yieldco - search results

If you're not happy with the results, please do another search

Yieldco Valuations Look Attractive

By Tom Konrad Ph.D., CFA

Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. Perhaps it is worries about hostility towards clean energy under a new Trump administration, or disappointment at the slow implementation of the Inflation Reduction Act. Whatever the cause, prices are low, and many clean energy stocks are likely to produce good returns even if the political climate turns further against them.

This is especially true for companies that are less dependent on favorable policy or subsidies. For instance, Yieldcos, high...

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

The Yieldco Virtuous Cycle

by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

A Yieldco’s stock price rises

It issues new shares, and invests the money in renewable energy projects.

Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if...

One Week, Three YieldCo Deals. Are More Buyouts on the Horizon?

by Tom Konrad, Ph.D., CFA

It's been a busy several days in the YieldCo space.

On February 5, 8point3 Energy Partners (NASD:CAFD) announced an agreement to be acquired by an infrastructure investment fund managed by Capital Dynamics. While I was still writing an article on why the sale price was at a virtually unheard of discount relative to the stock market price, two more YieldCo deals were announced: NRG Energy (NYSE:NRG) agreed to sell its sponsorship stake in NRG Yield (NYSE:NYLD and NYSE:NYLD/A) to Global Infrastructure Partners, and YieldCo TerraForm Power (NASD:TERP) made an offer to buy out Spanish YieldCo Saeta Yield (Madrid:SAY) at a 20 percent...

First Solar and SunPower Lobby Shareholders to Sell 8point3 YieldCo

by Tom Konrad Ph.D., CFA

Will shareholders accept the deal?

On Monday, 8point3 Energy Partners, the joint YieldCo from First Solar and SunPower, entered into a definitive agreement to be acquired by Capital Dynamics.

When public companies are sold, it's almost always at a premium to the market price. It's that price premium that persuades shareholders to sell. So why would 8point3 (NASD: CAFD) shareholders accept a deal that offers them only $12.35, or 15 to 20 percent below the roughly $15 price CAFD has been trading around for the past three months?

To answer this question, we need a little history.

Jan Schalkwijk, founder...

Brookfield’s Yieldco Buying Spree

by Tom Konrad Ph.D., CFA

Last week, a Bloomberg reported on a rumor that Brookfield Asset Management (BAM) was in talks to buy Abengoa's (ABGOY) stake in its former YieldCo Atlantica Yield (ABY). Atlantica had been looking for a new sponsor for well over a year since parent Abengoa filed for bankruptcy.

Purchasing Yieldcos (companies that own clean energy infrastructure and use the cash flows to pay large dividends to shareholders) is not new to Brookfield. Not only has BAM long sponsored Brookfield Renewable Partners, LP (BEP), a limited partnership that has essentially been a Yieldco since before the term was...

How Much Could Another Yieldco Pay For 8point3?

by Tom Konrad Ph.D., CFA

When SunPower (SPWR) and First Solar's (FSLR) YieldCo, 8point3 Energy Partners (CAFD), went public two years ago, I used the financial nerd joke in 8point3's ticker symbol as a launching point to explain what "cash available for distribution," or CAFD, means.

In that article, I cautioned against the risks of using a short-term cash flow measure for long-term investing decisions. That risk is becoming more and more real for investors in 8point3 because the YieldCo is using short-term, interest-only financing to fund its long-term investments.

All of 8point3's debt matures in 2020, and refinancing that debt will...

Yieldcos: Boom, Bust, and (Now) Beyond

The Yieldco model is not broken. But investor expectations have changed. by Tom Konrad Ph.D., CFA The Yieldco bubble popped almost exactly a year ago after a virtuous cycle turned vicious. Last May, I explained how these public companies (which own solar farms, wind farms and similar assets) could grow their dividends at double-digit rates despite no internal growth or retained earnings. This “weird trick” can work so long as the Yieldco’s stock price is rising, allowing it to sell stock at higher valuations and increase the amount of money invested per share. As long...

Comparing Community Solar Subscriptions And Yieldcos

By Tom Konrad, Ph.D. CFA Community solar is gaining traction in many states. The concept, also known as shared solar or solar gardens, originated in the mid-2000s as a way to allow broader participation in the ownership of solar photovoltaic (PV) systems, while also encouraging local development. Community solar broadens access to solar beyond homeowners with suitable roofs. A National Renewable Energy Laboratory report from 2015 estimated that 49 percent of households cannot own solar because they do not own their own home, or they live in high-rise buildings with insufficient roof space. Rooftop solar is impractical for many...

Comparative Valuation of 15 Yieldcos

Tom Konrad CFA Compared to the peak of the Yieldco bubble in May, many Yieldcos have dropped by more than half, and most by more than a third. Some of this decline is because rapid dividend growth depends on an endless supply of cheap investor capital which is another way of saying that we can have rapid dividend growth or high dividend yields, but not both. Part of the decline was due to the realization that many Yeildcos (most notably Terraform Power (TERP), Terraform Global (GLBL), and Abengoa Yield (ABY)) were not immune to...

What Yieldco Managers Are Saying About The Market Meltdown

by Tom Konrad Ph.D., CFA Note: This article was first published on GreenTechMedia on Noveber 27th. In the last six months, YieldCos have fallen from stock market darlings to pariahs. YieldCos are companies that buy clean energy projects such as solar and wind farms, and use the majority of free cash flow from these projects to pay dividends to investors. Many are listed subsidiaries or carve-outs of large developers of clean energy projects. Last year, investors repeatedly punished leading solar developers and manufacturer First Solar and SunPower for their reluctance to launch YieldCos. When...

The Status of The Yieldco

by Tom Konrad, Ph.D., CFA Last week I delivered the keynote at Yieldcon USA, a conference put on by Solar Plaza entirely focused on Yieldcos. (Yieldcos are companies that own clean energy assets such as solar and wind farms and use the cash flows to pay a high rate of current income to investors.) Given all that's gone on in the space in the last few weeks, the conference could not have been more timely. You can find the presentation here and embedded below:

Investors Awaken to NextEra YieldCo

by Debra Fiakas CFA Last week NextEra Energy Partners, LP (NEP: NYSE) reported financial results for the third quarter ending September 2015. The numbers were released in along with quarter results from its parent, Florida-based utility NextEra Energy, Inc. (NEE: NYSE). The partnership is the operating arm of clean energy projects originated by the NextEra parent. The ‘yieldco’ as these operating entities have been kindly dubbed by shareholders, delivered $1.0 million in reported net income, but operating cash flow was a whopping $36 million in the quarter. The consensus estimate had been for $0.24 in earnings per...

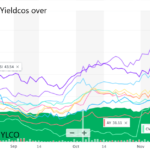

Yieldcos: Calling The Bottom

by Tom Konrad Ph.D., CFA On a podcast recorded on September 14th, I said I thought that Yieldco stocks had bottomed at the end of September. Two weeks later, that call still looks like a good one (see chart.) I'm starting to hear optimistic noises from other Yieldco observers, although the general tone remains quite bearish. Why do I think September 29th was the likely bottom? End of quarter. Some institutional investors such as mutual funds reshuffle their portfolios at the end of the quarter so that they don't have...

US Yieldcos Will Survive

by Susan Kraemer As unrealistic expectations of dividend growth are scaled back, yieldcos are now on a more sustainable path. Weaknesses in the US yieldco model came into sharp relief this summer as share prices fell along with oil and gas stocks. This was in part due to investor confusion about energy stocks but also in response to a flaw in US yieldco expectations. Manager of the Green Global Equity Income Portfolio and AltEnergyStocks.com editor Tom Konrad Ph.D., CFA had warned of the looming potential for exactly this kind of market correction in a conversation a...

Notes On YieldCos, Future Fuel, and Aspen Aerogels

by Tom Konrad Ph.D., CFA Since I have not had much time to write for AltEnegyStocks, I thought I'd share with readers some notes I wrote for investors in the JPS Green Economy Fund, a hedge fund for which I'm director of Research, regarding our holdings in the third quarter: In the third quarter, we took advantage of the general decline of clean energy "YieldCos" to add two of these owners of wind and solar farms to our portfolio at attractive yields. Pattern Energy Group (PEGI) is an owner of wind farms having long term power purchase agreements...