR For Climate Exchange plc

One of our readers made a useful comment on our last post about Goldman Sachs and Climate Exchange plc. I thought some of you who are unlikely to go back to that post might be interested: "Hey this article on the Climate Exchange was great information. But you should tell your readers that there is an ADR trading OTC here in the states - CXCHF. Get it while the gettin is good. How long 'til GS takes this to the big board?" Thanks for this heads up, cascadehigh. UPDATE: Following this post, I got the...