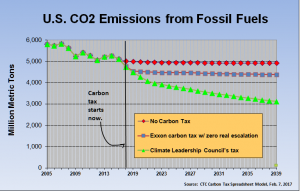

An article posted by ClimateLiabilityNews.org Hearing Glosses Over Carbon Tax Proposal’s Liability Waiver explains the ‘grand bargain’ being set forth in a proposal from the Climate Leadership Council. A Carbon Tax & Dividend plan is now being supported by big corporations, polluters and fossil fuel companies, which would seem to be a miraculous change in sentiment. But the fine print discloses that the deal includes a liability waiver exempting fossil fuels companies from federal & state climate tort lawsuits. The carbon tax is on the low end for “social cost of carbon” calculations, at $40/ton, so as a value proposition, it’s not as big of a concession as the benefit they are seeking in the tort immunization – they would get a huge relief in exchange for a pittance. As if that weren’t enough, it also asks for a rollback of most greenhouse gas regulations, what it calls “regulatory simplification.” So this proposal is grossly skewed in favor of fossil fuels.

Although most U.S. taxpayers would benefit from monthly dividend payments, none of the proceeds would help cities and states pay for the astronomical costs of climate mitigation and adaptation.

Kathrin Sears, supervisor for Marin County considers the permanent legal immunity provision a fossil fuel-funded Trojan Horse. Marin along with San Mateo county & city of Imperial Beach, CA sued 37 companies in 2017 seeking compensation for climate damages. “Letting oil, gas, and coal companies off the hook means taxpayers from Marin to Miami will have to pay tens of billions of dollars in order to protect our communities from the climate change-related costs and damages those companies knowingly caused,” Sears said.

CLC published a statement on 1/17/19 in the Wall Street Journal advocating for a carbon tax & dividend policy signed by more than 3,500 economists, which in itself is an indisputably impressive display of consensus. The statement did not directly cite the CLC’s Baker-Schultz Plan. CLC founder Ted Halstead, has characterized the Baker-Schultz plan as “bipartisan”. That may possibly be true if an exhaustive review were conducted of the partisan positions of all these economists, which was not included, but if evaluated against the partisan positions of the Founders, that is clearly not the case, the Founding members are not bipartisan in any real sense.

Founding members of the Climate Leadership Council include oil giants Exxon, BP, Shell, and Total, P&G, J&J, PepsiCo, Excelon. It names numerous republican and conservative luminaries including: former Fed chairmen Ben Bernanke & Janet Yellen, five former cabinet members , Steven Chu, Christine Todd Whitman, and Larry Summers, George Schultz & James Baker; former NYC Mayor Michael Bloomberg, former chairman of Reagan’s National Economic Council, Martin Feldstein, Harvard economics professor Greg Mankiw, Steven Hawking, & CEO of the largest hedge fund, Ray Dalio.

You could perhaps say that Steven Chu, Steven Hawking, and Larry Summers were representative non- republicans supporting CLC’s claim of bipartisanship, but I suspect Chu & Hawking as scientists were just happy to be part of something that seems positive & perhaps don’t really appreciate the liability part of the equation, so they are really more “non-partisan” than democrat. However, the same could not be said for Larry Summers who is much more akin to a republican than a Dem. He has a long history of working for elite interests, in how he advised Obama as Treasury Secretary & on the Economic Counsel, and as President of Harvard, not divesting from fossil fuels either for the Endowments or in refusing donations from fossil fuel companies. Everyone else on the CLC list are all dyed-in-the wool FF advocates, couldn’t fairly be described as having any real interest in environmentalist concerns.

However, most surprising was inclusion in this CLC list of Founders of the environmental organization The Nature Conservancy. I would have thought with a name like that, there would be an appreciation for enormity of the IMF’s enumeration of implicit subsidies from externalities totaling $5tr PER YEAR which has appeared in more than just an obscure NGO report, but also in the popular press Fossil Fuel Subsidies Cost U.S. More than Defense Budget: IMF Report – Rolling Stone. Litigation is one path to validate these expert assessments of aggregated costs that have been avoided, externalized by fossil fuel enterprises, and hence can be seen as subsidies, and as the basis for damage claims in these litigated climate tort cases. This is why if they ever result in an award, they will be much bigger than the tobacco settlements, and will result in a ripple effect through the universe of fossil fuel asset valuations. This would empower the ESG shareholder activists fighting with Exxon over climate disclosures, which, if they appraised the value of their assets in the ground for a value AFTER the financial earthquake of such a tort damage award. Their asset values would be at risk for a precipitous decline, which is the very risk disclosure that Exxon is refusing to make. They would prefer to continue to cultivate illegitimate doubt by sponsoring climate denialist experts, and by supporting diversionary carbon tax proposals.

Does Nature Conservancy understand this, that establishing values for damage claims through litigation will validate the IMF’s method that includes health costs & climate catastrophe costs, & property damage from rising sea level & fires? Surely they understand that preventing the success of this demonstration will be obviated if blanket liability waivers are legislated. Surely they understand that the only way for a long-term wind down of a fossil fuel based economy is to 1) devalue the assets in the ground, 2) reduce demand by shifting to renewable supply, & that 3) imposing litigated damages is the leverage that will catalyze these changes. Right?

Indeed they do, which makes sense once you see who is on their Board, and realize that this entity is a fossil fuel captive. https://www.nature.org/en-us/about-us/who-we-are/our-people/

Board of Directors:

- Larry Fink is CEO. They got the guy who runs the largest asset management company in the known universe, Blackrock, which as $5Tr in Assets Under Management. On the one hand, Larry Fink has expressed publicly in his famous Letter the need to broaden corporate responsibility away from rank corporatist shareholder supremacism, & use language about considering other stakeholders, which for most would mean customers, labor & environment, sounding very progressive, on the same page as Elizabeth Warren’s Accountable Capitalism. But Larry noticeably omits consideration of the Commons as having status as a “stakeholder”, focusing on the workers, generational wealth transfers, etc. Sitting on the Nature Conservancy board AND agreeing to accept FF liability waivers means that whatever dilute expressions of environmental concern he has ever made from his perch atop that $5tr AUM, is mere greenwash tokenism.

- Bill Frist, former republican senate majority leader….I don’t think could be trusted to be taking a stand against FFs. If medical costs were considered a damage item, he really has never been an advocate for enhancing & widening public medical coverage. Rather, his legislative legacy was just a typical conservative obsessive focus on anti-abortion legislation, and a mission to narrow public benefits, and continue their commitment to structuring upward wealth transfers.

- Joseph Gleberman comes from Pritzker, a private equity firm with zero environmental investments, and the site discloses only “various oil & gas interests, various lumber & farming interests”….tobacco….really not likely to have high ESG ratings. Why is he even on this board? Same answer, or maybe he’s the expert in appreciating the threat, from his front row seat in the tobacco litigation.

- Shona Brown, from Google….aggressive environmentally themselves, but not really advocates for eliminating externalities, more about gaming them.

- Harry Hagey former CEO of Dodge & Cox, a mutual fund, nothing particularly environmental here.

- Andrew Liveris, former CEO of Dow Chemical….. this doesn’t even need any research to see that this is obvious evidence that TNC intended to include foxes in this chickenhouse

- Jack M, CEO of Alibaba – who knows if he cares about anything, he’s just a big Asian investor

- Douglas Petno, CEO commercial banking JPMorgan…..the greenest thing JP Morgan is doing is bundling solar backed securities….definitely not in the business of taking a stand for imposing liability for externalities. JPM is more about tokenism & opportunism than carbon transition.

- Vincent Ryan, CEO of Schooner Capital – says his expertise is in alternative energy industries, but looking at Schooner’s portfolio, there wasn’t one single company that had anything to do with alternative energy, so that’s misleading. Bloomberg says he served at ChangingWorlds which is an arts org; he founded Iron Mountain, which is a data storage firm; director of Cablevision. There is a brief reference to an ambiguous title: National Hydro and Arch Mobile Comm, for which there are no google returns… stokes the imagination to wonder how a hydro firm & a telecom could be under one roof. His claim to have expertise in alt energy is completely unsubstantiated, maybe he reads a lot, like me.

- Moses Tsang, CEO of AP Capital Holdings – references one fund under private equity that includes “clean energy”, along with electronics, tech, food/bev. So clean energy is incidental.

- Yin Wu, China Capital group – Bloomberg does say it is invested in new energy & environmental protection, along with info tech, fintech, bio-med, media. So maybe an environmentalist, barely

- Meg Whitman. I do not see how she could claim to be an environmentalist, nothing in her history supports that. She has been in tech, in electoral flaps, is now in private equity, & is CEO of Quibi, as startup mobile media company. She is not on this board because of her environmentalism but because of her lack of it.

Buried in this throng of non-environmentalists are a few token representatives who have devoted more than a couple minutes to the issues:

- Thomas Tierney, Bridgespan Group – consulting for non-profits….but its spawn of Bain Capital – quacks vaguely about impact investing, vague goal of “social change”….at least mentions public health, but looks like it may just be a pretense for PE to dump tax deductible donations….so this belongs back up in the 1st group.

- Mark Tercek – http://marktercek.com/says he’s the CEO of TNC, wonder if Larry Fink knows…..maybe Fink is the titular head & Tercek the operational head. He was at Goldman Sachs for 24 yrs., was tapped to develop the firm’s environmental strategy and to lead its Environmental Markets Group. Cuomo appointed him to serve on the 2100 Commission after Superstorm Sandy to plan more resilient infrastructure. He sits on many other boards.

- Frances Ulmer, US Arctic Research Commission

- Sally Jewell, former Sec of Interior under Obama

- Nancy Knowlton, Chair Marine Science, Smithsonian Museum Nat. History

- Craig McCaw, CEO Eagle River, a firm that manages a portfolio of hydro plants.

So the ratio is 5:13 of actual environmentalists to life-long dedicated corporatists with either zero or antipathy to environmental concerns. Wonder how the voting went when the issue of liability waivers came up.

The mission statement sounds good: they focus on “Nature Based Solutions (NBS)”, meaning reforestation, grasslands, wetlands, sustainable land management, land trusts – all good, congruent with a progressive agenda that would include desert greening, halophytes crops, sea grasses & mangroves, farming soils regeneration, etc. But the other prong of their policy advocacy is pairing this with carbon offsets, which has so far been anything but revolutionary, a “transition” mechanism leading into carbon taxes, which is another transition mechanism. It is a tactic that advocates of more progressive carbon tax policies with a higher social cost of carbon, have had to accept as a negotiated, political alternative, for decades now. Which is not to say carbon offset programs, like RGGI for example, have not had some success and effectiveness, but they cannot be said to have closed the emissions gap appreciably, in part because adoption has been limited, again because of the effectiveness of fossil fuel lobbying in opposition. TNC has posted a huge repository of downloadable papers https://www.nature.org/en-us/what-we-do/our-insights/reports/ (their domain name is deceptively close to Nature.com, the prestigious science journal). One such paper makes a solid case for nature based solutions, and undoubtedly many of the other papers also have merit. NBS will be an important part of the overall solution.

The CLC’s economic attack dog is Gregory Mankiw who argues in favor of a carbon tax based on Pigou consumption tax model, & tries to downplay the IMF’s $5tr subsidy accounting. But nattering for shifting costs of a carbon tax to consumers obscures the point of the IMF’s radical analysis, which is to make visible the scale & invisibility of this subsidy, to confront the fact that the planetary system itself is making this invisible economic assumption manifest as a thermal behemoth.

The CLC’s approach is very business friendly. But there are two kinds of “business friendly” that should be distinguished. One is the path that supports a more libertarian “free market” & corporatist dominance perspective, which is a massive disinformation project since the very scale of both explicit and implicit subsidies constitutes evidence that these “market” adherents are beneficiaries of a market unfairly skewed to their advantage.

The other is the kind of advocacy seen from Rocky Mountain Institute & its affiliates, which has contended for decades that aggressive conservation & transition to renewables should be pursued because a) failure to do so has a big downside to profitability, & b) that renewable entrepreneurship has a huge upside potential, will be a boon, not a burden. RMI’s posture is different than the much more dilute advocacy from Nature Conservancy, which is oriented to protecting existing capital & enterprise structures from the burdens of re-internalized externalities and the potential for huge stranding of fossil fuel assets. RMI may not overtly advocate like the Nation or Jacobin for nationalization, but neither would I expect to see RMI advocate against climate liability litigation, in favor of liability waivers. That last step, supporting waivers, constitutes an admission by TNC that they are a FF captive, despite posing a very convincing presence as an environmental activist organization from their mission statement & published papers.

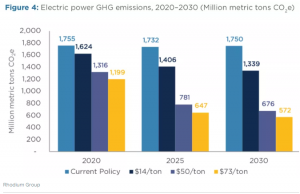

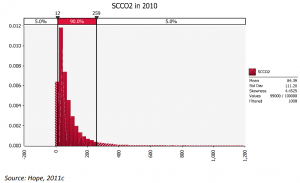

What is the alternative to CLC’s approach? Several excellent pieces comparing carbon proposals place it into context. David Roberts has posted excellent overviews about pricing the social cost of carbon in a 2012 piece in Grist making the case  that a low priced carbon tax is essentially a conservative project, that to be effective, the price must be significantly higher than $50/ton, and as updated in his 2018 piece in Vox where he notes that some researchers believe that the true social cost of carbon may be much higher than today’s estimates, as high as $250/ton in the US according to a study at Cambridge University. Even an aggressive social cost of carbon policy, although a step in the right direction, would barely scratch the surface of these subsidies in aggregate.

that a low priced carbon tax is essentially a conservative project, that to be effective, the price must be significantly higher than $50/ton, and as updated in his 2018 piece in Vox where he notes that some researchers believe that the true social cost of carbon may be much higher than today’s estimates, as high as $250/ton in the US according to a study at Cambridge University. Even an aggressive social cost of carbon policy, although a step in the right direction, would barely scratch the surface of these subsidies in aggregate.

It has been argued that a policy bias favoring these implied fossil fuel subsidies skews the entire spectrum of asset yields. An OECD study Role of Pension Funds in Financing Green Growth Initiatives (2011) contended that renewable projects are mispriced due to adequately pricing carbon externalities, which depresses the relative returns, resulting in lower yields for renewable assets.

To the extent the OECD premise is correct, that the yield environment is distorted by implicit subsidies for fossil fuels (coal, nat gas, & for nuclear) in the form of structurally embedded externalities, a reasonable conclusion is that policies which re-externalize these costs could contribute to enhancing the competitiveness of yield from renewables. This would do more to affect the global economy and capital flows than a carbon tax ever could. I covered this in a Roadmap for a Green New Deal article from last year. Green bond yields would likely outcompete yields for FF-related bond issuances if the defacto “put” benefit derived from these externalized costs were challenged. Then the discussion would not be restrictively framed 2-dimensionally as Mankiw would have it, to just slicing up the pie of carbon tax revenues.

Leveling the playing field is laudable, but if the very baseline economy itself is effectively owned by fossil fuel interests, by dollar-denominated fossil fuel assets, and the industry in turn politically “owns” all the regulatory bodies that could ostensibly have the publicly-conferred power to stand against their dominance, how else could this begin to happen? Except perhaps in the courts?

The other possibility would entail re-framing the social contract at the same level of abstraction that is necessary to argue that concentrated wealth is really just a concession that could be taken back, or that slaves as assets could be granted the liberty to run free. That is how deep this rut in our thinking is. And it took arguably 100 years after the civil war, past the Hayes bargain eviscerating Reconstruction, 80 years of Jim Crow, all the way to FDR in WWII & Johnson’s Civil Rights Act in ’64, to shift perspectives on a slave economy. We don’t have 100 years to alter the social contract that allows big corporate interests to dictate fossil fuel pollution policy.

The truly revolutionary path would be nationalization, most disruptive, most aggressively modeled on an environmental FDR new deal industrialization plan. So far, the two best articles I’ve seen elaborating this are: The Policy Weapon Climate Activists Need (Nation) & A Plan to Nationalize Fossil-Fuel Companies (Jacobin). As high level idealistic abstraction, nationalization is up there with Universal Basic Income, a green industrialization & social justice plan, re-empowering labor unions, putting Anti-Trust & corporate fraud prosecutions on steroids, & imposing a mandatory disclosure requirement for beneficial ownership to recover the $32Tr laundered away in nested shell corporations.

Climate liability litigation is going to be the place where these damage claims are entertained. A home base for this information is Climate Liability News and David Roberts again weighs in with one of the most comprehensive surveys of current climate litigation. Eight US cities, five counties, and one state are suing some of the world’s largest fossil fuel companies for selling products that contribute to global warming while misleading the public about their harms. In parallel, 21 young people are trying to suspend fossil fuel development as part of their high-profile climate rights case, Juliana v. United States, against the government. (The case is currently awaiting a hearing at the Ninth US Circuit Court of Appeals.) Lawsuits by the cities of San Francisco and Oakland are pursuing a legal theory of public nuisance. They were consolidated by District Court Judge Alsup who then dismissed the claim saying “the problem deserves a solution on a more vast scale than can be supplied by a district judge or jury in a public nuisance case,” & suggested that the harms of fossil fuels might have to be balanced against the benefits they yield to civilization. Alsup also requested a tutorial on climate change science & the defendants — BP, Chevron, Exxon Mobil, Shell, and ConocoPhillips — agreed that humanity is causing changes to the global climate and did not dispute the science. Another theory being pursued is a civil rights claim, arguing that the US government knowingly undertook policies that contributed to climate change, by leasing public lands, & providing supportive public policy.

If one of these cases finally hit, it would have a bigger impact than the tobacco settlement. Because the damage claims would be larger if relying on the IMF data for health costs from FF pollution, & data from catastrophic insurance payments are offered as credible basis, as the actuarial foundation for establishing that the scope of the public damages. Would an award be based on negligence or would it also include a punitive award based on demonstration of an intentional mass tort? Would the evidence of corporate lobbying to obtain preferential policy treatment be allowed in as evidence of an intentional act? Is the intentional concealment campaign by all the oil majors, Exxon, Shell, BP, etc, that has been widely publicized by investigative journalists at InsideClimateNews.org, sufficiently egregious to justify a punitive multiplier to the negligence claims? Is it a defense to say that public accepted their campaign misinformation, that the legislature collaborated with their misinformation campaign by agreeing to perpetuate permissive policies? That a campaign of deception & bribery cannot be challenged because it is so pervasive that it constitutes a defacto American business as usual? That it is Too Big to Fail?

Reinsurers are monitoring all this, and if there were to be a singular moment of success, the risk exposure for re-internalizing all these health claims and property claims would far exceed the capacity of existing liability insurance coverage. There would likely be denials of coverage because the risks would not have been underwritten prior to the legal award, so all the liability risks would have to be re-priced, which would add a huge operating expense, but there would likely also be a substantial amount of exposure simply left uncovered, with no recourse for indemnification. There would be similarities to what has happened in the nuclear power industry, which is allowed to operate with coverage limits far below the actual losses that would be incurred by a major nuclear catastrophe. Without these kind of concessions and legal immunities, the nuclear power industry would not likely have developed to the extent that it has. Even if a blanket liability waiver is not obtained, the model offered by the nuclear industry shows that much the same effect can be achieved, in socializing risks, by simply placing caps on liability. Rather than take the litigation risks to zero, they would be taken down to $.10 on the dollar. Interestingly, the costs for D&O liability coverage is rising as the exposure to executives for climate related decisions. This is a positive sign, that there is less sympathy for the idea that these decision makers are not necessarily “too big to jail”.

An influence campaign for Mitch McConnell to bury the conversation with a liability waiver for fossil fuels in exchange for a republican advocated carbon tax & dividend program would be a “bread & circuses” conciliation. It would have an even bigger adverse environmental effect than the Cheney/Halliburton waiver (allowing for concealment of fracking chemicals) had on precipitating the boom in gas fracking. It would accelerate, not suppress, taking FF’s out of the ground. If we can stipulate that this point is obvious, then Nature Conservancy is being willfully ignorant, but more likely complicit.

Other litigation being pursued by state Attorneys General in NY, MA & CA. They allege that it is fraud upon the shareholders in failing to fully disclose the risks of a potential write down of the value of the reserves in the ground, due to either a policy-driven imposition of a carbon “budget”, or a market driven fade in demand, or a combination. That failure in disclosure of a risk to the value of the shares constitutes a securities fraud that is referable to the SEC. It is, in effect, an ESG-focused enforcement, on disclosure alone, but does not include reference to the deliberate propaganda fraud. But if these cases were to be won, and some kind of preliminary damage claim established, the next level of litigation, which would be against the intentional propaganda fraud, would have a better likelihood of success. Most of the oil majors are having protracted legal battles with activist shareholder groups over these disclosure issues.

That is why the FF majors are advocating for relief, offering a pittance of a carbon tax as a weak show of “good faith” after decades of bad faith leading to multiple wars & now a threat of global climate catastrophe. They want a blanket waiver from litigation, to head off a potential blizzard of further litigation, which could escalate rapidly, if there were a few adverse outcomes. If there were a few multi-billion dollar damage awards, there would initially be a modest impact on their earnings reports, but the next round of litigation could more credibly be forecast to scale to a tipping point. A “run on the bank” would froth up, in the form of a rush of class action cases to capture the remaining profitability before they founder altogether. Momentum of capitulation would escalate, as the worst-case scenario of stranded assets on a colossal scale would begin to materialize. The previously remote possibility nationalization would begin to emerge appear eminently more reasonable. A substantial drop in share price of the largest 500 FF companies (including transnationals with sufficient market contacts to establish jurisdiction), would open the door to nationalization, framed either as a bargain or as a bail out. This would be the only scenario in which an orderly build down of the FF industry and a scale up of renewable energy, with the scope of a Green New Deal industrialization plan, could foreseeably occur. As long as the broad FF industry exists in the current framework, as private property assets rather than treated as a public asset, there will continue to be resistance to concerted climate action at the pace necessary.

The attitude is on display in the propaganda on the website of the largest industry association American Petroleum Institute, on the utter disinterest by Russian state fossil fuel firms like Rosneft, and even the relatively forward-looking Shell with its forecasts that it will still be winding down its fossil fuel operations in 2070.

Bottom line, policy on a liability waiver is the choke point, the Battle of Thermopylae, for the future of energy. The fossil fuel industry is pulling all its available propaganda and influence levers to get the kind of immunity it desperately needs. But the environmentalist litigants have facts and public sentiment behind them, and need one major success in the courts to trigger a cascade of consequences that would open up a far more hopeful pathway for planetary survival.