By Tom Konrad, Ph.D., CFA

Even as the broad market rose, the start of 2021 was brutal for clean energy stocks. The sector experienced a bubble in late 2020 and January this year as optimism grew that we finally had a President who understands the magnitude of the climate problem and has committed to do something about it. The bubble also grew from the great hope that with the presidency and slim majorities in both houses of congress, he would actually be able to get his agenda through.

That might have happened if the Senate Republicans were interested in governing and solving this country’s problems, or if the Democrats majority did not depend on a coal state Democrat like Joe Manchin, who takes regular meetings with fossil fuel lobbyists.

With climate, renewable energy, and social infrastructure stripped out of the slim bipartisan infrastructure deal, action on climate depends on getting them into a reconciliation deal which Senate democrats would pass without any Republican votes. That means this bill would need the vote of every Senate Democrat, including Manchin and Kristen Sinema.

This leaves a large investment in climate infrastructure between a rock and a hard place. Progressive Democrats in the House (rightly, in my opinion) are making their support for the bipartisan traditional infrastructure package recently agreed by Joe Biden and five moderate senators from each party contingent on getting a strong reconciliation bill which includes climate action. But any such bill will have to get every Democratic vote in the Senate, which gives Manchin and other conservative Democrats a veto on any part of it.

There is still a good chance that such a reconciliation bill will pass, but January’s euphoria is rightfully gone.

Reasons for Bottom

When things are darkest, and investors are looking for reasons to be pessimistic rather than reasons to hope is the best time to buy. Clean energy stock ETFs like PBW and RNRG seem to have found bottom in May. Biden is still making progress on climate with executive actions despite the congressional deadlock. Local and international governments are also not sitting idle waiting on the dysfunctional US congress. Further, economics are now on the side of renewable energy:

- In many places, it now costs less to build new solar plants than to run existing coal plants to produce electricity

- It costs less to build and operate an all-electric home than one that uses fossil fuels in most parts of the US.

- Wind, solar, electric and batteries are continue to fall in price, making these already competitive technologies the most cost-effective option in more and more situations.

On top of all that, we still may see significant spending on climate out of a reconciliation bill this fall.

Conditions feel right for clean energy stocks to resume their upward trend. That assumes, of course, that the market as a whole remains stable.

10 Clean Energy Stocks For 2021

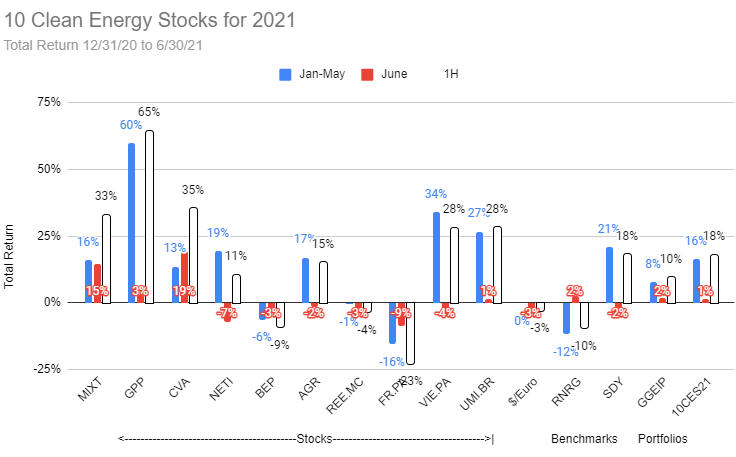

Below are the first half 2021 returns for the Ten Clean Energy Stocks model portfolio. I feel Eneti (NETI) and Valeo (FR.PA, VLEEF, VLEEY) are particularly attractive right now.

DISCLOSURE: Long all stocks in the 10 Clean Energy Stocks for 2021 portfolio, including NETI and VLEEF.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.