Amyris: 90 Days To Build The Future

Jim Lane In California, Amyris (AMRS) reported Q1 revenues of $13.0M compared with $8.8M for Q1 2016, and touted the “significant increase in product sales, primarily in the personal care and health and nutrition markets, offset by a slight decline in collaboration revenue.” Collaboration revenues contributed $4.7M and product sales added $8.3M for the quarter. Big Q1 miss vs analyst expectations As Jeff Osborne at Cowen & Co noted, “Amyris reported revenue of $13.0mn, well below our estimate of $37.1mn due to much lower collaboration payments than we had anticipated. Management has highlighted that these payments can...

Why Traffic Lights Are Turning Green For BioAmber

Jim Lane As many technologies pivot or delay, one train keeps chugging on its route to biosuccinic acid, and markets like BDO, resins and polyols. What is it about the business model that keeps on working? What can every integrated biorefinery learn from its approach? In Minneapolis, BioAmber (BIOA) just announced a contract to supply a minimum of 80% of PTTMCC Biochem’s total bio-succinic acid needs until the end of 2017. PTTMCC Biochem is a joint venture established by Mitsubishi Chemical and PTT, Thailand’s largest oil and gas company, to produce and sell polybutylene succinate (PBS),...

List of Biochemicals Stocks

Biochemicals stocks are publicly traded companies whose business involves using plant or animal based feedstocks (biomass) to create new chemicals or substitutes of existing petrochemicals, plastics, or other fossil fuel derived substances other than fuels.

This post was last updated on 7/9/2021.

Amyris (AMRS)

BioAmber (BIOA)

Bion Environmental Technologies (BNET)

Circa Group AS (CIRCA.OL)

Codexis (CDXS)

Corbion (CRBN.AS; CSNVY)

Danimer Scientific, Inc. (DNMR)

Eastman Chemical Company (EMN)

Global Bioenergies (ALGBE: EURONEXT)

Novozymes (Copenhagen:NZYM-B; OTC:NVZMY)

Royal DSM (DSM.AS; KDSKF; RDSMY)

SECOS Group (SES.AX)

If you know of any biochemicals stock that is not listed here and should be, please let us know by leaving a comment. Also for stocks in the list that you think should...

Amyris Launches Leading Hand Sanitizer and Receives Initial Positive Result for Vaccine Adjuvant

by Jim Lane

In California comes the news that synthetic biology leader Amyris (AMRS) is stepping out to help fight COVID-19. Amyris may be more well known for its sustainable ingredients for the Health & Wellness, Clean Beauty and Flavors & Fragrances markets, but as you all know, things have changed a lot over the last few months and Amyris is now launching a hand sanitizer to help address the high demand triggered by COVID-19. Additionally, the company has completed initial testing of a leading vaccine adjuvant.

Amyris is leveraging its existing capabilities to fast track the availability of a safe...

Amyris’ Date With Destiny: Better Late Than Never

Jim Lane Amyris was dismissed by the critics some time ago, but is ately continuing a big comeback. We have become so accustomed to receiving obituaries of Amyris (AMRS) that recently I was inspired to re-read the Devotions of John Donne to discover if, in fact, he wrote, “Send not to know for Whom the Bell Tolls, it Tolls for Amyris.” Amyris, we were recently assured by short-sellers, was as dead as a doornail, just as Jacob Marley was reputed to be in the opening stave of A Christmas Carol and it is therefore...

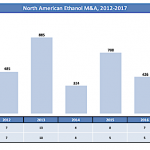

Biofuels M&A: 2017 Review and Outlook

by Bruce Comer, Ocean Park Advisors

More industry players chose to develop and build new capacity rather than buy plants

The North American biofuels industry experienced the fewest merger and acquisition transactions in recent history in 2017. There were only six M&A transactions, with a total estimated value of more than $100 million. They involved eight plants with 297 million gallons per year (MGPY) of production capacity. Half of these deals were for non-operating plants. A fourth deal was for a sub-scale demonstration plant. Contributing to the limited deal flow, two historically active acquirers, Green Plains and REG, did not close...

Amyris’ Mysterious Partner

Jim Lane In California, Amyris (AMRS) has a new partner, described fetchingly yet with near-to-complete vagueness as a “a leader in food ingredients and nutraceuticals” which is roughly as helpful as describing a person as “someone who enjoys ice cream”. Some ice cream there is, nevertheless, in this agreement, which will bring a short-term collaboration investment of $10 million, an equity investment of up to $20 million at $1.40 per share, and $100 million in annual revenue starting in 2017 connected to the production and cost improvement of fermentation molecules. One thing, and the only one, we discover...

Interview With Dan Oh, CEO Of Renewable Energy Group

Jim Lane Leading a series this week, “The Strategics Speak", in which we’ll look at what a number of major strategic investors see in the landscape relating to industrial, energy and agricultural investment, Biofuels Digest visited with Dan Oh, CEO of Renewable Energy Group (REGI), which has long been the US’s leading independent biodiesel producer but in recent years has steadily diversified and expanded operations. In many ways, REG is the entire industrial biotech business in a nutshelll. They’re fermentation (through REG Life Sciences), and thermocatalytic (through REG Geismar and their extensive biodiesel business). They use both...

BioAmber Completes IPO

Jim Lane Raises $80M at $10 per share; becomes first new industrial biotech company to complete IPO in more than a year. What went right and how? Is the IPO window re-opening? In Minnesota, BioAmber announced the pricing of its initial public offering of 8 million units consisting of one share of common stock and one warrant to purchase half of one share of common stock at $10 per unit, before underwriting discounts and commissions. All units are being sold. BioAmber has granted the underwriters an option for 30 days to purchase up to an additional 1.2 million...

BioAmber’s $150 Million IPO: The 10-Minute Version

Jim Lane A first-to-market leader in bio-succinic acid comes to the public markets with its IPO. Can BioAmber translate a lead in succinic acid’s smallish market into leadership in a vast array of high-priced renewable chemicals? Here’s our 10-minute version of the BioAmber IPO, with a translation of the risks into English. In Minnesota, BioAmber has filed an S-1 registration statement for a proposed $150 million initial public offering. The number of shares to be offered in the proposed offering and the price range for the offering have not yet been determined. The lead book-running managers for...

Amyris Reaches Positive Cash Flow

Jim Lane In California, Amyris announced positive cash flow of $1.7 million in the first quarter despite negative currency effect of $1.2 million. Overall, Amyris recorded Q1 2015 non-GAAP cash revenue inflows of $30.3 million, compared with $17.9 million for Q1 2014. Total Q1 2015 revenues were $7.9 million, an increase of 30% compared with same quarter last year. Cash, cash equivalents and short-term investments of $44.9 million at March 31, 2015, an increase from $43.4 million at December 31, 2014. “We’re pleased with our continued execution toward diversifying and growing our revenue base through an expanding...

BioAmber: Fingers Crossed

by Debra Fiakas CFA Plastic is everywhere - our homes and offices, the cars we drive, our personal items, food containers and even our dental fillings. Plastic is also toxic. Dioxins, BPA (bisphenol A) and PCBs (polychlorinated biphenyl), both of which are critical chemicals in plastics, have been identified as endocrine disruptors, upsetting hormonal balance, triggering the growth of tumors and interfering with sexual development in fetuses. Even people who deliberately avoid plastics are exposed to the toxicity. For example, we ingest BPA when eating fish that lived in waters contaminated with plastics. Remember that ‘island’...

Biofuels & Biobased Earnings Roundup: Amyris

by Jim Lane

The Top Line. In California, Amyris (AMRS) reported Q2 GAAP revenue for the second quarter of 2018 of $24.8 million, compared with $25.7 million for the second quarter of 2017. Grants and collaborations revenue was $11.4 million for the second quarter of 2018 compared with $10.3 million for the year-ago period. The company noted that Q2 revenue was $24.8 million compared with the same period in 2017 of $21.7 million when adjusted for the low margin product sales on contracts assigned to DSM (DSM.AS). This reflects 15% growth on an absolute basis. GAAP net loss for the first half was $89.1...

The Velocity of Amyris

Jim Lane What makes Amyris (AMRS), Amyris? We look at the products, the evolution of the story, the partners, the focus on yield, and deeper into the story of Rate. “I mean, man, whither goest thou? Whither goest thou, America, in thy shiny car in the night?” “Whither goest thou?” echoed Dean with his mouth open. We sat and didn’t know what to say; there was nothing to talk about any more. The only thing to do was go.” Jack Kerouac, On the Road Amyris experienced last month what CEO John Melo referred to as “our...

Gevo: Are We There Yet?

by Debra Fiakas CFA The renewable chemicals and biofuel company Gevo, Inc. (GEVO: Nasdaq) is scheduled to report fourth quarter 2013 financial results on March 25th. Analysts have a couple of weeks to prepare questions for management during the earnings conference call. Top on the list has to be got to be about Gevo’s recent agreement to license its novel isobutanol technology to Porta Hnos of Argentina. Porta Hnos is a well established ethanol producer so if the license is consummated, it is expected that this partner has the ability to execute on plans to produce isobutanol for...

Biofuels & Biobased Earnings Roundup: DSM

by Jim Lane

The Top Line. In the Netherlands, Royal DSM (Amsterdam: DSM.AS; US OTC:KDSKF; US ADR:RDSMY) reported a good H1 with organic sales growth in underlying business estimated at 10% and adjusted EBITDA growth of underlying business estimated at 7%, with sales of €4,794 million and adjusted EBITDA of €771 million.

The Big Highlights. Nutrition: an estimated 8% underlying organic sales growth and Adjusted EBITDA growth of underlying business estimated at 6%. Materials: 7% organic sales growth and Adjusted EBITDA growth of 5%. DSM also confirmed its full year outlook 2018, as provided at Q1 2018, and expects an Adjusted EBITDA growth towards...