Rarer Rare Earths Are Not Going To Sink The Wind Power Sector

Charles Morand Once the electric and plug-in hybrid vehicle frenzy fizzles out, as cleantech frenzies typically do when reality comes knocking (i.e. corn ethanol and solar PV), the next hot thing to hit the world of alternative energy investing could very well be rare earths, or the lack thereof. Rare earth metals are used in a number of technologies, most importantly for alt energy investors in NiMH HEV batteries and in permanent magnets for wind turbine generators and electric motors (made with the element neodymium). This article, as its name indicates, will focus on the wind sector. ...

List of Wind Power Manufacturing Stocks

Wind power manufacturing stocks are publicly traded companies whose business is involved in the development or manufacture of wind power equipment.

AB SKF (SKF-B.ST, SKFRY)

Broadwind Energy (BWEN)

China High Speed Transmission Equipment Group Co., Ltd. (0658.HK, CHSTF)

General Electric (GE)

Helix Wind, Corp. (HLXW)

Inox Wind Limited (INOXWIND.BO)

Nordex AG (NRDXF, NDX1.DE)

Sauer Energy, Inc. (SENY)

Siemens Gamesa Renewable Energy (GCTAF, SGRE.MC)

Sif Holding NV (SIFG.AS)

Suzlon Energy Limited (SUZLON.BO)

Toray Industries, Inc (TRYIF, 3402.T)

TPI Composites, Inc. (TPIC)

Trinity Industries (TRN)

Vestas (VWS.CO, VWSYF, VWDRY)

Xinjiang Goldwind Science & Technology Co., Ltd. (2208.HK)

If you know of any wind power manufacturing stock that is not listed here, but which should be, please let us...

Do You Need To Invest In Oil To Benefit From Expensive Oil?

Two months ago, Tom told us how he'd dipped a toe into the black stuff (i.e. bought the OIL etf) on grounds that current supply destruction related to the depressed price of crude oil would eventually lead to the same kind of supply-demand crunch that led oil to spike during the 2004 to mid-2008 period. If you need evidence that the current price of crude is wreaking havoc in the world of oil & gas exploration, look no further than Alberta and its oil sands. The oil sands contain the second largest oil reserves in the world after...

Northern Power Systems to Supply Northwind(R) 100 Wind Turbines to Alaska Village Electric Cooperative

Northern Power Systems, Inc., a subsidiary of Distributed Energy Systems Corp (DESC) has been awarded a $1.9 million contract from Anchorage-based Alaska Village Electric Cooperative (AVEC) for seven of Northern's NorthWind® 100 wind turbines. The advanced-design 100 kW wind turbines will generate renewable electric power for 3 remote communities, in western Alaska, served by AVEC. As part of the contract award, Northern will provide on-site installation and commissioning services of the turbines in the harsh Alaskan environment. It is the first stage in a broader effort through which AVEC will be integrating wind into more of the 51...

Xcel Energy Gets Approval to Add Renewable Energy in Colorado

Xcel Energy (XEL) received approval from the Colorado Public Utilities Commission (CPUC) on Wednesday that could triple the company's wind power capacity in Colorado by 2007. The CPUC approved Xcel Energy's proposal to acquire up to 500 megawatts (MW) of renewable energy resources, primarily wind, through an early competitive bidding process. This will allow the company to take advantage of any short-term renewal of the federal production tax credit (PTC) for wind energy, currently under consideration by Congress. The company also will study the impact that additional renewable resources will have on system reliability, operation, cost and transmission....

Newsweek Special Report

"Experts generally agree that our current reliance on fossil fuels is unsustainable. Already oil is near $50 per barrel, and the great millions of Chinese and Indians destined to take to the road in the next decades have not yet gotten behind the wheel." This week Newsweek has written several special reports about alternative energy in all its forms. All of these reports can be found at the following link.

E.On Launches $34.72B All-Cash Endesa Bid

German utility E.On AG launched a 29.1 billion euro ($34.72 billion) all-cash bid for ENDESA (ELE) on Tuesday, topping a previous offer from Gas Natural by more than 30 percent and threatening to disrupt carefully laid plans for Spanish power-market consolidation. Endesa said in a statement that the E.On offer was "clearly" the better of the two, but added that it still did not adequately reflect Endesa's true value. Shares of Endesa were up 15% in yesterday's trading.

Key Players in New Wind Turbine Technology

David Appleyard Vestas Wind turbines in Sloterdijk. Photo by Aloxe. With annual market growth of almost 10 percent, and cumulative capacity growth of about 19 percent according to the latest figures from the Global Wind Energy Council, the wind sector continued to make robust progress in 2012. But while these figures suggest a relatively buoyant market for installations, perhaps a more accurate way to judge the health of the wind sector is to consider investment in R&D, and more specifically the products of that research, development and testing....

Wind Investors Beware!

Charles Morand I received a press release yesterday about a new Emerging Energy Research (EER) study on wind power installations in the US for 2009 and beyond. EER argues that US installations could be down as much as 24% in 2009 from a record 8.55 GW in 2008. While utility-led projects remain mostly on track, smaller IPPs and developers that rely on project finance or other forms of external financing are finding the current market environment challenging. However, record growth could return as early as 2010 with 9 GW...

Another Reality Check for Wind Power Investors

John Petersen Last Wednesday I stirred up a hornets nest with an article titled "A Reality Check for Wind Power Investors" that included two graphs from the Bonneville Power Administration, or BPA, which manages a four state, 300,000 square mile service region that's home to over 40% of the installed hydro capacity and roughly 12% of the installed wind capacity in the US. The first graph tracks the BPA's regional load and power production from hydro, thermal and wind facilities over the last seven days and shows why the region is one of the largest power exporters...

Amazing Pictures of Offshore Wind Farms

One of the stories recently featured on one of my favorite sites, Reddit, was a link to some amazing pictures of offshore wind farms. Seeing these pictures of wind turbines really made clear to me the reality of offshore wind power, and the size and scope required to harness the power of wind over the ocean. Summarizing some points from the article: average wind speeds are greater over the ocean than they are over land the world's largest offshore wind farm is Horn’s Reef project located 14 kilometers (or about 9 miles) off the coast of Denmark...

Pattern Energy Investors Enjoy The Breeze

by Debra Fiakas CFA This week Pattern Energy Group’s (PEGI: Nasdaq), the independent wind power generator, is scheduled to report sales and earnings for the quarter ending September 2015. The company has cultivated a strong following among analysts for a company its size. Nine estimate contributions have gone into a consensus estimate of $87.2 million in sales for the quarter, resulting in a net loss of a penny per share. If achieved the sales hurdle would represent 22% growth over the same quarter last year. A penny loss may not seem impressive, but it is substantially better than...

Offshore Wind A Big Part Of Why GE Wants Alstom

Who's the Energy Alpha Dog? GE or Siemens? By Jeff Siegel General Electric (NYSE:GE) wants to acquire one of the largest companies in France, and it could get what it wants if Germany doesn't get in the way. Alstom SA (AOMFF), the target of GE's desires, is a French energy and transportation company with a market value of approximately $11.5 billion. It deals in hydroelectric and nuclear power, environmental control systems, wind turbines and battery storage, as well as trains and rail infrastructure. It's a huge company, and GE could spend as much as $13 billion to...

AMSC Consolidates US Wind Operations To Focus on Europe

Meg Cichon AMSC (NASD:AMSC) will shutter its manufacturing facility in Middleton, Wisconsin by the end of 2014, but hopes to fold its product development operations and employees that are willing to relocate into its headquarters in Devens, Massachusetts, which recently underwent a workforce reduction. While it consolidates its U.S. workforce, AMSC plans to open a new wind turbine controls manufacturing facility in Timisoara, Romania in 2014, which will serve all of its clients outside of China. Its Chinese facility will continue to cater solely to China customers. With this move, AMSC corporate communications manager Kerry Farrell said it has...

How Weather Risk Transfer Can Help Wind & Solar Development

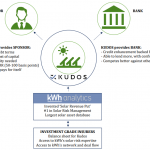

by Daryl Roberts

The Need To Accelerate Renewables Adoption

Renewables are growing rapidly as a percentage of new electric generation, but are still being assimilated too slowly and still constitute too small of a fraction of total generation, to be able to transition quickly enough to scale into a low carbon economy in time to mitigate climate change.

The issue of providing public support, with subsidies and other reallocation methods, is a politically charged subject. High carbon advocates, for example American Petroleum Institute, argues that support for renewables distorts the market. On the other hand, it has been argued, for example by...

Distributed Energy Systems profile on Forbes.com

Distributed Energy Systems Corp (DESC) has been profiled on Forbes.com. Kenneth Reid, editor of Spear's Security Industry Analyst, recommends buying shares of Distributed Energy Systems. The Wallingford, Conn.-based company creates and delivers a variety of products for the alternative and decentralized energy markets.. . .The story of Distributed Energy and other alternative-energy players is a long-term one, say bulls like Reid. With the surge in oil prices this year, the story is resonating with investors. Distributed Energy shares are up 333% in the past year, trading around $8 after hitting a 52-week (intraday) high of $8.09 on Sept....