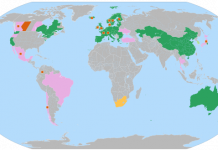

The term environmental markets remains foreign to most investors (and environmentalists!), even though these markets represent, in my view, a very compelling investment story. Although we’ve discussed trading in carbon emissions in the past, I thought I would expand a bit and talk about environmental markets in general, and about good ways to play them. What’s An Environmental Market? Environmental markets exist at the confluence of two movements: (a) A growing desire on the part of national and regional governments in several countries to both limit environmentally-damaging behavior and to promote the growth of alternative energy sources (b) A realization by policy-makers that economists were indeed right – if you let the market sort it out on its own you will most likely end up with a more efficient outcome than if you try to tell it what to do Environmental markets serve one of two purposes. First, scarcity for an undesirable environmental commodity is created via regulation (e.g. a cap on emissions of a pollutant) and market participants must determine, among themselves, who needs that commodity most and what is a fair price to pay for it. A token example, and one which we’ve discussed here on several occasions, is trading in greenhouse gas emissions, also called carbon trading. Second, the production and/or use of an environmentally-desirable commodity is mandated by government, and market participants are allowed to trade certificates worth a certain number of units of that commodity. The best example in this case is the use of Renewable Energy Certificate (REC) programs in several US states to promote renewable energy. RECs certify that a certain amount of green power has been produced and pumped into the grid, and a company under obligation to use renewable energy can buy RECs to meet that obligation instead of producing the clean power directly. To be sure, environmental markets are, by and large, far from mature. The European Emissions Trading Scheme (ETS), the largest and most liquid environmental market in the world, continues to be dominated by brokers. Latest estimates place the share of OTC markets at around 71% of total traded volumes for the ETS, while exchanges get the remainder. With regards to RECs, there are issues with their transferability between jurisdictions. But environmental markets are at most a few years old, and never in their history have there been as many policies and regulations in place to favor their expansion. As issues of scale, liquidity and jurisdictional transferability are worked out, I am certain that we will see the rise of healthy cash markets for a number of positive and negative environmental commodities, further bolstered by advances in electronic trading. Who’s Playing Environmental Markets? What initially got me thinking of writing this post was a press release by a Massachusetts-based, Toronto-listed company called World Energy Solutions [TSE:XWE] announcing that a solar REC trade had been completed through its trading platform. In its own words, “World Energy is an energy brokerage company that has developed the World Energy Exchange online auction platforms, through which a diverse set of energy buyers and sellers can trade energy, financial instruments and renewable energy credits […]” Basically, it’s an exchange.  Then, out of curiosity, I decided to check, after hearing that it had made an unsolicited bid for the Chicago Board of Trade, whether IntercontinentalExchange [NYSE:ICE] offered any environmental products. Turns out it does: it recently launched an ETS-based futures contract in collaboration with the European Climate Exchange, the outfit responsible for about 75% of volumes in the European exchange-traded carbon market.

Then, out of curiosity, I decided to check, after hearing that it had made an unsolicited bid for the Chicago Board of Trade, whether IntercontinentalExchange [NYSE:ICE] offered any environmental products. Turns out it does: it recently launched an ETS-based futures contract in collaboration with the European Climate Exchange, the outfit responsible for about 75% of volumes in the European exchange-traded carbon market.  And then I remembered that, about a month ago, the Montreal Exchange, the exchange responsible for derivatives in Canada, had announced a Canadian energy-focused strategic partnership (PDF document) with NYMEX. Canada has become, by most accounts, a global energy heavyweight. The Montreal Exchange also recently set up the Montreal Climate Exchange (PDF document) in collaboration with the Chicago Climate Exchange. Part of the NYMEX partnership entails opening offices in Alberta, not only home to Canada’s famous oil sands but also the largest single source of its infamous greenhouse gases. A recent research note (PDF document) by CIBC World Market conservatively estimates the value of a potential Canadian carbon market at around C$12 billion (circa US$10.2 billion) – not a bad niche to be in. Finally, I would be remiss if I did not also mention Climate Exchange plc, a little outfit we’ve discussed on several occasions in the past. Climate Exchange [LSE:CLE or OTC:CXCHF.PK] owns both the European Climate Exchange and Chicago Climate Exchange, and is about 19% owned by Goldman Sachs. Of all of the companies discussed above, this is the only environmental trading pure-play.

And then I remembered that, about a month ago, the Montreal Exchange, the exchange responsible for derivatives in Canada, had announced a Canadian energy-focused strategic partnership (PDF document) with NYMEX. Canada has become, by most accounts, a global energy heavyweight. The Montreal Exchange also recently set up the Montreal Climate Exchange (PDF document) in collaboration with the Chicago Climate Exchange. Part of the NYMEX partnership entails opening offices in Alberta, not only home to Canada’s famous oil sands but also the largest single source of its infamous greenhouse gases. A recent research note (PDF document) by CIBC World Market conservatively estimates the value of a potential Canadian carbon market at around C$12 billion (circa US$10.2 billion) – not a bad niche to be in. Finally, I would be remiss if I did not also mention Climate Exchange plc, a little outfit we’ve discussed on several occasions in the past. Climate Exchange [LSE:CLE or OTC:CXCHF.PK] owns both the European Climate Exchange and Chicago Climate Exchange, and is about 19% owned by Goldman Sachs. Of all of the companies discussed above, this is the only environmental trading pure-play.  So What’s Point of All This..? Environmental markets are currently in their infancy, but there are a number of macro drivers at play that should see them emerge as healthy industries in their own right. Over the next decade, they will become larger in size and value, more liquid, increasingly exchange-based, and, because of their nature, many of them could be international before too long (e.g. the carbon market). But environmental markets are, by and large, playgrounds for institutional actors. Most retail investors, if they want a piece of that pie, will likely have to look at the intermediaries that allow environmental trades to take place – namely exchanges. As an asset class, exchanges have done extremely well over the past few years, and it would be worth keeping an eye on how they position themselves with regards to environmental markets, as these markets should offer good growth potential. DISCLOSURE: I do not have positions in any of the securities discussed in this article.

So What’s Point of All This..? Environmental markets are currently in their infancy, but there are a number of macro drivers at play that should see them emerge as healthy industries in their own right. Over the next decade, they will become larger in size and value, more liquid, increasingly exchange-based, and, because of their nature, many of them could be international before too long (e.g. the carbon market). But environmental markets are, by and large, playgrounds for institutional actors. Most retail investors, if they want a piece of that pie, will likely have to look at the intermediaries that allow environmental trades to take place – namely exchanges. As an asset class, exchanges have done extremely well over the past few years, and it would be worth keeping an eye on how they position themselves with regards to environmental markets, as these markets should offer good growth potential. DISCLOSURE: I do not have positions in any of the securities discussed in this article.

I am a long-term investor in climate exchange CLE.L (CXCHF.PK in the US). They have recently experienced a meltdown in price for no apparant reason. Possibly the peak was just irrational exuberence. At the current price I feel that it is an excellent buy as it could experience a dramatic pop when the US passes a cap and trade law. Nancy Pelosi has set July 4 as a deadline for passing a bill.

Yes,

The ADR is down by about 50% over the past month and a half. Not too sure why either.

I agree with Tom here, this stock could get a great pop if federal legislators moved on this.

I think that one point that needs to be highlighted here is that there is a financial opportunity in the EU Emissions Trading Scheme that has not yet been clearly expressed.

I hope to be concise here: The EU emitters need credits. They can trade the already existing ones or they can invest in the incubation of new, tradeable, credits (basically by cleaning up harmful emissions elsewhere in the world).

The opportunity lies in the fact that project developer-funds can incubate, develop and deliver these credits for half to one/third of the currently traded credits.

Of course this realm of investment is new and dominated by big banks or ‘environmental investment banks’, but it exactly what my firm does. Sorry for the advert, but look for these funds in the future; I certainly believe it will become mainstream in the next 5 years.