yieldco - search results

If you're not happy with the results, please do another search

Hannon Armstrong Declines to Raise Dividend, Sets 3 Year Guidance

Investors did not like Hannon Armstrong's (NYSE:HASI) fourth quarter earnings announcement last night. While core earnings were a little weaker than expected, that is not what has the stock trading down 11% today. What shocked investors is the fact that the company did not raise the dividend this year for the first time since the REIT went public, and it gave 3 year guidance which likely disappointed many investors.

Last month, I wrote,

I expect that Hannon Armstrong will continue to be a well run and conservative business in 2018, and that management will raise the dividend at the lower end...

Ten Clean Energy Stocks For 2018

Tom Konrad Ph.D., CFA

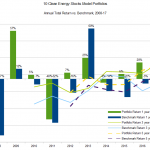

Ten Years of "10 Clean Energy Stocks." A 38% total return in 2017 is the one to beat.

I started blogging about investing in clean energy stocks in 2005. At the time, I had just started an independent investment advisory practice, and thought blogging was a good way to impress people with my knowledge of clean energy. I don't know how many people I impressed, but the clients were hardly pounding down the door.

What I did learn, however, was that I loved writing about clean energy from the perspective of a stock investor. Because I was...

Ten Clean Energy Stocks For 2017: Taking Profits

By Tom Konrad Ph.D., CFA

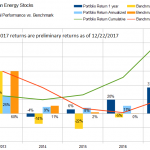

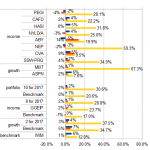

2017 is turning into a second banner year in a row for my “Ten Clean Energy Stocks” model portfolio. I expected at best to make high single digit returns after the impressive 20% (while my benchmark fell 4%). Instead, the portfolio produced a 36.8% total return while its benchmark is up 19.5% with only four trading days left in the year.

Such returns are obviously cause for celebration, and also for profit taking. I plan to replace at least five of this year's list with new stocks in the 2018 (tenth annual) “Clean Energy Stocks” model...

Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...

Ten Clean Energy Stocks For 2017: Sunny August Skies

by Tom Konrad Ph.D., CFA

After a strong performance all year, the stock market stumbled in August, along with clean energy stocks in general, although the sector continues to outperform the broad market. My Ten Clean Energy Stocks model portfolio again came out on top, buoyed by two winners (Seaspan Preferred (SSW-PRG) and MiX Telematics (MIXT). Both were catalyzed by strong earnings reports at the start of August, which I summarized last month.

For the month of August, the model portfolio was up 0.9%, for a 26.3% total gain for the year to the end of August. It's clean energy benchmark...

Ten Clean Energy Stocks For 2017: Summer Harvest

Tom Konrad Ph.D., CFA

Colossal Fossil Failure

With a president actively hostile towards renewable energy and focused on promoting fossil fuels, it would be easy to think that clean energy stocks would underperform their fossil cousins. The exact opposite has been true. Despite the administrations' efforts and tweets bragging about new highs for the Dow, energy funds are down over 10% for the year. For example, the Energy Select Sector SPDR (XLE), largely composed of oil and gas companies, is down 13% for the year. The tiny coal sector did better, with the VanEck Vectors Coal ETF up 18%.

Even so, Trump's...

Power REIT: No News Is Good News

Tom Konrad Ph.D., CFA I first wrote about Power REIT (NYSE MKT:PW) in 2012, when the tiny real estate investment trust unveiled its plans to become what would have been the first Yieldco by investing in the land underlying solar and wind farms... before the term 'Yieldco' had even been invented. In the years since, the company made some progress buying land under solar farms. According to the most recent shareholder presentation, they now own land under seven solar farms totaling 601 acres and 108 MW, in addition to their legacy railroad asset. These assets produce...

Ten Clean Energy Stocks For 2017: First Quarter Earnings

Tom Konrad Ph.D., CFA In the two months since the last update, most of the stocks in my Ten Clean Energy Stocks model portfolio have reported first quarter earnings. There were few surprises, and those were mostly pleasant ones, allowing the model portfolio to add to its gains, and pull a little farther ahead of its benchmark. For the year to the end of May, the model portfolio is up 13.8%, 2% ahead of its benchmark. The benchmark is an 80/20 blend of the clean energy income...

Ten Clean Energy Stocks For 2017: Earnings Season

Tom Konrad Ph.D., CFA Earnings season began in earnest in February. My Ten Clean Energy Stocks model portfolio gave back a little of its large January gains because a mix of good and bad earnings mostly offset each other. One pick (Seaspan Preferred) gave back its large January gains. Neither the original gain nor the loss were driven by news. Instead, they seemed driven by investors changing expectations for global trade in an uncertain political environment. For the year to March 17th, the portfolio and...

Ten Clean Energy Stocks For 2017: January Jump

Tom Konrad Ph.D., CFA The year got off to a spectacular start for my tenth annual Ten Clean Energy Stocks model portfolio. (You can read about the performance in 2016 and prior years here.) The portfolio and its income and growth subportfolios were up 9%, 8%, and 14%, respectively. Clean energy stocks in general also did well, with my three respective benchmarks up 2 to 3% each. (I use the YieldCo ETF YLCO as a benchmark for the income stocks, the Clean Energy ETF PBW as a benchmark for the...

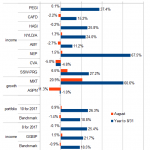

Ten Clean Energy Stocks For 2016: Year In Review

Tom Konrad, Ph.D., CFA 2016 was generally a good year for the stock market, but the average clean energy investor did not share in the gains. Clean energy investors naturally gravitate toward exciting stocks developing solar and, more recently, electric vehicles. These technologies are bringing great benefits to the planet and customers (including me- I installed a solar array on my home in in 2014, and my wife and I just bought a Toyota Prius Prime plug-in.) Investors' lousy returns are due to a common problem in sectors with rapidly improving technology: Competition within the industry...

Ten Clean Energy Stocks For 2017: Finessing Trump

Tom Konrad Ph.D., CFA The History of the "10 Clean Energy Stocks" Model Portfolios 2017 will be the ninth year I publish a list of ten clean energy stocks I expect to do well in the coming year. This series has evolved from a simple, off-the-cuff list in 2008, to a full blown model portfolio, with predetermined benchmarks and (mostly) monthly updates on performance and significant news for the 10 stocks. While there is much overlap between the model portfolio and my own holdings (both personal and in the Green Global Equity Income Portfolio (GGEIP),...

Quick Take: What Sunpower Project Sales to 3rd Party Mean for 8.3 Energy Partners

This morning, SunPower (SPWR) announced that it had sold a majority interest in two solar projects totaling 123MW. Owners of stock in SunPower's jointly sponsored Yieldco 8point3 Energy Partners (CAFD) might be wondering, "Hey, shouldn't SunPower be selling these projects to CAFD?" The Yieldco model has Yieldcos using inexpensive capital from income investors to fund the purchase of projects from their developer sponsors, which have more expensive capital because developing solar projects is riskier than owning already-developed ones. In fact, one of the two projects in question can be found in 8point3's "Right of First Offer" or ROFO...

Ten Clean Energy Stocks Under Trump (November 2016)

Tom Konrad, Ph.D., CFA So far, the broad stock market seems to like the idea of a tax and regulation-cutting and infrastructure spending Trump administration and Republican controlled Congress. The bond market is less pleased at the rapidly growing deficits such a "borrow and spend" policy will inevitably entail. While the S&P 500 advanced 3.4% in November, bond funds fell in the face of rising interest rates. The iShares 20+ Year Treasury Bond (TLT) fell 8.4%. Clean energy stocks were also hurt by the incoming President's climate change skepticism and his promises to undo environmental regulations put...

Election Jitters Spell Opportunity: Ten Clean Energy Stocks For 2016

Tom Konrad, Ph.D., CFA This October saw falling leaves and falling stocks. Then came the first week of November with its election jitters and stripped the trees of the rest of their leaves like a fifty mile an hour wind sending stocks flying as well. While Donald Trump's unpredictable performance has the whole stock market rattled (at least when it looks like he might win), his anti-environment and pro fossil fuel rhetoric have had stocks in the sector quaking like the leaves on an aspen. Although all its benchmarks were decidedly in the red for October...

Ten Clean Energy Stocks For 2016: August Earnings

Tom Konrad, Ph.D., CFA My Ten Clean Energy Stocks for 2016 model portfolio continued to coast upward in August after five months of blistering performance since February, while clean energy sector benchmarks and real managed portfolio, the Green Global Equity Income Portfolio (GGEIP), pulled back slightly. The following chart shows the performance of the model portfolio and its sub-portfolios against their benchmarks. The portfolio, its growth and income subportfolios, and GGEIP all remain far ahead of their benchmarks. Second quarter earnings announced this month were neutral or positive for the income...