Alternative Energy Mutual Funds and ETFs Returns Flatten

By Harris Roen Alternative Energy Mutual Fund Returns Alternative energy mutual funds have given back some of the gains they have enjoyed since the beginning of the year, though they are still up almost 20% on average. All MFs are in positive territory, with annual returns ranging from 9.8% to 40.9%. MFs are also up nicely for the week and month, but on average are down slightly in the past three months. These returns are very different than those of just five months ago, when alternative energy MFs were doing almost twice as well… ...

2015: a Mixed Year for Alternative Energy Funds

By Harris Roen Alternative Energy Mutual Funds Trade Flat for the Year Alternative energy mutual funds followed the overall stock market this year, closing about flat on average for 2015. The story gets more interesting, though, when you look at gains in the last quarter. Sectors such as solar and wind took a big hit by September, but then rebounded handsomely before years end. Green MFs were up 7% on average for the past three months, with 14 out of the 15 funds trading in the black… ETFs are Widely Lower 2015 was a year...

Clean Energy Mutual Funds and ETFs

UPDATE 3/4/2011: An up-to-date article on selecting green mutual funds and ETFs can be found here. by Tom Konrad For new investors looking to green their portfolios with clean energy, the first thought is usually mutual funds. The following three are available in North America: Mutual Funds Expenses New Alternatives Fund (NALFX) 0.95% + Sales load Guinness Atkinson Alternative Energy Fund (GAAEX) 1.64% ...

UltraPromises Fall Short

When I first came across ProShares' UltraShort ETFs, I thought they were a brilliant idea. They seem to promise a multitude of advantages for investors: The ability to hedge market or sector exposure without having to go short. (Going short requires a margin account, and US law prohibits the use of margin in most retirement accounts.) They should have a better risk profile than shorting. With an UltraShort, you can't lose more than your initial investment. With true shorting, the potential losses are unlimited. As the underlying index rises, each percentage gain creates a smaller dollar fall, while...

How the Gabelli Green Growth Fund Got Its Five Stars

Tom Konrad, CFA An interview with John Segrich, CFA, portfolio manager at the the Gabelli Green Growth Fund (SRIGX). When I did my recent past performance comparison of clean energy mutual funds, I found that the Gabelli Green Growth Fund (SRIGX and SRICX) beat all its rivals by a long shot over the last three years, earning a coveted five-star rating from Morningstar. In general, I'm a skeptic about short-term past performance: If you look at enough funds, sooner or later you'll find one that has had great performance by sheer luck. Even when a few years'...

Alternative Energy Mutual Funds and ETFs Go In All Driections

By Harris Roen Alternative Energy Mutual Funds, Solid Long-Term Gains Returns for alternative energy mutual funds are virtually flat on average for the past three months, down slightly at a loss of 0.3%. The best short-term performer is Pax World Global Environmental Markets (PGRNX), up 2.1%… Over the longer term, returns for alternative energy mutual funds remain very strong. MFs are up 14.7% on average, with all companies showing double-digit gains on an annualized basis… Returns for ETFs are ranging widely Returns for ETFs are ranging widely, both in the short and long...

Calpine Gets Hammered

Shares of Calpine Corp. (CPN) suffered a greater than 20% loss yesterday and is now down almost another 13% today. All of this was caused by a court ruling stating that they will be unable to use the $395 million in cash they received from the sale of oil and gas fields earlier this year for the purpose of buying natural gas to run its power plants. The dispute stems from the Bank of New York's decision in September when, acting as trustee for Calpine bondholders, it withheld proceeds from Calpine's sale in July of North...

Green Energy Mutual Funds Compared

UPDATE 3/4/2011: An up-to-date article on selecting green mutual funds and ETFs can be found here. Tom Konrad, Ph.D., CFA Most investors looking to get into clean energy think first of mutual funds. Here are the options, and how to choose. We track seven mutual funds with a focus on green energy and climate change at AltEnergyStocks.com, since the American Trust Alternatives Fund closed early this year. I split them into two categories: the funds with a primary focus on clean energy, and those with a primary focus on the environment. The clean energy funds are: the Firsthand...

Not All Alt Energy ETFs Were Created Equal

Charles Morand A few months ago, I conducted analyses of the wind and solar power ETFs. I've recently turned my attention to the general alternative energy ETFs, or those that span several sectors. The general alt energy ETFs fall into two categories: 1) US Only and 2) Global. The US Only ETFs are the First Trust NASDAQ Clean Edge US Liquid (QCLN) and the PowerShares Clean Energy (PBW). The Global ETFs are the iShares S&P Global Clean Energy Index ETF (ICLN), the PowerShares Global Clean Energy Portfolio (PBD) and the Van Eck Global Alternative Energy Fund (GEX). The chart below shows...

Alternative Energy Outperforms All Other Sectors in September

By Harris Roen Alternative energy MFs racked up extremely robust gains in the past year. Returns range from a low of 16%, to a high of 64% for a mutual fund that is heavy into solar investments. ETFs also did well, but returns are much more variable. They range from a loss of 34% for a carbon ETF, to more than doubling of a solar ETF. Mutual Funds Returns remain excellent for alternative energy MFs overall, with average mutual fund up 32.3% for the year. Not a single fund posted a loss in...

Shares in Active Power Purchased

I currently don't have time to do a complete writeup on this stock, but wanted to let everyone know that I purchased shares in Active Power Inc (ACPW) this afternoon for both my personal portfolio and the mutual fund. The average price was at $3.77. I will updated this post later this afternoon with more details. Updated at 10:00 PM As I mentioned above I purchased shares in Active Power Inc (ACPW) this afternoon for both the mutual fund and my personal portfolio. Active Power designs and sells battery-free uninterruptible power supply (UPS) systems....

Do Falling Alternative Energy Funds Returns Signal Danger?

By Harris Roen Green Mutual Fund Returns Falter Returns for green mutual funds have slid as of late. Longer term, however, alternative energy MFs are still showing strong gains. All MFs are in positive territory for the past 12 months, and 6 out of 14 funds are up double digits. Three year returns have faired even better, showing an annualized return of 14.3% on average. Short term, however, almost all the funds have given up a significant amount of their recent gains. For example, Firsthand Alternative Energy (ALTEX), the MF with the best one-year returns, gave up...

Wind Energy ETFs: A Comparison

Three weeks ago, I wrote on the year ahead for the US wind sector and said I would analyze the two new wind ETFs now available to US investors: the First Trust ISE Global Wind Energy Index Fund (FAN) and the PowerShares Global Wind Energy Portfolio (PWND). While I don't currently have a position in either ETF as I expect headwinds in the US (no pun intended) to place downward pressure on some of the global wind stocks in the next few months (the US accounted for 27% of global installed capacity in '07), I still intend to...

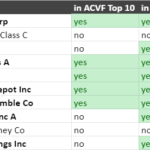

Are ESG Funds All That Different?

by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto...

Alternative Energy Funds Post Solid Gains

By Harris Roen Mutual Funds Performance for MF’s have been outstanding, following a surge in solar stocks, energy efficiency companies, and other alternative energy sectors. Over the past 12-months the average alternative energy MF returned 30.3%, and not a single fund was down for the year. Three-month and one-month returns were similarly spectacular, gaining 10.5% and 7.3% respectively on average, also with no losers. I expect this trend to continue, as many of these alternative energy sectors are bouncing back from the overly pessimistic levels of 2012. Exchange Traded Funds ...

Strong Returns Continue for Alternative Energy Mutual Funds and ETFs

By Harris Roen Alternative Energy Mutual Fund Returns Alternative energy mutual funds have posted extremely strong returns across the board. Gains have shown a wide breadth, with all MFs up for the last 12-month and 3-month periods. In the past year, all funds are up double digits. A new fund has been added to our tracking system, Calvert Green Bond A (CGAFX). This fund started trading in November 2013, and is the first green open end bond fund designed for retail investors. CGAFX focuses at least 80% of its assets on “…opportunities related to climate change...